In the present computerized world, a cell phone is one of the main contraptions as it is utilized for booking tickets, digital payments, and shopping online in addition to other things. Subsequently, it is critical to keep it completely safe.

Nonetheless, if your mobile gets taken or you lose it, you ought to quickly follow the below ventures as cheats nowadays search for only one thing once they get hold of your cell phone – – your bank subtleties.

As additional individuals deciding on digital payment applications, it is so easy for cell phone hoodlums to get to these wallets.

Follow these means right away if you lose your mobile:

Block your SIM card

This is the main move toward guarantee the mobile number isn’t abused when you lose the mobile.

By impeding the SIM card, you can hinder each application on the mobile that can be gotten to through OTPs. You can continuously get a similar number given on another SIM card.

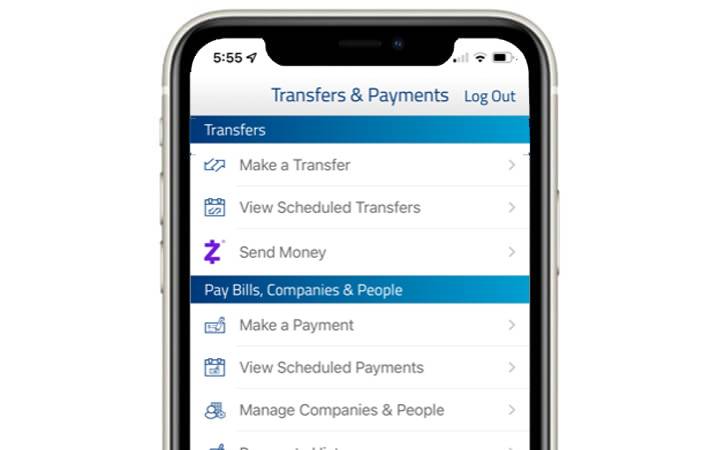

Block admittance to mobile banking services

Not simply SIM cards, it is likewise vital to obstruct your financial administrations also. They are only a tap away and in this way impeding admittance to these services is significant.

Deactivate UPI payment

If the hoodlum couldn’t get to web based financial administrations, s/he might attempt to mess with UPI payments, that is the reason deactivate it at the earliest opportunity.

Block every single mobile wallet

Mobile wallets, for example, Google Pay and Paytm might well end up being expensive if your mobile arrives at some unacceptable hands.

Thus, it’s vital to reach out to the individual application’s assistance work area and guarantee no entrance is allowed to anybody until you set up the wallets again on another gadget.

File a report

Subsequent to doing every one of the above things, announcing the make a difference to the police is significant. Do take a duplicate of the FIR which you can use as proof in the event the mobile is abused, or your cash is taken.