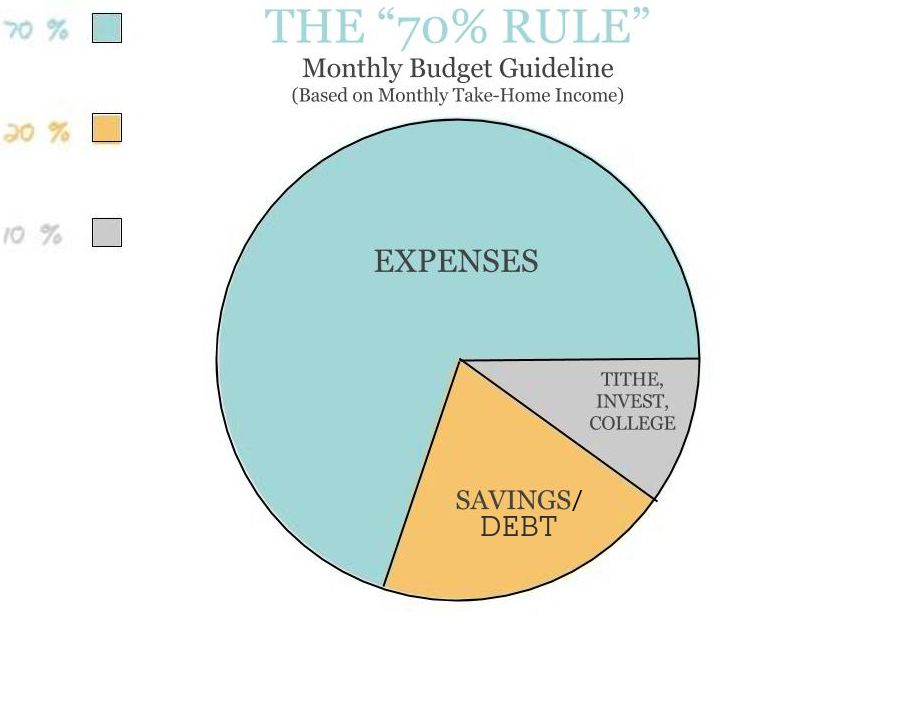

The 70/20/10 rule is a way to handle your personal finances that says you should spend your money in the following order: 70% go toward essential costs, 20% go toward financial objectives, and 10% go toward leisure and other expenses.

The first category,The things you need to pay for in order to maintain your basic standard of living are included in the first category, called essential expenses. These include bills for housing, transportation, food, utilities, and anything else you need to keep your current lifestyle going.

The second category, financial objectives, is for investing and saving money. Saving for a down payment on a house, paying off debt, saving for retirement, or saving for a child’s education are all examples of this. Long-term financial security and stability depend on this category.

The final category,Non-essential spending falls under the final category, which is called leisure and other expenses. This could cover things like vacations, eating out, entertainment, and other things you can choose. Even though these costs are not absolutely necessary, they can still be included in a sound financial strategy as long as they stay within the 10% budget limit.

The 70/20/10 rule is a flexible guideline that can be modified to meet the needs and circumstances of each individual. For instance, if a person is having trouble paying off a lot of debt, they might decide to spend less on entertainment and other errands and spend more on debt repayment.

Or, if a person earns a lot of money and has a lot of money saved, they might put more money toward their financial goals, leisure, and other expenses. It’s important to remember that the 70/20/10 rule is a guideline, not a strict rule. Because every individual’s financial situation is unique, it is essential to modify the principle to meet your specific requirements and objectives.

However, individuals can increase their financial control and work toward long-term financial stability by adhering to the rule’s fundamental principles.

To apply the 70/20/10 rule, you must first keep track of your expenses for a few months before determining where your money is going. You can create a budget that follows the 70/20/10 rule once you know how much you spend. It’s also a good idea to look over your budget on a regular basis and make any necessary adjustments.

You can ensure your long-term financial success by keeping your expenses in line with your income and allocating your funds in accordance with your objectives and priorities.