DALL-E 2 (a mishmash of WALL-E and Dali) builds on the success of its predecessor DALL-E, which OpenAI unveiled in early 2021, and improves the quality and resolution of the output images thanks to advanced deep learning techniques.

Generating realistic images isn’t new to AI. What sets DALL-E and DALL-E 2 apart is they can generate them from natural language prompts of varying complexity.

While that may sound straightforward, it’s actually incredibly difficult for a machine learning algorithm to pick up on the subtleties of natural language instructions (or we’d all be programming computers in plain English), and create beautiful images with them.

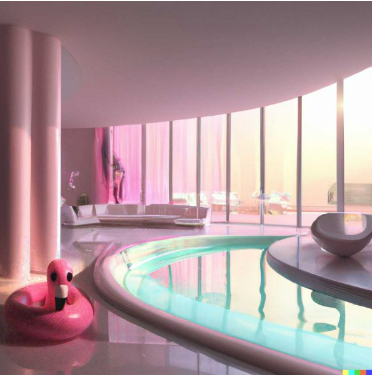

What makes DALL-E 2 revolutionary is the incredible quality of the images it churns out. Take a look.

“A fire hydrant in the Sahara desert.”

“An oversized grizzly bear delivering a pizza”

“Mosaic of a bad ancient Roman cat being chased by an angry ancient Roman woman.”

“Macro 35mm film photography of a large family of mice wearing hats cosy by the fireplace.”

Unlike its predecessor, DALL-E 2 can also edit images, changing their composition, shadows, reflections, and textures through a process called ‘inpainting’.

In the image below, it added the flamingo – reflections and all – with a simply worded instruction to do so. RIP Photoshop?

How does it work?

DALL-E 2 has learned the relationship between images and the text used to describe them better than any other deep learning model to date.

One of the biggest challenges for such models has been picking up on latent features that remain consistent across different lighting conditions, angles and backgrounds. For example, a machine learning model may associate the colour blue with birds because all the pictures of birds it was trained on were taken against the sky.

To solve this problem, OpenAI uses CLIP, a computer vision system that it also released last year, as the basis for DALL-E. CLIP was created to look at photographs and summarise their contents the way a human would.

OpenAI iterated on this process to produce “unCLIP”, an inverted version that begins with the description and churns out an image. Encoding and decoding images this way lets researchers see which features of an image CLIP recognised and which it ignored.

Finally, DALL-E 2 creates the actual image through a technique called diffusion, which involves starting with a random collection of pixels and gradually filling in a pattern with more and more complexity.

So when do we get to try it? Sadly (or perhaps thankfully, knowing the internet), OpenAI has said that unlike the original, DALL-E 2 will be made available for testing only to vetted partners, and with many restrictions in place, such as no nudity, hate symbols or obscene pictures.

DALL-E 2 is already a huge improvement over its predecessor but these are still early days in AI. What does the future hold? Will DALL-E 200 deal in video and have the ability to, say, turn books into movies on the fly?

Top Stories By Our Reporters

Tesla India team takes APAC route amid higher import duty issue

With the government yet to reduce import duties on electric vehicles (EVs), Tesla’s team in India has started working for the Asia-Pacific (APAC) market and others, several industry sources told us.

In limbo: Tesla’s plan to enter the country has been on hold since 2019 as India levies a 60% import duty on EVs priced at $40,000 or lower and a 100% duty on EVs priced at more than $40,000. Tesla has been lobbying the government to reduce the rates.

To boost startup financing, government offers incentives to VC, PE funds

The government will let venture capital (VC) and private equity (PE) funds take a higher share of profit, earn more fee and go for a faster drawdown of the money they receive from the state’s fund of funds.

The fund of funds for startups (FFS) was introduced in 2016, for contribution to various alternative investment funds (AIFs) registered with the capital market regulator Sebi. The FFS, run by the state-controlled Small Industries Development Bank of India (SIDBI) has invested more than Rs 9400 crore in 86 AIFs (the regulatory term for PE and VC funds).

SIDBI is the country’s largest limited partner (LP), investors contributing to the capital shored up by VC and PE funds.

CCI tweak could expose several firms open to antitrust probes

What’s the change? Earlier, the commission used to club online and offline markets while determining the market dominance of a digital player, the sources said.

- For instance, while considering an ecommerce platform that sells consumer goods, the CCI used to consider the online and offline markets together to arrive at the market share of the ecommerce player.

- Since the offline market is a large segment, most ecommerce firms ended up below market dominance threshold as they did not own any bricks-and-mortar stores.

- But now the CCI has started considering only the online segment as a ‘relevant market’ for digital platforms.

IPO Watch

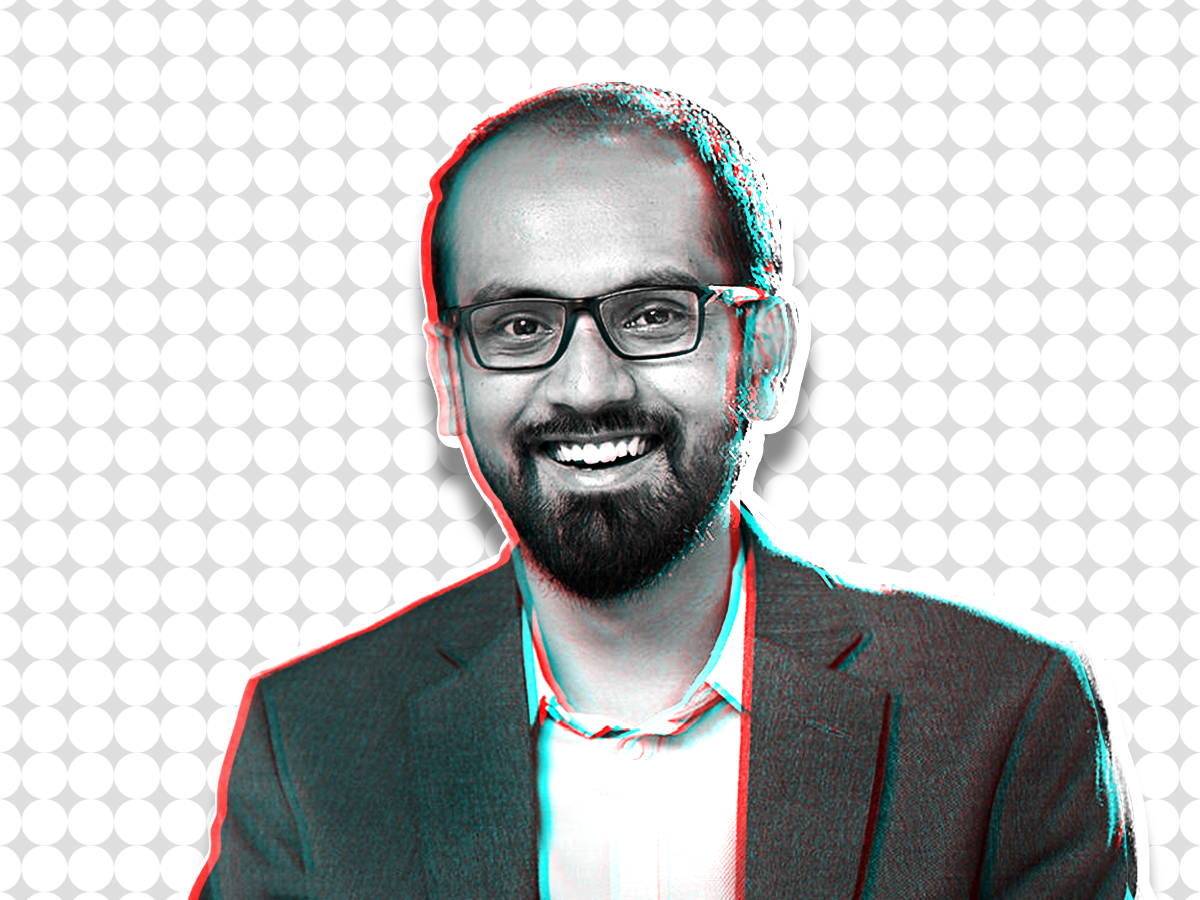

Not worried about short-term valuations, says Delhivery CEO

Sahil Barua, cofounder and CEO of Delhivery, which will launch its initial public offering (IPO) for subscription on May 11, told ETtech that the logistics and supply chain company was not worried about valuations in the short term as markets eventually value businesses correctly in the long term. Barua was talking about how investors may have priced the company if it had listed last year amid the euphoria in India’s startup ecosystem and overall capital markets.

IPOs on hold as startups look to wait out storm: Multiple startup IPOs including that of Boat, a direct-to-consumer (D2C) brand, Oyo Hotels & Homes, Snapdeal and PharmEasy are delayed and may not hit the public markets this calendar year, amid uncertain economic conditions triggered by geopolitical developments and rising interest rates in the US.

Zomato CEO donates Esops worth Rs 700 crore to Future Foundation

Zomato CEO Deepinder Goyal announced on Friday that he would donate all proceeds from the employee stock options (Esops) he received from investors and the board of directors to the Zomato Future Foundation (ZFF).

At Zomato’s average share price over the past month, these Esops are worth around $90 million (Rs 700 crore), he said in a note.

Quote: “To reap the most benefit for ZFF, and protect the interests of our shareholders, I do not intend to liquidate all these shares immediately but over the next few years. For the first year, I will liquidate less than 10% of these Esops towards this fund,” Goyal said.

IT Corner

LTI-Mindtree merger gets board nod, to create fifth-largest IT firm

Larsen & Toubro Infotech (LTI) board on Friday approved a scheme of amalgamation with Mindtree, creating a $3.5 billion IT services provider. The two companies are subsidiaries of Larsen & Toubro.

Flush with cash, IT biggies plan dividends, share buybacks: TCS, Infosys and Wipro are looking at a mix of dividends and share buybacks to return money to their shareholders, key executives told us. Earlier in the year, TCS completed a Rs 18,000-crore buyback process, the fastest in recent history, while Infosys wrapped up a Rs 9,200-crore buyback last year.

Cognizant will completely shift to hybrid work by early 2023, says India chief: Cognizant Technology Solutions expects to fully transition to a hybrid work model by early 2023 as it gives employees more flexibility, its India chairman and managing director Rajesh Nambiar told us in an interview.

TCS achieves net zero emissions across Asia Pacific: Tata Consultancy Services has achieved net zero emissions across its Asia Pacific locations, ahead of its 2030 target, a senior executive told ET. Last year, the company announced plans to reduce its absolute greenhouse gas emissions and achieve net zero emissions by 2030.

Brand roll-up action

Good Glamm is in talks to buy Raymond’s consumer care business

The Good Glamm Group is in advanced talks to acquire the Raymond Group’s consumer care business, which houses the Park Avenue and KamaSutra brands, three people with knowledge of the deal said. The cash-and-stock deal, pegged at around Rs 2,500-Rs 2,800 crore, is expected to be one of the largest acquisitions in the beauty and personal care segment.

Thrasio set to rework India plans amid global rejig: Thrasio Holdings, the company which pioneered the brand roll-up model about four years ago, may review its ambitious India strategy amid a global shake-up at the firm. Tharsio, which buys and scales brands which sell on Amazon, announced on Wednesday that its chief executive Carlos Cashman was being replaced by Greg Greeley, even as media reports suggested that the company was expected to lay off about 20% of its staff.

Thrasio names new CEO, plans layoffs: Thrasio said Greg Greeley will take over as its new chief executive officer replacing Carlos Cashman. Greeley, a former senior executive at Amazon and Airbnb, has also joined the board of Tharsio and will assume his new role at the company from August.

Cars and EVs

Batteries unlikely to be replaced in EV recall

Electric vehicle (EV) makers, faced with a problem of defective models after more than two dozen electric two-wheelers caught fire recently, are not replacing their batteries but only tweaking the wiring and connectors, people in the know have said. Ola Electric, Okinawa and Pure EV have recalled electric two-wheelers to fix battery-related issues, but since the battery is a sealed unit, it cannot be opened or tampered with.

Ola Cars CEO Arun Sirdeshmukh set to leave: Ola Cars chief executive Arun Sirdeshmukh has resigned, multiple people aware of the development told ET. Sirdeshmukh’s exit comes soon after chief financial officer (CFO) GR Arun Kumar took up a wider role at the ride-hailing firm.

Crypto and NFTs

Crypto market tanks a day after US Federal Reserve raised interest rates

The crypto market declined, mirroring the US stocks sell-off, after the US Federal Reserve announced raising interest rates by half a percentage point to restrain inflation.

At 5 PM on Friday, on Coinmarketcap, the global crypto market cap stood at $1.66T, a 7.73 % decrease over the last day.

Following the US Federal Reserve meeting statement on Wednesday, the world’s largest digital currency by value climbed sharply to challenge the $40K resistance, but has since dropped 9.40 percent to $36,200 levels, the biggest drop in the previous four months.

De-Fi under taxman’s lens; govt set to levy additional taxes: Indians earning interest on their crypto from platforms outside India have come under taxman’s scrutiny, two people familiar with the development told us.

The tax department is looking to impose an additional tax deducted at source (TDS) and equalisation levy on such transactions and interest income generated by Indians, they said. The government is looking to levy 20% TDS on such transactions and income, especially when one of the parties involved has not submitted their PAN card details, a person aware of the development said.

Coinbase hires former Snap India head to lead emerging markets: Coinbase has hired Durgesh Kaushik, the former head of Snap India, to lead the company’s growth in emerging markets. Coinbase confirmed Kaushik’s appointment. We reported on April 30 that Kaushik, who joined Snap Inc. in 2019, had quit the company.

As NFT prices drop, taxman could come knocking: A recent drop in the prices of high-value non-fungible tokens (NFTs), coupled with ambiguity in the recently established tax framework, will lead to tax scrutiny for Indian investors in the coming months, according to tax experts.

Musk will be a great steward of Twitter, says Sridhar Vembu

Elon Musk’s acquisition of Twitter will widen views on the global platform that has “painted itself into a corner” by limiting diversity of opinion, founder & CEO of Zoho Corp Sridhar Vembu told us in an exclusive interview. The social media platform, he said, was limiting itself with its “virtue-signalling” and ideological affiliations.

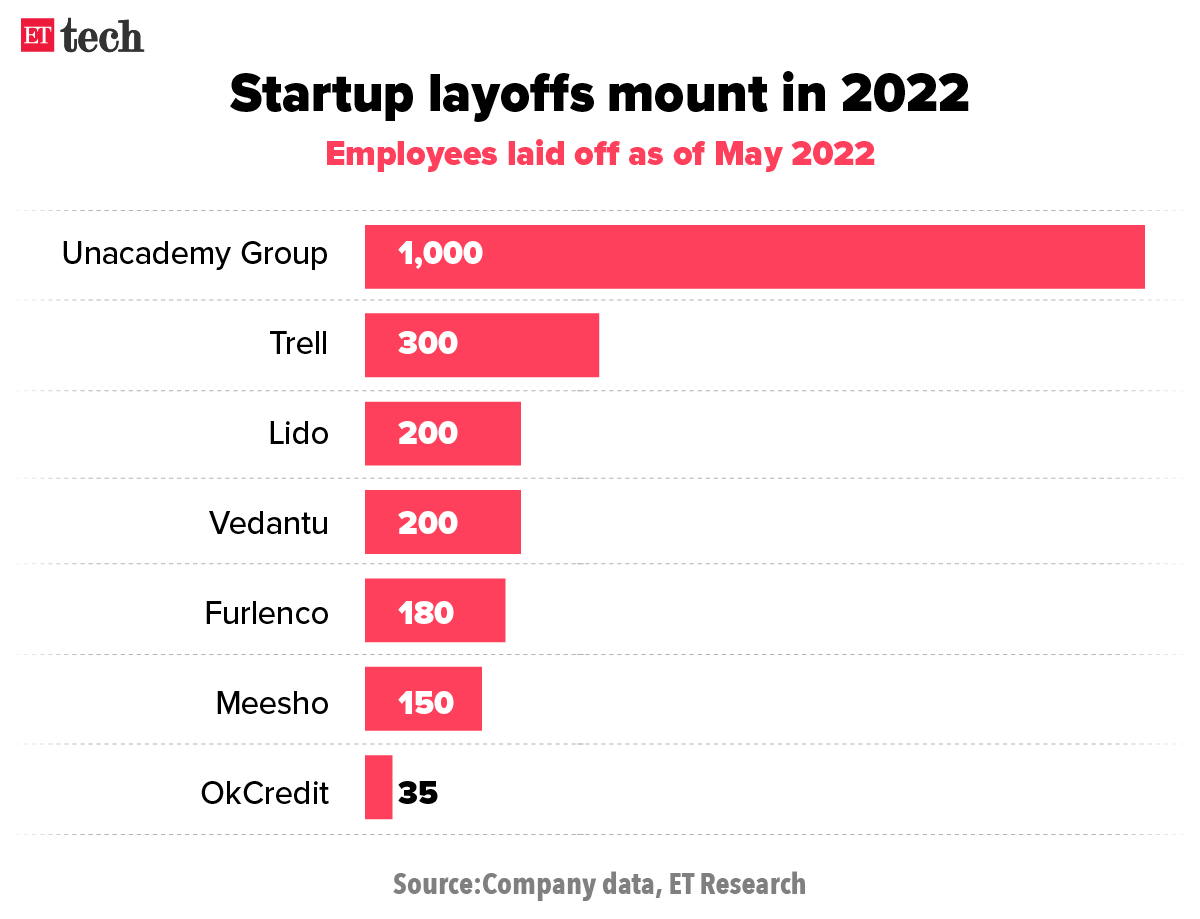

Startup hikes may shrink as funding slows

Startups are likely to become more circumspect about pay hikes in 2022 amid a slowdown in large-sized funding rounds and job cuts at some companies. A gradual drying of the funding tap, geopolitical tensions and a slump in the valuation of high-profile startups after listing have made the scenario less sanguine.

The industry is also grappling with the paradox of high attrition and a war for talent in some key tech roles.

Also Read: Edtech unicorn Vedantu lays off 200 employees

Companies such as upGrad, CashKaro and Smoor and the Good Glamm Group said that increments would be higher than last year to attract, reward and retain talent. Others like Wakefit and Eruditus said they would be similar to, or less than, last year.

Funding crunch: Late-stage companies have been under increasing pressure to reduce their cash burn and market insiders say layoffs could rise if they fail to raise newer rounds. Funding for Indian startups in April has been the lowest so far in 2022.

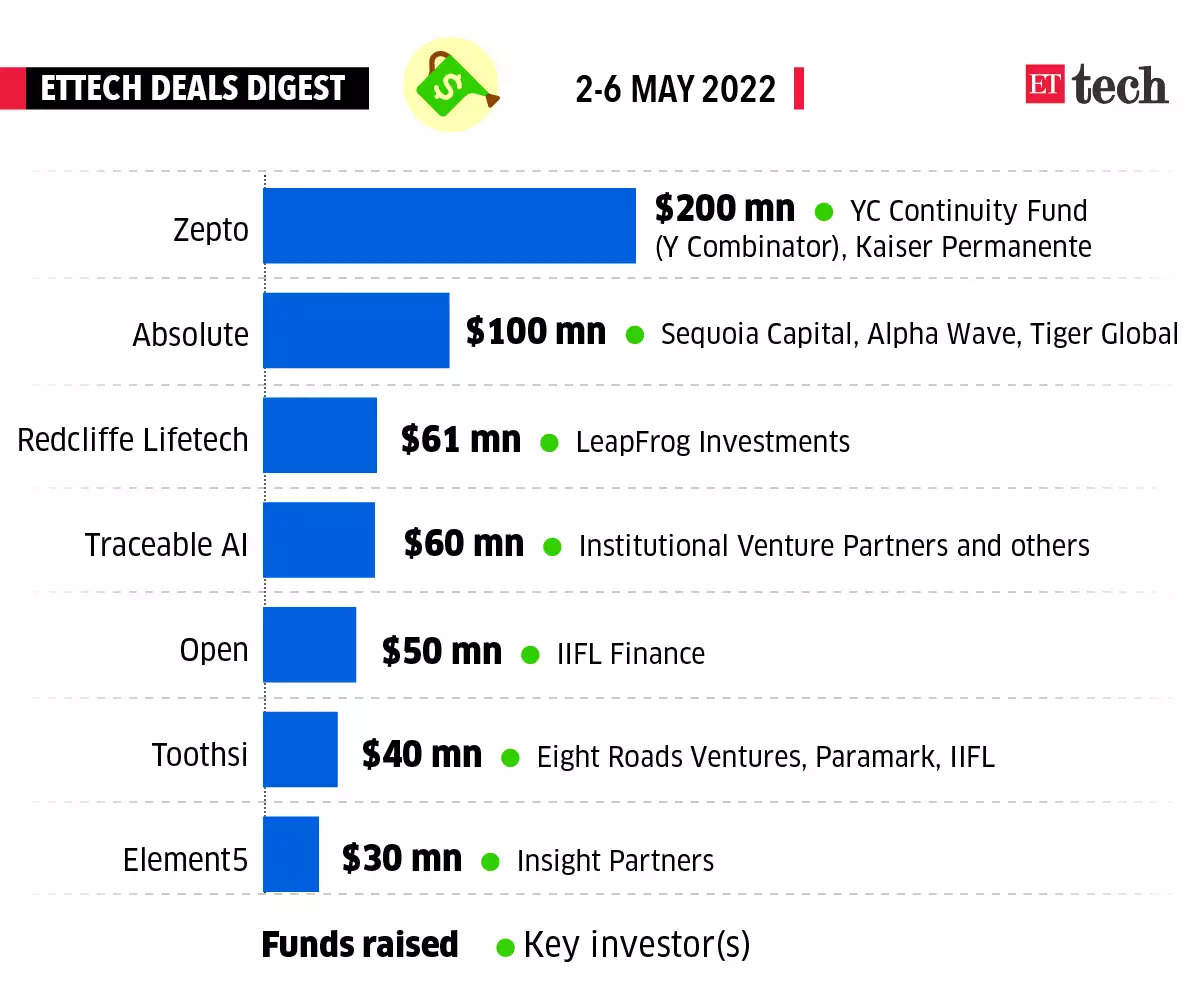

ETtech Deals Digest

Quick commerce startup Zepto, Agritech startup Absolute, omnichannel diagnostics platform Redcliffe Lifetech, and Neobank Open were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

■ IIFL Finance is preparing to foray into the neobanking segment and will set up a joint venture (JV) with neobanking fintech firm Open following after investing $50 million in the startup on Monday, a top company executive told us.

■ Quick commerce startup Zepto has closed a $200 million funding round led by existing investor YC Continuity Fund, the growth-stage fund run by Silicon Valley’s famed accelerator Y Combinator.

■ Uday Shankar and James Murdoch-backed Bodhi Tree Systems have reached an agreement to acquire a significant minority stake in Kota-headquartered Allen Career Institute. Bodhi Tree will be investing $600 million (around Rs 4,500 crore) in Allen.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.