Credit: Giphy

Also in this letter:

■ Lack of ‘basic safety systems’ behind EV fires: probe panel

■ Byju’s offers over $1 billion for 2U to expand in the US

■ Bank-led PPI issuers only onboarding full-KYC users after RBI order

Govt gives Twitter India ‘last chance’ to follow IT rules

The union government has given Twitter India “one last opportunity” to comply with India’s Information Technology Rules, 2021 by July 4 or risk losing its immunity as an intermediary, sources told us.

Strike three: The Ministry of Electronics and Information Technology’s (MeitY) action follows Twitter’s “repeated failures to act on the content take-down notices sent under Section 69 A of the IT Act” as well as on “non-compliance notices issued for not taking content down,” officials said.

In a notice, sent on Monday, the ministry said Twitter had failed to comply with two previous notices, sent on June 6 and June 9.

Consequences: MeitY’s notice — addressed to Twitter’s chief compliance officer — said “if Twitter Inc. continues to be in violation of these Directions and therefore the IT Act, significant consequences under the IT Act shall prevail.”

This includes “loss of immunity as available (to) an intermediary… and liability for punishment under the IT Act 2000.”

Yes, but: It was not immediately clear which specific content takedown notices Twitter had not responded to or acted upon. MeitY’s notice did not provide details.

Precedent: In May 2021, when the IT Rules 2021 came into effect, MeitY had issued a similar warning to Twitter, asking it to appoint a resident grievance officer, a resident chief compliance officer and nodal contact person or risk losing protection as an intermediary.

Subsequently, Twitter appointed executives in all the required roles and had informed the IT ministry of its compliance with the norms.

Lack of ‘basic safety systems’ behind EV fires, says probe panel

Electric two-wheelers involved in recent fire incidents lacked “basic safety systems’, an expert panel formed to investigate the accidents has found.

The final report is expected in a week but its recommendations on safety have already been shared with EV manufacturers.

Details: The committee found there was no “venting mechanism” for overheated cells to release energy and that the battery management systems (BMS) were seriously deficient, an official privy to the findings told us.

The panel is said to have pointed out that many of the electric two-wheelers came with only “minimum functionality” and that “shortcuts” were taken instead of prioritising vehicle safety.

BMS failures: The panel said the EVs lacked a mechanism for identifying overheated cells and isolating them.

“Secondly, the battery management system is not even basic. A particular battery, when it’s getting overheated, must be identified and cut off. This is, in fact, what even a minimally functional BMS will do. These vehicles didn’t even have that basic identification system for failed cells,” the official added.

Battery packs typically need to adhere to safety standards set by the Automotive Research Association of India (ARAI). It is unclear how these vehicles passed muster without such basic safety features.

What’s next? The government has shared the panel’s recommendations with the relevant companies for corrective action and has sought to know why they should not be sued, the official said. Meanwhile, several manufacturers have already begun recalling EVs from the market.

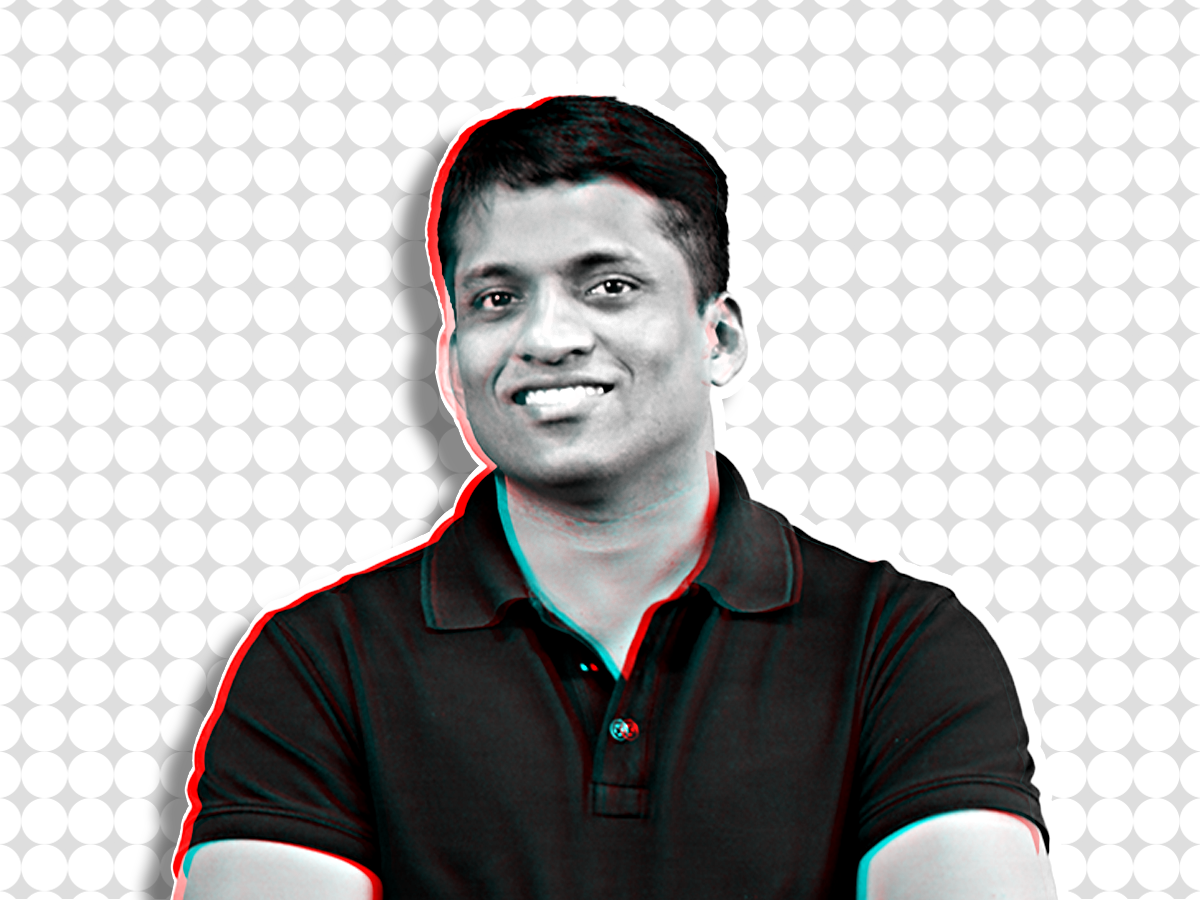

Byju’s offers over $1 billion for 2U to expand in the US

Indian edtech giant Byju’s has offered over $1 billion to buy US-listed edtech company 2U in an all-cash deal as it seeks to expand its US operations, Bloomberg reported.

It said Byju’s made an offer of $15 per share — a 61% premium to 2U’s closing price of $9.30 on Tuesday, which would give it a $2 billion valuation. Byju’s has also been in talks to acquire 2U’s rival Chegg, as we reported in May.

Yes, but: The talks with 2U could still fall apart and a deal may not materialise if its board rejects the offer.

Aakash deal payments: We reported on Tuesday, citing sources, that Byju’s sought a two-month extension from Blackstone and other shareholders of test-preparation provider Aakash Educational Services on payments that were due this month. It had acquired Aakash in a nearly $1 billion dollar deal last April.

The news came amid a round of layoffs at WhiteHat Jr, which Byju’s acquired in 2020.

Other done deals

■ Business-to-business (B2B) consumer electronics startup Arzooo has raised $70 million from Japan’s SBI Holdings, Trifecta Leaders Funds, and existing investors like Celesta Capital and 3 Lines VC in an all-equity deal. The company will use the funds to expand and improve its tech stack.

■ Commercial electric vehicle startup Turno raised $3.1 million in a funding round led by Stellaris Venture Partners and Avaana Capital. Angel investors such as BigBasket’s Vipul Parekh, Urban Ladder’s Ashish Goel, and the Goenka Family Office also participated.

■ Bengaluru-based ‘move-to-earn’ startup Fitmint closed a $1.6 million seed round from General Catalyst and other institutional investors. It will use the funds for hiring, team expansion, marketing, and optimising tech infrastructure.

Bank-led PPI issuers only onboarding full-KYC users after RBI order

Bank-led prepaid card issuers like Slice and Uni Card are onboarding only full-KYC users to their platforms after last week’s RBI order, barring non-banks from loading credit lines on prepaid instruments.

RBI’s notice had left fintech companies in disarray, forcing them to engage with partner banks and non-bank lenders to understand how they can continue to offer prepaid payment instruments (PPI) without violating the rules.

Quote: “We are working with the bank that is the PPI issuer, and the partners have decided to only onboard customers with full KYC. We are working with banks that are in turn working with the RBI on how to operate in the present environment,” an executive at one of the affected companies.

Card-based fintech firms cater to nearly 10 million customers in India and are growing rapidly. The industry processes monthly payment volumes of over Rs 3,500 crore.

Tweet of the day

US regulator asks Google and Apple to ban TikTok

The US Federal Communications Commission (FCC) head, Brendan Carr, has fired off a letter to tech giants Apple and Google, asking them to remove the short video app TikTok from their app stores because of its suspicious data handling practices.

Quote: “It is clear that TikTok poses an unacceptable national security risk due to its extensive data harvesting combined with Beijing’s apparently unchecked access to that sensitive data,” Carr wrote in the letter.

Just a week ago, BuzzFeed News reported that ByteDance employees repeatedly accessed US TikTok users’ data, sparking concern in the Biden administration.

TikTok takes over: TikTok was banned in India along with several other Chinese apps in 2020 but has thrived nonetheless. According to app analytics firm App Annie, it first overtook YouTube on screen time in the US in August 2020, and as of June 2021 its users watched over 24 hours of content a month, compared with 22 hours and 40 minutes on YouTube.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.