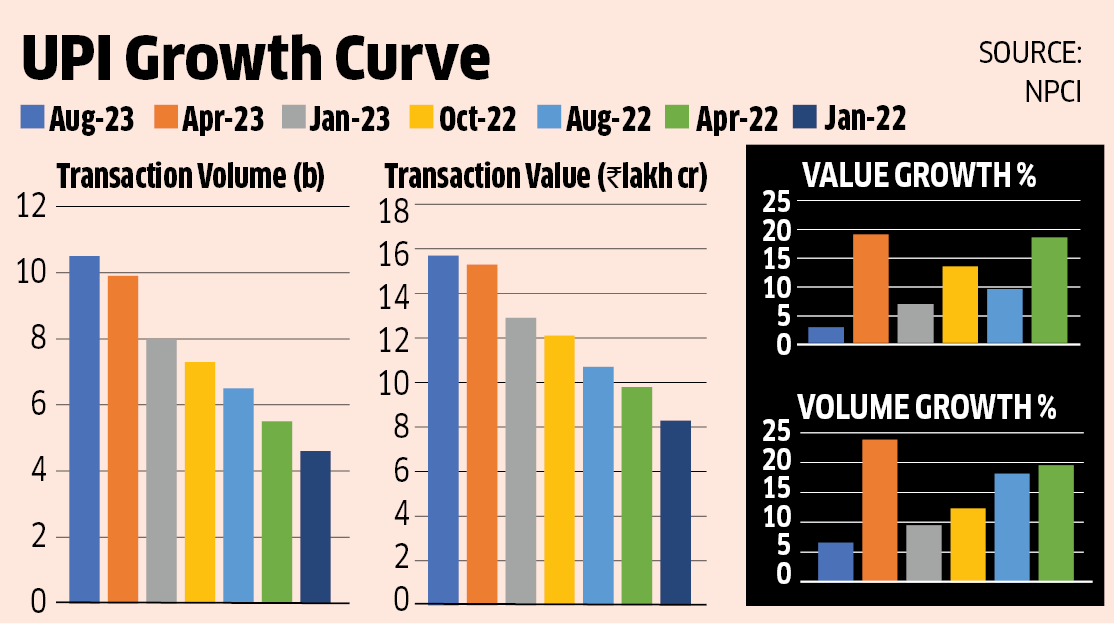

Unified Payments Interface (UPI), the real-time bank transfer mechanism, breached the 10 billion monthly transaction volume mark last month. And with the festive season not too far away, one can only expect it to grow more in the coming months.

But what does this 10 billion really mean and how did we get here?

I look at the top five changes that have had a deep impact on the Indian fintech ecosystem.

Beyond cards: Before UPI, digital payments meant card swipes at point of sale (PoS) terminals – and these were restricted to large format retail shops or high-end branded stores. UPI changed all that, taking merchant digital payments to every nook and corner of the country. A street corner coconut seller using QR codes to accept payments digitally became the brand image of India’s digital payments journey.

While the likes of Paytm, PhonePe brought QR codes to India, banks have got into the game as well and are playing catch-up now. Large lenders like HDFC Bank, ICICI Bank and others are pushing QR codes to their merchants.

Going Global: Before UPI, the only global payment mechanisms accepted worldwide were Visa, Mastercard and other card payment systems. The central government made it a point to take UPI to other nations who showed interest in the technology. Our immediate neighbours Sri Lanka and Bhutan, then France, the UAE, Singapore are all adopting UPI.

In terms of domestic payments, UPI has helped reduce India’s dependence on multinational companies for its payments, a crucial piece of national infrastructure.

Cash flow-based lending: India has historically been a credit-starved nation. While lenders were keen to cater to the credit needs of micro-enterprises, the customers were difficult to underwrite. UPI democratised digital payments and in turn made cash flow-based lending possible.

Today Paytm is giving out around Rs 2,500 crore worth of merchant loans every month.

“There was a time when credit assessment was done manually by estimating a merchant’s income by looking at his stocks, now the POS machine gives out all those details,” said Arun Kumar Nayyar, managing director, NeoGrowth, an NBFC which caters to small retailers.

Non-banks into financial services: UPI in some way ushered in an open banking revolution in India. Unlike the other instant payment rails, the unique idea around UPI was that it was created as an open architecture on top of which tech companies could build applications for consumer use. PhonePe, Google Pay, Amazon Pay, Paytm — all leveraged this opportunity to build their fintech businesses.

Today PhonePe and Google Pay dominate more than 70% of the UPI payments market. This has also shown how open financial services can actually help usher in financial inclusion. The government is now pushing open services in data through NBFC-AA, commerce through ONDC, and open credit through OCEN.

Ancillary services: Lastly, UPI has also impacted other services like offline payments, subscribing to IPO mandates and even credit card transactions.

UPI123 and UPI Lite are designed for small-value offline transactions. Consumers have wholeheartedly adopted UPI for subscribing to company shares using UPI ASBA services. ASBA, which stands for ‘Applications Supported by Blocked Amounts,’ has made IPO subscription smoother.

Finally, EMI collections have been made easier with UPI. Multiple digital lenders have told me how they encourage their borrowers to set up mandates on UPI. Or in case of delayed payments, just a UPI QR code sent over WhatsApp solves the purpose, instead of having to physically reach out to the customer seeking cash.

UPI might be a simple digital payment mechanism, but its role in transforming the Digital India mission is something quite noteworthy. And today, as we celebrate a milestone for UPI, these impacts are very significant.

Top stories this week

Dunzo delays June-July salaries further: Troubled quick commerce firm Dunzo told employees on Wednesday that it will further delay pending salaries for the months of June and July, as it struggles with a deepening cash crunch. Employees have been promised that salaries for August will be paid on time on September 4. The Reliance Retail-backed firm, which also counts Google among its investors, had first delayed salary components above Rs 75,000 for the month of June, which were to be paid in July.

Three business heads quit as Byju’s rejigs verticals: Edtech major Byju’s on Tuesday said it has consolidated four verticals into two, K-10 and exam preparation, as part of moves to restructure its mainstay business. “At present, two very seasoned and senior leaders lead both verticals, Ramesh Karra leads the K-10 vertical, while Jitesh Shah leads the exam prep business,” a spokesperson said in a statement.

The reorganisation of businesses led to the resignation of three business heads—Mukut Deepak, Pratyusha Agarwal and Himanshu Bajaj, the spokesperson added.

Following the rejig at Byju’s, Ananya Tripathi, the CEO of its subsidiary Whitehat Jr. also tendered her resignation on Thursday.

Tiger Global exits Zomato by selling remaining 1.4% stake: New York- based investment firm Tiger Global sold its remaining 1.44% stake in online food delivery platform Zomato in the open market on Monday. According to BSE bulk deal data, Tiger Global’s Internet Fund III Pte sold 12.35 crore shares at Rs 91.01 apiece to raise about Rs 1,124 crore.

Japanese tech investor SoftBank also sold 10 crore shares in the Gurugram-based food delivery company, amounting to 1.17% of equity. The company is likely to exit Zomato fully in the next few months.

Baron Capital marks up Swiggy, Pine Labs valuation; almost halves Byju’s value: US-based asset management firm Baron Capital Group has marked up the valuation of food and grocery delivery company Swiggy and fintech platform Pine Labs in its books as of June this year, taking a positive outlook on India’s macroeconomic environment.

However, it slashed the valuation of Byju’s by almost half, underscoring that the edtech platform was a big drag on funds managed by Baron.

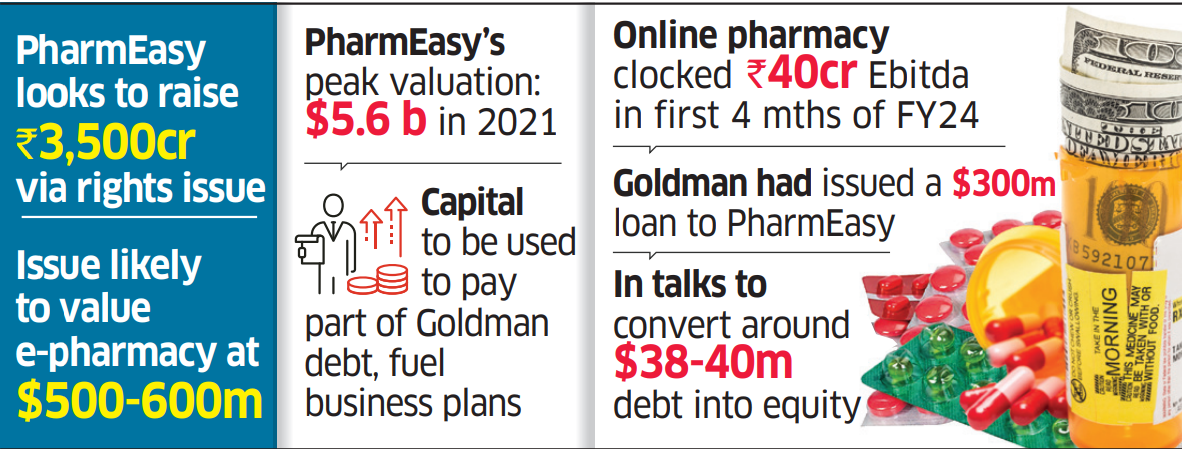

Goldman may convert part-debt into equity in PharmEasy: Goldman Sachs is likely to convert a part of the debt it advanced to PharmEasy into equity, following the upcoming rights issue of about $424 million (Rs 3,500 crore) by the online pharmacy, that is due to open on September 4, sources aware of the matter said.

Goldman, which had issued a $300-million loan to PharmEasy, is in talks to convert around $38-40 million debt into equity.

Swiggy tests bundling for ‘One’ subscriptions, experiments with pricing tiers: Food-delivery major Swiggy is working with banking and telecom firms to roll out bundled plans that include Swiggy One subscriptions. The company is also experimenting with different pricing and service tiers for the subscriptions, people in the know told ET.

From Left: Sarthak Misra, Sumer Juneja and Narendra Rathi of SoftBank Investment AdvisersLate-stage investing is stuck as Indian companies still at 2021 valuations: SoftBank Vision Fund’s Sumer Juneja | Indian late-stage startups with adequate capital are still sticking to their 2021 valuations, unlike their global counterparts which have undertaken significant cuts, deterring investors like SoftBank Vision Fund from deploying fresh funds in this market, Sumer Juneja managing partner, India & EMEA at SoftBank Investment Advisers, told ET.

Amazon local revenues enough to fund India investments; on track for profitability: Amit Agarwal | While a bulk of the Seattle-based technology major’s earlier investments in India went into building logistics and seller infrastructure, the newer investments are going into technology and services to bring more shoppers online, Amazon’s senior vice president for India and emerging markets, Amit Agarwal, told ET in an interview.

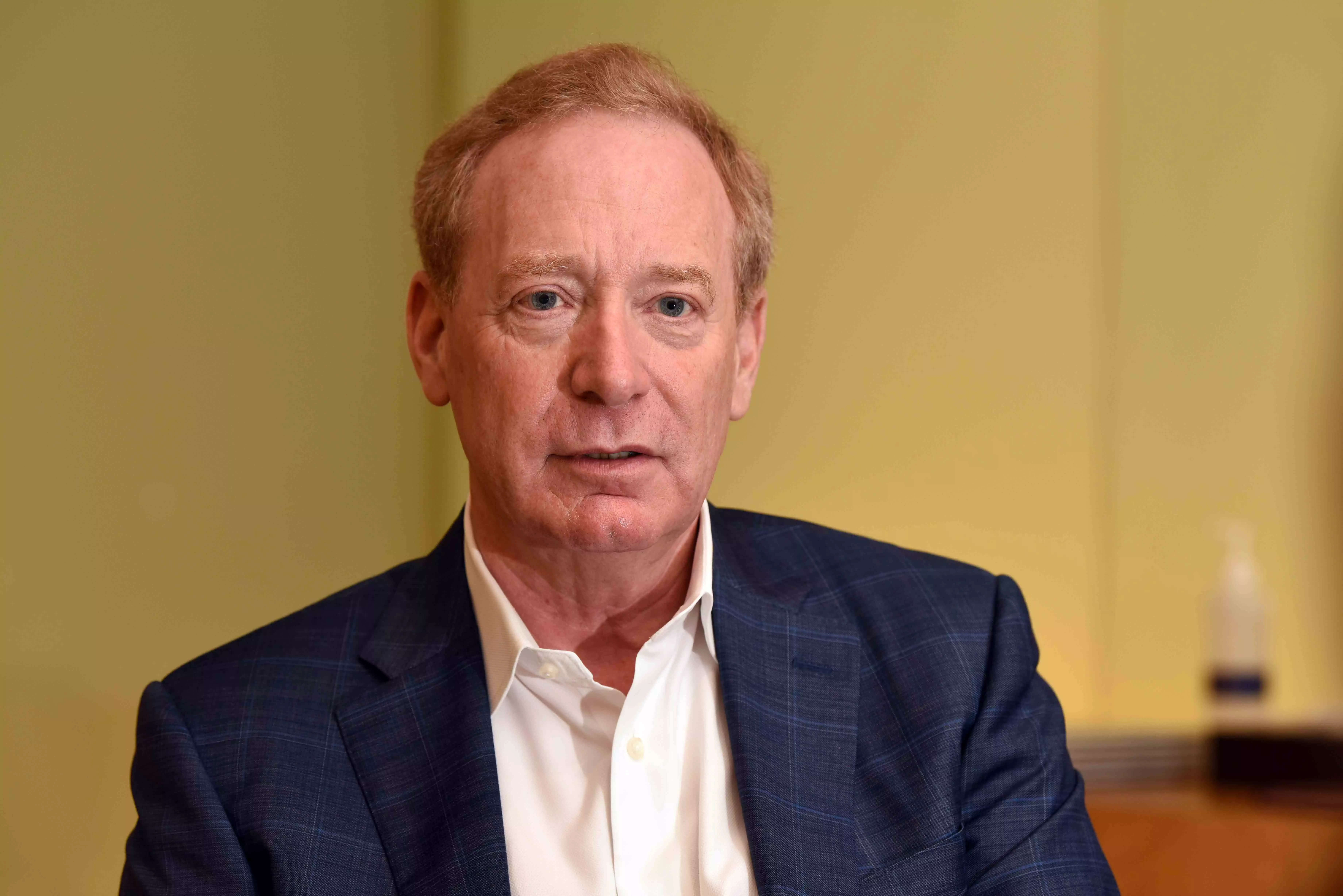

Microsoft vice chairman Brad Smith

India has got Data Bill right; it’s a sound framework: Microsoft vice chairman Brad Smith | India has got the new Data Bill “right”, applying “strong protection” for personal data while allowing cross-border data flow, said Brad Smith, Microsoft’s vice chairman and president.

Countries need to build sovereign AI capabilities: IBM CEO Arvind Krishna | As AI usage gains prominence, countries will need to work on building their own capabilities in large language models and computing infrastructure to support sovereign AI capabilities, IBM chairman and CEO Arvind Krishna told ET in an interview.

India should expand manufacturing base by taking advantage of supply chain shift: Punit Renjen of SAP | India has a tremendous opportunity to expand its manufacturing base due to the current supply chain relocation triggered by the geopolitical situation, and the country should grab the opportunity with both hands, says Punit Renjen, CEO-emeritus of Deloitte Global and the incoming chairman of SAP.

AI will augment human ingenuity, not replace it: Adobe CEO Shantanu Narayen | Shantanu Narayen, chairman and chief executive of $17.61-billion Adobe Inc, has been at the helm of the Nasdaq-listed company for the last 15 years. In a wide-ranging interaction with ET, he cautioned that a rush to regulate AI and “arbitrarily limiting advancements may be harmful,” adding that the technology will augment human ingenuity, not replace it.

Chandrayaan-3: ISRO makes first observations from ChaSTE payload | The Indian Space Research Organisation (ISRO) on Sunday made the first observations from the ChaSTE payload onboard Vikram lander from the Chandrayaan-3 mission.

Chandrayaan-3 rover confirms presence of sulphur on moon: On Tuesday, ISRO announced that the payload or instruments aboard the Pragyan rover confirmed the presence of sulphur and other chemical elements, as expected, on the lunar surface near the south pole, and that the search for hydrogen is underway.

Also read | Lessons from Chandrayaan-3 may Land in IIM Classrooms

Isro wants a place in the Sun, sets September 2 date for Aditya-L1: India will soon have a greater advantage of observing solar activities and its effect on space weather in real time, thanks to the launch of Aditya-L1, the first space-based Indian observatory to study the Sun, which is scheduled to be launched on September 2, at 11:50 am from Sriharikota.

India will be the fourth country to place a spacecraft in an orbit around the Sun-Earth Lagrangian point, termed as L1 after the USA’s NASA and European Space Agency’s Solar and Heliospheric Observatory (SOHO) and Chang’e-5 extended mission by China that has instruments to study the Sun, top solar scientists said.

PhonePe cofounders Sameer Nigam & Rahul Chari

PhonePe enters stock broking segment, launches Share.Market app: Walmart-backed digital payments firm PhonePe entered the stock broking segment with the launch of its mobile application Share.Market, in line with its expansion plan.

Nudged by RBI, P2P lenders look to diversify partnerships: The Reserve Bank of India wants peer-to-peer (P2P) lending startups to work towards diversifying their partnerships to ensure there is no overlap of lenders and borrowers from the same partner which might eventually lead to an asset-liability mismatch.

AU Small Finance Bank making credit card cornerstone to attract new customers: AU Small Finance Bank is fast expanding its credit cards business, competing with some full-service commercial banks as well as the new generation of fintech companies that are trying to grab a share of this growing segment.

IT and hiring

Indian IT drives PE interest despite global headwinds: The number of private equity firms holding stake in Indian IT services companies has doubled between 2019 and 2022 to more than 50 now, data by Avendus Capital show.

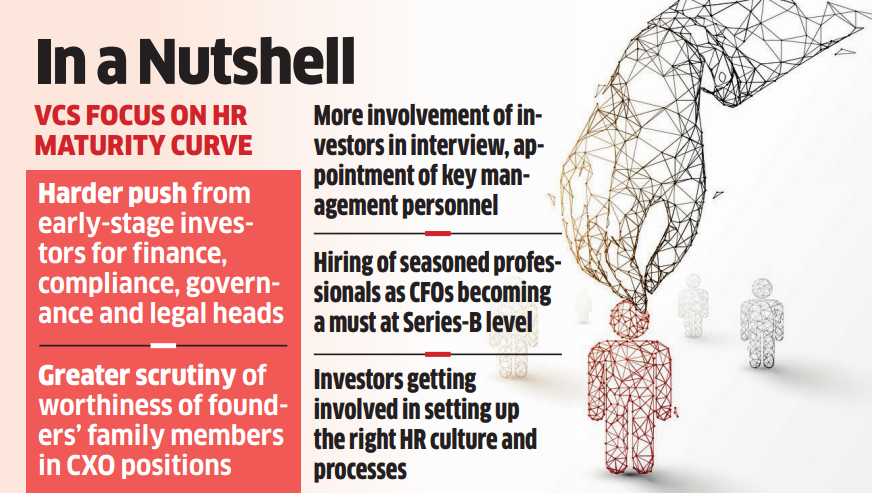

VCs get more involved in CXO search at early-stage startups: An increasing number of compliance- and governance-related issues at Indian startups is leading venture capital investors in early-stage companies to push for greater involvement in the recruitment process for crucial governance roles and appointment of key management personnel.

Big fish land in tech’s talent pool amid layoff woes: Executive search and hiring firms including Transearch, Longhouse Consulting, CIEL HR and GI Group Holdings say that unlike earlier, when it was difficult to even pin down senior Big Tech professionals for job offer conversations, now they’re the ones who often make the first move.

ETtech Done Deals

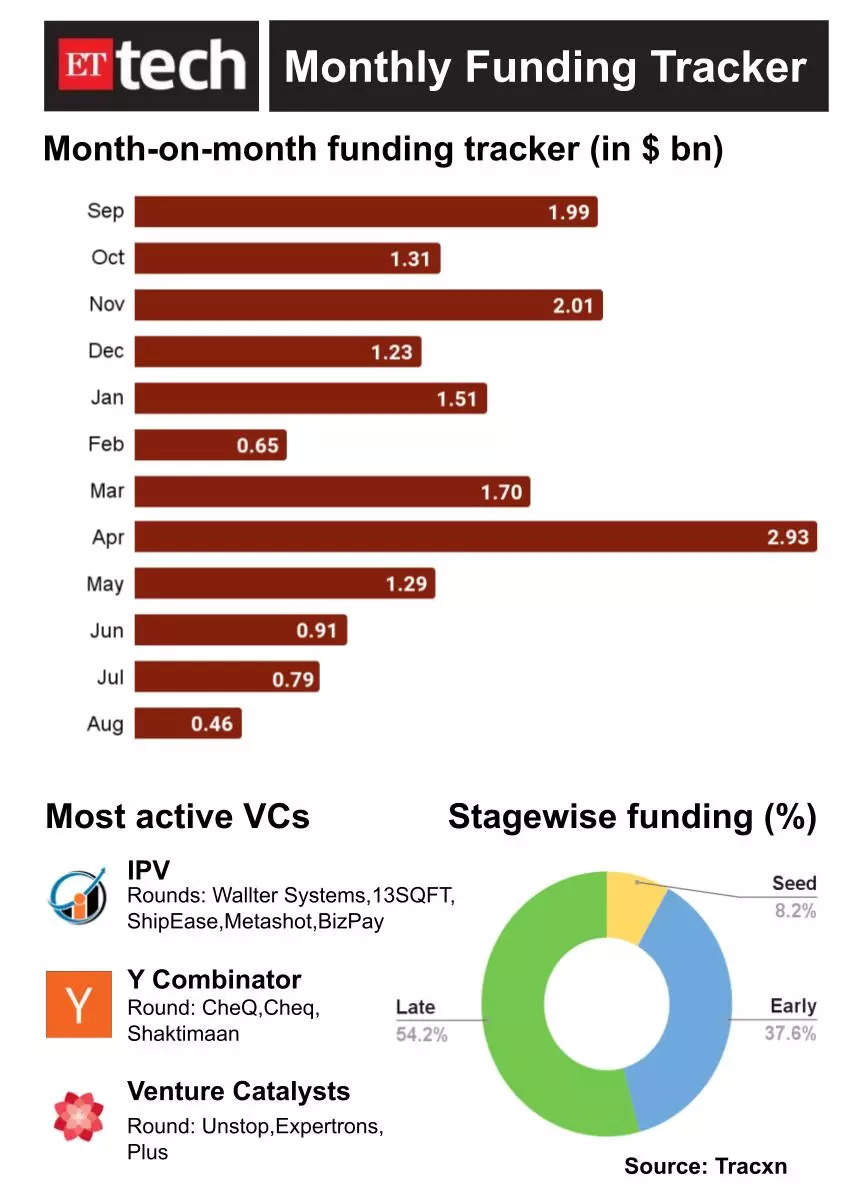

Venture capital funding in technology startups recorded the lowest monthly tally in well over a year, in total value terms, with $458 million having been deployed across 79 funding rounds in August 2023.

The figure is an almost 68% plunge from the $1.4 billion that venture capital firms deployed across 263 rounds in August 2022. Volume-wise, it’s a nearly 70% crash.

As per Tracxn data reviewed by ET, monthly funding totals have never gone below $600 million, trailing at least as far back as March 2022 — 17 months ago, until July and August this year.