The ceremony will see the most influential names in India’s new economy come together with policymakers in the backdrop of what was a definitive year for the Indian startup ecosystem. India produced over 40 unicorns, privately-held startups valued at $1 billion or more, in 2021.

Goyal, Vaishnaw, Chandrasekhar and Bommai will engage with the gathering on what the government can do to fuel the momentum further, and what role startups will play in the government’s vision of a $1 trillion digital economy.

IPO discussion: A select group of industry leaders will also debate the opportunities thrown up by IPOs and the challenges faced by startups that transition from private to public markets.

The line-up includes Nithin Kamath, founder and CEO of Zerodha, Zest Money’s Lizzie Chapman, Delhivery cofounder Sahil Barua and Shekhar Kirani, partner at venture capital fund Accel.

The awards: ET had assembled a high-powered jury consisting of top Indian and global business leaders, investors and entrepreneurs, who met virtually on September 24, 2021 to pick the winners. Zomato was declared Startup of the Year 2021, joining a prestigious list of previous winners, including Zerodha, Delhivery, and Ola.

IPO corner

The funding round values the edtech company at roughly $22 billion post-money, individuals aware of the discussion told ET. Other investors in the round included Sumeru Ventures, Vitruvian Partners and BlackRock.

With the investment, Raveendran’s stake in the edtech company has grown from roughly 20-22% to 25%, making him one of the largest shareholders on the company’s captable. Byju’s founders, management and employees now own roughly 29% in the company.

Sachin Bansal’s Navi to file for Rs 4,000-crore IPO: Sachin Bansal’s Navi Technologies is set to file draft papers with the markets regulator for a Rs 4,000-crore initial public offering (IPO) later this week, sources briefed on the matter told us.

The company plans to launch its IPO in June, according to the current plans. The public issue will be entirely through an issuance of new shares, with no offer-for-sale (OFS) component.

News of Navi’s IPO plan comes as India’s listed new-age companies such as Zomato, Paytm and Nykaa have seen their value erode significantly over the past few months. Other startups such as Delhivery and PharmEasy that have received Sebi’s approval for their IPOs are now unlikely to launch them this financial year. But Navi is ploughing ahead.

JP Morgan, ICICI Sec to deliver Swiggy IPO: Swiggy has hired investment banks JP Morgan and ICICI Securities for the launch of its $800 million-$1 billion IPO, two sources told us.

Swiggy plans to offer a stake of around 10% in the IPO, which may be a mix of primary and secondary offerings, one of the sources said. A couple of merchant banks will be hired later to run the process.

Swiggy, backed by SoftBank Group, had doubled its valuation to $10.7 billion in its latest funding round in January. The $700-million round was led by asset manager Invesco and also involved a host of new investors such as Baron Capital Group, Sumeru Ventures, IIFL AMC Late Stage Tech Fund and Kotak.

Amazon set to wheel away Cloudtail basket

Two days after the Competition Commission of India (CCI) approved Amazon’s bid to acquire Cloudtail’s parent firm Prione Business Services, we reported that the US ecommerce major will shut Cloudtail as a seller on its platform in India in about a month.

Amazon is now looking to close the transaction with Catamaran Ventures, people briefed on the matter said. The contract between Amazon and Catamaran Ventures – NR Narayana Murthy’s investment office –- is slated to expire on May 19, but Amazon is expected to close Cloudtail before that, sources close to the development said.

Catamaran Ventures holds 76% in Prione Business Services while Amazon holds the rest. Amazon used to hold 49% in Prione in 2019 but to comply with the new foreign direct investment regulations for ecommerce, it was forced to reduce its stake to 24%.

We had reported on December 22 that Amazon had sought CCI’s nod to buy Catamaran’s stake in Prione.

Tata Digital seeks more funds from Tata Sons for expansion

Why? Negotiations with global firms have been delayed by geopolitical issues, and Tata Digital is understood to have sought working capital funds in recent weeks, officials close to the development said.

Interim investment: The group is expected to make an “interim investment” of around $500 million as Tata Digital needs to expand aggressively to take on incumbents such as Amazon Walmart and Reliance. It will be spread across several tranches, a source told us.

Tata Digital has estimated a valuation of $18 billion for the digital entity, which includes Big Basket, online pharma store 1 mg, Croma and Tata Cliq.

BigBasket’s valuation jumps to $2.7 billion after secondary share sale

Egrocer BigBasket has seen its valuation jump to $2.7 billion following a secondary share sale earlier this year. Brand Capital, the strategic investment arm of the Times Group, has part sold its stake in the firm to Tata Digital, people briefed on the matter said.

Tata Digital funding talks in limbo: The steep rise in BigBasket’s valuation comes at a time when Tata Digital’s discussions with marquee global investors to raise new capital for its ecommerce venture have hit a hurdle. Tata Digital is thus seeking additional cash from holding company Tata Sons to fuel its ambitious growth plans, as we reported on March 9.

EY India probes finances of influencer-led social commerce startup Trell

A forensic team from EY India is carrying out a detailed investigation into the finances of influencer-led social commerce startup Trell and has submitted an interim report, four sources with direct knowledge of the matter said.

The team from the consulting firm is looking into alleged related-party transactions by its founders and other financial irregularities, they said.

Trell’s board of directors is likely to act on the EY report over the next few weeks, they added.

Funding on hold: The alleged irregularities have stalled Trell’s existing $100-million funding round, for which it had been in talks with Amazon.

“There is an investigation underway on related party transactions and its scale in the company,” a person briefed on the matter said. “While the due diligence was being carried out, there seemed to be an issue around the monthly transacting users and revenues, but those details will be clear in the final report,” a source said.

The BharatPe saga

BharatPe shareholders may have to settle Grover-Koladiya fight: BharatPe’s shareholders will need to sort out the ongoing conflict between two of the company’s cofounders – Bhavik Koladiya and Ashneer Grover – over Koladiya’s stake in the firm, as the company board is unlikely to intervene in the matter, sources told us.

Catch up quick:We reported on March 5, after Grover was removed from the fintech firm, about the growing discontent between him and Koladiya, whose stake in BharatPe had previously been split between the two other cofounders.

Koladiya – one of the original founders of BharatPe – assumed the role of a consultant after he was convicted of credit card fraud in the US. He was removed from BharatPe parent Resilient Innovation’s cap table, splitting his holding between Grover and the other cofounder Shashvat Nakrani, we reported on Saturday, citing two people who were briefed on the matter.

BharatPe board acted quickly, says cofounder Nakrani: In an internal memo sent to employees on Monday, BharatPe cofounder Shashvat Nakrani said the company’s board “acted quickly and decisively to uphold good corporate governance”. Nakrani was referring to the audit of BharatPe undertaken by PricewaterhouseCoopers (PwC), the findings of which were tabled before the board on March 1.

This is one of the first times Nakrani has publicly spoken about the controversy that has plagued BharatPe since the start of the year. “What is important to note is that this is an aberration and not the norm,” he added in the memo.

Retail sales of passenger EVs, two-wheelers see huge jump

Retail sales of electric passenger vehicles grew 296% from 593 in February 2021 to 2,352 units in February 2022, while those of electric two-wheelers rose 433% from 6,083 to 32,443 units over over the same period, data from the Federation of Automobiles Dealers Association showed.

Who’s doing what: Most auto companies are stepping up production by partnerships or by putting up separate assembly lines, which will see more EV models on the road in fiscal year 2023.

- Hero Electric and the Mahindra Group announced a Rs 150-crore, five-year partnership last month, and rolled out their first electric two-wheeler, Optima.

- Ola Electric and Ather Energy are also increasing production capacity of EVs.

- MG Motor India on Monday launched its all-new ZS EV variant, with a starting price tag of Rs 21.99 lakh.

Indian firms face increased risk of cyberattacks, experts warn

Fitch Ratings has said that cyberattacks on businesses and government agencies have increased across the world, and the risk of spillover cyberattacks against non-primary targets has escalated.

Indian enterprises have not been victims of any major targeted cyberattacks yet, but there are concerns that attacks on larger global supply chains could affect Indian businesses, security experts said.

Phishing and supply chain attacks: “Cyberattacks directed elsewhere may find their way to enterprises in India, making supply chain attacks one of the top concerns. Similarly, the way pandemic-themed attacks played out last year, threat actors are likely to exploit the current crisis to launch new types of phishing attacks,” said Gaurav Shukla, partner, Deloitte India.

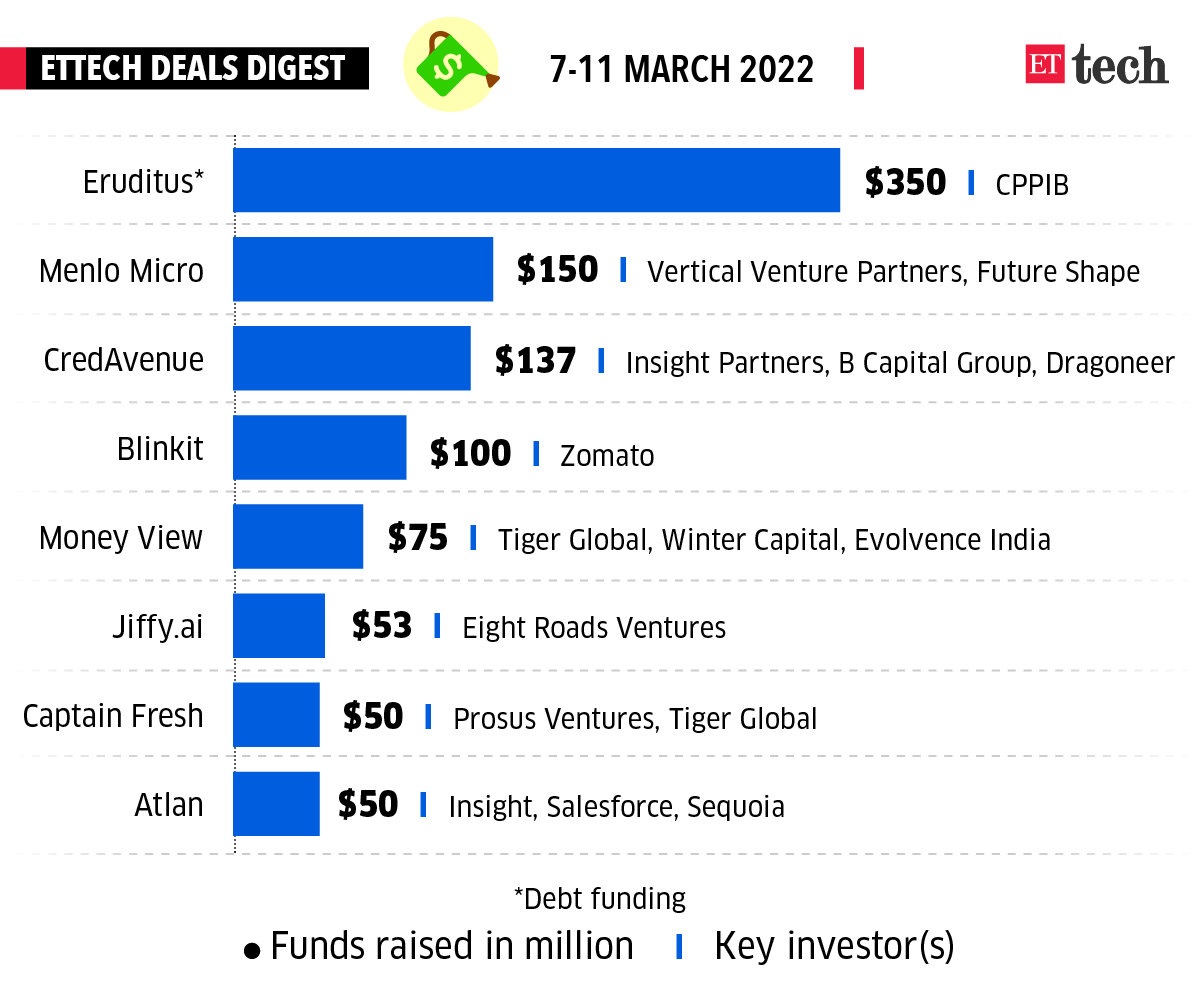

ETtech Deals Digest

Ninjacart acquires SaaS platform Tecxprt to streamline supply chain: Fresh produce supply chain startup Ninjacart acquired Tecxprt, a Software-as-a-Service (SaaS)-based communication platform. The entire team of Tecxprt will join Ninjacart as part of the deal. The company did not disclose the transaction size.

Electric two-wheeler startup Yulu to raise $100 million: Electric two-wheeler startup Yulu is planning to raise up to $100 million to expand its business model and grab a larger pie of the growing last-mile mobility segment. Yulu, which has created the country’s largest battery as a service network with 3 million battery swaps till date, will expand its fleet to 100,000 units by the end of the year from 10,000 units currently, open up franchisee models to reach newer cities and cater to personal buyers in the next one year.

Zeta raises another $30 million from Mastercard, others: Banking tech platform Zeta raised $30 million as a part of strategic investment from Mastercard and other investors, taking the company’s valuation to $1.5 billion. This is a continuation of the $240 million funding round that Zeta raised last May, led by SoftBank Vision Fund 2. The round valued the company at $1.45 billion, marking its entry into India’s unicorn club. A unicorn is a privately held startup valued at $1 billion or more.

Agritech startup Otipy raises $32 million: Otipy, a community group buying platform for fresh produce and daily essentials, raised $32 million (about Rs 235 crore) led by WestBridge Capital. Existing investors SIG and Omidyar Network India also participated in the round. The fresh funding round has come within six months of the Crofarm Agriproducts-operated platform raising Rs 76 crore ($10.2 million) from SIG, Omidyar Network India, and IPV (Inflection Point Ventures), Pravega Ventures.