Credit: Giphy

Also in this letter:

■ Netflix loses subscribers for the first time in a decade

■ VideoVerse raises $46.8 million, and other done deals

■ Koo brings more transparency to its algorithms

Battery policy in the works after a spate of two-wheeler EV fires

India could soon come out with standards for electric vehicle (EV) batteries, after a spate of fires involving electric two-wheelers.

“Matter of concern”: A senior official from the Ministry of Road Transport and Highways told us the government was planning to put out quality-control rules for EV batteries.

The rules will cover performance testing and manufacturing standards, as well as the heat resistance of these batteries.

Also Read: Niti Aayog to roll out EV battery swapping policy in four months

“The fires are a matter of concern… We have informally started directing EV manufacturers to improve their existing vehicles,” said the official, adding that work had begun on the proposed battery policy, too.

Investigation: Meanwhile, the government has asked the Centre for Fire, Explosive and Environment Safety (CFEES), a laboratory of the Defence Research and Development Organisation, to investigate the recent fires.

Also Read: E-scooter fires in India trigger safety concerns, in setback for Modi push

These involved include, among others, Ola S1 Pro, Okinawa Praise Pro and Pure electric scooters, apart from 26 electric scooters made by Jitendra New EV Tech, which caught fire after being loaded onto a truck in Nashik on April 9.

Also Read: As EVs catch fire, makers look for ways to cool batteries down

No recalls for now: The official said any decision to recall these products will be taken after looking into CFEES’s preliminary findings. “For now, we want them (manufacturers) to voluntarily fix the shortcomings in their vehicles,” he added.

Netflix loses subscribers for the first time in a decade

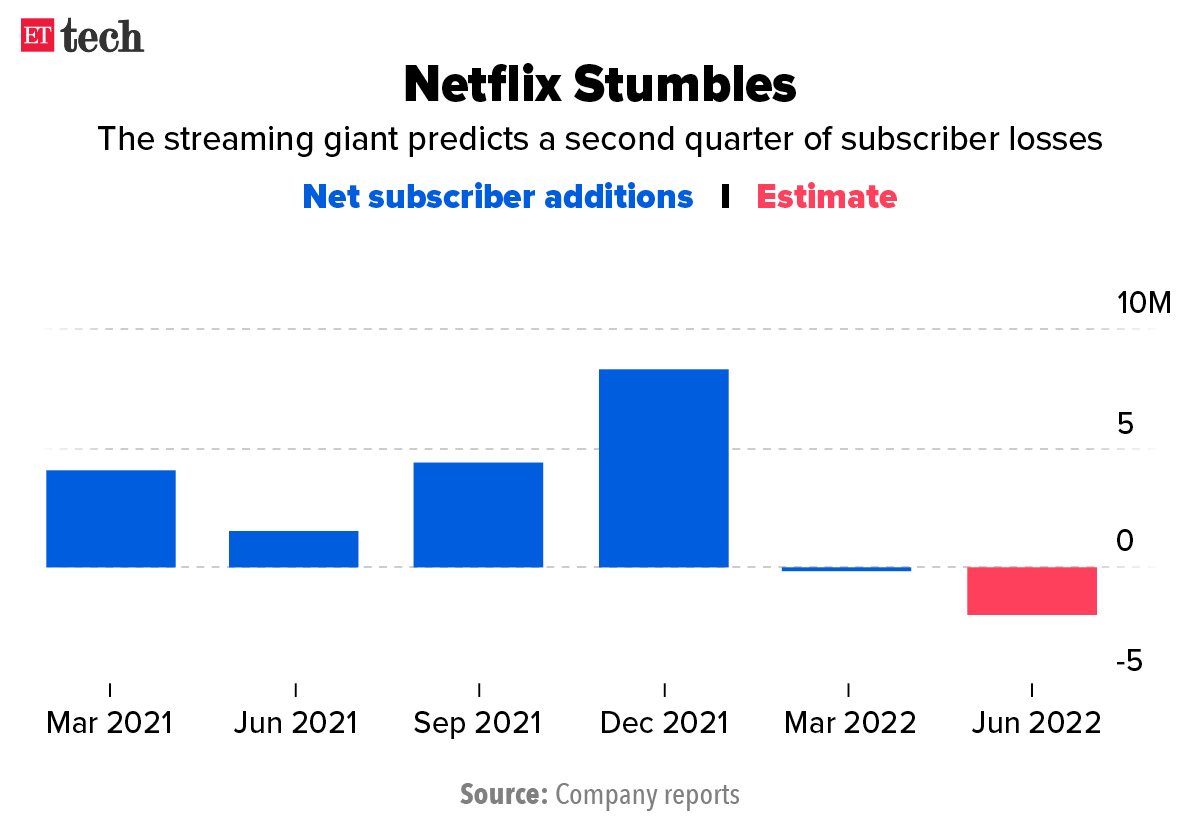

Netflix shares lost more than a quarter of their value in premarket trading in the US after the company revealed its paid subscriber numbers shrank in the first quarter of the year (January to March). It was the first time since October 2011 that the streaming service had lost subscribers.

Details: The company said it lost 200,000 subscribers in the quarter, after estimating that it would add 2.5 million.

- Suspending its service in Russia after the Ukraine invasion resulted in a loss of 700,000 members.

- That meant Netflix ended the first quarter of 2022 with 221.6 million subscribers, slightly less than the last quarter of 2021.

- Netflix’s first-quarter revenue grew 10% to $7.87 billion, slightly below Wall Street’s forecasts. It reported per-share net earnings of $3.53, beating the Wall Street consensus of $2.89.

Stock set to tank: The company’s shares shed more than a quarter of their value in premarket trading on Wednesday. If the 27% fall in premarket trading holds, Netflix will be on course for the biggest one-day fall in its share price in nearly a decade.

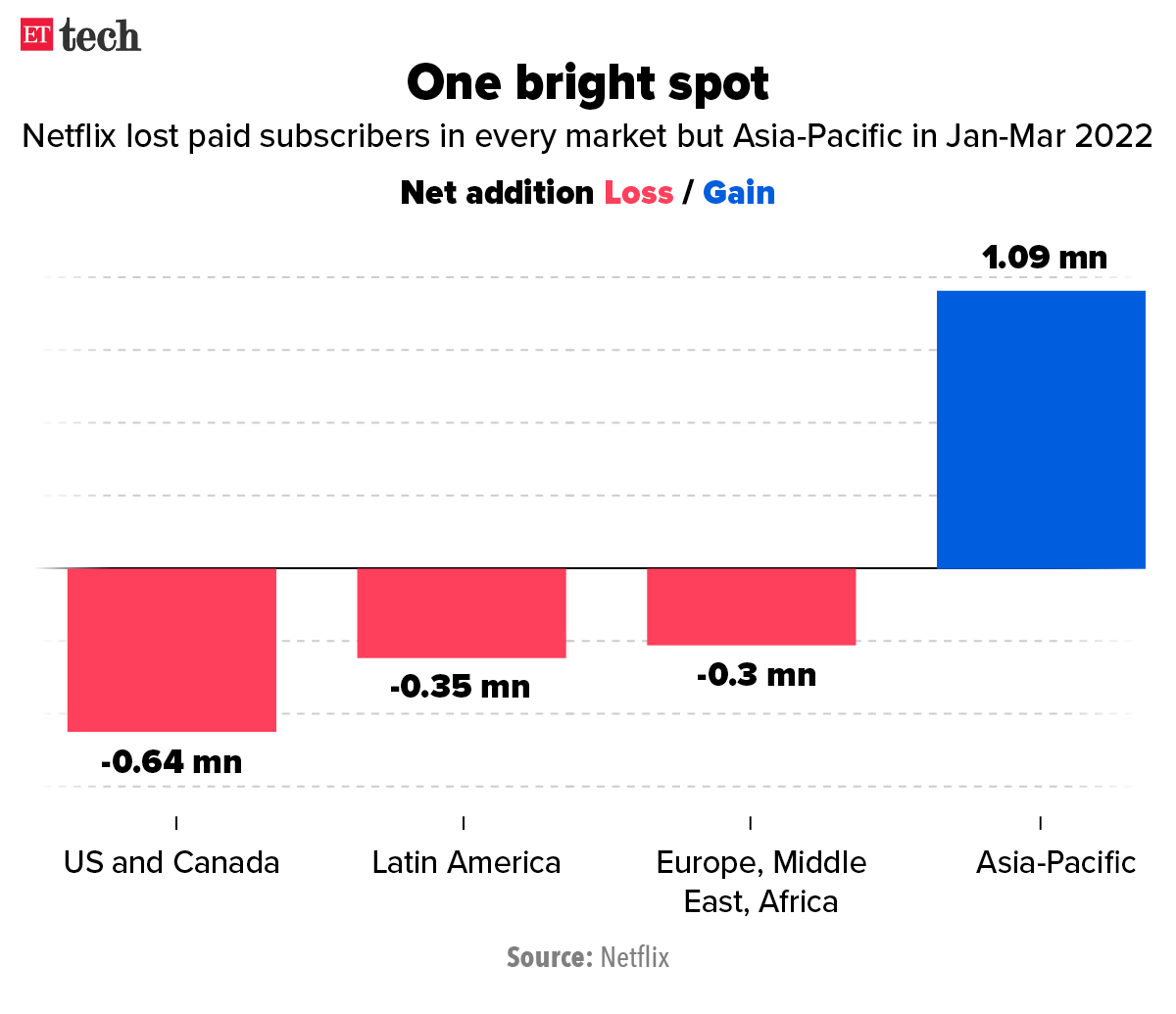

APAC is the silver lining: Asia-Pacific was Netflix’s sole silver lining, having shed subscribers in all other markets. The company, which reduced its subscription prices in India late last year, said it is witnessing an uptick in user engagement in the country as it doubles down on localised content.

Also Read: Despite price cut, Netflix’s rates remain in a league of their own

Password sharing: The company said factors hampering its growth include subscribers sharing their accounts with people not living in their homes. It is estimated that while nearly 222 million households pay for its service, accounts are shared with more than 100 million other households that don’t pay subscription fees.

Ads on the horizon? Netflix said it is looking at offering a lower-priced ad-supported version of the platform to boost its subscriber numbers. That would mark a big shift for a company that has always positioned itself as an ad-free haven for its subscribers.

ETtech Done Deals

VideoVerse cofounders Vinayak Shrivastav, Saket Dandotia and Alok Patil

■ Video editing software startup VideoVerse, formerly known as Toch AI, has raised $46.8 million in a funding round led by A91 Partners and Alpha Wave Global. Flipkart cofounder Binny Bansal also participated in the round, as did Stride Ventures, Innoven Capital and Pacific Western Bank, among others. The funding is a mix of equity and debt.

■ Financepeer, an education focussed fintech startup, has raised $31 million in a funding round led by QED Investors and Aavishkaar Capital. The company offers loans to students to pay school and college fees. It will use the funds to enhance its technology platform and offerings, expand and strengthen its education-institution partnerships, and deepen its reach in rural areas.

■ Chennai and Delaware-based software-as-a-service (SaaS) startup Everstage has raised $13 million in a funding round led by Elevation Capital, with participation from existing investor 3one4 Capital. Everstage plans to use the funds to further expand its sales, engineering and solutions teams.

■ Trade finance platform Vayana Networkhas raised Rs 114 crore (about $15 million) in an extension of its ongoing fundraise, led by International Finance Corporation (IFC) and PayU, the fintech arm of Dutch multinational Prosus. With this, the company has closed its latest fundraising of Rs 397 crore (about $52 million).

■ Rigi, a platform for creators and influencers, has raised $10 million in a funding round co-led by Accel India, Sequoia Capital India, and Stellaris Venture Partners.

Tweet of the day

Mindtree, L&T Infotech chase deals together, say CEOs

Mindtree and Larsen & Toubro Infotech (LTI), group companies of L&T, have been collaborating with each other as they chase big deals, the chief executives of both firms told us independently. Debashis Chatterjee is the CEO of Mindtree, while Sanjay Jalona heads LTI.

Merger talks: People familiar with the matter told us that merger talks between the companies were at an advanced stage, though as a timeline had not been finalised.

“The board has given its go-ahead,” a source close to the development told us.

Making of an IT giant: The likely merger of these two mid-tier firms will create a large IT services entity that will replace Tech Mahindra as India’s fifth largest software services exporter by market capitalisation. In terms of revenue, though, the combined entity will still rank lower than Tech Mahindra.

LTI Q4 results: LTI’s net income rose 16.8% to Rs 637.5 crore in the fourth quarter, in line with analyst estimates, due to strong execution of contracts. Revenue was up 31.6% on year to Rs 4,301.6 crore, slightly missing analyst estimates of 32.5%-33.5% growth.

Koo brings in more transparency on its algorithms

Homegrown microblogging platform Koo has published the philosophy and workings behind its core algorithms in a bid to bring in more transparency. The move is aimed at helping users understand why they see the content they do.

Timing: Koo’s move comes as Twitter is facing flak from billionaire Elon Musk. After picking up a 9.2% stake in the company, the Tesla CEO said Twitter’s algorithms should be open source.

While Koo hasn’t gone that far, it is seeking to make users aware of how it achieves its objectives.

Quote: “To speak openly about our algorithms is part of our commitment to letting users know that there are no hidden agendas at Koo,” Aprameya Radhakrishna, its cofounder and CEO, said in a statement.

Musk mischief continues: Meanwhile, Elon Musk tweeted posted another cryptic tweet, days after he offered to buy Twitter for $43 billion. “______ is the Night,” the tweet read, sparking speculation that he planned to launch a tender bid for Twitter. ‘Tender is the Night’ is a 1934 novel by F Scott Fitzgerald.

Last week he tweeted the words ‘Love Me Tender’ keeping everyone guessing about whether he was considering a tender bid or simply listening to Elvis Presley.

Also Read: ETtech Explained | Twitter pops a ‘poison pill’ against Elon Musk’s hostile takeover bid— what does that mean?

Chasing Twitter: The New York Post reported Musk was willing to invest between $10 billion and $15 billion of his own money to take Twitter private. The report said he plans to launch a tender offer in about 10 days and has tapped Morgan Stanley to raise another $10 billion in debt.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.