Credit: Giphy

Also in this letter:

■ Flipkart sells Cleartrip’s Middle East business to Wego

■ Paytm, Nykaa, Cartrade and Policybazaar hit fresh lows

■ ETtech Opinion: A fresh look at social media regulations

India to be hub for PUBG maker’s foray into emerging markets

Krafton, the South Korean gaming firm behind PUBG, is making India the hub of its emerging markets strategy as it looks to expand its global presence following an initial public offering (IPO) last year.

India template: The company said it is looking to replicate its approach in India across other emerging markets.

“India is like our hub for emerging markets. [These] markets have their own flavour for media and entertainment, and can’t be typecast. We feel Indian IP is going to be super important, not just in India but also globally in the next five to six years,” said Anuj Tandon, head of corporate development, India and MENA, Krafton.

Show me the money: The company has committed to investing more than $100 million in India’s startup ecosystem. In the past 10 months, it has announced six deals totalling about $86 million, including investments in game studio Nautilus, game streaming platform Loco, esports firm Nodwin Gaming, and Indian language content firm Pratilipi.

Back from the dead: The original PUBG Mobile game was one of 59 China-linked apps banned in India in September 2020. Though Krafton owns PUBG, it had licensed PUBG Mobile to China’s Tencent, which is presumably why it was banned.

In 2021, the company launched Battlegrounds Mobile India, the Indian version of PUBG Mobile.

Investment strategy: Rather than focus on a predefined opportunity, Krafton is looking at opportunities across stages, with investments so far ranging from small seed rounds to $48 million in Pratilipi.

The company will also consider taking properties from India to other emerging markets in future but does not have any immediate plans to build games out of India.

App war continues: On February 15, we reported that the Indian government had issued fresh orders to ban over 54 Chinese apps, terming them a threat to the privacy and security of Indians. It was the fifth round of Chinese app bans dating back to June 2020.

Flipkart sells Cleartrip’s Middle East business to Wego

Wego, an online travel marketplace in the Middle East, has signed an agreement with Flipkart Group to acquire Cleartrip’s Middle-East business. Cleartrip had organically expanded into the region in 2010.

The boards of directors of Wego and Flipkart have approved the transaction, which is expected to close in the second half of 2022, the statement said. Flyin.com, a Saudi-based travel company Cleartrip acquired in 2018, will be sold to Wego as a part of the deal. The deal also involves a technology sharing agreement between Flipkart and Wego. After the deal, Flipkart’s Cleartrip will have operations only in India.

Wego claims to be the largest online travel marketplace in the Middle East and North Africa and is backed by Tiger Global Management, Crescent Point, Square Peg Capital, Middle East Venture Partners and the MBC Group.

Other Done deals

■ Direct-to-consumer (D2C) healthy snacking brand Happilo has raised $25 million from Motilal Oswal PE (MOPE). The company, which sells dry fruits, trail mixes, nut protein bars and muesli, will use the funds to grow its D2C channel and distribution network, it said in a statement.

■ Invact Metaversity has raised $5 million in a seed round led by Arkam Ventures. Antler India, Picus Capital (Germany), M Venture Partners (Singapore), BECO Capital (Dubai) and 2amVC (the US) also invested in the round, which values the startup at $33 million. The startup has also raised capital from over 70 individuals such as Balaji Srinivasan, former chief technology officer at Coinbase; Nithin Kamath, cofounder of Zerodha; and Kunal Bahl, founder of Snapdeal, among others.

■ RetainIQ, an ecommerce marketing company, said that it has raised $2.3 million (Rs 17.2 crore) in a funding round led by venture capital firm Accel Partners. RetainIQ plans to use the capital to rapidly scale its operations, accelerate product development, and expand its core teams across engineering, product, sales, marketing and operations.

■ AiDashannounced the acquisition of geospatial and AI (artificial intelligence) powered farming solutions provider Neurafarms.ai. With the acquisition of Neurafarms.ai, AiDash strengthens its product line and adds valuable talent to its team, according to a statement. The company did not disclose the size of the acquisition.

Paytm, Nykaa, Cartrade and Policybazaar hit fresh lows

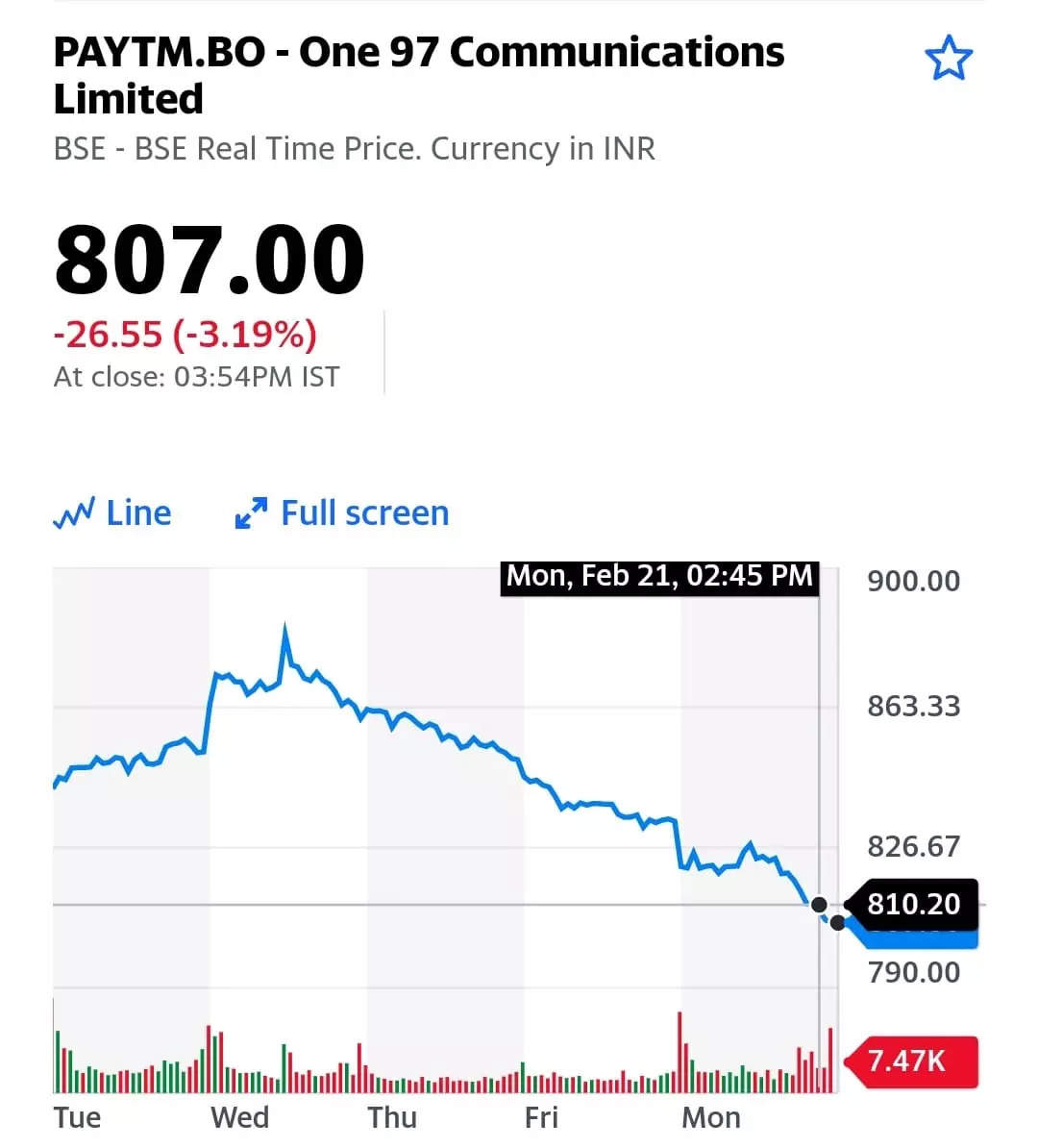

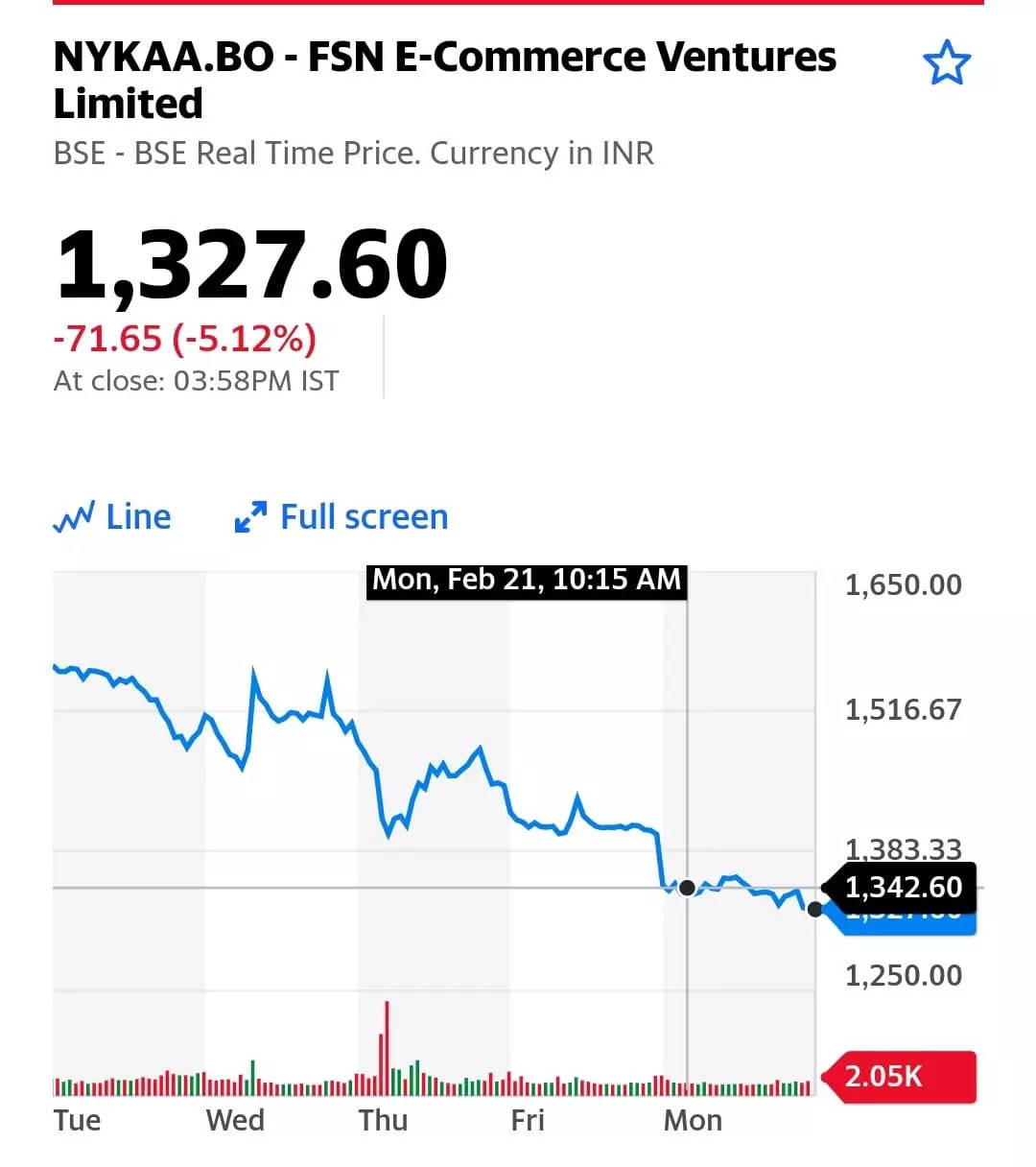

Shares of new-age companies hit new lows on Monday with Paytm, Nykaa, CarTrade and PolicyBazaar falling sharply amid an overall negative trend in the market. Shares of Paytm’s parent firm One 97 Communications have now fallen more than 60% from their high, while Nykaa is down 42% from its record high.

But why? The downtrend in the market seems to be on the back of the Russia and Ukraine crisis. Small-cap and medium-cap stocks were particularly badly hit on Monday. At close, the Sensex was down 149.38 points or 0.26% at 57,683.59, while the Nifty was down 69.60 points or 0.4% at 17,206.70.

Taking stock

- Paytm: The shares of One 97 Communications (parent firm of Paytm) opened at Rs 830 and hit a 52-week low of Rs 801 on Monday.

Credit: Yahoo Finance

The fintech’s shares closed the day Rs 807 down 3.19% on Monday.

- Nykaa: The shares of Nykaa’s parent firm FSN E-Commerce Ventures Limited have been under tremendous selling pressure of late. The stock crashed 5.12% to hit an all-time low of Rs 1,313 on BSE. It had opened at Rs 1,395 against the previous close of Rs 1,399.25.

Credit: Yahoo Finance

- PB Fintech: Shares of PB Fintech, the parent company of Policybazaar, also hit a 52-week low of 718.05 on Monday after opening at Rs 745.

Credit: Yahoo Finance

The scrip closed the day 3.30% lower at Rs 726.70.

- CarTrade Tech: Shares of CarTrade fell 4.36% to close the day at Rs 526.15, hitting a 52-week low of 560.05 on the way.

Credit: Yahoo Finance

ETtech Opinion: It’s time for a fresh look at social media regulations

The world over, governments have become acutely aware of issues around content moderation on social media and have been coming up with legislative frameworks that seek to reign in these platforms. The UK Online Safety Bill is a case in point. It proposes doing away with the intermediary and safe harbour constructs altogether and imposing extensive ‘duties of care’ on social media platforms and search engines with respect to the content on their platforms.

The conundrum: Social media in essence does serve as an intermediary, providing users with a window to cyberspace through which they can project their views, knowledge, skills and creativity. Making them wholly liable for content shared by users, over which they have no editorial control, may not be the most cogent way forward.

On the other hand, calls for a more responsible social media ecosystem require platforms to proactively block harmful content and suspend offending accounts. The paradox is that as this policing activity of social media platforms becomes more extensive, it correspondingly erodes their status as passive intermediaries of content.

A possible solution: A possible way out might be to retain the intermediary construct, but with more clear-cut obligations for platforms in order to qualify as intermediaries and enjoy safe harbour protection. This may be achieved through seven steps carried out by way of legislative actions/amendments to the IT Act.

Click here to read the full column by Delhi-based lawyers Varun Mehta and Anmol Jain.

Donald Trump’s Truth Social app launches on Apple’s App Store

Donald Trump’s new social media venture, Truth Social, launched late on Sunday on Apple’s App Store, potentially marking the former US president’s return to social media after he was banned from several platforms last year.

The app was available to download shortly before midnight Eastern Time and was automatically downloaded to Apple devices of users who had pre-ordered it.

Teething problems: Some users reported either having trouble registering for an account or were added to a waitlist with a message: “Due to massive demand, we have placed you on our waitlist.”

Listing plans: Trump Media & Technology Group (TMTG), the venture behind Truth Social, is planning to list in New York through a merger with blank-check firm Digital World Acquisition Corp (DWAC) and stands to receive $293 million in cash that DWAC holds in a trust, assuming no DWAC shareholders redeem their shares.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.