HDFC Asset Management Company has send off HDFC Silver ETF in a bid to grow its set-up of HDFC Mutual Fund (MF) Index Solutions, the organization said in its media discharge on Thursday. The New Fund Offer (NFO) opened on 18 August and will close on 26 August 2022.

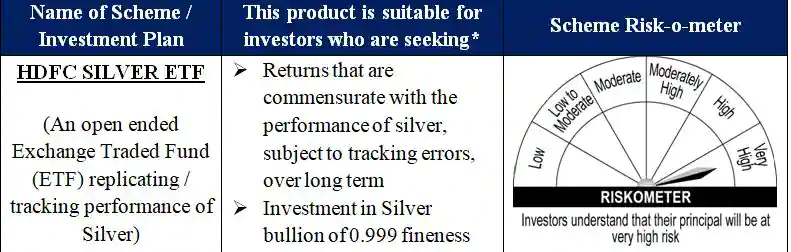

HDFC Silver ETF is an unconditional Exchange Traded Fund (ETF) reproducing/following execution of Silver, the delivery said.

“HDFC AMC has consistently kept an investor first methodology offering our clients with the best arrangements while sending off items. This Fund will give investors a chance to improve portfolio expansion by putting resources into a metal with a separated gamble return profile,” Navneet Munot, Managing Director and Chief Executive Officer at HDFC Asset Management Co. Ltd said.

HDFC Silver ETF – things to be aware:

1) The NFO time frame is between 18 August and 26 August 2022.

2) Objective: The venture objective is to create returns that are in accordance with the exhibition of actual silver in homegrown costs, liable to following blunder.

3) Investing in actual silver and putting away it couldn’t be pretty much as protected and helpful as holding silver in computerized form. Silver ETFs offer an open door to the investors to contribute and possess silver carefully.

4) Digital Silver is effectively tradable during market hours, and recreates or tracks the presentation of silver, and enhances one’s portfolio for a minimal price.

5) It is a valuable metal which fences against cash deterioration since it is universally estimated.

Standpoint:

Silver has multi-reason utility in modern exercises, for example, convenient gadgets, modern gear, Electric Vehicles, portability, energy creation andtelecom. Silver interest standpoint is vigorous by virtue of higher reception in new age and green technologies.

One should comprehend that common assets are liable to advertise chances.

“There is no affirmation that the venture objective of the Scheme will be understood,” the delivery cautions investors.

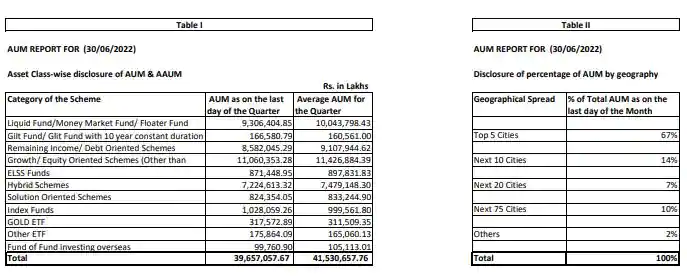

The organization professes to oversee resources worth Rs 4.15 trillion.

(Disclaimer: The perspectives/ideas/prompts communicated here in this article is exclusively by venture specialists. Dellyranks.com recommends its perusers to talk with their venture consultants prior to pursuing any monetary choice.)