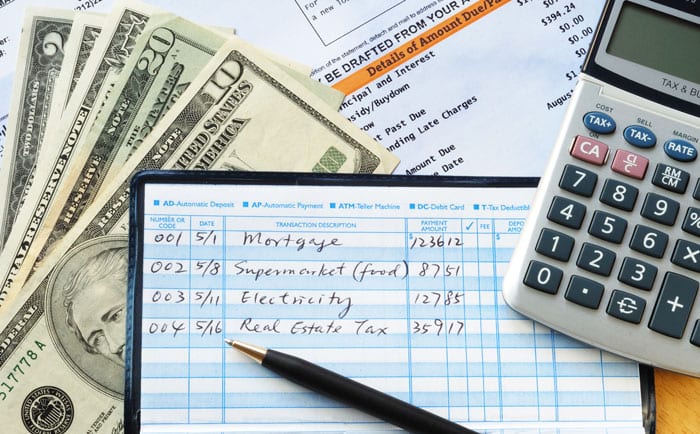

We are now in the fiscal year 2023-24, and by this point, the majority of people may be planning to make some new resolutions. Investment and tax planning-related financial commitments typically rank highly on most promise lists. However, it is essential to comprehend that budgeting is a prerequisite for attaining financial stability.

Planning for expenses, unknowns, and long-term objectives is made easier with a budget, which also prevents overspending, which can cause stress and anxiety.

For long-term financial security, consider the following five suggestions for developing effective budgeting discipline:

Review current lifestyle and determine net income

The first step in developing an effective budget is to determine net income.

“On the basis of this figure, one can create a monthly or annual budget that is long-lasting and effective enough to cover regular expenditures comfortably. The total compensation is the sum that remaining parts in one’s grasp after obligatory derivations like expenses, lease, medical coverage and other manager related benefits like opportune asset,” Sidharth V, Boss Gamble Official at KreditBee told CNBC-TV18.com.

Establish clear financial objectives

The primary objective of budgeting is to achieve financial objectives. Therefore, it is essential to identify these objectives and select a budgeting strategy that is effective in achieving them.

The simplest and most widely used approach to budgeting is the 50-30-20 strategy, which recommends allocating 30% of one’s income to wants, 20% to necessities, and 50% to savings. Sidharth V stated that in addition to these buckets, one should also consider retirement planning and any other unfortunate events and plan accordingly.

Pay yourself first

It is a budgeting principle that places savings and planning for retirement ahead of other costs and discretionary spending. This aides in building a reserve funds corpus that turns into a piece representing things to come riches or retirement store.

According to Sidharth V, the enquired strategy proposes that a predetermined amount of income be deposited into savings and investments immediately upon receipt.

After that, the remaining amount can be used for any other expenses that are necessary.

Resolve debts

Debt instruments with high interest rates, such as outstanding loans and credit card bills, have costs that increase over time. The budget is disrupted as a result of this. It is prudent to pay off all debts as soon as possible and avoid taking on additional obligations as much as possible to achieve true financial stability.

Sidharth V stated to CNBC-TV18.com, “It is a must to follow the 70-20-10 rule wherein the income can be demarcated into three buckets – 70% for necessities, 20% for savings and investments, and 10% for debt repayment.”

Maintain regular progress

Monitoring Progress monitoring is an essential step in budgeting. The way we live our lives, the economic environment around us, and our priorities change with income.

As a result, monitor the budget on a regular basis and adjust it as necessary to reflect internal and external changes.