Budge for 2023:The budget includes a significant amount for personal income tax. A new tax system for taxpayers was proposed by the government in 2020.The new system of taxing income is up to you.

The government lowered tax rates and added more tax brackets to the new system. The majority of taxpayers had been requesting this for some time, but it came with the catch that all of the previous tax system’s deductions and exemptions would be eliminated.

New Tax Regime

Under the new system, there are more tax brackets and lower rates starting at Rs 15 lakh. In addition, the new system does not provide taxpayers with access to any of the exemptions or deductions that were available under the previous system.

Old Tax Regime

There are numerous ways to lower your tax bill under the old tax system. Exceptions like House Lease Stipend (HRA) and Leave Travel Recompense (LTA), derivations permit citizens to bring down their expense sum by financial planning, saving or spending on unambiguous things.

The largest deduction is Section 80C, which allows taxpayers to reduce their taxable income by Rs 1.5 lakh. In addition, there are several other sections that allow you to deduct interest on home and education loans as well as health insurance premiums from your taxable income.

Exemptions and Deductions What is a Tax Deduction?

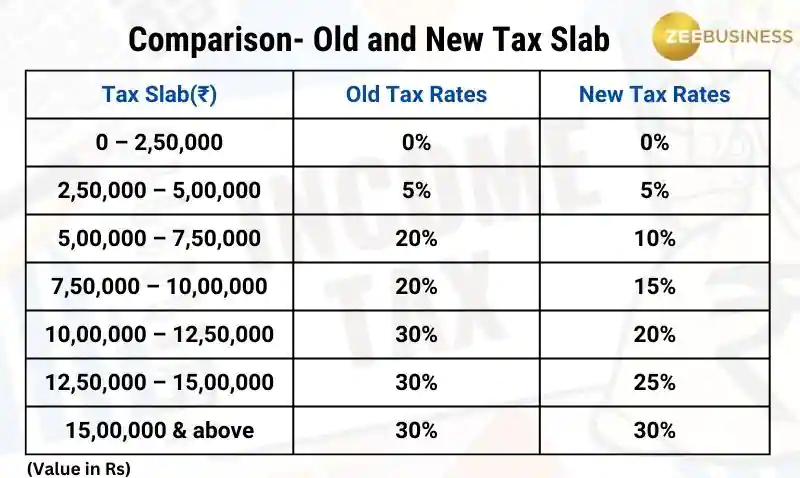

The following table compares the old and new tax brackets:

The term “tax deduction” refers to claims made by taxpayers to lower their taxable income as a result of various investments and expenses. As a result, income tax deductions lessen overall tax obligations. It’s a type of tax break that helps people save money on taxes.

What is Expense Exception?

The right to avoid paying taxes on some or all of one’s income in a country is known as a tax exemption. The majority of taxpayers are eligible for a number of exemptions that can be used to reduce their taxable income, and some individuals and businesses are exempt from paying taxes at all.

Numerous deductions and exemptions were eliminated as a result of the new tax system. If you fall into the category of salaried individuals, businesses, or professionals, a comprehensive list is provided below.

A standard deduction of Rs 50,000 could be claimed by salaried individuals.

- Travel and Leave Allowance – House Rent Allowance, based on salary structure and paid rent – Professional Tax, up to Rs.2,500/- – Deductions for interest from savings accounts and deposits allowed by Sections 80TTA and 80TTB – Tax deductions for entertainment allowance and professional tax for government employees – Maximum deductions of Rs. 24 for the interest on a home loan for a self-occupied or vacant property2 lakhs; a deduction of Rs 15,000 from a family’s pension under clause (ii) (a) of Section 57; and special allowances under Section 10(14), with the following exceptions:

- A disabled employee’s transportation allowance; – A conveyance allowance; – Any allowances given to cover the cost of an employee’s tour or transfer; – A daily allowance; – Perquisites; – Professionals and business owners will lose their exemption from Special Economic Zones under Section 10AA.

- Deductions under Section 32AD, 33AB, 33ABA, 35(1)(ii),35(1)(ii( (a), 35(1)(iii), 35(2AA), 35AD and 35CCC of the Income Tax Act.

- Options of additional depreciation under Section 32(ii) (a) of the Income Tax Act

- The option to carry forward or unabsorbed depreciation of earlier years

- Tax-saving investment deductions under Income Tax Act , Chapter VI-A 80C, 80D, 80E, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc. These tax-saving investment options include ELSS, NPS, PPF tax relief on medical insurance premium, FDR, dependents who are differently-abled, expenses for specific medical treatments, interest on education loan and many more.