Also in this letter:

■ No conflict of interest in Zomato’s Shiprocket investment: Goyal

■ PM to take final call on cryptocurrency regulations

■ Musk “thinking of quitting” his jobs, becoming full-time influencer

Google blinks again, puts off new Play Store policy to Oct 2022

Google said on Friday that its new Play Store billing policy would come into effect from October 2022 and not March 2022.

The company said the move would “provide developers in India the required product support for recurring payments through convenient payment systems, including UPI (Unified Payments Interface) and wallets, and also provide them more time in light of the changes to India’s recurring digital payments guidelines.”

Catch up quick: Google has been under intense pressure from app developers, startups and regulators, especially in India, for its steep commissions and restrictive Play Store payment policies.

This is the second time in two months that the company has put off implementing its new Play Store billing policy, after postponing it to March 2022 in early October.

Later that month Google said it would also slash its commission on in-app subscriptions from 30% to 15% effective January 1. But this did little to appease developers and startups. The next day, the Alliance of Digital India Foundation (ADIF), a grouping of Indian digital startups, called Google’s move a distraction tactic and said it would continue its efforts to protect fair competition and developer choice.

Play Store saga: Google has made announced several tweaks to its Play Store payments policy since announcing last year that developers would have to pay a flat 30% commission on all in-app purchases.

In March, it reduced its commission on in-app purchases (not subscriptions) from 30% to 15%, for the first million dollars of revenue earned per year. Apple had made a similar change for its App Store last November.

Changes in October included halving the commission on in-app subscriptions and lowering its service fee for ebooks and on-demand music streaming services to 10%.

‘No conflict of interest’, Deepinder Goyal says, on Zomato’s investment in Shiprocket

Zomato CEO Deepinder Goyal

Zomato founder and chief executive Deepinder Goyal said on Friday that he pulled out of his personal investment in Shiprocket at zero profit before his company invested in the logistics startup as part of a larger funding round.

Explain? Goyal was responding to a question from former Infosys director TV Mohandas Pai, who had posed the “conflict of interest” question to Sanjeev Bikhchandani, cofounder of Info Edge and an early investor in Zomato.

“Shiprocket to raise $185 million in Series E round co-led by Zomato, Temasek. Is there a conflict of interest if a listed co invests in a startup where the founder of the listed co had invested? @sbikh how will this be resolved!” Pai wrote in a tweet.

Goyal responded on Twitter, saying: “There was no conflict of interest to begin with. This personal investment was one of the key reasons we got closer to Shiprocket (and its founders). That’s how we discovered that there was potential long-term strategic fit between the two companies.”

“Such things (personal investments followed by Zomato stepping in) might continue to happen by design, while we continue to ensure the highest levels of disclosure and corporate governance at Zomato. Next time, please tag me directly on such queries and skip @sbikh,” he said in the tweet, which was retweeted by Bikhchandani.

Brush with controversy: In October, Goyal had reinstated a Zomato customer service employee just hours after she was sacked for telling a customer he ought to know Hindi.

Terming the employee’s actions “an ignorant mistake”, Goyal said the company was reinstating her as “this is easily something she can learn and do better about going forward”.

The company had come under fire on Twitter after the customer, from Tamil Nadu, posted screenshots of his chat with the Zomato employee.

“Customer care says amount can’t be refunded as I didn’t know Hindi. Also takes lesson that being an Indian I should know Hindi. Tagged me a liar as he didn’t know Tamil. @zomato not the way you talk to a customer,” he wrote.

The tweet triggered a storm on Twitter and soon #Reject_Zomato was trending.

PM to take final call on cryptocurrency regulations

Prime Minister Narendra Modi will take a final decision on the regulatory framework for cryptocurrencies amid conflicting views among stakeholders, two people familiar with the development told us.

Driving the news: A high-level meeting was held on Thursday to consider all the options as well as stakeholder views including the concerns voiced by the Reserve Bank of India.

What’s on the table? The options include a complete ban on private cryptocurrencies, a partial ban, allowing all categories of crypto products with regulation, or just a select few, one of the persons said.

Deliberations were likely to continue on Friday before a decision on the framework was taken, the second person said.

The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 is listed for consideration and passing in the ongoing winter session of Parliament.

Draft bill could undergo changes: The finance ministry has finalised a draft note on the proposed bill, but sections within the government felt more detailed discussions were needed on the principles underlying the bill and on the broad details of the treatment of virtual currencies by India, the person said. Discussions are likely to focus on various options and pros and cons of adopting them.

Treat crypto as securities: The Confederation of Indian Industries (CII) said on Thursday that the government should treat cryptocurrencies as a special class of securities with its own regulations.

It said that existing securities regulations should not be applied to crypto and that “a new set of regulations would be appropriate, keeping in mind their jurisdiction-less and decentralised character.”

Earlier this week, we reported that the cryptocurrency bill will require crypto exchanges to share the know-your-customer (KYC) data of their customers with regulators and government agencies including the Securities and Exchange Board of India (Sebi), the Reserve Bank of India (RBI) and the tax department.

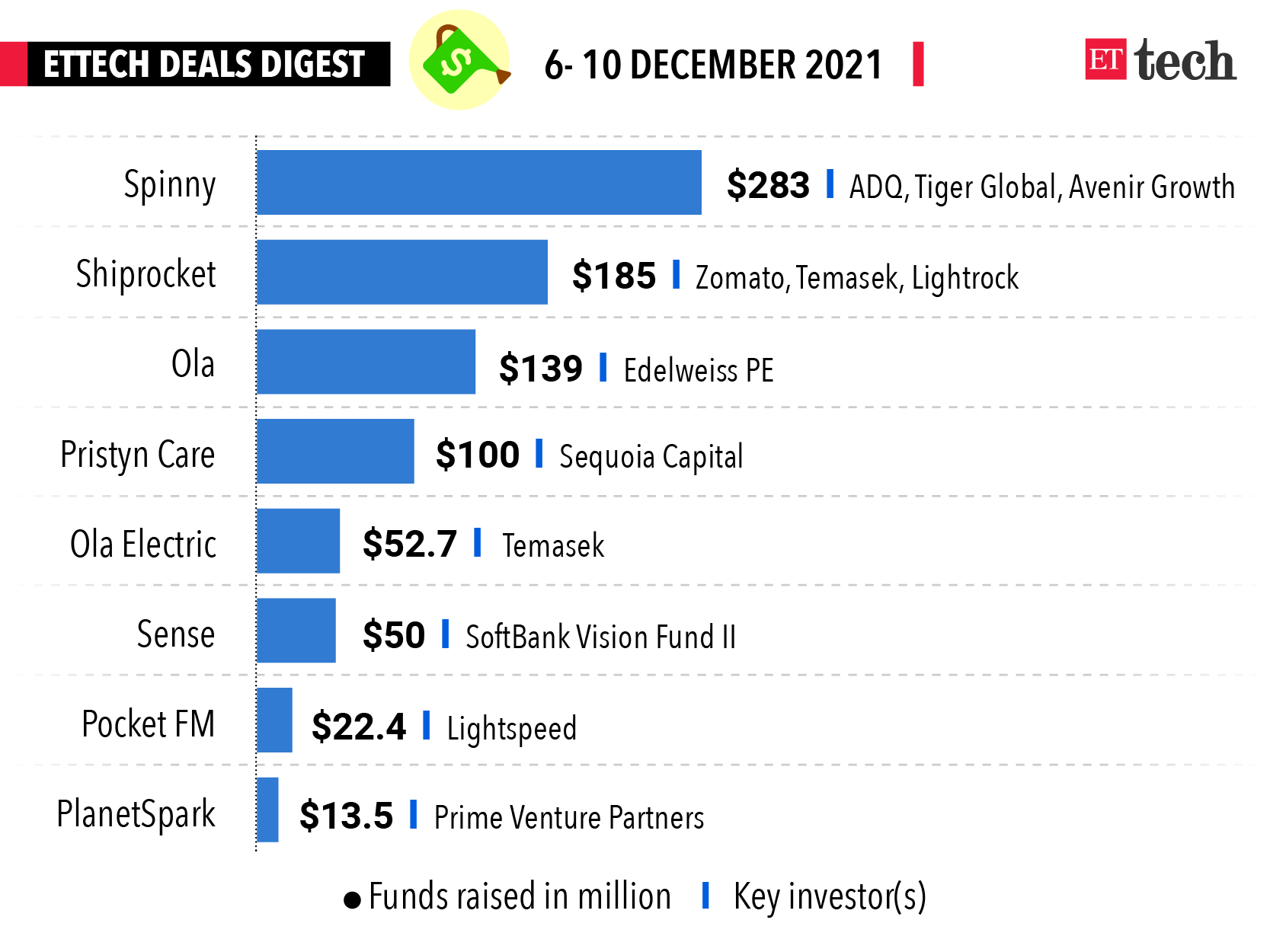

ETtech Deals Digest

India minted another unicorn this week as health technology startup Pristyn Care entered the club. Here’s a quick look at the top funding deals of the week.

Elon Musk says he is thinking of quitting his jobs

Tesla and SpaceX CEO Elon Musk on Friday said that he is planning to quit his “jobs” and become a full-time influencer.

“Thinking of quitting my jobs and becoming an influencer full-time wdyt (what do you think),” Musk wrote in a tweet, which evoked thousands of meme-tastic responses from social media users in minutes.

American YouTuber Mr Beast said he would show the Tesla CEO how to get views on YouTube.

“Looking forward to your YouTube tutorial on How to cut your own hair,” another user said.

One user replied: if you had a dollar for every sh*tpost you’d be a… oh wait, nvm”, prompting a laughing emoji from Musk.

Musk’s tweet also caught the attention of OnePlus and Nothing cofounder Carl Pei, who wrote, “You’re already an influencer.”

Musk sells shares worth nearly $12 billion in a month: The billionaire has sold Tesla shares worth nearly $12 billion over the past month, since he polled Twitter users about offloading 10% of his stake in the electric-car maker.

On Thursday, he sold another 934,091 shares for $963 million to pay for taxes on the exercise of stock options to buy 2.17 million shares in Tesla, according to US securities filings.

He has sold a combined 11.03 million shares and has acquired 12.87 million shares by exercising options since November 8.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai.