We’ve been following all the crypto developments since last week when a Lok Sabha bulletin gave way to speculation on what India’s Cryptocurrency Bill — to be tabled in the ongoing session of Parliament — will actually contain. Read what Apoorva, our crypto reporter, wrote in the previous edition of ETtech Unwrapped.

There’s a lot to unpack here, so I’ll let our reportage this week do the talking..

India looks to add crypto to Tax Law: Indians who trade or invest in cryptocurrencies on Indian platforms could come under the taxman’s lens, as might those who hold such coin outside the country.

- The government is looking to amend current income tax and disclosure norms in the upcoming budget to include terms such as cryptocurrency.

- The government wants to capture cryptocurrency income and investments within and outside India, said people aware of the development.

- The government is considering amending Section 26A of the Income Tax Act and the Annual Information Regulation (AIR), often called a ‘tax passbook’.

“There is a recommendation to add the words cryptocurrency, crypto assets or digital currency in some parts of the Income Tax Act,” one of the persons said. “This would mean that those filing tax returns will have to specifically disclose their income from cryptocurrency investment or trading.”

Talks, and more talks: The central government, the country’s banking regulator and members of India’s crypto community have discussed several proposals during separate interactions to explore a possible regulatory framework if private cryptocurrencies are allowed to survive in India—with restrictions.

The proposals include:

- Curbs on peer-to-peer transactions

- Tax on airdropped crypto coins

- Capital criteria for exchanges

- A filtration mechanism for crypto

The industry wants the government to consider a separate crypto regulator, sources say.

RBI-backed CBDC likely to feature in Crypto Bill: The proposal for a central bank digital currency, backed by the country’s banking regulator, may be included in the upcoming bill to regulate cryptocurrency, a top government official told us.

- The law aims to also ensure that the RBI does not lose control of India’s monetary economics while minimising speculative betting around cryptos, the source said.

“Unregulated cryptocurrencies can destabilise the macroeconomy and create big speculative bubbles. To that extent, the RBI is right,” the person added.

No proposal to recognise Bitcoin as currency, FM says: The government has informed the Lok Sabha that there was no proposal to recognise Bitcoin as a currency.

- To a query on whether the government had any proposal to recognise Bitcoin as a currency in the country, Finance Minister Nirmala Sitharaman replied in the negative. “No, sir,” she said in a written response in the Lok Sabha.

The central government doesn’t collect data on Bitcoin transactions, she said.

Finance Minister Nirmala Sitharaman.

A status update on crypto ads: Crypto exchanges are turning to targeted advertising and marketing campaigns to soothe the nerves of investors who are exiting their investments amid regulatory uncertainty on the virtual currencies. Their new sign-ups are also shrinking.

- Some of the exchanges—including CoinDCX and CoinSwitch Kuber—have restarted advertising and marketing campaigns, albeit not as aggressively as earlier. In most cases, the ads are aired on social media and other digital platforms.

The exchanges had suspended crypto ads, after an advertising blitzkrieg in the past few months that were criticised for being puffery and misleading by many.

Separately, the Advertising Standards Council of India is in discussions with the government to refresh guidelines related to cryptocurrency advertising, to include adequate disclosure of risk, ensuring that consumers don’t mistake crypto products to be legal tender.

New crypto law set to red-flag chit fund, multi-level marketing schemes: India is set to red flag several investment schemes launched by individuals and cryptocurrency exchanges that are similar to chit funds, multi-level marketing and systematic investment plans, to build a robust regulatory framework to protect vulnerable rural populations buying risky crypto assets.

- Regulators including the RBI and Sebi have raised concerns before a parliamentary panel about how some individual investors are collecting money in small towns—with business models resembling those of chit funds—for investing in crypto assets.

- The banking regulator has pointed out how some Indians have even started accepting cryptocurrency payments for export services, thus posing a broader systemic risk.

“It is observed that some individuals are going to small towns and raising money from people, mainly in cash, with the promise of great returns in cryptocurrencies,” said a person familiar with the representations to central lawmakers. “This is exactly like chit funds, but without any framework or regulations.”

OTHER BIG STORIES BY OUR REPORTERS

What Parag Agrawal as Twitter CEO means for India

Twitter CEO Parag Agrawal.

Mumbai-born Parag Agrawal’s ascension to the post of Twitter CEO could stoke greater adoption of local innovation and calm regulatory turbulence faced by the world’s largest microblogging platform in key markets such as India.

That’s according to company executives and privacy experts, who believe that he will have to do a bit of a balancing act. Cyber law expert Pavan Duggal is expecting “a more balanced, nuanced view” as “he is from India and understands the Indian ecosystem, ethos and laws”.

- “Twitter’s commitment to freedom of speech can’t be doubted or faulted but if you operate in a jurisdiction, you have a choice of either complying with the laws or vacating it,” Duggal told us.

Public policy experts are of the view that the strong “ethnicity connect” with India does help firms like Google, Microsoft, IBM and Adobe, all of which are led by India-born CEOs. Twitter’s case should be no different.

(From left) Alphabet CEO Sundar Pichai, Microsoft’s Satya Nadella and IBM’s Arvind Krishna.

“The Indian government and political leadership connects better to ethnic Indian leaders and could be less abrasive with them than they have been with Twitter leadership,” said Prasanto K. Roy, a public policy expert. “New Delhi’s expectations could also go up—for instance, that all engagement must happen with Parag Agrawal and not an India-based CEO.”

Related Coverage

Swiggy to invest $700 million in Instamart amid grocery wars

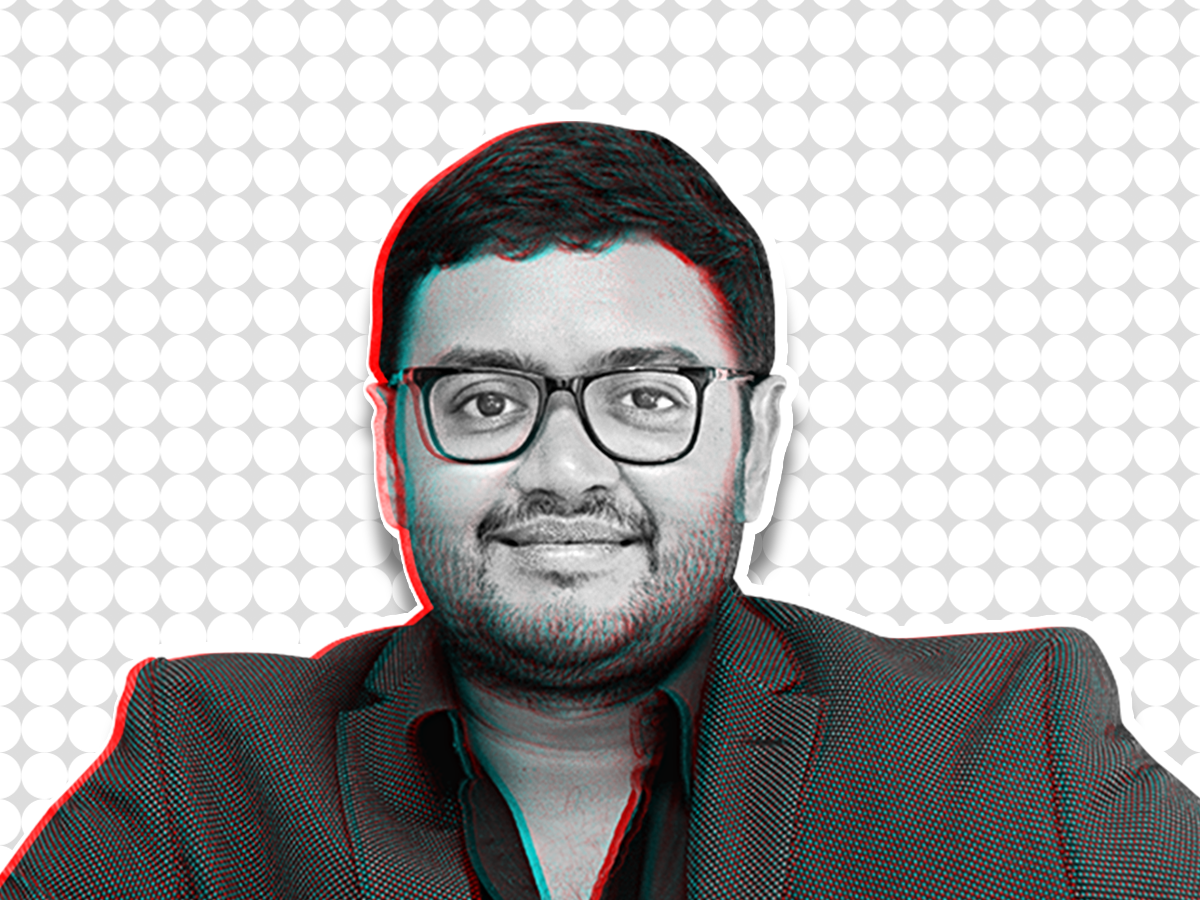

Swiggy’s cofounder Sriharsha Majety.

Swiggy has earmarked $700 million for its Instamart service, amid heightened investor interest and growing competition in the instant grocery delivery segment, cofounder and chief executive Sriharsha Majety said.

Instamart, launched in August last year as Swiggy’s quick commerce vertical, is set to reach an annualised gross merchandise value run rate of $1 billion in the next three quarters, the company said. It recently crossed the milestone of two million active users.

- “We think that is the size of ammunition that we need to deploy to be able to do justice to this (online grocery) category,” Swiggy CEO Sriharsha Majety said.

Swiggy’s large capital commitment for Instamart comes on the back of its talks to close a $600-700 million funding round led by US asset manager Invesco, according to a Sept. 28 ET report.

Uber brings back Rs 2-crore job offers at IITs

Uber Technologies has emerged as the top paymaster on day one of final placements at the Indian Institutes of Technology, handing out Rs 2 crore-plus package offers.

- The Uber package amounts to approximately $274,250, or about Rs 2.05 crore, including around $128,250 (approx. Rs 96 lakh) base pay, target cash bonus, new hire grant and a sign-on bonus.

The offer marked the comeback of a Rs 2-crore compensation package on IIT campuses after a nearly six-year gap. We had previously reported that the IITs are likely to witness a spike in big-ticket job offers.

A large number of international trading firms, including Da Vinci Derivatives and Maverick Derivatives to Quantbox Research, Quadeye and Graviton Research, are also making a beeline at IITs to seek fresh graduates who can take to their algo-trading platforms instantly.

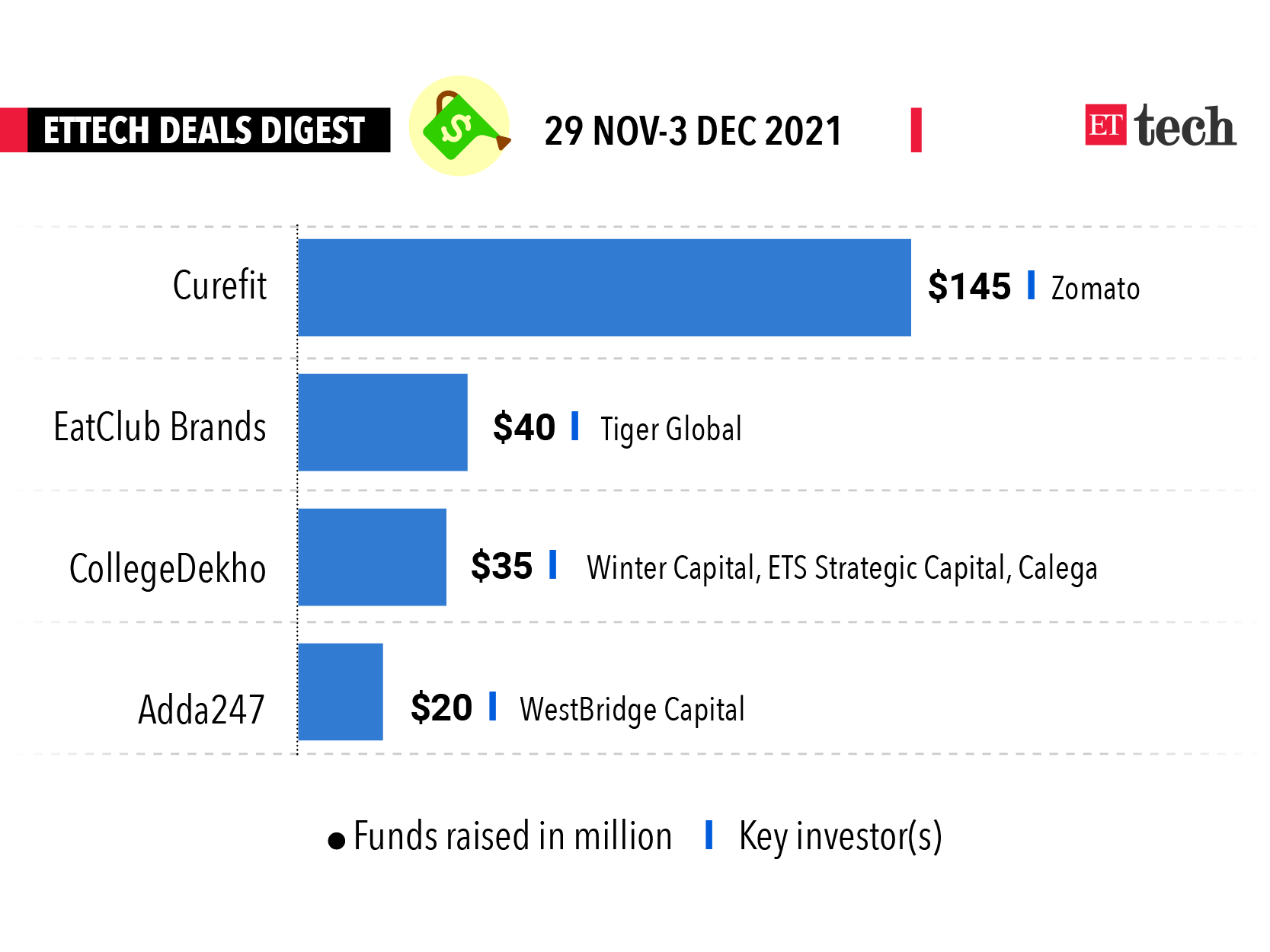

ETtech DEALS DIGEST

■ Cars24 is in advanced stages of talks to close a $250-300 million funding round led by Falcon Edge at a valuation of at least $3 billion.

■ Slice has become the newest entrant to the club of Indian startups valued $1 billion or more after raising $220 million from Tiger Global and Insight Partners.

■ Kunal Shah’s Cred has agreed to acquire Happay, a corporate expense management platform, in a cash-and-stock deal to add to its suite of fintech offerings.

■ Cloud kitchen startup EatClub Brands—formerly BOX8—has raised $40 million from Tiger Global at a post-money valuation of $340 million.

■ Curefit Healthcare, which operates the fitness platform Cultfit, has raised $145 million in a funding round led by Zomato at a valuation of about $1.5 billion.

ETtech Analysis: Behind Paytm’s dismal IPO and its constant valuation catch-up

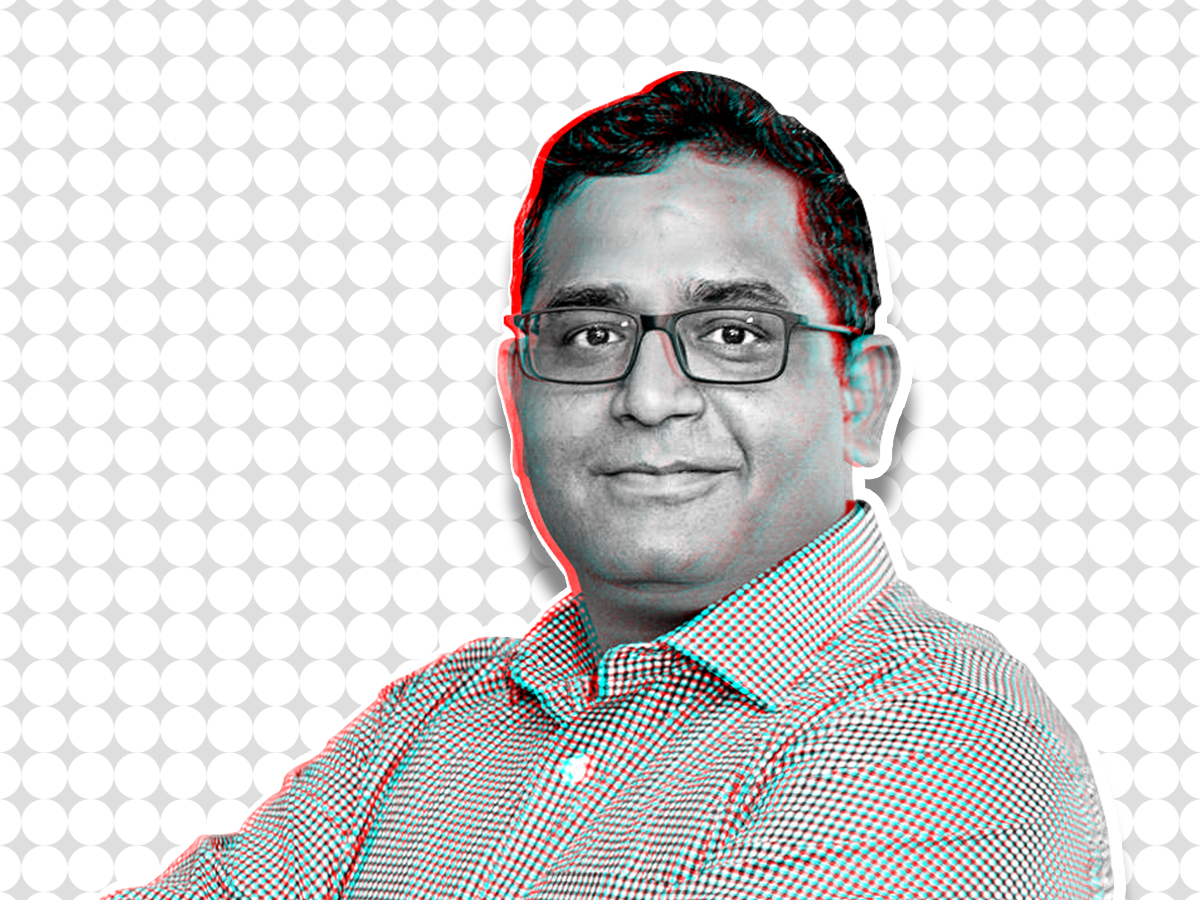

Paytm founder Vijay Shekhar Sharma.

Paytm’s founder Vijay Shekhar Sharma is synonymous with setting big goals and he isn’t shy about his grandiose ambitions. “Go big, or go home”, a sales slogan believed to have originated in the ’90s America, is an exhortation emblematic of what Sharma and Paytm stand for.

But while there were doubts cast on Paytm’s IPO — India’s biggest on record — and how its listing will impact sentiments around Indian startups, not many expected the rout that unfolded on Nov. 18.

What went wrong? A lot more than overpricing, steep valuation and unclear path to profitability, as Digbijay Mishra and Rajesh Mascarenhas found out in this ETtech Analysis.

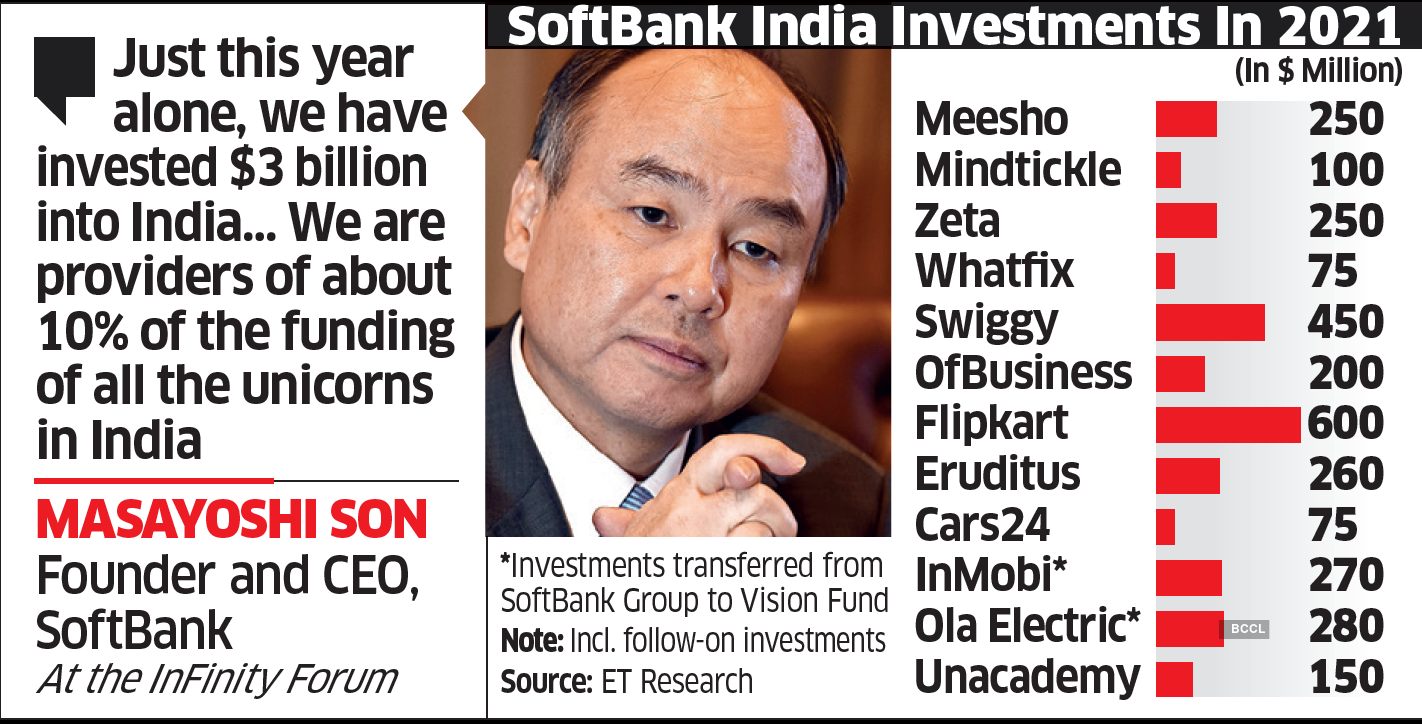

SoftBank is biggest foreign investor in India, Masa Son says

SoftBank CEO Masayoshi Son.

SoftBank has invested about $14 billion over the past decade in India, making it the country’s largest foreign investor, its chief executive has said.

“Just this year alone, we have invested $3 billion into India. We are the biggest foreign investor in India,” Masayoshi Son said at the Infinity Forum, India’s flagship global fintech summit, on Friday. “We are providers of about 10% of the funding of all the unicorns (private firms valued at $1 billion or more) in India.”

He estimated that Softbank-backed firms in India have created one million jobs.

“I believe in the future of India. I believe in the passion of young entrepreneurs in India. There is a bright future. I tell the young people in India, let’s make it happen. I will support.”

Legal threat to India’s data law in the works

Big Tech firms may go to court to challenge certain provisions of the Data Protection Bill if lawmakers accept and adopt all the recommendations of the Joint Committee of Parliament in the final legislation, sources told us.

- The Joint Committee on the Personal Data Protection Bill, 2019—headed by BJP MP PP Chaudhary—adopted a draft report on Nov. 22 with seven of its 31 members moving dissent notes against various clauses.

The biggest point of contention is the proposal to classify social media platforms as publishers. This will impact Facebook, Google’s YouTube, Twitter and WhatsApp, all of whom stand to lose the safe harbour provided by the Information Technology Act, 2000.

Indian IT + SaaS — A symbiosis takes root

As Indian SaaS startups gain scale and vie for larger global deals, there’s a growing scope for them to partner some of the country’s largest IT services firms to manage and implement digital transformation projects at a rapid scale.

Early signs of such partnerships are already visible.

- Freshworks Inc., which announced a strategic tie-up with Tata Consultancy Services Ltd, in June last year, is partnering with India’s IT bellwether on around 50 projects.

- Healthcare-focused Innovaccer, which has partnered with HCL Technologies, feels its next stage of growth will be dependent on partnerships with large IT firms.

Innovaccer CEO Abhinav Shashank and Freshworks’ Girish Mathrubootham believe that there is a big opportunity for a symbiotic relationship between Indian SaaS and IT firms. While some of it might be scale dependent— given the size of the software services firms, small software makers might find it harder to build meaningful partnerships—but as the industry for Indian software products grows, so will the opportunity.

That’s all from us this week. Stay safe and get that jab.