Credit: Giphy

Also in this letter:

■ Startup unicorns eyeing IPOs meet top mutual funds

■ More pain for SoftBank as valuations of listed portfolio firms slide

■ ED freezes bank assets of WazirX worth Rs 64.67 crore

India seeks wider authority over global M&A with antitrust law

India proposes mandating antitrust scrutiny for mergers and acquisitions valued above Rs 2,000 crore ($250 million), according to a draft law.

The proposal is part of a larger overhaul of India’s competition law in a bill set to be introduced in parliament on Friday.

Significance: The move appears to be aimed at global tech companies with substantial local business. The proposals stem from India’s view that it should have a say on deals such as Meta’s 2014 takeover of WhatsApp.

Under current law, the Competition Commission of India (CCI) reviews mergers and acquisitions that surpass thresholds for asset size or turnover.

But many high-value deals between technology firms with a major presence in India have escaped scrutiny in the country because the companies involved have had few assets and low turnover.

Case in point: Meta’s acquisition of WhatsApp in 2014 for $19 billion required no CCI clearance, even though WhatsApp counted India as a major market, lawyers said.

“The hotly debated deal value test seeks to attract scrutiny of transactions where parties do not meet the conventional asset and turnover thresholds particularly in the tech space,” said Anisha Chand, a partner specialising in antitrust law at law firm Khaitan & Co.

“If passed in the present form, the incoming amendment may likely result in a jump in (the) number of transactions particularly in new-age markets to require prior clearance,” she added.

Policy flux: The news comes days after the government withdrew the Data Protection Bill, 2019 from parliament, saying it was working on a new bill. The previous version had come under intense criticism from tech companies and privacy advocates.

On Friday morning we reported, citing officials, that the government is looking to introduce the new data bill in the winter session of parliament, though the next budget session may be a “more realistic target”.

Startup unicorns eyeing IPOs talk tech with India’s top mutual funds

More than a dozen domestic institutional investors (DIIs) including the likes of HDFC Mutual Fund, Axis Mutual Fund, Mirae, ICICI Prudential, with $250 billion under management, met with the founders and leadership teams of Indian unicorns Swiggy, Meesho, Unacademy, Lenskart and Acko, among others, all of which are eyeing a possible stock market listing in the next two years.

Purpose: The two-day meeting, held in Bengaluru and hosted by Japan’s SoftBank and JP Morgan, was aimed at helping the domestic public investment community understand some of the tech businesses and their path ahead.

Significance: The meeting comes at a time when the global tech industry is going through a major correction in both private and public market valuations.

“DIIs are a vital constituent of the Indian stock market, and they will only get more important with time… As more tech companies go public and become a more significant part of the indices, it is essential for these two constituents to build a relationship and understand each other better,” said Sumer Juneja, managing partner and India head, SoftBank Investment Advisers.

DIIs still wary: Last year, eight Indian startups listed on the public markets, including the likes of Zomato, Nykaa, PolicyBazaar, Paytm — with seven of these being on the domestic exchanges.

However, DIIs have had a mixed outlook towards these tech listings.

As opposed to the venture capital community, which encourages pivots and high growth for a startup, DIIs are focused on stability in execution from even some of the companies that listed last year, said another person who met with the asset managers.

Tweet of the day

More pain for SoftBank as valuations of listed portfolio firms slide

SoftBank CEO Masayoshi Son will be staring at more pain when the group reports April-June earnings on Monday as valuations of the listed portfolio of SoftBank Group Corp’s Vision Fund unit continue to slide.

The mighty fall: The Vision Fund’s public portfolio first-quarter loss could top $10 billion, Redex Research analyst Kirk Boodry estimated, after falls in robotics firm AutoStore Holdings Ltd, ecommerce firm Coupang Inc and artificial intelligence firm SenseTime Group Inc, whose shares fell by almost half on the last day of June.

Writedowns continue: While there is limited visibility on valuations of Vision Fund’s private portfolio, writedowns contributed to the record $26 billion Vision Fund loss reported in May as investor concern over the prospects for high-growth stocks fed through to private markets.

Meanwhile, Elon Musk might also be in a spot of bother. Twitter rejected his claims in a Delaware court filing that he was hoodwinked into signing the deal to buy the social media company, saying that it was “implausible and contrary to fact”. Musk made the claims in a countersuit filed under seal last Friday, which was made public on Thursday.

ED freezes bank assets of WazirX worth Rs 64.67 crore

The Enforcement Directorate on Wednesday froze bank assets worth Rs 64.67 crore of crypto exchange WazirX under the Prevention of Money Laundering Act (PMLA) following a laundering case against numerous Indian non-banking financial companies (NBFC) and their fintech partners.

Allegation: The agency said since the investigation began, it found a large number of funds were diverted by fintech companies to purchase crypto assets and launder money. It said the lion’s share was diverted to WazirX, and the crypto assets purchased were diverted to foreign wallets.

The ED said its search operation on August 3 revealed Sameer Mhatre, a director with WazirX, had complete remote access to the database of the crypto exchange but was “not providing the details of the transactions relating to the crypto assets purchased from the proceeds of crime of Instant Loan app fraud.”

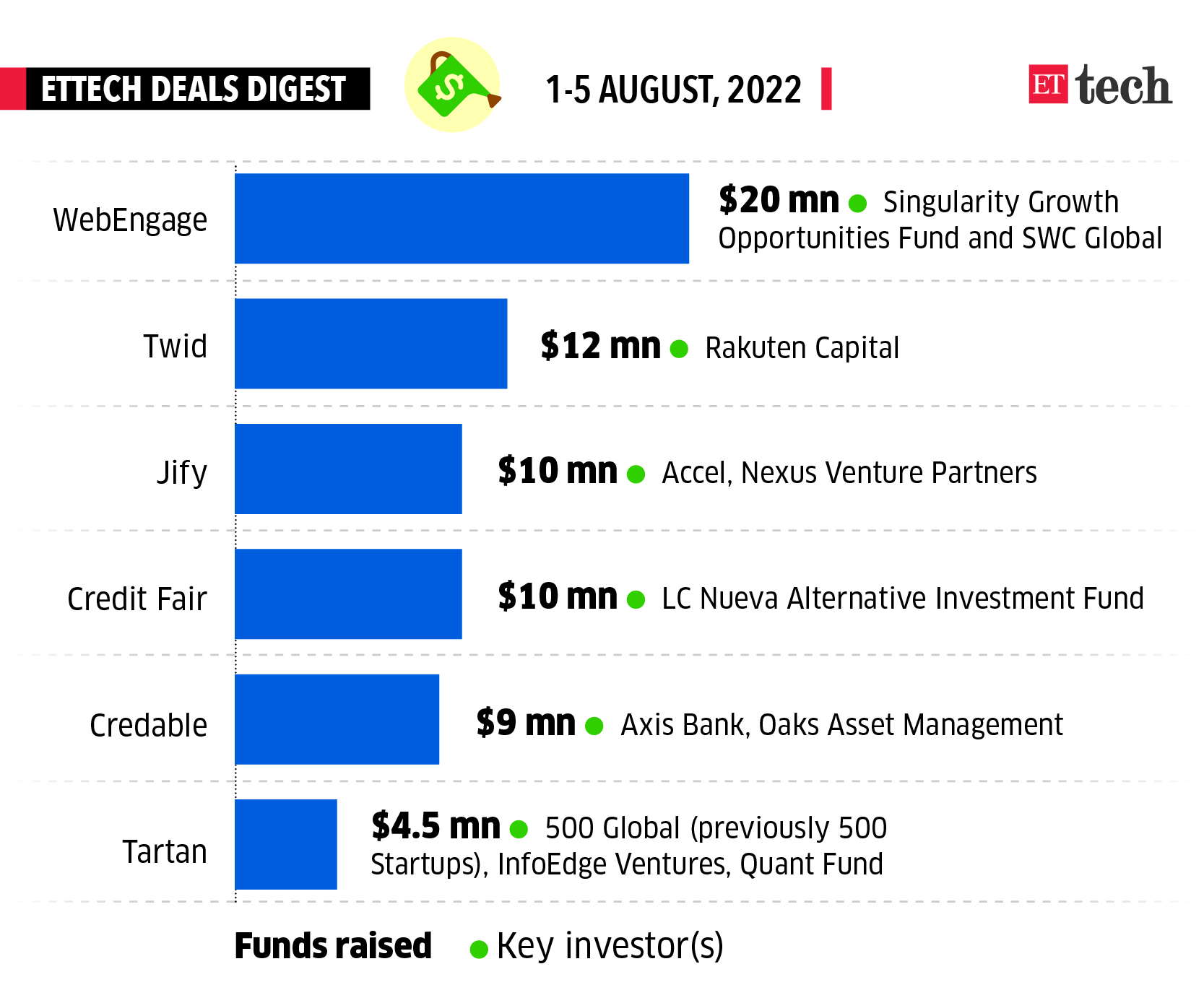

ETtech Deals Digest

This was the third week in a row that startups failed to attract big-ticket investments as VCs continued to weigh their options amid tightening macroeconomic conditions and high inflation. Automation startup WebEngage bagged $20 million in the largest fundraise of the week.

Here is a list of all the startups that raised funds this week.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.