Also in this letter:

■ LazyPay updates terms to comply with RBI order

■ Ecom Express seeks $125-150M funding as IPO plans stall

■ Crypto a ‘clear danger’ to financial systems: RBI governor

Govt to cover a lot of ground in final eGaming framework

The union government is drawing up an extensive framework to regulate online gaming companies including proposals for time-bound retention of specific user data and robust grievance redressal mechanisms, senior government officials told us.

Final stages: An inter-ministerial task force with secretaries of finance, home, IT, sports and youth affairs, as well as officials from the Department for Promotion of Industry and Internal Trade and Niti Aayog are working on the rules, expected to be out soon, sources said.

“We are in the initial stages of discussions. A nodal ministry which will administer the rules is yet to be finalised,” one official said, adding that “it must be a light-touch framework which co-exists with the regulations that states such as Rajasthan and Karnataka have already developed for their jurisdiction.”

Light touch: Pointing to gaming being a very nascent sector, the official noted that the government does not “wish to go for over-regulation and stifle innovation in the area.” Among the approaches being debated is including the gaming sector under the purview of the Information Technology Rules.

“With social media intermediaries, there are now defined guidelines of dos and don’ts. The (IT) ministry has emergency powers which it can invoke under various sections of the IT Act. We must look at including those for the gaming sector as well,” a person involved in the discussions said.

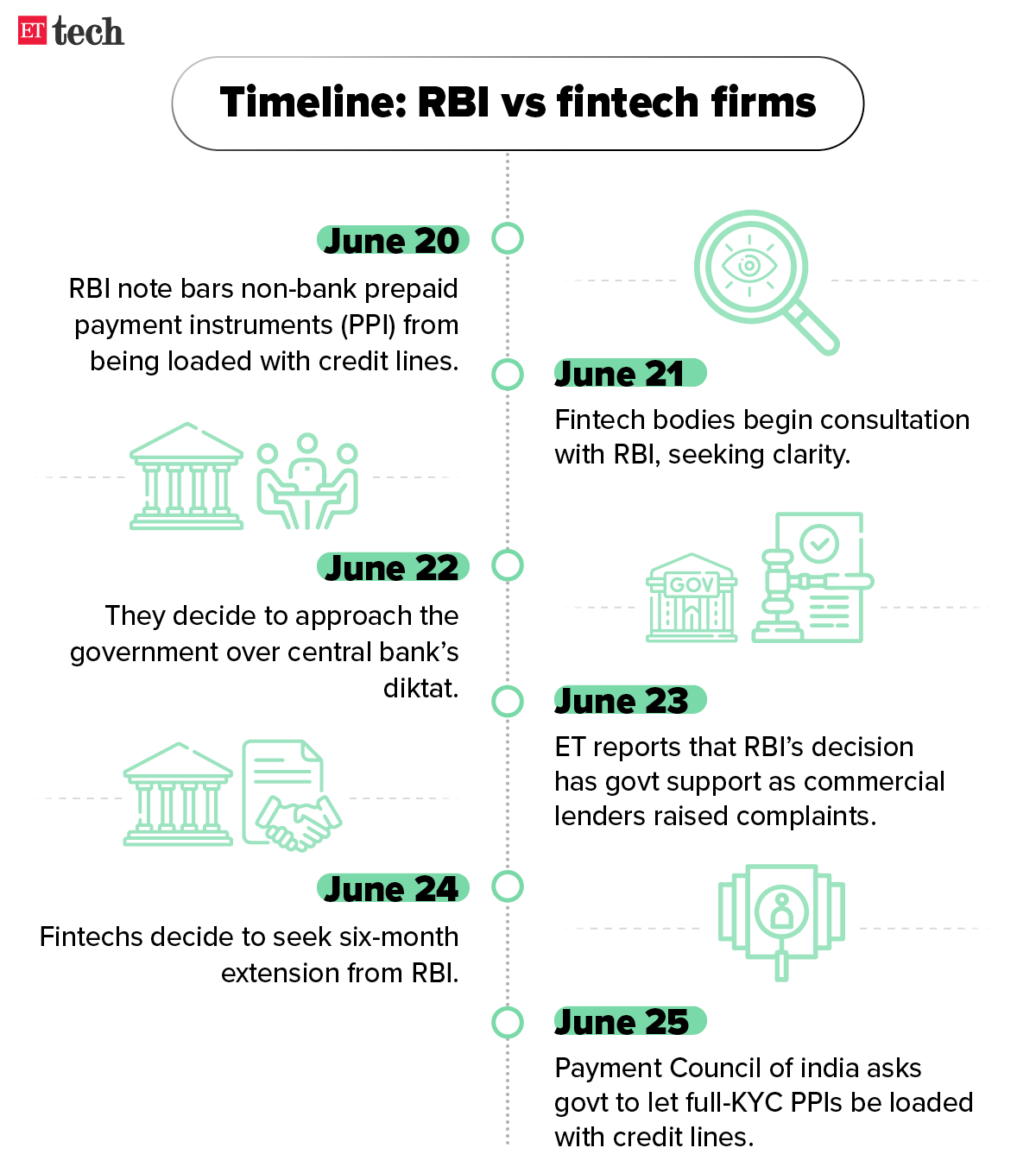

LazyPay updates terms to comply with RBI order

LazyPay, the lending arm of PayU India, has updated its terms and conditions to comply with a recent directive by the Reserve Bank of India (RBI) that barred prepaid payment instruments (PPIs) from being loaded with credit lines.

The buy-now-pay-later (BNPL) service asked customers in a message on Thursday to accept the terms, failing which all transactions would be blocked across LazyPay products.

“To comply with the latest regulations, we need to block your transactions on all LazyPay products from today. To continue using LazyPay, please accept the updated T&Cs now,” the company said in a communication to customers.

We were the first to report about LazyPay’s plans to update its terms on June 23.

On June 20, the central bank disallowed non-bank wallets and pre-paid cards from loading their credit lines onto these platforms.

The move caused disruptions among certain lending and card-based fintech firms. Industry stakeholders have since reaching out to the RBI for consultations.

Earlier this week, Slice updated its terms and conditions, saying it would charge customers a 36% interest rate for loan repayments made in more than one instalment.

Ecom Express seeks $125-150 million in private funding as IPO plans stall

Ecommerce-focused logistics player Ecom Express, which was preparing for a listing before the markets turned choppy, is looking to raise $125-$150 million in private funding, people aware of the matter said.

Ecom Express, like multiple other top-tier startups, has put its initial public offering (IPO) plan on hold for now.

The company is working with investment banks JM Financial and Barclays for the fundraising, according to people who know about its pitch to investors, and is looking to benchmark itself against Delhivery, the largest third-party logistics player which went public in May.

“IPO looks unlikely in a market now and they have pitched to investors for a round of up to $150 million. The conversations are early, and a valuation has not been finalised yet,” one person said.

The Warburg Pincus-backed firm is valued at around $760 million, according to Tracxn.

ETtech Done Deals

■ Revenue-based finance platform GetVantage raised $36 million in a funding round led by Varanium Nexgen, Fintech Fund, Chiratae Ventures and a few others. It will use the fresh funds to improve its tech, scale its products and venture across Southeast Asia.

■ AquaExchnage, a fintech platform catering to India’s shrimp and fish ecosystem, raised $3 million from Endiya Partners, Accion Venture Lab and a few others. Started in 2020 by Pavan Kosaraju, AquaExchange offers a fintech-enabled e-commerce platform that provides manufacturers with high-quality materials at affordable prices and a ‘hardware-as-a-service’ platform.

■ Urvann, a gardening-focused hyperlocal marketplace, raised Rs 3 crore in a seed funding round led by Inflection Point Ventures (IPV). It plans to use the fresh funds to expand its operations.

TWEET OF THE DAY

Cryptocurrencies a ‘clear danger’ to financial systems: RBI governor

Reiterating his long-held stance on cryptocurrencies, the Reserve Bank of India (RBI) governor Shaktikanta Das said in the 25th issue of the RBI’s Financial Stability Report (FSR) that “we must be mindful of the emerging risks on the horizon”.

Sophisticated speculation: “Cryptocurrencies are a clear danger. Anything that derives value based on make-believe, without any underlying asset, is just speculation under a sophisticated name,” Das said in the foreword of the report released on Thursday.

Drastic measures: The report, which reflects the collective assessment of the sub-committee of the Financial Stability and Development Council (FSDC) on risks to financial stability and the resilience of the financial system, said crypto assets are seen as a growing threat that warrants drastic approaches by national authorities.

It noted that global regulatory efforts continue to focus on risks associated with the crypto ecosystem and the “threat of decentralisation”.

Terra collapse: The report also mentioned to collapse of Terra blockchain’s native token Luna in May, which erased over $40 billion of investor wealth.

SoftBank-backed Lenskart buys Japan’s Owndays in $400 million deal

Lenskart, the Softbank-backed omni-channel eye-wear retailer, has picked up a majority stake in Owndays – a Japanese direct-to-consumer eyewear brand – the company said. The strategic partnership through this merger will build Asia’s largest omni-channel eyewear retailer, Lenskart added.

Details: The deal is estimated to value Owndays at around $400 million, a source told us. The company declined to disclose the deal size.

The majority shareholders of Owndays – L Catterton Asia and Mitsui & Co., Principal Investments – will sell their stakes to Lenskart as part of the deal.

Owndays cofounders Shuji Tanaka and Take Umiyam will continue as shareholders and lead the management team of Owndays after the deal. It will continue to operate as a separate brand.

Other Top Stories By Our Reporters

Tata Cliq to be Integrated with Tata Neu: Online retail platform Tata Cliq is likely to be integrated with the Tata Neu super app and made a subsidiary of Tata Digital as the group seeks to consolidate its major ecommerce ventures under this entity, officials close to the development told us.

Ankiti Bose steps down from Zilingo board: Ankiti Bose, the cofounder and former CEO of beleaguered B2B ecommerce firm Zilingo has resigned from her directorships at the company owing to “opacity of information”, she announced in an Instagram post on Thursday.

Swiggy Esop liquidation: Swiggy has announced that its employees will have the option to receive liquidity of up to $23 million against their stock options, marking the first milestone in its two-year liquidity plan.

QuickBooks to exit India: Global technology giant Intuit will shut down its financial management suite Quickbooks in India on January 31, 2023, as per a company email. Quickbooks launched in India in 2012. The company has about four million customers globally, with less than 1-2% in India.

Global Picks We Are Reading

■ Singapore’s proposed online safety laws look like more censorship in disguise (Rest of World)

■ Tencent, ByteDance implement fresh layoffs amid China’s economic pains (WSJ)

■ The fight over which uses of AI Europe should outlaw (Wired)