For investors who wish to create long haul financial wellbeing without depending on market-based returns and have an okay resilience limit, fixed deposit ventures are the best debt choice. Fixed deposits are all year ventures that offer different advantages to investors, including tax benefits, liquidity, adaptable developments that can change from seven days to a decade, minimal expense speculation choices, and extraordinary benefits for senior residents.

Since the RBI expanded the repo rate at its MPC meeting in June, interest rates on fixed deposits have been on the ascent. Thus, more established grown-ups can now get returns on fixed deposits that dominate expansion over their brilliant years. Retail, not entirely set in stone by the Consumer Price Index (CPI), diminished to 7.01 percent in June. In this article, we’ll examine three fixe deposits from banks that are DICGC-guaranteed as well as proposition senior residents returns of up to 8.15 percent, which is a huge effect on expansion and empowers them to procure genuine profits from their fixed deposit ventures.

Jana Small Finance Bank

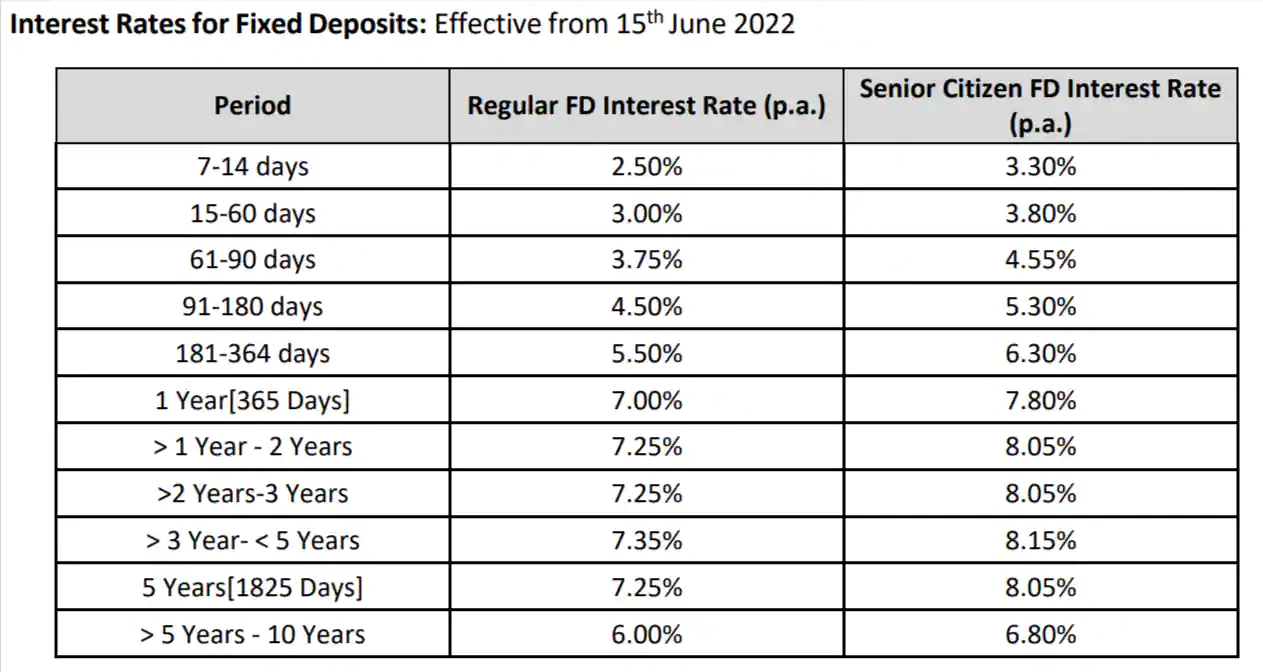

The bank recently refreshed its fixed deposit interest rates on June 15, 2022, and thus, it is presently giving senior residents fixed deposits with maturities going from seven days to a decade at interest rates going from 3.30 percent to 6.80 percent.

On deposits maturing in 1 to 3 years, the bank is offering an interest rate of 8.05% to senior residents, and on term deposits maturing in 3 to 5 years, senior residents will get a most extreme interest rate of 8.15% which isn’t just a lot higher than the expansion level but at the same time is the most noteworthy loan cost among bank fixed deposits for senior residents.

North East Small Finance Bank

Recurrent deposits (RD) are one more form of fixed deposits where investors can set aside regularly scheduled payments as opposed to money management a singular amount sum, and RDs offer comparative rates to that of fixed deposits. On RD, North East Small Finance Bank is giving more seasoned people an interest rate of up to 8% on deposits that adult in 2 years. This is the main small finance bank in the monetary area that furnishes older people with the most noteworthy interest rate on RD of up to 8%. On April 1, 2022, the bank last changed the interest rates on its deposit accounts.

Suryoday Small Finance Bank

On June 6, 2022, Suryoday Small Finance Bank last altered the interest rates on its FDs. The bank guarantees more seasoned individuals loan costs between 3.75 percent and 6.50 percent on FDs with maturities going from 7 days to 10 years. Be that as it may, on term deposits maturing in 999 days, the bank gives senior occupants the most noteworthy interest rate of 7.99 percent, which is tantamount to our subject 3 bank deposits with interest rates of around 8%.