Every single significant bank, both in people in general and confidential area, permit a predetermined number of free exchanges at the ATMs consistently. Past the free exchanges, which incorporate monetary and non-monetary administrations, the loan specialists demand an accuse of relevant duties.

The quantity of free exchanges at the ATMs might vary on the kind of record and the debit card you hold.

Utilizing the ATMs past the allowable maximum limit of free month to month exchanges will be chargeable.

As per a notice gave by the Reserve Bank of India in June last year, the banks were permitted to charge ₹ 21 for every exchange at the ATM over the month to month free exchange limit, viable from 1 January 2022.

Prior, the banks were permitted to charge ₹ 20 for each such exchange.

Clients are permitted five free exchanges at their bank ATMs consistently, and the breaking point is sans three exchanges for other bank ATMs. Clients in non-metro focuses can profit of five free exchanges at other bank ATMs.

The RBI permitted banks to exact an exchange charge of ₹ 17 for every monetary exchange and ₹ 6 for each non-monetary exchange at all focuses beginning 1 August 2022.

The banks gather ATM service charges to meet the rising ATM franchise and upkeep costs.

Every one of the significant banks likewise charge a yearly expense on debit cards or ATM cards, contingent upon the sort of card a client has.

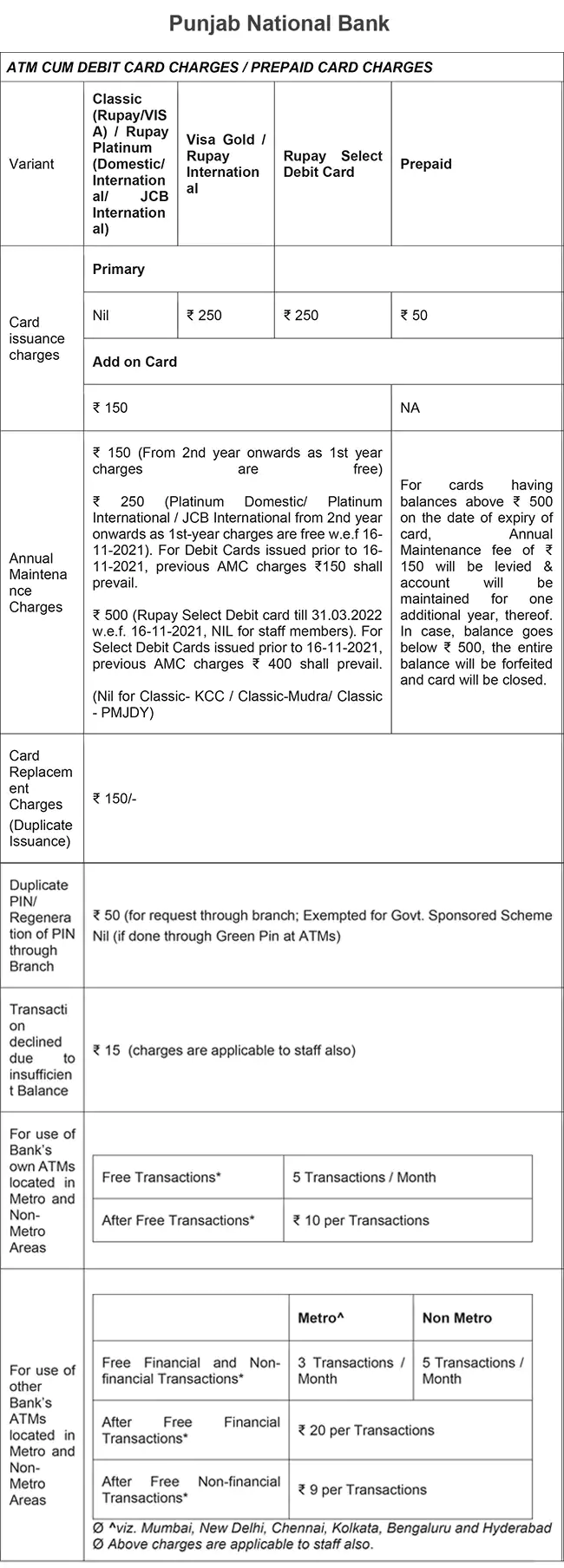

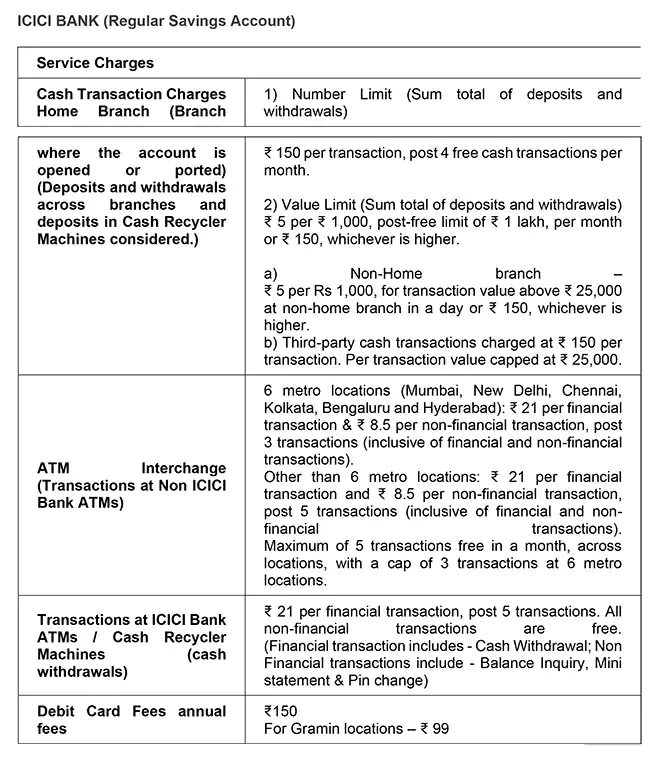

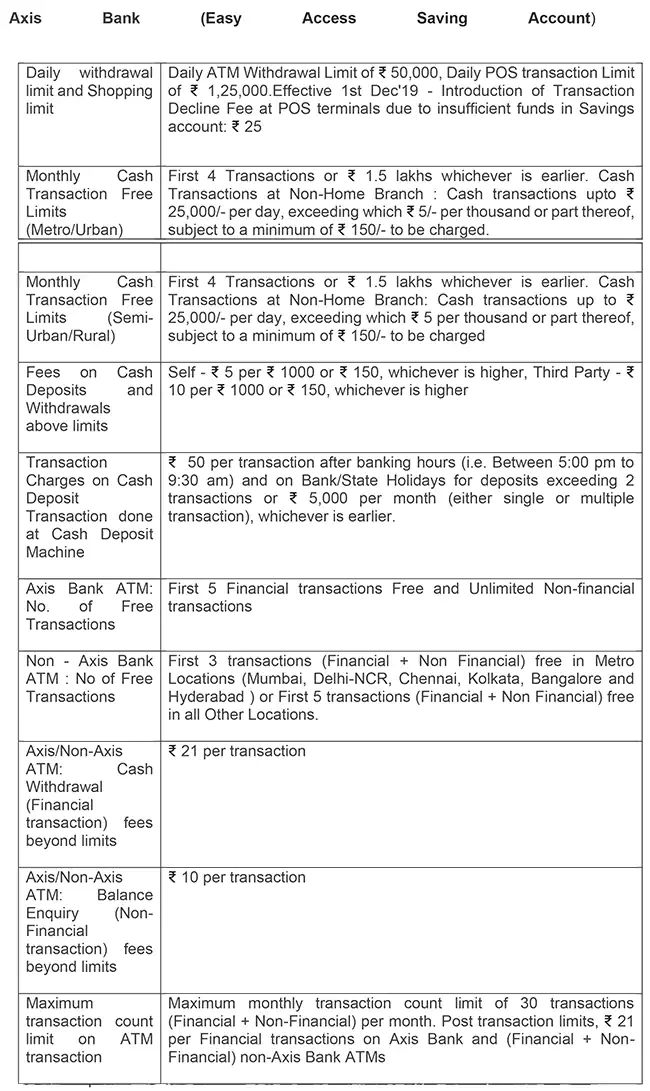

Here is a correlation of different kinds of ATM charges collected by SBI, PNB, HDFC Bank, ICICI Bank and Axis Bank: