Also in this letter:

■ Blow for Tesla as India refuses tax breaks

■ Amazon results bring cheer after Meta disaster

■ The biggest deals of the week

Ashneer Grover seeks removal of CEO from BharatPe’s board

Ashneer Grover, the embattled founder and managing director of BharatPe, has asked the company’s board members to remove CEO Suhail Sameer from the board.

Context: News of the letter, dated February 2, came just hours after reports that a preliminary investigation by Alvarez and Marsal (A&M), commissioned by BharatPe’s board last week, had found evidence of financial irregularities around recruitments and payments to non-existent vendors. A fortnight ago, Grover had gone on leave until the end of March over allegations that he abused and threatened a bank employee last October.

The letter: Grover wrote in his letter to the board that he has decided to “withdraw my nomination of Suhail Sameer as a Director nominated by me to the Board of Directors of the Company.”

Sameer, who was hired by Grover in 2020, was made chief executive of BharatePe in August 2021. Grover had assumed the role of managing director around the same time.

Grover has also alleged that the board pursued tactics of “corporate intimidation” by appointing law firm Shardul Amarchand and including it in board discussions.

We reported earlier this week that Grover had himself hired New Delhi law firm Karanjawala & Co amid mounting pressure to leave the company.

Headed for court? On Friday evening, several sources told us the BharatPe board was unlikely to accept Grover’s demand for a payout to leave the company. They said the saga is expected to culminate in a complex legal battle since Grover is unlikely to leave BharatPe without being paid.

Also Read: Timeline: The Ashneer Grover audio clip controversy

BharatPe audit report reveals ‘financial irregularities’

Ashneer Grover

On Friday morning we reported that a preliminary investigation by Alvarez and Marsal (A&M) commissioned by BharatPe’s board had found evidence of financial irregularities around recruitments and payments to non-existent vendors.

Details: The report, dated January 24, said BharatPe pays recruitment fees to a number of ‘consultants’ for employees recruited through them.

“In five sample cases, the employees have confirmed their date of joining as slated in the vendor invoice. But they have denied being recruited or engaged through the stated consultant or any knowledge of them,” said the report, which has been reviewed by ET.

Apart from having the same typeface, these ‘irregular’ invoices also had similar physical addresses, and some even named the same bank branches, A&M’s investigation found.

Also Read: BharatPe board says yet to receive final report of internal probe

All in the family: It also said Grover’s wife Madhuri Jain received at least three of these invoices herself and forwarded them to the company for payment. The invoices were created by Shwetank Jain, Jain’s brother, the report added.

“All of them appear to have a ‘Panipat connection’. It may be mentioned that Madhuri Grover is originally from Panipat,” the report read.

“We understand from public domain sources that the brother of Madhuri Jain is ‘Shwetank Jain’. We noted invoices of three other vendors related to recruitment expenses. These have the same commonalities as mentioned above and all have the ‘author’ in document properties as ‘Shwetank Jain,” report added.

Also Read: Ashneer Grover, Aman Gupta fuel Shark Tank meme explosion

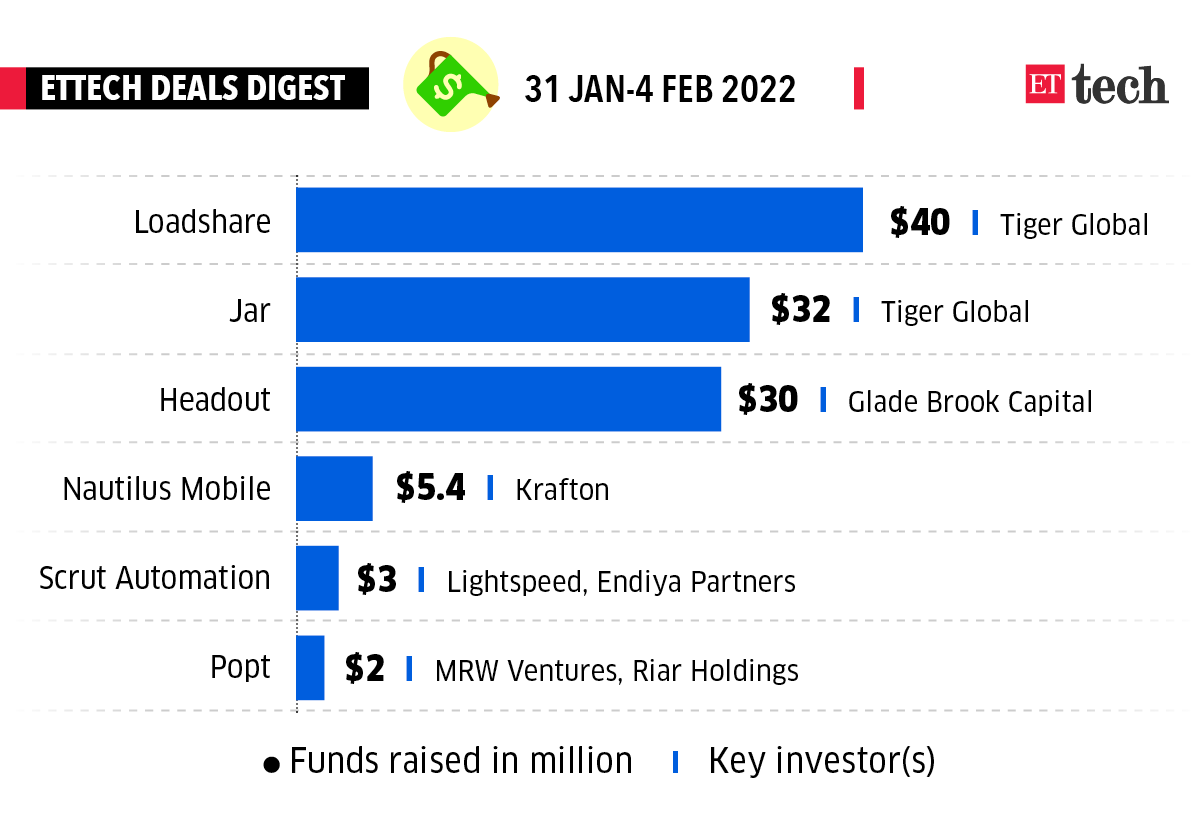

ETtech Deals Digest

Logistics platform Loadshare, online experiences marketplace for travellers Headout and savings app Jar were among the startups that raised funds this week.

Here’s a look at the top funding deals of the week.

Tweet of the day

Blow for Tesla as India refuses tax breaks

The government has turned down a demand by Elon Musk’s Tesla Inc. for lower taxes on imported electric cars, saying the rules already allow bringing in partially built vehicles and assembling them locally to pay less tax.

Quote: “We looked at whether the duties need to be re-jigged, but some domestic production is happening and some investments have come in with the current tariff structure,” Vivek Johri, chairman of the Central Board of Indirect Taxes and Customs, said.

Taxing issue: The government wants Tesla to build or assemble cars locally, while the company wants India to lower its duty — as high as 100% – on imported EVs to allow the company to first sell vehicles built elsewhere at competitive prices. The duty on parts assembled in India is 15-30%.

States line up to woo Tesla: Politicians from at least five states have invited Tesla to set up shop in their respective states after Musk said last month the US electric-vehicle pioneer was still facing a lot of challenges with the federal government.

Tesla’s hurdles in India: Musk has been planning to bring Tesla to India since 2019 and the company made its first moves in 2021. But talks between Tesla and the government have come to a standstill over two main issues: high taxes and Tesla committing to set up a factory and manufacture cars in India.

Also Read: Stop-and-go traffic: the story of Tesla in India

Amazon reports strong Q4 results despite supply chain snags

Amazon reported strong fourth-quarter sales and profits even as the online behemoth continues to contend with surging costs tied to a snarled supply chain and labour shortages.

The Jeff Bezos-led company also raised its annual Prime membership fee to $139 per year from $119. This is the first time Amazon has raised the price of Prime membership since 2018.

By the numbers: The company reported a profit of $14.32 billion, or $27.75 per share, for the three-month period ended December 31, 2021.

- That compared with a profit of $7.22 billion, or $14.09 per share, during the year-ago period.

- Revenue rose 9% to $137.41 billion, the company’s fifth consecutive quarter of revenue topping $100 billion.

- The company said that sales are expected to be between $112 billion and $117 billion for the current fiscal quarter. Analysts were expecting $120.93 billion, according to FactSet estimates.

Shares rose more than 13% in after-hour trading when Amazon released its results.

The rainmaker: Amazon might give the market back what Meta Platforms took away. The ecommerce giant is poised to add about $155 billion in market value if the stock’s premarket gain of about 11% holds through Friday’s close, according to a Bloomberg report.

That would be among the top five single-day gains in US stock market history, and would come just a day after Meta Platforms entered the other end of the record book with a $251 billion wipeout, the report added.

Bezos up, Zuck down: Meta Platforms CEO lost $29 billion in net worth on Thursday as Meta Platforms Inc’s stock marked a record one-day plunge, while fellow billionaire Jeff Bezos was set to add $20 billion to his personal valuation after Amazon’s blockbuster earnings.

Following the $29 billion wipeout, Zuckerberg is in the twelfth spot on Forbes’ list of real-time billionaires, below Indian business moguls Mukesh Ambani and Gautam Adani.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.