Also in this letter:

■BharatPe statement comes from ‘personal hatred’: Grover

■Urban Company gig workers to get Rs 150 crore in stock options

■Accel raises $650 million for seventh fund

Battle for Ashneer Grover’s BharatPe shares begins

BharatPe is looking to claw back its cofounder Ashneer Grover’s restricted shares in the company, multiple people aware of the developments told us, as the confrontation between the fintech firm and its former managing director escalates.

Catch up quick: Earlier on Wednesday, the company said Grover and his family members had engaged in “extensive misappropriation of funds” and “siphoned money away from the company’s accounts”.

BharatPe said it reserved the right to “take further legal action against [Grover] and his family”.

The statement was an aggressive comeback by the firm a day after Grover resigned from the company and its board at midnight on March 1 and accused the firm’s investors of having “vilified” him.

Details: “While the board has noted the termination of employment of Grover, his resignation without the adequate approvals of the company board allows BharatPe to trigger the Articles of Association (AOA),” said one of the people cited above. An AOA a legal document containing rules for the internal management of a company.

According to the AOA filed by BharatPe’s parent firm Resilient Innovations in September 2021, if a founder terminates his employment without the consent of the board, the company will buy back the shares at a lower fair market value.

Grover currently holds roughly 8.5% in BharatPe. Of this 1.4% is not vested, according to the people quoted above.

In addition, he was also set to receive management stock options, estimated to be worth Rs 100 crore.

In an interaction with ET, on March 1, Grover had said that he would lose out management stock options worth that amount as a result of his spat with the company’s board.

BharatPe statement comes from ‘personal hatred’, says Grover

Hours after BharatPe issued its statement on Wednesday, Ashneer Grover said he was “appalled but not surprised” by its “personal nature”, adding that it came from “a position of personal hatred”.

What he said: “I am appalled at the personal nature of the company’s statement, but not surprised. It comes from a position of personal hatred and low thinking. The board needs to be reminded of $1 million of secondary shares investors bought from me in Series C, $2.5 million in Series D and $8.5 million in Series E. I would also want to learn who among Amarchand, PwC and A&M has started doing audits on ‘lavishness’ of one’s lifestyle?”.

Grover added that he expects the board to “get back to working soon”. “The only thing lavish about me is my dreams and ability to achieve them against all odds through hard work and enterprise. I hope the board can get back to working soon. I, as a shareholder, am worried about the value created. I wish the company and the board a speedy recovery,” he added.

In his interview with ET on March 1, Grover made allegations against BharatPe’s board members, its founder, and top management, saying the entire matter was a “witch hunt” to get him out of the company.

Jain had posted videos of parties at BharatPe’s office on Twitter last week, taking a dig at chief executive Suhail Sameer and group product head Bhavik Koladiya. In a series of tweets, she also termed BharatPe’s all-male board “chauvinistic”.

Both Grovers out: BharatPe head of controls and Grover’s wife Madhuri Jain was sacked by the company on February 22 on grounds of misappropriating funds. Her stock options were also cancelled. Jain had been named in a preliminary investigation by professional services firm Alvarez & Marsal (A&M) that linked her to alleged financial irregularities at the startup.

Urban Company to allot Rs 150 crore in stock options to gig workers

Urban Company said on Wednesday that it will allot stock options in the company worth Rs 150 crore to its gig workers – who comprise plumbers, electricians, cleaners, groomers and so on – through a ‘partner stock ownership plan’ (Psop).

Founder Raghav Chandra told ET that the Psop would be similar to employee stock option plans (Esops) of companies across the world that use stock options to reward employees.

How will it work? Under the plan, the company will allot shares worth Rs 150 crore to thousands of service partners over the next five to seven years. It will set up a trust to manage the Psop and the stock options will be alloted to gig workers over and above what they already earn. The company said it has received board approval for the first tranche of stock options worth Rs 75 crore, which are to be disbursed over the next three to four years.

Who is it for? The Psop is only for India, where the company employs more than 32,000 gig workers. It also operates in Australia, Singapore, the UAE and Saudi Arabia.

How big is it? Chandra did not disclose the percentage of total shares that will be allotted to the Psop but said the number of shares in it was “substantial”.

Is this a first for gig workers? Not quite. We reported last July that edtech company Unacademy plans to issue stock options worth $40 million to teachers on its platform over the next few years.

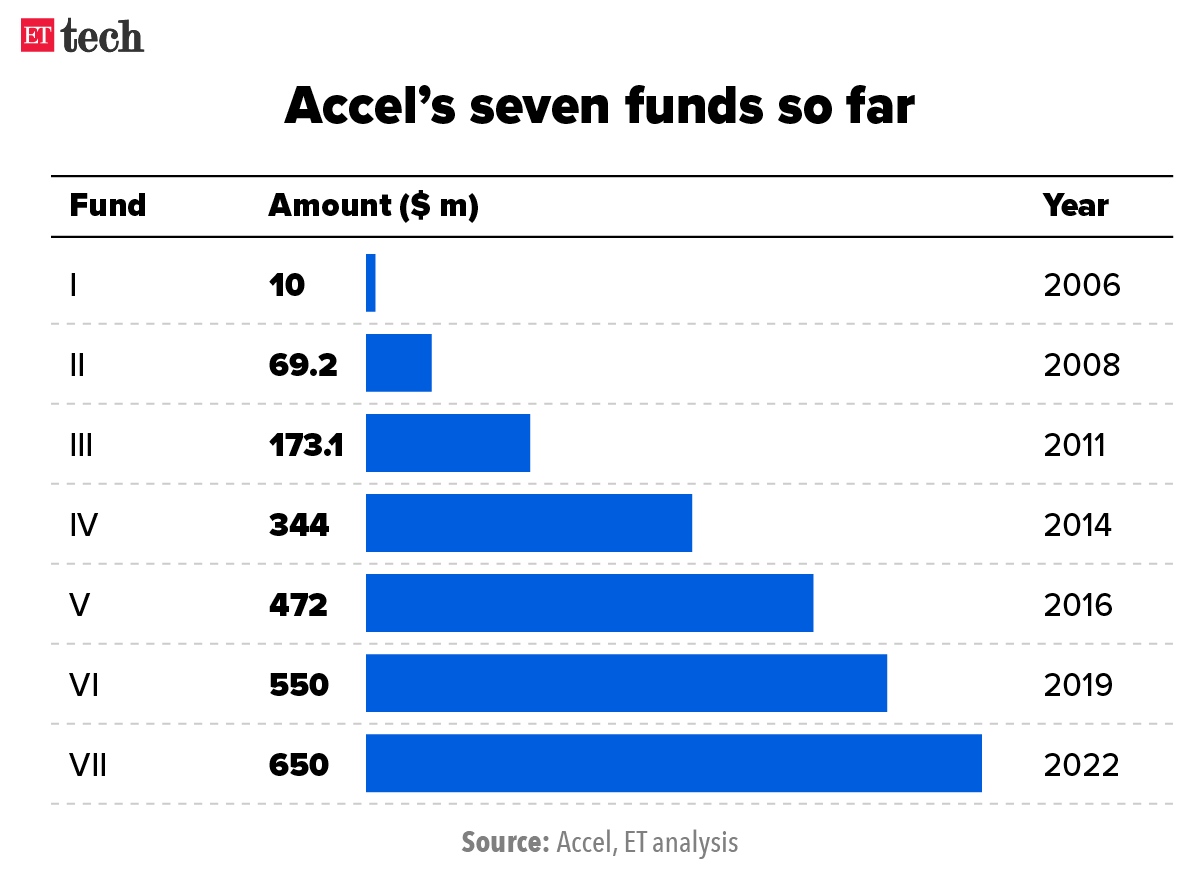

Accel raises $650 million for seventh fund

The investing team at Accel India

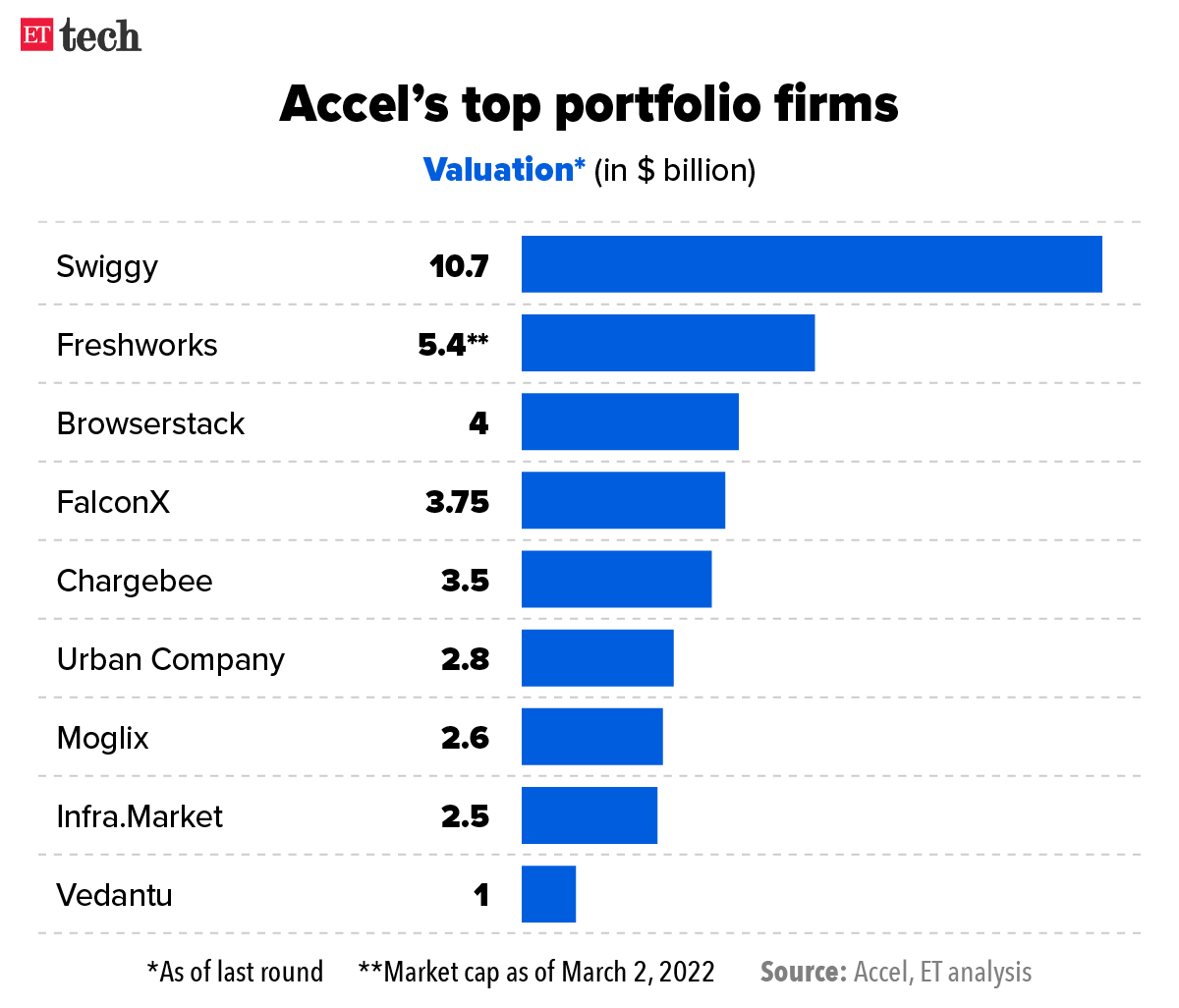

Accel, an early-stage venture capital firm that has backed the likes of Flipkart, Swiggy, Freshworks and Browserstack, said it has launched a $650-million seventh fund to back startups across India and Southeast Asia.

Context: The new fund comes three years after it mopped up $550 million as the VC firm continues to focus on early, seed and pre-seed stage startups, per senior executives at Accel. The total commitments for Accel in the region have now crossed $2 billion.

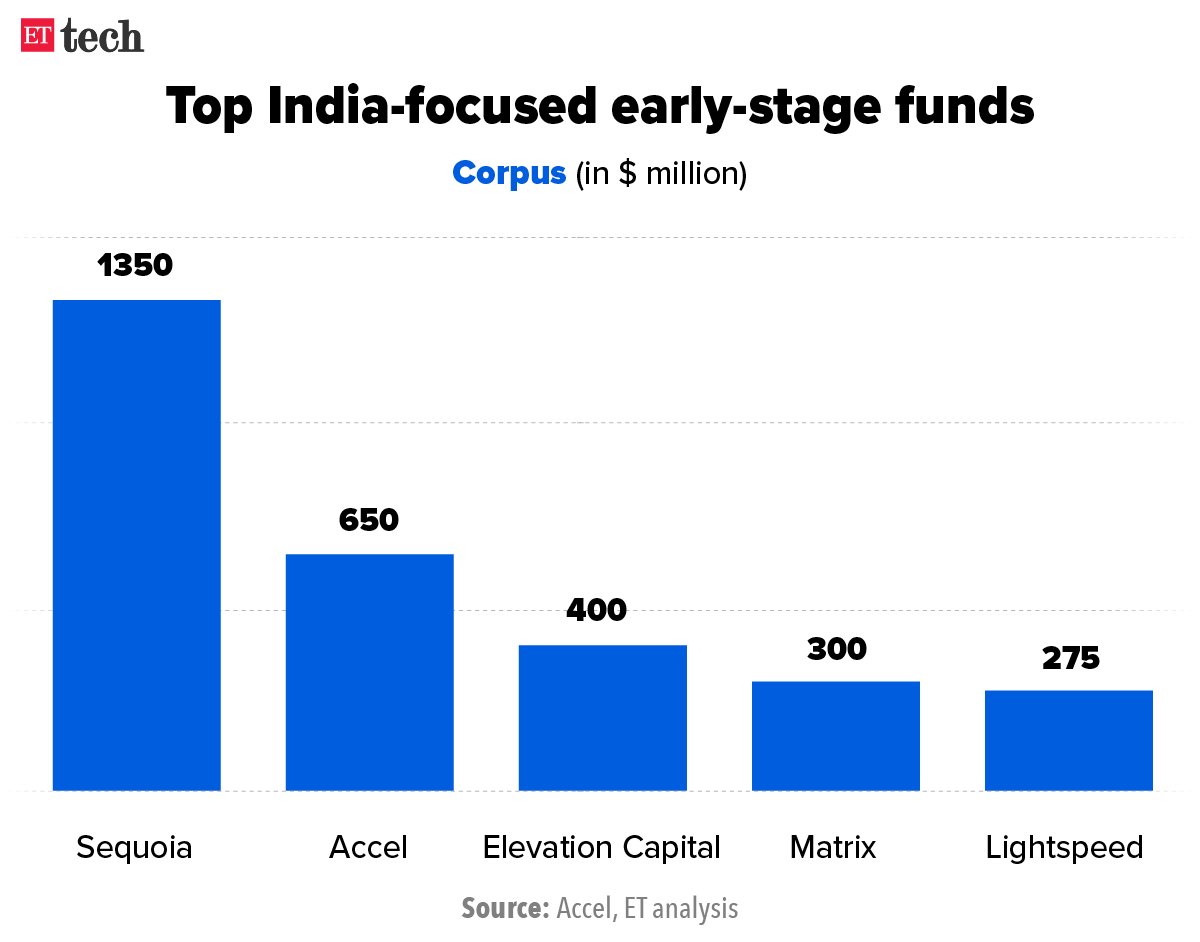

Famous for being an early Facebook backer, the Palo Alto-headquartered fund’s latest corpus will be the second-largest raised by a venture capital firm to invest in India and Southeast Asia after Sequoia India, which picked up $1.35 billion in 2020 to back early- and growth-stage startups. Sequoia is expected to close a much larger fund at around $2.8 billion.

What’s the plan? “We will continue to back companies in sectors such as consumer tech, global software-as-a-service companies (Saas), healthcare and ecommerce,” said Anand Daniel, partner, Accel India. As much as 90% of the latest find corpus will be deployed in the early stages, Daniel added.

IPOs here to stay: Accel’s big bet in cross-border enterprise software and the SaaS sector paid off with the Freshworks IPO on Nasdaq last year.

But with the current crash in tech stocks across global and Indian public markets, many tech startups have delayed their IPO plans. Chaturvedi, however, said exits for early investors in India through IPOs are here to stay, calling it an irreversible trend.

Tweet of the day

ETtech Deals Digest

- Cloud kitchen company Kitchens@ announced that it has merged with Kitchens Centre. The merger makes Kitchens@ one of the biggest players in the space, with 1,000 kitchens in around 100 locations in 20 cities.

Cloud kitchen firm Kitchens@ merges with Kitchens Centre

Kitchens@ founders Junaiz Kizhakkayil and Saurabh Jha

Cloud kitchen company Kitchens@ has merged with Kitchens Centre, making it one of the biggest players in the space with 1,000 kitchens in around 100 locations across 20 cities. The terms of the deal were not disclosed.

This is the second big consolidation in the sector this year. In January, cloud kitchen startup Curefoods merged with rival Maverix, expanding its presence to 125 kitchens across 12 cities.

Kitchens Centre last raised funds in November 2020 and counts US-based early-stage venture capital firm Village Global among its backers.

Currently, Kitchens@ has 12 hubs with 350 kitchens in Bengaluru.

It works with several food brands including Domino’s, Subway, Taco Bell, Nando’s, ChicKing, and national chains such as ITC, Mainland China and Barbeque Nation.

Other Top Stories By Our Reporters

Steradian partners with Astra for traffic radar modules: Steradian Semiconductors, which is developing chipsets for 4D radar sensing that can go into autonomous vehicles, said it has tied up with Astra Microwave Products for the production of radar modules for a traffic management system. (Read more)

Indian apps booming on Play Store: Indian apps and games saw a 200% increase in active monthly users on Google’s Play Store last year, compared to 2019, a senior Google executive said on Wednesday. She was speaking at the launch of Appscale Academy, the company’s initiative with MeitY Startup Hub. (Read more)

Global Picks We Are Reading

■Teen who tracked Elon Musk’s jet turns his attention to Russian oligarchs (The Guardian)

■Fitbit recalls roughly one million smartwatches in US over burn hazard (WSJ)

■How one Ukrainian startup is adapting its app during a time of war (The Verge)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.