Early-stage Indian VC firm Antler India, a unit of Singapore-based venture capital platform Antler, has committed to invest in 25-30 startups in the blockchain and Web 3.0 space in the next 2-3 years. It plans to deploy $100 million – $150 million in over 100 Indian startups over the next 3 years, of which up to $50 million is committed to the Web 3.0 space.

The fund will make a minimum investment of $250,000 and will come in at a pre-product market fit stage, Nitin Sharma, partner and global blockchain lead at Antler, told ET.

Sharma is also the founder of another VC fund, Incrypt Blockchain, as part of which he has invested in Mudrex, a social trading and decentralised finance (DeFi) aggregator, OnJuno, a payroll infrastructure bridging banking and crypto, among others.

In an unprecedented year for the Web 3.0 space in India, Sequoia India has made about 20 investments in Web 3.0 startups including Betafinance, Clearpool, Coinshift, and Faze, through a combination of equity and token investments.

This is a significant jump for the marquee VC fund that has so far invested in two such startups prior to this year.

Shailesh Lakhani, managing director of Sequoia India, said the fund will mainly focus on consumer applications that get to scale.

“What we are most excited about is that the underlying infrastructure of blockchain is finally getting to the point where it can support volume applications at low transaction costs,” Lakhani told ET.

“Blockchain to date has had wonderful theoretical implications, but practically was not really easy to use, nor was it cost effective to scale. That is starting to change in 2021 and we expect this trend to accelerate,” he added.

Blockchain technology encompasses categories such as nonfungible tokens (NFTs), decentralized autonomous organization, on-ramps and infrastructure.

Antler’s announcement and Sequoia India’s bullishness have come despite regulatory uncertainty in India as the Cryptocurrency Bill is expected to be tabled in the ongoing Winter session of parliament.

Additionally, the space has been largely dominated by international funds like Jump Capital, Pantera Capital, and Coinbase Ventures, which have been scooping up early winners in the Indian ecosystem.

ETtech

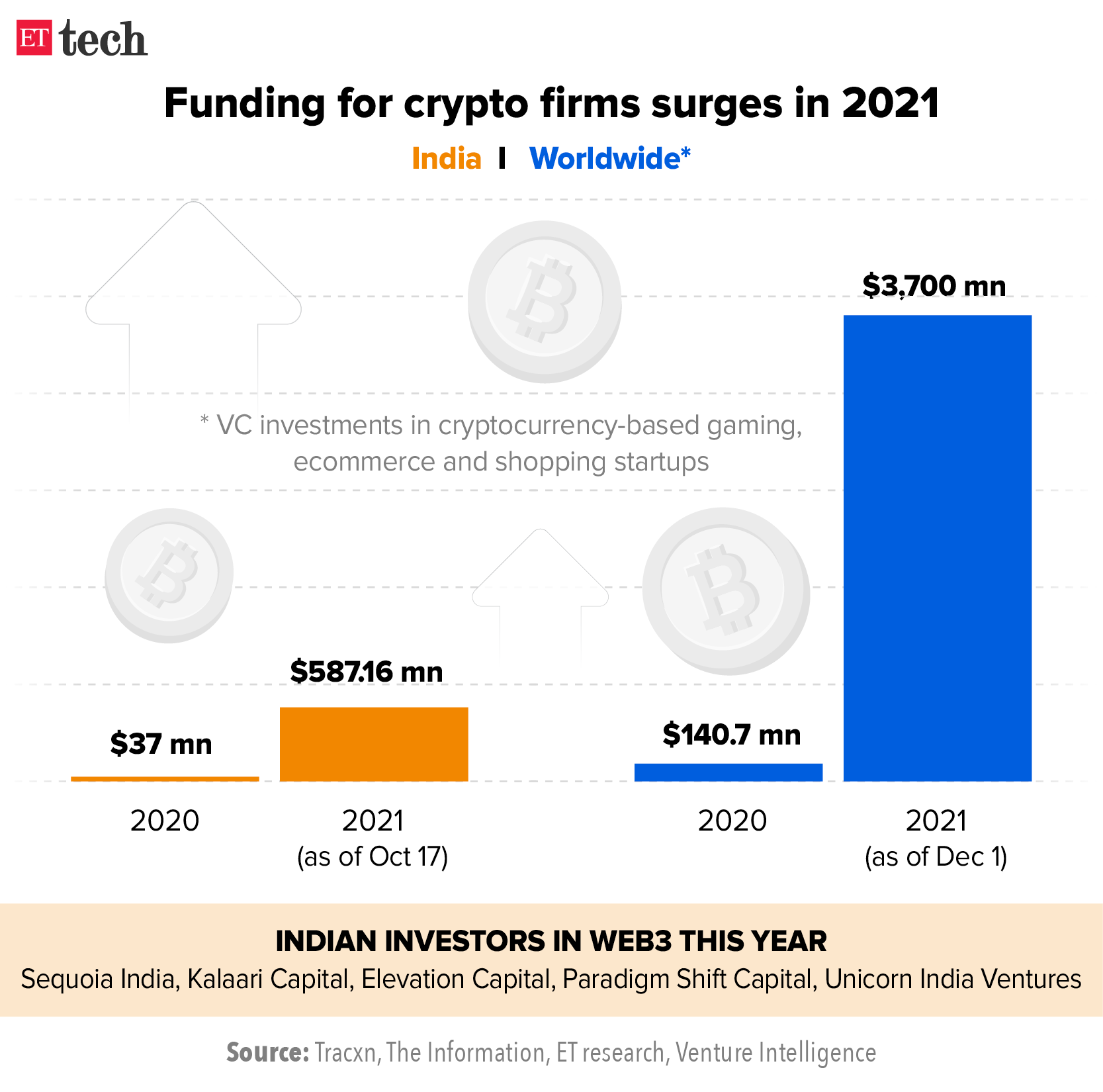

ETtechInternational funds have invested over $500 million this year in the Indian startup and blockchain ecosystem.

“I still think there is a regulatory risk,” said Sharma. “…we are making a commitment officially not because we think the regulations are necessarily going to be 100% positive, but we think that the point is that there is a long-term story here.”

“We will certainly find folks building in India for the world and between things which are in equity or digital assets. We will have ways to invest,” he added.

The fund will give founders access to a global community of Web 3.0 founders as well as the ability to leverage the developer ecosystem through the fund’s partnership with Solana and Polygon, as well as Questbook, Sharma said.

Crypto native vs consumer tech VCs

While some Indian VCs have been studying this space and strengthening their technical knowledge for years, they are competing with more experienced funds and may have their competition cut out.

“Crypto is very different, it is not traditional kind of play where you go for entrepreneurs and help them with sales and marketing,” said Saurabh Sharma of Jump Capital, an early investor in crypto exchange CoinDCX. “In my view, only specific types of VCs actually have a value add here, because capital in space is almost a commodity.”

Sharma said the ability to help “with actual technical development of the projects, your understanding of the product composability or whether you are active in market making or liquidity provision or validation all those crypto native things matter…”

This is also the first year in which Elevation Capital – which has backed startups like Paytm, Meesho and Swiggy – has added Web 3.0 to its investment portfolio and set up a specialised team to look at investing in such startups.

“Several of us have been engaging with Web 3.0 companies for 5+ years. We have seen companies get to scale in Web 2.0. And a lot of the lessons are not really different when it comes to things like how to scale organizations or go to market,” Lakhani said.

“We don’t expect Web 3.0 to be a complete refresh. In fact, we are also helping many of our Web 2.0 companies embrace Web 3.0 concepts and our knowledge and experience across both is a big plus,” he added.

Snapdeal founders Kunal Bahl and Rohit Bansal’s early stage fund Titan Capital invested in a blockchain gaming platform Doss and is also hiring to build its crypto investment practice.