In India, Iron Pillar has invested in companies likes of software startup Uniphore, meat delivery startup FreshToHome, cloud kitchen player, Eatfit among others.

According to the Iron Pillar report titled ‘India Tech Trends’, the aggregate valuation of Indian unicorns stands at $535 billion in 2022. The fund said that total unicorns in the country have more than doubled to 130 in the last 15 months, this includes the ones domiciled out of India.

Further, India’s startup landscape has seen close to 100 unicorns being added since January 2019.

ETtech

ETtech“ We believe that this pace may reduce a bit in the next 24 months, creating 250 companies with over $1 billion valuation by 2025 is an extremely achievable goal for Indian founders. We are especially bullish since almost 50% of these scaled companies are building for markets beyond India as well,” said Anand Prasanna, managing partner at Iron Pillar, in a statement on Monday.

Discover the stories of your interest

Indian startups raised $38 billion in risk capital in 2021, making it a seminal year for fundraising, also because a bunch of tech firms went public on the Indian bourses.

Despite private market investors taking a ‘wait and watch’ approach, due to global headwinds, Indian startups still raked in

over $10 billion in funds during the first quarter of 2022, up from $5.7 billion in the same period in 2021, according to data sourced from Venture Intelligence.

ETtech

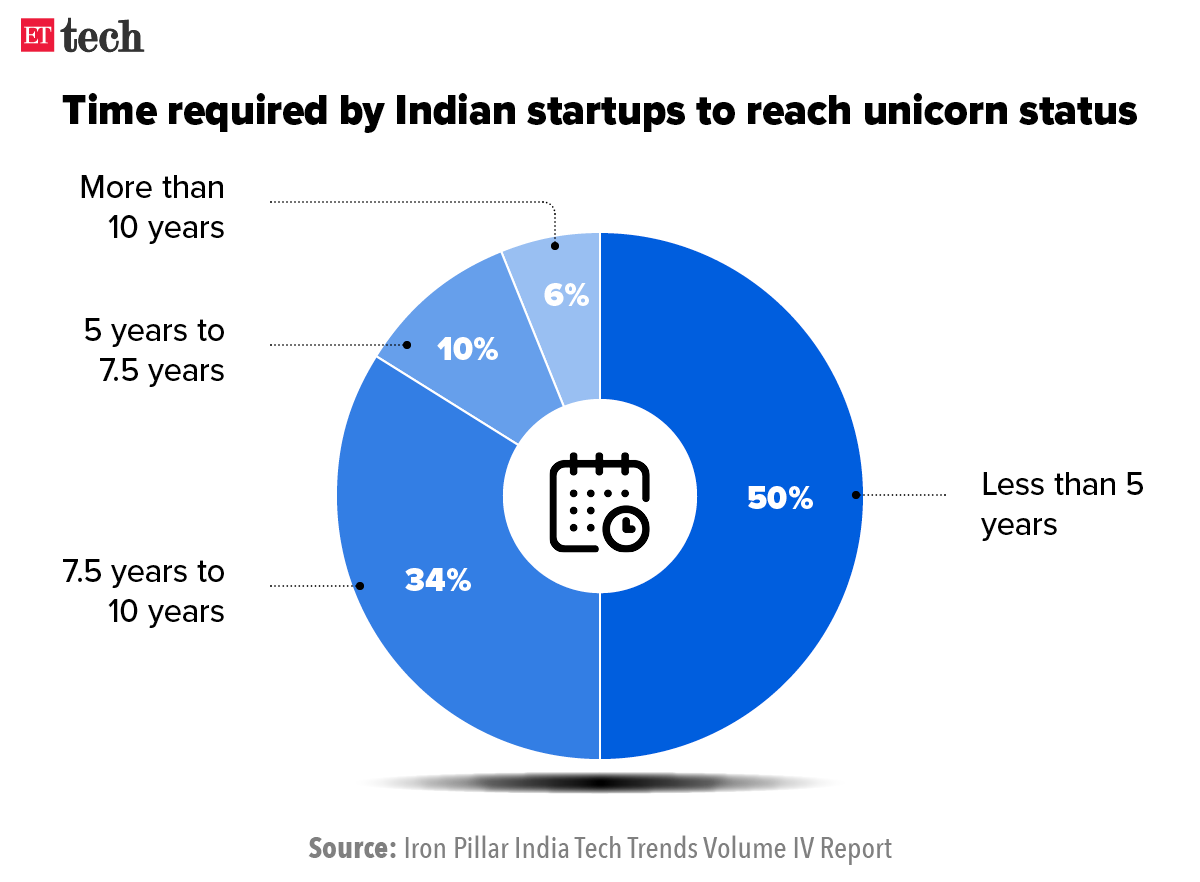

ETtechIn addition to this, the time required for Indian companies to turn ‘unicorn’ has also reduced with 50% of India’s unicorn stable achieving $1 billion of valuation or more, within five years of inception, Iron Pillar said.

According to data sourced from market intelligence platform, CB Insights, India continues to be the third largest technology ecosystem in the world with the most number of unicorns, after the US and China.