Today we bring you the highlights of India’s crazy crypto year.

Also in this letter:

- Startups to offer biggest hikes in coming wage war

- Taxman to inspect Swiggy, Zomato discounts

- Crypto exchanges on a token on-boarding spree

Programming note: ETtech Morning Dispatch will be on a break until Monday, January 3. We wish you a healthy and a happy new year. See you in 2022!

Defining moments in India’s crypto saga this year

India has a weird relationship with cryptocurrencies. The government was twice set to introduce a crypto bill seeking to ban “all private cryptocurrencies” this year before backing out.

Meanwhile, demand for these digital assets has exploded across the country. India’s crypto market grew 641% from July 2020 to June 2021, helping turn a region spanning central and southern Asia and Oceania into one of the world’s fastest-growing cryptocurrency markets, according to a Chainalysis report from October.

Here are some of the defining moments in India’s crypto space in 2021.

■ The crypto bill, take 1: In January, a Lok Sabha bulletin said the government would introduce a bill in the budget session of Parliament that would ban “all private cryptocurrencies” and set up a framework to create an official digital currency to be issued by the Reserve Bank of India. But in the end the bill is not tabled.

■ Don’t ban, regulate: In March, cryptocurrency players represented by industry body Internet and Mobile Association of India (IAMAI) appealed to the government not to ban cryptocurrencies, proposing instead to develop mechanisms to regulate the ecosystem.

■ Dogecoin mania: In May, Dogecoin mania reached Indian cryptocurrency exchanges. They witnessed record-breaking trading volumes of Dogecoin and a massive surge in traffic. Binance-owned WazirX’s Doge/INR trading slowed its entire system.

■ Crypto bill, take 2: In November, the government once again appeared likely to introduce a bill on cryptocurrencies during the winter session of Parliament beginning November 29. But the bill was delayed again as the government was reportedly considering changes to the proposed framework. Only one thing’s for sure at this point – that India’s wait for crypto rules will continue into 2022.

India levels-up on crypto: Meanwhile Nischal Shetty, chief executive of crypto exchange Wazir X told us that India’s cryptocurrency ecosystem has levelled up in every aspect this year. He was referring to the number of startups that have been founded, the capital raised, the discussions around a possible cryptocurrency policy framework, and retail investor adoption in the country.

2021, the year of the NFT: If someone had said the words “non-fungible token” to you in 2020, you’d be well within your rights to ask if they’d recently banged their head on something. But in 2021, NFTs broke out of their niche to become one of the hottest tech trends (and buzzwords) of the year. On November 24, Collins Dictionary named NFT its “Word of the Year”.

Click here to read about the phenomenon that is NFTs and the five most expensive ones sold this year.

Startups to offer the biggest hikes in coming wage war

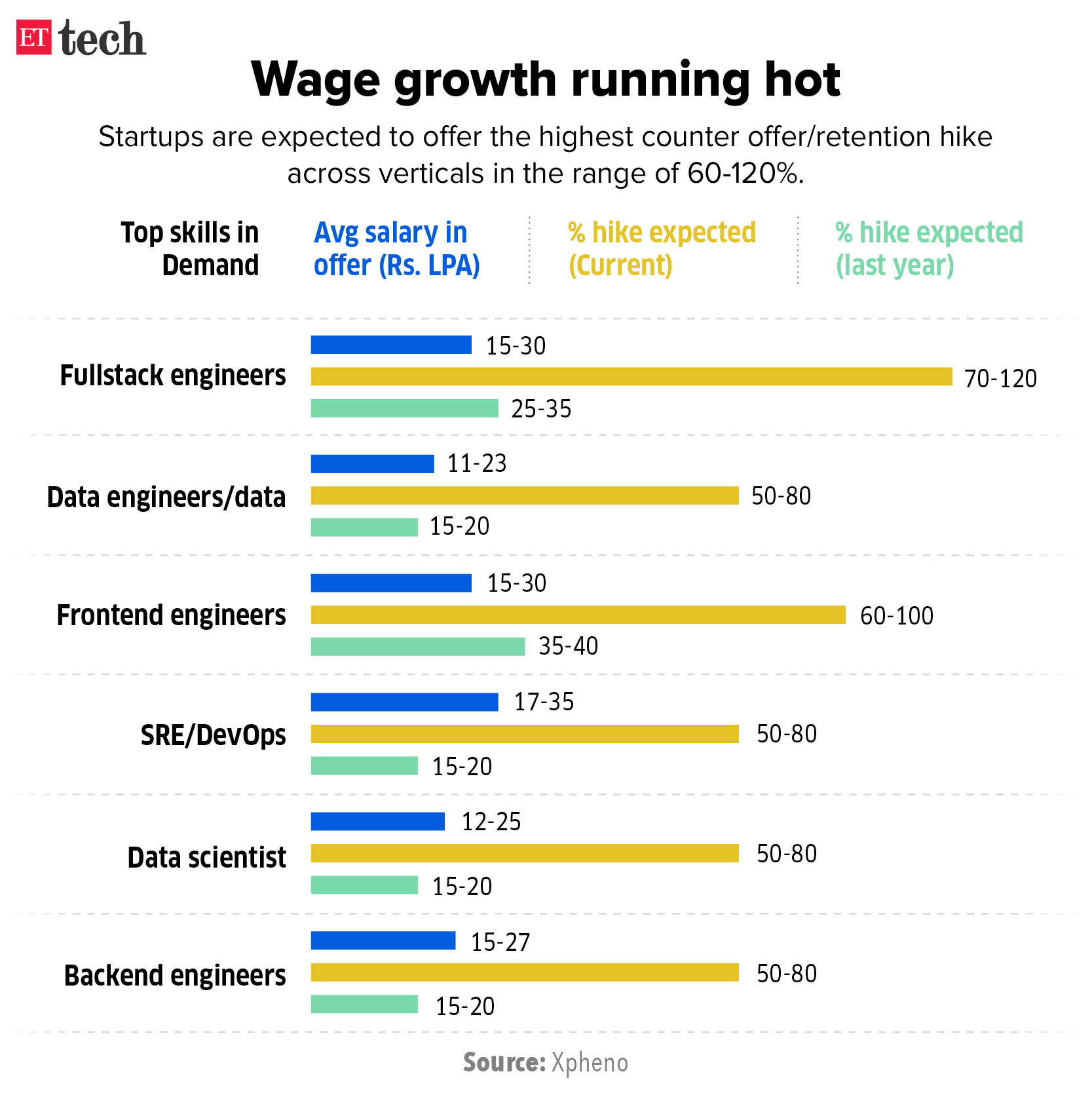

Indian tech firms are expected to hike salaries or counter offers by 60-120% in 2022 as they seek to attract and retain talent with niche skills, staffing services providers told us.

At the forefront: Startups that have raised funds over the last few months are expected to roll out the highest offers and counter offers, ranging from 50-120%, while IT services companies are likely to unveil relatively modest offers in the range of 5-14% for the same skills.

In demand: Those in high demand include full-stack engineers, data scientists, data engineers and backend engineers, according to recruitment consultancy firm Xpheno. This demand is likely to persist into 2022, until enterprises create an organic talent pool and upskill workers, which would typically take six to eight quarters, said Kamal Karanth, cofounder of Xpheno.

Other niche skills likely to gain in popularity in 2022 include artificial intelligence, cloud, securit, and engineering, which will be among the top technology drivers for 2022, said Vijay Sivaram, CEO of Quess IT Staffing.

Wage war: Xpheno’s Karanth said wages in India have traditionally been below par at the entry level and some correction in the short term is inevitable. However, over the next few quarters at least, enterprises have no choice but to indulge in a wage war.

“It is mostly digital skills that will be in demand, as spending on digital has increased over the (Covid-19) pandemic,” said Siva Prasad Nanduri, VP and business head at IT staffing firm TeamLease Digital. “This isn’t restricted to any one industry or sector, and demand is across organisations, barring small and medium enterprises,” he added.

Tweet of the day

Taxman to inspect Swiggy, Zomato discounts

Coupon discounts offered by food delivery platforms including Zomato and Swiggy are set to face the taxman’s scrutiny under the Goods and Services Tax (GST) regime beginning January 2022.

What’s happening? The issue is around discounts offered by the delivery apps against using a particular credit card, debit card, or digital wallet for making payments. Beginning January 1, both Swiggy and Zomato are set to be treated on par with restaurants. This would mean that they would have to cough up a 5% tax on the total cost of food.

The tax department is scrutinising whether these are “barter” agreements between Swiggy and Zomato. Nothing is free under GST, and even barter is taxed.

Quote: “While barter transactions are subject to levy under GST, all transactions may not fall within barter and have tax implications on both legs. For instance, the coupon discount recovered by an ECO will completely depend on the facts, nature of the transaction, and intention of the service to be provided, ” said Abhishek A Rastogi, Partner at Khaitan & Co.

Cryptocurrency exchanges are on a token on-boarding spree

Indian cryptocurrency exchanges are offering a larger portfolio of digital assets – tokens – to satiate a growing investor class seeking higher returns.

What’s happening? WazirX launched 12 tokens in December, while CoinSwitch Kuber added five, named Mana, Sand, Gala, Req, and Coti. Unocoin onboarded five new coins recently, while CoinDCX brought in a bunch like DappRadar, Highstreet, Convex Finance and ConstitutionDao.

Investors in search of outsized returns are exploring options other than the tried-and-tested Bitcoin, Ethereum, Tether, Solana and Shiba Inu. To keep pace, these exchanges are strengthening their portfolios to better compete with global crypto exchanges.

Top global crypto exchanges like Binance, Coinbase, FTX3, Mandala Exchange, and Huobi Global have hundreds of coins on their platforms. A few Indian investors also trade on these platforms to access new tokens.

Ola Electric in talks with partners to set up public chargers

Amid delays in the launch of its electric two wheeler, Ola Electric is looking to build infrastructure for charging batteries.

The Bengaluru-based mobility firm is in advanced talks to tie-up with Bharat Petroleum to set up its fast chargers at petrol pumps across the country, sources told us.

Internally, the company has set a target of setting up 140 charging points across the country by March 2022, sources said. ET has learnt that the company plans to inaugurate the first public charger early next month.

We reported earlier this month that Ola Electric delivered its first 100 scooters without all the promised features. Smart features like the app, proximity sensors, Bluetooth, hill hold and cruise control will only be available through over-the-air updates. The company has been under immense pressure after promising to deliver the scooters in October.

View: Dear founders, it’s ok to give yourself a break

Pankhuri Shrivastava was a super-achiever. She co-founded Grabhouse in 2013, left for Quikr rather prematurely, and came back after a break to discover Pankhuri, an online platform to empower women all over the country, especially small towns. She had multiple career options including Bollywood, but chose the toughest career battlefield – startup entrepreneurship. In an era of macho founders, she was the only one with the guts to name a company after herself. She was fit, cheerful, bubbly, full of positive energy, and one would not think to enquire about her health if one met her.

She died of a sudden cardiac arrest on December 24.

One can’t keep wondering if she was pushing herself too hard. Fishing for the smallest hints of trouble, one can point to conversations at an after-party where she was hell-bent on raising her next round. I wish she knew she did not have to try hard at all. I wish we had all told her so. For she would have made it big rather easily. Does each founder plan for a long journey? Does she spend enough time and money on herself? Do founders fear judgement if they take care of themselves? Do they feel pressure to endure unnecessary struggle, physically and mentally?

Click here to read the full column by Anand Lunia, cofounder of India Quotient, an early-stage investment fund.

Other Top Stories By Our Reporters

GlobalBees enters unicorn club with $110 million funding: Thrasio-style venture GlobalBees has raised over $110 million led by Premji Invest with participation from new investor, Steadview Capital and existing investors, SoftBank, FirstCry among others, said the company in a statement shared with ET. Post the investment, GlobalBees said its valuation has risen to $1.1 billion.

Sebi approves several new measures to reform IPO market disclosures: The Securities and Exchange Board of India on Tuesday approved several new measures to further reform the initial public offering market in the country. The regulators’ board approved mandatory disclosure by companies of their intended acquisition target in case where funds are raised from public for the purpose of such acquisitions.

Global Picks We Are Reading