Contingent upon the assets accessible, risk-disinclined people can think about putting resources into fixed deposits as well as recurring deposits. If an individual has a singular amount of cash, he can put resources into fixed deposits; for month to month speculations, he can put resources into recurring deposits (RDs).

Many banks offer recurring deposits at appealing interest rates.

For RDs, an individual needs to deposit a proper measure of their pay consistently for a foreordained period. After maturity, the chief sum is refunded, alongside any interest got.

Here is a speedy compariosn between SBI, ICICI Bank, and HDFC Bank to check which is offering the healthy rates for recurring deposits.

Post Office RD interest rates

India Post office offers RDs at an interest rate of 5.8 percent for a proper tenure of 5 years (60 months) for the July-September quarter for the current monetary. While it tends to be reached out for an additional 5 years by presenting an application to the pertinent Post Office. The interest rate appropriate all through the augmentation will be equivalent to when the account was first opened.

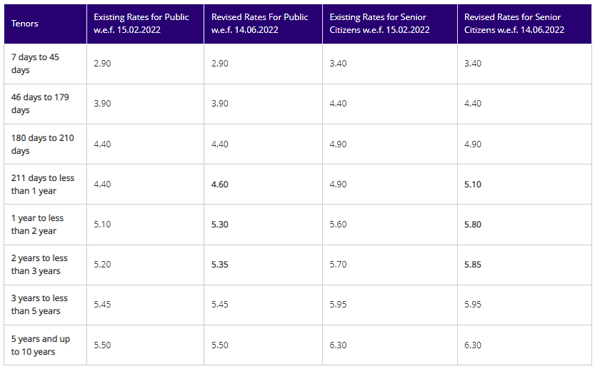

HDFC Bank RD interest rates

HDFC Bank offers RD facility from a half year to 120 months with interest rates differing from 3.75 percent to 5.75 percent. The rate presented by HDFC Bank for a 5-year or 60-month term is 6.70 percent.

ICICI Bank RD interest rates

The ICICI Bank RD highlight is accessible for periods going from a half year to a decade. The interest rate presented by ICICI Bank for a RD with a time of three to five years is 5.70 percent, while the rate over that is 5.75 percent.

SBI RD interest rates

State Bank of India offers RD interest rates that are equivalent to term deposit rates for at least a year and a limit of 120 months. SBI offers 5.50 percent premium on maturities of 5 years or more, and 5.45 percent based on conditions of 3 to 5 years.