Also in this letter:

- BharatPe’s Ashneer Grover goes on leave

- Interview with Infosys CEO Salil Parekh

- Online grocers step it up amid Omicron

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

Startups seek new definition in note to govt

In a note to the government, the Indian Private Equity and Venture Capital Association (IVCA), an industry body, has proposed a new definition for startups.

IVCA’s note, sent to various stakeholders in the government including officials in the finance ministry, also reiterated older demands such as allowing local firms to directly list overseas.

Define ‘startup’: IVCA has proposed that a company should be considered a startup, irrespective of revenue, so long as it is less than 10 years old and not a subsidiary or outcome of a merger or spin-off, multiple people aware of the matter told us.

“Currently, the amended provisions by the Department for Promotion of Industry and Internal Trade (DPIIT) say a company will be recognised as a startup till 10 years from its date of incorporation, with a revenue threshold of Rs 100 crore,” a person aware of the matter said. “They (IVCA) have proposed that revenue should not be a benchmark at all.” Previously, the revenue threshold was Rs 25 crore.

It also proposed that any startup backed by an Alternative Investment Fund or a foreign venture capital fund should be considered a startup and get the relevant tax benefits. Government certification through the inter-ministerial board (IMB) could be used for bootstrapped startups, it said.

Overseas listing: A consortium of overseas investors has also proposed that the government allow direct Indian startups to list overseas directly. People aware of government officials’ views on the issue said if an Indian startup is allowed to list overseas, it should come back after a certain number of years and list here.

Last August, the heads of 22 top startups and venture capital firms had jointly written to the prime minister, urging him to allow homegrown companies to directly list abroad.

“The current inability of unlisted companies to tap international markets for raising capital is an impediment to growth and most Indian startups do not have a level-playing field with their foreign counterparts,” these founders and investors had said in the note then. The move will also lead to curbing “migration of startups outside India, or flipping”, they had said.

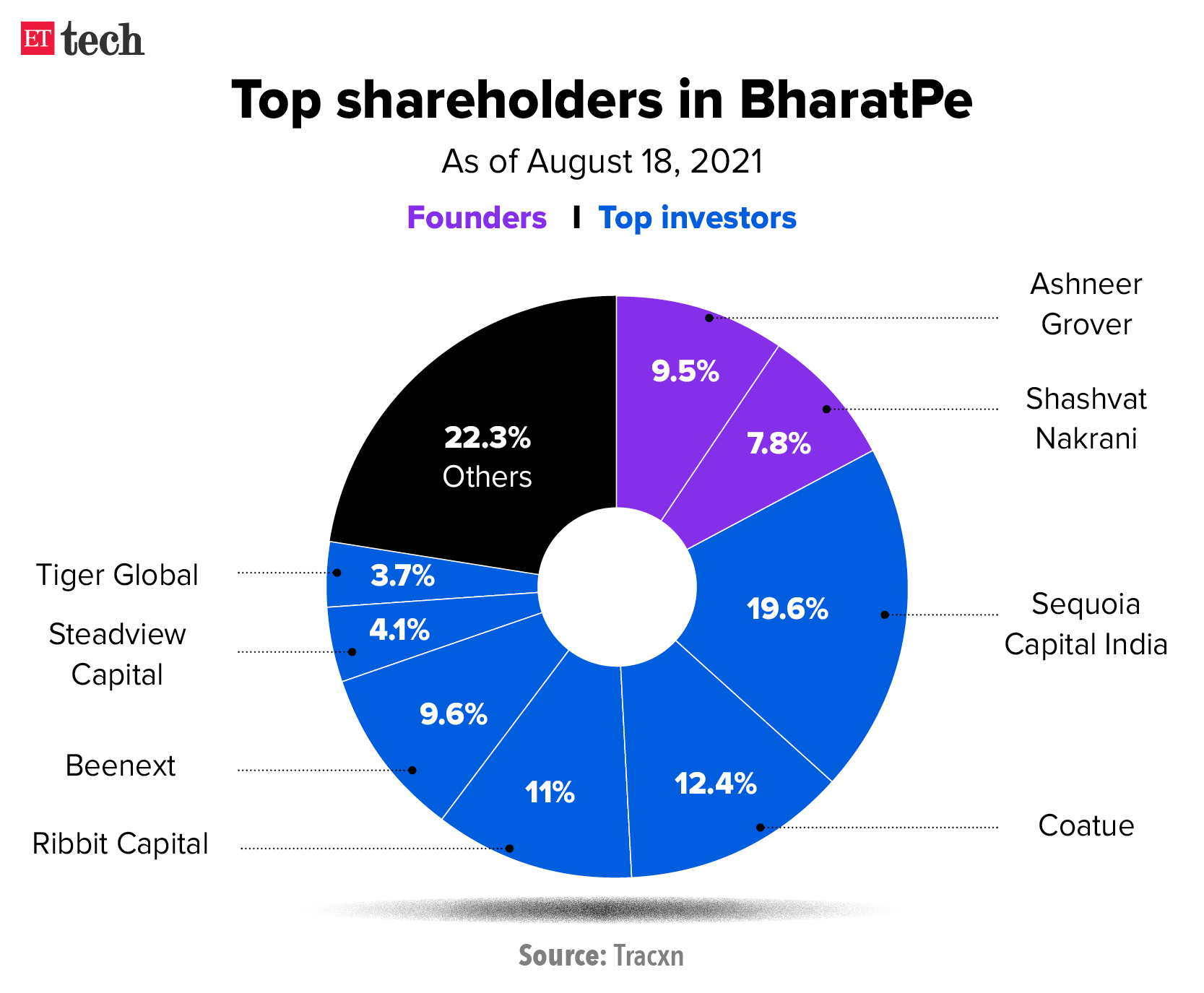

Two weeks after rant went viral, BharatPe’s Grover goes on leave

BharatPe’s cofounder and MD Ashneer Grover

Ashneer Grover, the controversial cofounder and managing director of BharatPe, has taken a voluntary leave of absence until the end of March.

In a statement issued on Wednesday, he said, “I’ve been relentlessly at work building up BharatPe for almost four years. After much deliberation and introspection, I plan to take a temporary leave of absence from BharatPe till March-end. I will return on or before April 1, 2022.”

Mum’s the word: Grover has been in the midst of a controversy after an audio clip of his purported phone conversation with a Kotak Mahindra Bank employee was leaked earlier this month, but his statement did not not address the controversy or the allegations against him.

It said instead he would use his time off to “rejuvenate and refresh” himself for Bharatpe’s “next sprint of value creation” and “invest in myself personally”.

‘Best interests’: The company’s board earlier said it had accepted Grover’s decision, which it agreed was “in the best interests of the company, its employees, investors and merchants. It said the company would continue to be led by chief executive Suhail Sameer, who was appointed to the post in August.

Inside dope: Investors in BharatPe had met Grover last week to discuss the matter and the next steps to be taken, people aware of the discussions told ET. One of them said, “The option was to either ask him to step down or get him to go on temporary leave and then phase him out.”

It’s not clear if the board has started a formal investigation into the allegations against Grover. The company’s investors and board members didn’t respond to our queries on this.

“It was a difficult conversation with Grover… It has been advised that he stay away from the company for a few weeks until the dust settles,” said another person aware of the discussions.

Controversies: Grover has been in the spotlight since the turn of the year for all the wrong reasons.

In the first week of January, an anonymous handle on Twitter—‘bongo babu’—had posted a SoundCloud link to an audio clip of a man, allegedly Grover, abusing and threatening the bank employee over the phone in October after missing out on Nykaa’s initial public offering.

Grover initially tweeted that the audio clip was fake and that “some scamster” was trying to extort $240,000 in bitcoin from him. He also shared screenshots of the alleged emails seeking money. The same week, the audio clip was taken off Twitter and SoundCloud and Grover deleted the tweet claiming it was fake.

On Monday, we reported on a leaked email exchange from August 2020 between Grover and Harshjit Sethi of Sequoia Capital India, in which the BharatPe founder allegedly used several expletives. Sethi, who has been with Sequoia Capital India since 2015, was promoted to managing director in the venture team in July 2021.

The previous day, we had delved deep into Grover’s controversial past, quoting the founder of a startup who has known him for over a decade as saying, “I have seen this problem in some of the prominent founders in India. It’s called the God Syndrome. Often when things don’t turn out the way they intended, he said, “it comes out as extreme anger and frustration.… Ashneer’s alleged remarks over the call are a typical example of this.”

Grover and BharatPe have also been embroiled in a public spat and legal battle around the ‘Pe’ suffix with rival PhonePe, which is owned by Flipkart.

Fundraising machine: Despite the controversies around it, BharatPe has been one of the well-funded fintechs in the Indian startup ecosystem and recently raised $370 million in a round led by Tiger Global.

Timeline: Ashneer Grover’s fortnight to forget

Tweet of the day

Infosys has seen rapid growth from Big Tech firms: CEO

Infosys CEO Salil Parekh

Infosys would have registered a similar pace of growth even without the Covid-19 pandemic, having invested heavily over the past few years in anticipation of an increase in digital spending by clients, chief executive Salil Parekh told us in an interview.

“We would have seen this level of traction with our clients in any scenario,” he said, adding that the Bengaluru-based IT services provider would continue to gain market share going forward. Here are some edited experts from the interview:

You have set Infosys on a strong growth path. What are your next goals?

(Our) four years of very strong strategic focus has resulted in this industry-leading performance. There are some critical components – a big focus on digital. We’ve gone from about 25% of our (revenue) in digital to about 58%. In the last quarter, we grew about 21%. Within digital, the biggest focus area was Cloud, where we put together this cloud capability called Cobalt that fuels much of the work with cloud companies. The most critical element is the skilling of our people, which…we have accelerated. We are leading the industry in many parameters on digital. We see very good traction for this financial year.

Do you think this has also been accentuated because of the pandemic? Will Infosys continue to gain?

Clearly, we put in place many of these building blocks on digital and digitisation over the past four years. We would have seen this level of traction with our clients in any scenario. Large companies have seen the benefits of digital in the last 18-24 months to better connect with customers or employees or within the supply chain. They have gone faster into it. We’ve been taking (digital projects) over the last four years and not just the last six months; we were extremely well positioned to support clients in doing that.

What are your opportunities with Big Tech companies?

That’s another fast growth area within our client base because those businesses are growing at a tremendous pace. We have deep relationships across a broad set of companies in that area. Their growth in many places is so rapid that they’re very happy to work with Infosys as we support them in various aspects of technology and operations that they’re driving through. So, (there are) huge, huge set of opportunities in the digital natives. Typically, we have much, much faster growth there. Our own business within them is also growing at a very good pace.

Online grocers step it up amid Omicron

Amid a surging third wave of Covid-19 cases in India, while various physical retailers and dine-in restaurants are putting on hold their expansion plans, online grocers are making an aggressive push to take advantage of the growing demand for quick online deliveries.

- Blinkit has since December 2021 added 200 “dark stores” that are designed only for deliveries in ten minutes, and plans to increase the number of such mini distribution centres to 1,000 by March.

- MilkBasket is more than doubling its warehousing capacity to almost 350,000 square feet in Delhi NCR to cater to 150,000 orders a day, double the current order size.

- Tata-owned BigBasket plans to increase its existing warehousing capacity by about 40% and will open more than 300 dark stores in the coming financial year starting April.

Online grocery platforms have been in expansion mode since the coronavirus outbreak nearly two years ago, but the number of orders has increased 30-40% during the third wave.

Temp hiring by delivery firms surges amid third wave

Hiring of temporary workers for last-mile home delivery of essentials has surged 35-40% in the past two weeks, industry executives said. There are two reasons for this:

- Demand for home delivery amid the third wave of the pandemic.

- Rising absenteeism among delivery personnel due to infections.

Hiring for related services, like warehouse management and customer support, have also surged across India as etailers are responding to higher consumer traction in non-metros. The pressure on temp workforce hiring is expected to ease out once curbs are lifted and infections fall.

ETtech Done Deals

■ StockGro, a social investment startup, has raised $32 million in a funding round led by Bitkraft Ventures, General Catalyst and Lightricks cofounder Itai Tsiddon.

■ SaaS startup Rocketlane has raised $18 million in a Series A funding round to expand its product offerings and accelerate marketing, as well as for hiring.

■ Pi Ventures, an early-stage venture capital firm, has raised Rs 300 crore towards the first close of its $100 million second fund. The capital was raised entirely from high net-worth individuals and family offices from India and abroad.

■ Lummo (formerly BukuKas), which builds software that enables small companies to get online, has raised $80 million in a Series C funding round led by Tiger Global and Sequoia Capital India.

■ L&T Technology Services has won a $45-million deal from a US-based Tier-I automotive company to provide engineering services for its electric vehicle portfolio.

Other Top Stories

Matrix Partners-backed Protonn shuts business: Protonn, a startup that was offering its platform to independent professionals to launch their businesses online, has shut operations within six months of getting investor capital. The firm could not find the right product-market fit and the founders did not agree to pivot its business model, sources said. (read more)

L&T Infotech logs its best ever quarterly performance: Net profit of the Larsen & Toubro Group firm rose 11% over the previous three months to Rs 612 crore in the December quarter on the back of revenue that rose 9.8% sequentially to Rs 4,137 crore. (read more)

Awfis to double its workspace portfolio in 2022: Apart from adding 60,000 seats across 100 centres, the coworking startup will enter four new Tier-II cities in 2022 apart from expanding operations in cities where it is already present. (read more)

Global Picks We Are Reading

■ The metaverse has a groping problem already (MIT Technology Review)

■ ‘It’s all just wild’: Startups reach a new peak of froth (NYT)

■ 3D printing’s next act: Big metal objects (Axios)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.