Also in this letter:

- Reliance may follow kirana playbook for epharma push

- Business as usual for IT firms despite Omicron: experts

- Relief as RBI extends card tokenisation deadline

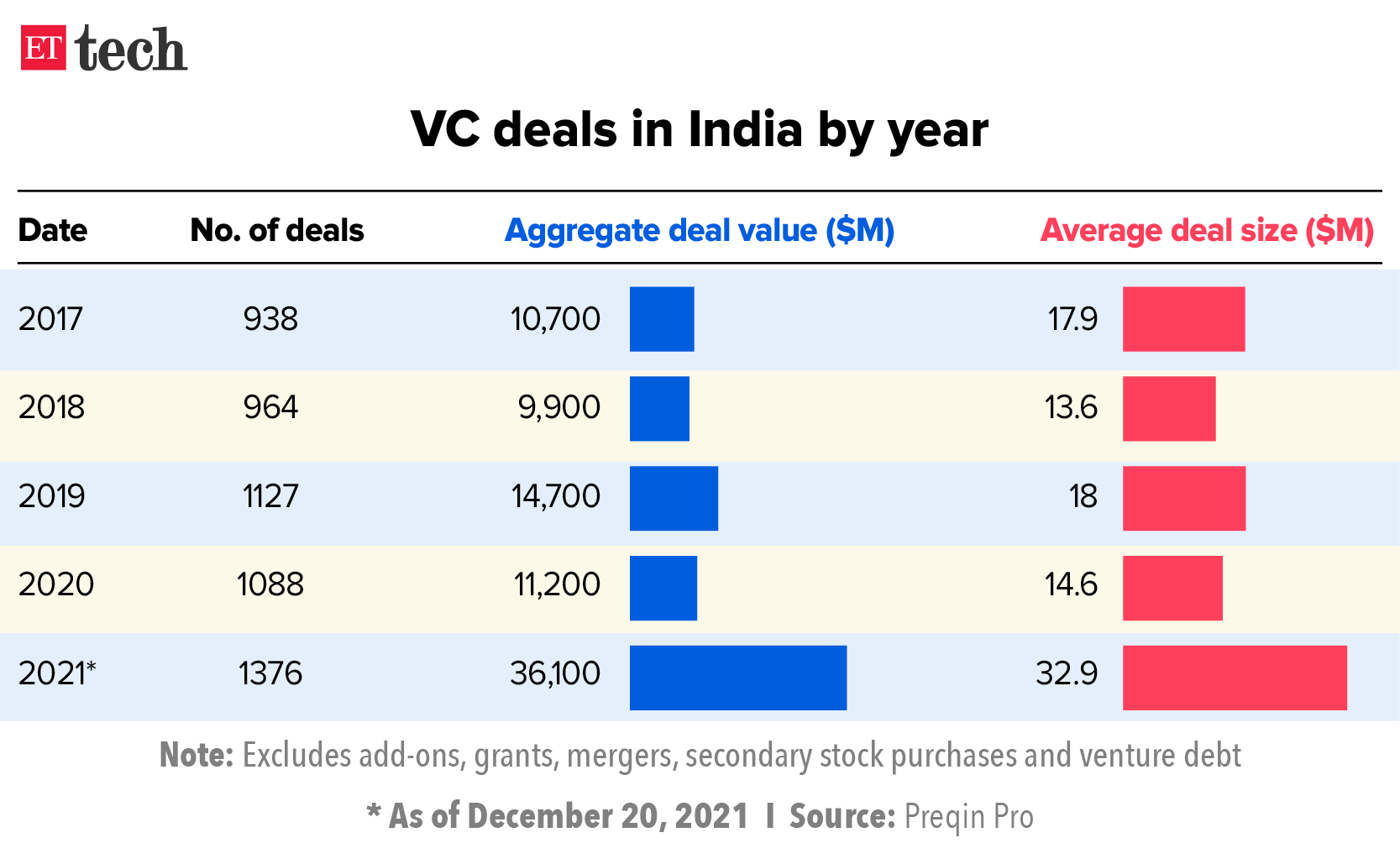

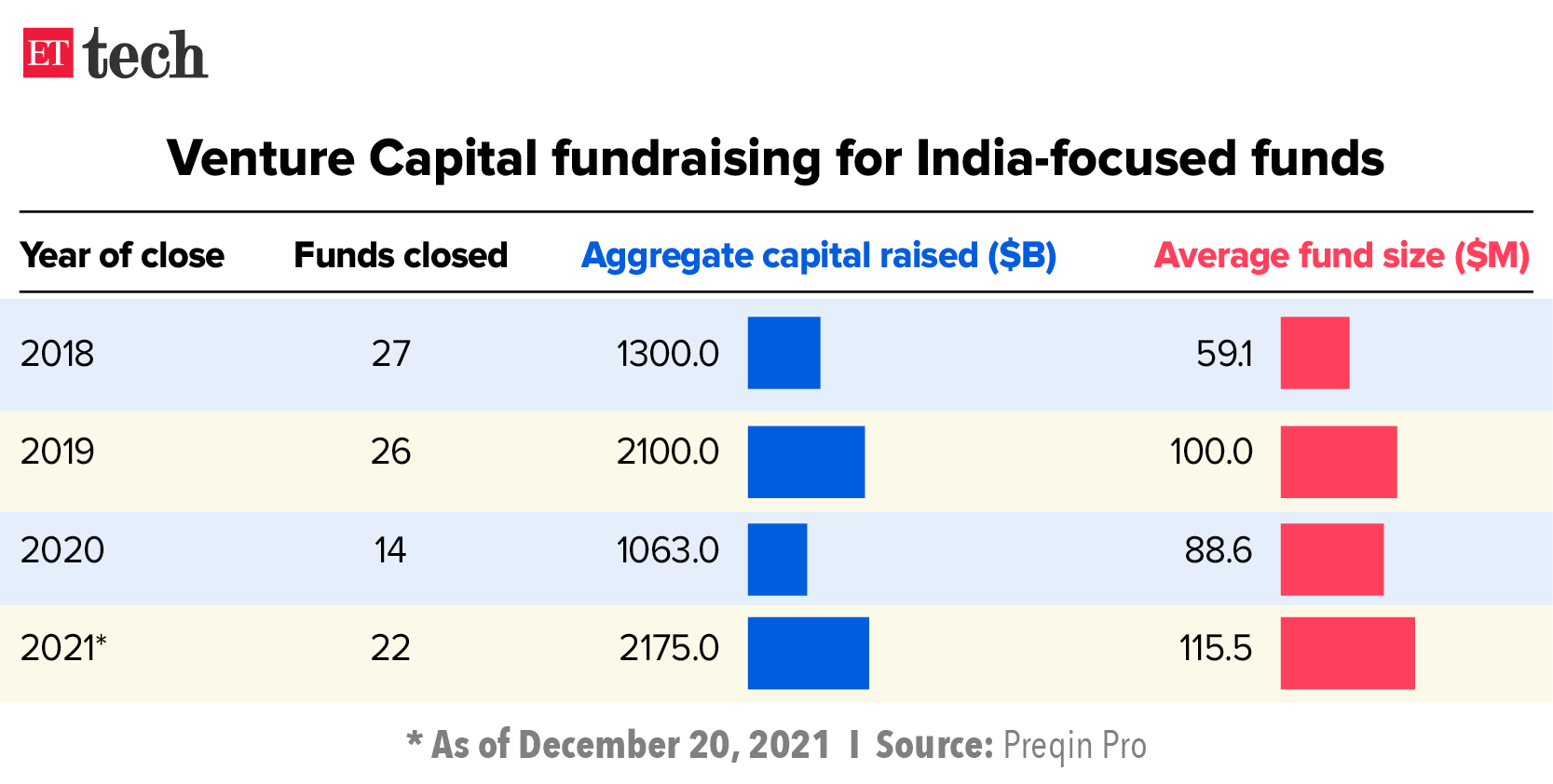

Indian startups rake in $36 billion in record-breaking year

India’s startups raised a record $36 billion from investors in 2021 as demand for digitisation skyrocketed during the second year of the Covid-19 pandemic.

The numbers: Preqin, an investment data platform based in the UK, estimated that venture and private equity investments increased more than 3X this year (as of December 20) from the $11 billion in 2020.

Seed-stage deals dominated in 202, with nearly 396 deals totalling to $705.86 million, while there were about 166 Series A rounds amounting to about $1.67 billion, the data showed.

But the bulk of the investments were in pre-IPO financing rounds of companies such as Zomato, Ola, Policybazaar and Paytm. The top 10 deals totalled $5.58 billion.

A signal year: There weren’t just more deals than last year – the average size of a deal was also bigger this year as funds took bigger bets on high-growth companies early on. The result was that many companies saw their valuations double and triple over successive funding rounds. These included Cred, OfBusiness, Groww, Cars24, Licious, Spinny, Infra.Market, Good Glamm Group and Pristyn Care.

“Valuations are a reflection of an investor’s exit expectations. 2021 has proven the full venture cycle for India. Some fabulous exits like Zomato, Nykaa, PolicyBazaar and others have increased exit size expectations, and consequently the valuations,” said Alok Goyal, founder and investment partner at Stellaris Venture Partners, an early-stage VC firm.

Cool your heels: But Goyal also cautioned that markets “have a habit of overreacting on both sides – in bull and bear cycles. We are seeing a bull cycle reaction right now and (won’t) be surprised if there is a bearish overcorrection in the future”.

Unicorn stampede: Unicorn, a moniker for startups valued at $1 billion or more, were birthed by the dozens this year. Nearly 40 companies launched themselves into the unicorn club, with a week in April seeing half-a-dozen startups in a span of four days entering the unicorn club. But it was not only unicorns, high-growth companies too went on to raise multiple rounds this year indicating the aggressive intent to back the leaders.

India’s first tech IPOs: The year also saw the very first Indian startup IPOs. Small startups such as Nazara Technologies went public early in the year but it was food delivery firm Zomato’s Rs 9,000-crore IPO in June that set the stage for others such as as Policybazaar, Nykaa, as well as Paytm, which raised nearly $2.5 billion from public market investors.

Reliance may follow kirana playbook for epharma push

Reliance Industries is planning to adopt a B2B2C strategy like its omni-channel kirana (neighbourhood store) playbook, sources told us.

Driving the news: The company, which acquired a majority stake in online pharmacy Netmeds for Rs 620 crore last August, has been digitising its wholesale business through JioMart-enabled point-of-sale machines over the past couple of months and has plans to scale that up rapidly, one of the sources said.

Just like its kirana strategy, Reliance not only aims to sell to the end customer through its B2C business, but also supply to small pharmacies across the country. In this model, the company gets orders directly from customers and asks the nearest partner store to deliver. These partners will thus play a crucial role in the company’s hyperlocal delivery plans.

Expanding: The company had opened around 114 Netmeds stores across the country as of May and has planned to increase this to 200 by the end of the year, a third source said. These are mostly attached to Reliance’s Smart Point stores, which sell everything from groceries to electronics and medicines. They also act as fulfilment centres for its B2B and B2C ecommerce businesses.

The most important project at JioMart, one of the sources said, is building a marketplace that will compete with ecommerce giants Flipkart and Amazon, as well as a beauty and personal care platform like Nykaa.

Challenges: Enabling B2B2C commerce has proved complicated for the company, said one of the sources. It has faced problems integrating Netmeds and C-Square, a software company that Reliance acquired in 2019.

Reliance’s kirana B2B business has also faced protests from traditional FMCG distributors after the company allegedly started undercutting them. Reliance has also used a similar strategy in the electronics category, aiming to sell smartphones and other devices to mom-and-pop mobile phone stores through JioMart Digital.

Tweet of the day

Business as usual for IT companies despite Omicron, say experts

It seems to be business as usual for Indian IT services providers despite reports emerging of a staggering increase in daily Covid-19 numbers from the United States, parts of Europe and the United Kingdom, which are battling the new Omicron variant.

The United States and UK are the top two markets for the $190 billion Indian IT industry.The spike in Covid-19 cases has brought back concerns of a global lockdown, and how this would impact the sector. But industry watchers have ruled out a wider fallout for the industry, which has seen demand rise sharply in the past year as companies accelerated their digital transformation.

Sanchit Vir Gogia, founder of industry consultancy Greyhound Research, said customers were opting for larger IT service providers that usually have a bigger talent pool, over smaller ones that struggle to retain employees during boom times.

Quote: “A lot of the digital transformation that started last year is still in progress and it will not stop. The (IT service) companies are insulated by the remote and hybrid working arrangement rolled out over the past year, existing and ongoing demand for digital solutions,” Gogia said. A third Covid-19 wave globally would help speed up digital transformation initiatives, instead of hampering them, he added.

RBI postpones card tokenisation rule by six months

The Reserve Bank of India on Wednesday evening postponed the implementation of its card tokenisation rule – which requires online merchants to erase all stored payment details of customers – by six months to June 30, 2022. It was originally meant to come into effect from January 1.

Pushback succeeds: The move came after digital payment firms, like Merchant Payments Alliance of India (MPAI) and the Alliance of Digital India Foundation (ADIF), said the industry was not prepared for the rule change, which would cause “large-scale disruption”.

We had reported on Wednesday that ecommerce firms and online service providers were bracing for chaos on January 1. About five million Indians have stored their card details with various online merchants.

What’s tokenisation? Tokenisation enables card transactions without disclosing the cardholder’s account information to either the merchant or any intermediaries. It involves replacing a 16-digit credit or debit card number with another string of 16-digit numbers known as a “token”, which is unique for each combination of card, token requestor and device. Importantly, tokenisation only applies to domestic, online purchases. The measure, which the RBI had announced in September, is aimed at protecting cardholders from fraud.

RBI’s concerns over stablecoins: The RBI also raised fresh concerns over stablecoins on Thursday, saying any crypto asset pegged to the US dollar or any other global currency could undermine the Indian rupee. This comes at a time when the government has still not decided whether it wants to regulate or ban cryptocurrencies.

What are stablecoins? Stablecoins are cryptocurrencies that attempt to peg their market value to some external reference, such as the US dollar or gold.

RBI officials have raised these concerns with the government in several meetings held recently, sources told us. The fear is that going ahead, companies or traders could use stablecoins even for domestic payments. The central bank said that if stablecoins were allowed in India, they could affect the its ability to control the currency fluctuations and volatility.

Neobank Open expected to turn unicorn with $100-150 million funding

Open, one of India’s fledgling neobanks, is in advanced talks to close a $100-$150 million funding round that would value it at $1.1-$1.3 billion.

Unicorn soars: If the deal goes through, Open’s valuation will have more than doubled in two months. The company had raised $100 million from Temasek, Google, Visa and others in October at a valuation of $500 million.

Investors: Qatar Investment Authority (QIA), the country’s sovereign wealth fund, is among the investors that have held talks with Open, sources told us. The company also received a term sheet from existing investors such as Tiger Global and Temasek to co-lead the new round, the sources said. A term sheet is a nonbinding agreement detailing the terms and conditions of a potential investment deal.

More in store? One of the sources said while QIA has put in a term sheet, it typically writes bigger cheques when leading a round. This means Open may also conduct a secondary share sale, which would take the size of the round to $150 million.

Acquisition: Earlier this month, Open had acquired consumer neobanking platform Finin in a $10 million cash-and-stock deal. It said it would use the company to strengthen its enterprise business and take it overseas in a significant way.

What’s a neobank? Neobanks are financial institutions that give customers a cheaper alternative to traditional banks. You could think of them as digital banks without any physical branches, offering services that traditional banks don’t, and doing so efficiently. They leverage technology and artificial intelligence to offer personalised services while minimising operating costs.

In India, these firms don’t have a bank licence of their own but rely on bank partners to offer licensed services. That’s because the Reserve Bank of India (RBI) doesn’t allow banks to be 100% digital yet (though some foreign banks offer digital-only products through their local units.) The RBI remains unwavering in prioritising banks’ physical presence, and has spoken about the need for digital banking service providers to have a physical presence as well.

Read our full explainer on neobanks here.

Vedanta Group eyes investment in display fabrication facility

Vedanta Group is looking to invest between $3 billion and $5 billion in a display fabrication facility in India and is in talks for a technology partnership with top companies from Taiwan and Japan, including Foxconn, Innolux Corp, Samsung, LG and Sharp, a top executive told us.

AvanStrate Inc, which is part of the Vedanta Group, is planning to apply under the government’s recently announced $10 billion semiconductor policy, said Akarsh Hebbar, managing director, AvanStrate.

The government notified the scheme on Tuesday and said it would provide a 50% capital subsidy to two chip and two display fab units in the country.

Quote: “In the first phase, we will spend about $3 billion to $5 billion. We will be building out; the panel fabs cost anywhere between $2.5 billion and $3.5 billion; it is similar for semiconductors, too,” said Hebbar. “So, we will look at putting out $3-$5 billion, if not a little north of $5 billion to build the first phase of an electronics cluster that contains an integrated display fab and a semiconductor fab. Then we’ll start investing more as we go along in 10-12 years.”

The company is also in talks with various state governments, including those of Gujarat, Maharashtra and Tamil Nadu, to zero in on a location for the facility.

Other Top Stories By Our Reporters

RBI imposes fine on One Mobikwik Systems, Spice Money: The Reserve Bank of India has imposed a penalty of Rs 1 crore each on One Mobikwik Systems and Spice Money for violation of norms on net worth requirement provided by the regulator for Bharat Bill Payment Operating Units.

Eggoz bags $3.5 million in funding: Egg-focused consumer brand Eggoz said it has raised $3.5 million (over Rs 25 crore) in Series-A funding, led by Nabventures, a venture capital fund anchored by National Bank for Agriculture and Rural Development.

Global Picks We Are Reading