Also in the letter:

■ Crypto exchange Coinswitch to foray into Indian stock trading

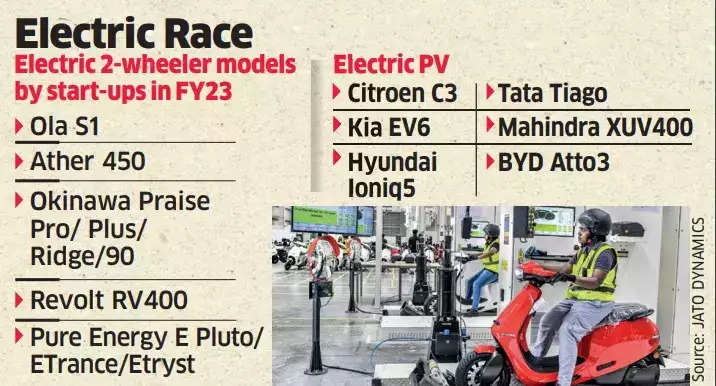

■ Startups outpace legacy auto companies in e-scooter launches

■ Nuggets in numbers from the filings of IT companies

Outsourcing hubs like India to bag 40% of jobs lost to layoffs

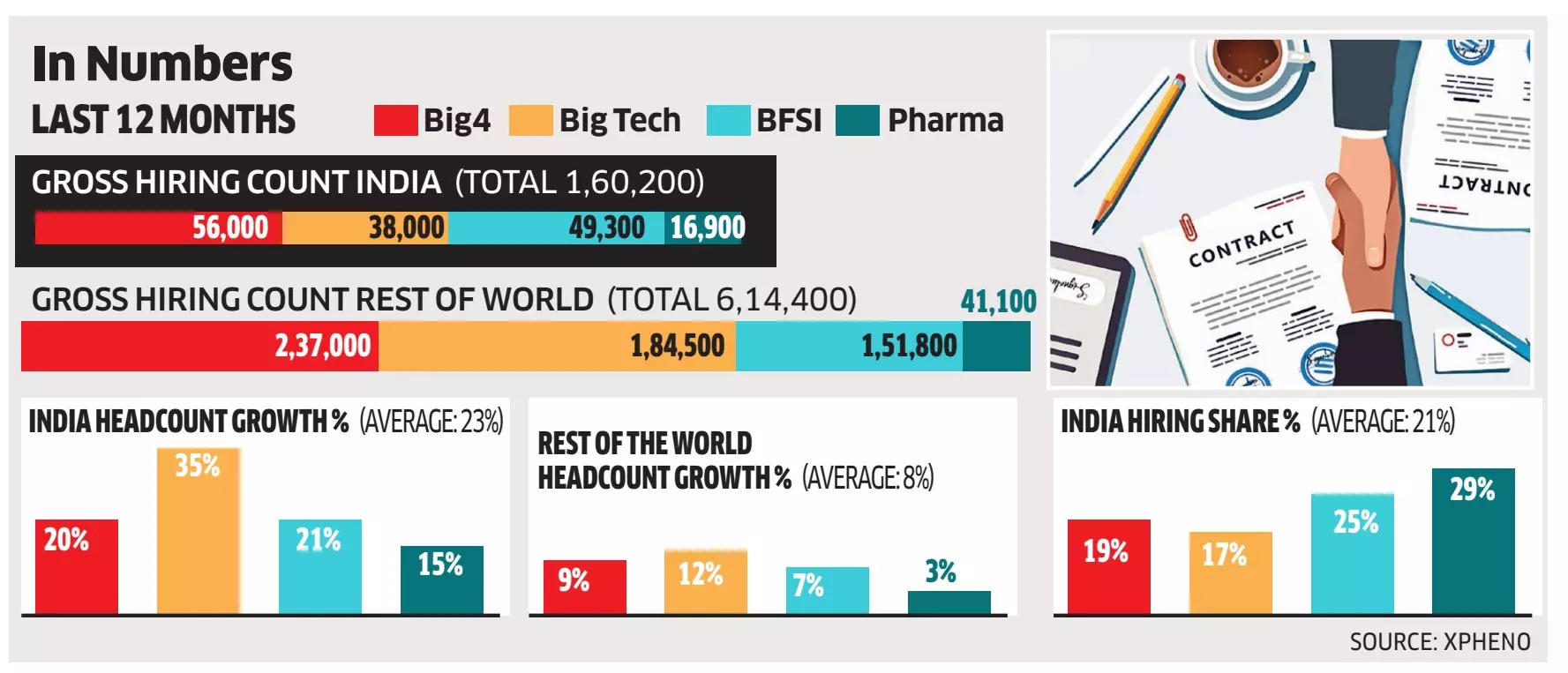

In the coming months, outsourcing hubs like India are projected to absorb about 30-40% of the over 3,00,000 technology jobs cut globally, according to experts.

Why India? “India is going to be the biggest gainer in the medium-to-long term, as almost every company we speak to is looking at expanding its base here,” Sanjay Shetty, director-professional search and selection, Randstad India, an HR firm, told ET.

Data provided by staffing firm Xpheno reveals that Indians constitute about 17% of the global workforce of major tech companies. This number has grown 35% over the last 12 months, compared to 12% for the rest of the world.

An outsourcing hub: Tech industry body Nasscom reports that India houses over 2,700 global capability centres (GCC), more than 65% of which are of companies headquartered in the US. Kamal Karanth, cofounder of Xpheno, said that the GCCs collectively added slightly over 1,50,000 employees, and grew from 1.45 million in the fiscal year (FY) 21-22 to 1.6 million in FY 22-23.

Fire & hire: “A dipstick of 25 Indian bellwether GCCs and their affiliates across banking, big tech, the Big Four consultancies, and the pharma sector shows a significant concentration of hiring action in India versus their rest-of-the-world locations. The list also includes big tech players who have announced waves of layoffs globally and in India,” said Karanth.

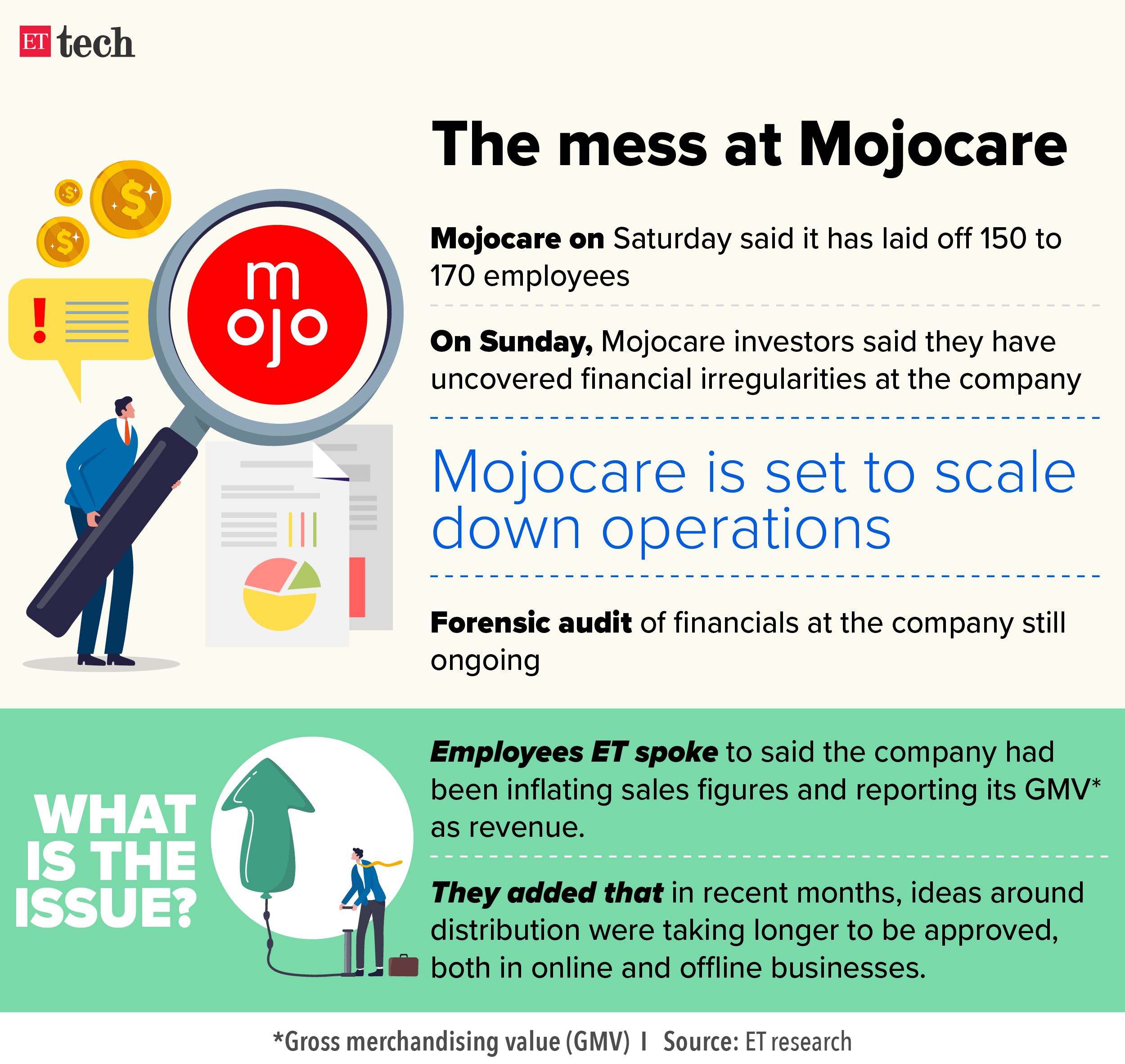

Mojocare funders flag financial finagling

Mojocare founders Rajat Gupta (Left) and Ashwin Swaminathan

Bengaluru-based healthcare and wellness startup Mojocare’s investors have found irregularities in the company’s ongoing forensic audit, a statement from the group of investors, including Peak XV Partners (erstwhile Sequoia India), Chiratae Ventures, and B Capital, said.

Verbatim: “A majority of Mojocare investors initiated a review of the company’s financial statements. While the analysis remains ongoing, initial findings have uncovered financial irregularities, and it has become apparent that the business model is not sustainable due to a variety of operational and market factors. As a result, Mojocare will be scaling down operations, and the investor group is working with the company through its transition’’, the statement from investors said.

Layoffs: ET reported on Saturday that the company had laid off close to 170 employees citing difficult market conditions. The company said it undertook layoffs to ‘improve on its unit economics and better its capital efficiency’.

What went sideways? The audit results have not yet been made public, but according to several employees ET spoke to, the leadership has been inconsistent and opaque when providing updates on revenue growth. One employee claims that over the past few months, new distribution strategies have taken longer to be approved, both in the online and offline segments. Another employee disclosed that the company has been inflating its sales volumes and misrepresenting the gross merchandise value as its revenue for months.

Cap table and funding: Chiratae Ventures is the largest shareholder in the company, while B Capital has pumped in the most capital yet. The startup had raised about $20 million, led by B Capital Group, along with existing investors — Chiratae Ventures, Sequoia Surge, and Better Capital — in August 2022.

Coinswitch plans to launch platform for trading in Indian stocks

Ashish Singhal, CEO and cofounder, CoinSwitch Kuber

In an effort to expand its offerings, cryptocurrency trading platform Coinswitch is planning a foray into stock trading in India to compete with the likes of Zerodha and Upstox.

What’s happening? The Tiger Global and Andreessen Horowitz-backed crypto trading platform is planning to apply for a stockbroker’s licence with the Securities and Exchange Board of India (Sebi), a person aware of the matter told us. The company is also in talks with non-banking financial companies (NBFCs) and banks to offer fixed deposits, the person added.

“The thinking here is that since the crypto investor is looking at other options, why not offer those on Coinswitch,” the person said.

As cryptocurrencies take a battering across the world, the company had earlier announced plans to widen its scope beyond cryptocurrencies and offer conventional investment products like mutual funds, and US stocks.

Focus shifts to Indian markets: Coinswitch is eyeing India now as its plans to offer investment in US stocks went for a toss following a hike in the tax collected at source (TCS) on foreign remittances under the Liberalised Remittance Scheme (LRS).

Quote, unquote: Coinswitch co-founder and CEO Ashish Singhal confirmed the development to ET. “Our ambition is to become a full-fledged wealth tech platform. To that end, we have several products in our pipeline,” he said.

Quick catch-up: ET had reported in November that in the backdrop of regulatory ambivalence and dampened demand for cryptocurrencies, exchanges and trading platforms were looking at diversifying their offerings to non-crypto products.

E-scooter launch: startups outpace legacy auto companies

Startups have outpaced established automobile manufacturers in launching electric two-wheelers, accounting for more than 10 of the 18 new models on offer in 2022-23, even as the legacy firms continued to dominate the electric passenger vehicle segment.

Disruptors lead the rEVolution: On the world stage, disruptors led the shift to clean energy. In India, the largest two-wheeler market in the world in terms of both sales and production, the EV transition started with two- and three-wheelers.

Legacy players catching up: Established automakers are now seeking to emulate startups by leveraging their strengths such as access to capital, strong brands, and manufacturing prowess, an industry expert told ET.

Electric two-wheelers are easier to manufacture than electric cars due to their simpler design, supply chain, and manufacturing processes. They also require a smaller battery, and their reliance on a public charging infrastructure is much lower as well.

Meanwhile, in the electric passenger vehicle segment, traditional players such as Tata Motors, Mahindra, Hyundai, Kia, MG Motor, and Citroen continue to dominate.

ICE on ice: “Startups are leading the way at this stage of the category development. EV startups don’t have a safety net or Plan B in ICE (internal combustion engines). Therefore, they are deeply vested in electrification and don’t have either the cultural baggage or financial considerations that stops them from going all-out,” Ravneet S Phokela, CEO of Ather Energy, told ET.

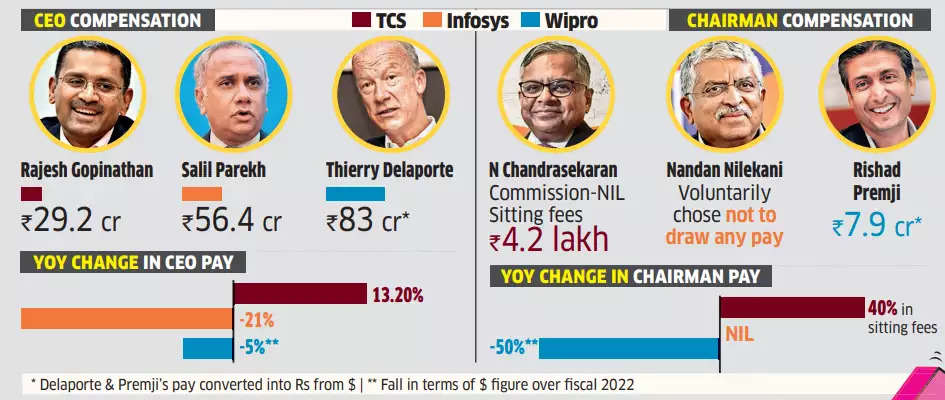

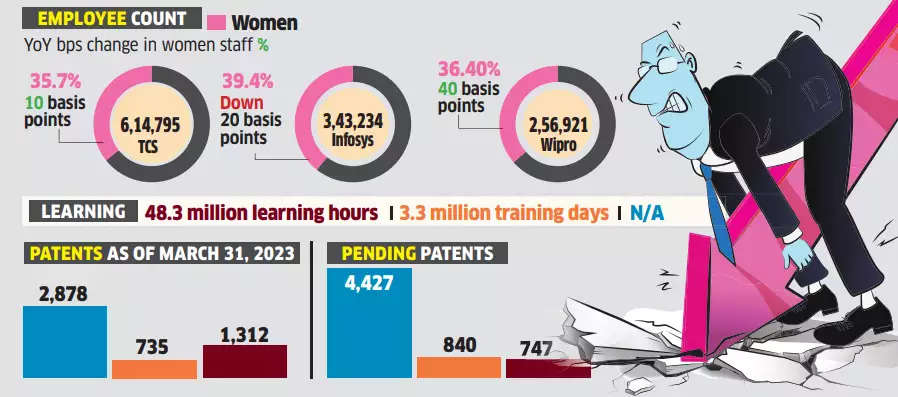

Infographic: Nuggets in numbers from the filings of IT companies

The financial year-end results and guidance season is drawing to a close. Here’s a look at a few nuggets from the filings of the major IT companies, and what they mean.

Compensation: A weak Q4 and muted revenue-growth projections of the top IT companies are reflected in the pay packages of their C-suite executives. Wipro chairman Rishad Premji and CEO Thierry Delaporte have taken 50% and 5% pay cuts, respectively, while the salary of Infosys CEO Salil Parekh was 21% lower than last year.

Learning hours: Learning hours is a key indicator for top IT companies as it shows the degree of re-skilling and up-skilling of their workforce. Experts anticipate a fall in this indicator in the coming quarters as commuting may eat into training time with most firms making return to office mandatory.

Workforce analysis: The IT majors clocked marginal improvements in terms of women as a percentage of the workforce, except Infosys. Female employee attrition reached a high of 30-40% in recent months, compared to the standard sector attrition levels of around 15%.

Other Top Stories By Our Reporters

How Europe is leading the race to regulate AI: Last week, the European Union (EU) became the first jurisdiction to take a definitive step towards regulating artificial intelligence. ET takes a look at the key provisions of the EU AI Act.

Move over, celebs: Cannes lays out the red carpet for influencers — Apart from the slew of A-listers that garnish the Cannes film festival each year, there were a number of social media influencers who sashayed down the crimson carpet wearing some of the biggest names in the business.

Global Picks We Are Reading

■ Is Crypto Dead? (The Atlantic)

■ Victims speak out over ‘tsunami’ of fraud on Instagram, Facebook, and WhatsApp (The Guardian)

■ A coupon-crazy Brazilian app figured out how to beat Uber Eats (Rest Of World)