The year-end is the best opportunity to purchase another vehicle. It is when weighty limits are presented on the vehicles to clients before the new stock comes to display areas. In case you are wanting to purchase another vehicle, this could be the best opportunity to request limits from vehicle organizations.

When you select a vehicle in view of your bank account and solace, the second thing that strikes a chord is subsidizing. Frequently individuals need a Car Loan to buy their number one vehicles. The following are a couple of things you should think about when you choose to apply for a Car Loan.

FICO assessment

Your financial assessment is fundamental. In the event that you have a FICO rating of 750 or more, moneylenders will be quick to offer you a decent credit bargain. A decent FICO rating guarantees loan specialists that lending to you is safer. Keep your FICO rating at sound levels, as it can get you advantages like fast endorsements, pre-supported offers, and so forth.

Reimbursement tenure

The reimbursement tenure is imperative. In case you pick a more extended term, your EMIs will be lower. Be that as it may, you will pay higher interest. Then again, in the event that you pick a more limited tenure, however the EMIs are higher, you will actually want to early reimburse the credit. Banks ordinarily charge a lower interest rate on the Car Loan in case you pick a more limited tenure.

Loan Sum

A credit sum should be selected cautiously to stay away from an excess of monetary weight and issues in loan reimbursement. The higher the credit sum, the higher your EMIs will be. You might need to keep your credit tenure longer to try not to pay high sums EMIs.

Existing Moneylenders

Existing moneylenders will have every one of your subtleties, and you could likewise have a decent relationship. Banks might give Car Loans at lower interest rates, and they could likewise consider postponing off a portion of the extra charges that you could need to pay in any case with the loan specialist with whom you have no relationship.

Pay

In case your pay is great, you won’t have any monetary issues reimbursing your credits. It is simple for moneylenders to rapidly survey your qualification and proposition you a credit. Take the loan in light of your pay and reimbursement ability to keep away from monetary issue later.

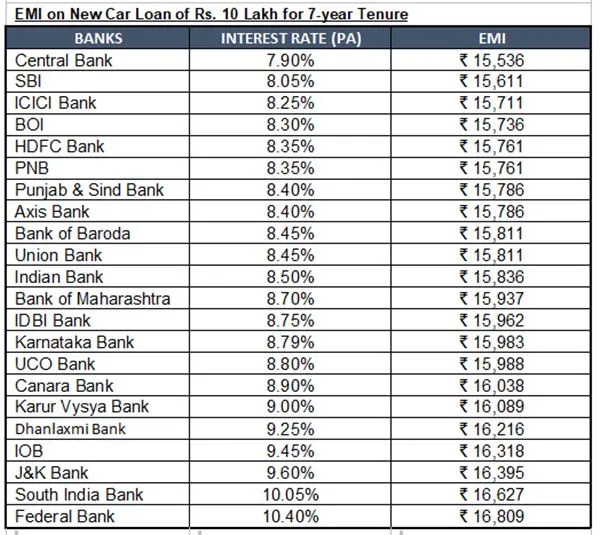

The table below looks at the interest rates of in excess of 20 banks, including SBI, HDFC Bank and ICICI Bank, alongside EMIs. You can take a choice in view of your necessities.

Interest rates and EMIs on New Car Loan

Note: Interest rate on Car Loan for all listed (BSE) Public and Pvt Banks considered for information aggregation (Barring small finance banks and EV credit); Banks for which information isn’t accessible on their site are not thought of. Information gathered from particular bank’s site as on 01 Nov 2022.

Banks are recorded in climbing request based on interest rate for example bank offering most minimal interest rate on Car Loan is put at top and most noteworthy at the base. Least financing cost presented by banks regardless of the loan sum is displayed in the table.

EMI is determined based on the interest rate referenced in the table for a Rs 10-Lakh Credit with a tenure of 7 years (processing and different charges are thought to be zero for EMI estimation); Premium referenced in the table is characteristic and it might fluctuate relying upon the bank’s T&C.