Also in this letter:

■ Zomato picks up stakes in Adonmo, UrbanPiper

■ Dealshare turns unicorn after raking in $130 million

■ SoftBank COO quits over pay dispute with Son

Google to invest up to $1 billion in Bharti Airtel

Bharti Airtel said on Friday that Google will invest up to $1 billion in it from the Google for India Digitisation Fund. The deal involves Google investing $700 million to acquire 1.28% in Airtel and up to $300 million for potential multi-year deals.

Details: Google will make an equity investment of $700 million in Bharti Airtel at Rs 734 a share. The $300 million go towards scaling Airtel’s offerings via affordability programmes and other offerings aimed at accelerating digital inclusion in India.

The partnership, Bharti Airtel said, will focus on enabling affordable access to smartphones, and potentially co-creating India-specific use cases for 5G and other standards. It will also help accelerate the cloud ecosystem for businesses across India, the company said.

Together, the companies will continue to explore further opportunities to bring down the barriers of owning a smartphone across a range of price points, in partnership with various device manufacturers, Airtel said in a BSE filing.

Jio partnership: Airtel is the second telecom player Google has partnered with in India after Reliance Jio. Last June, the two companies deepened their partnership, announcing an ultra-affordable smartphone developed by Google that could connect hundreds of millions of customers to high-speed mobile data. They also have a cloud tie-up to boost Jio’s 5G push.

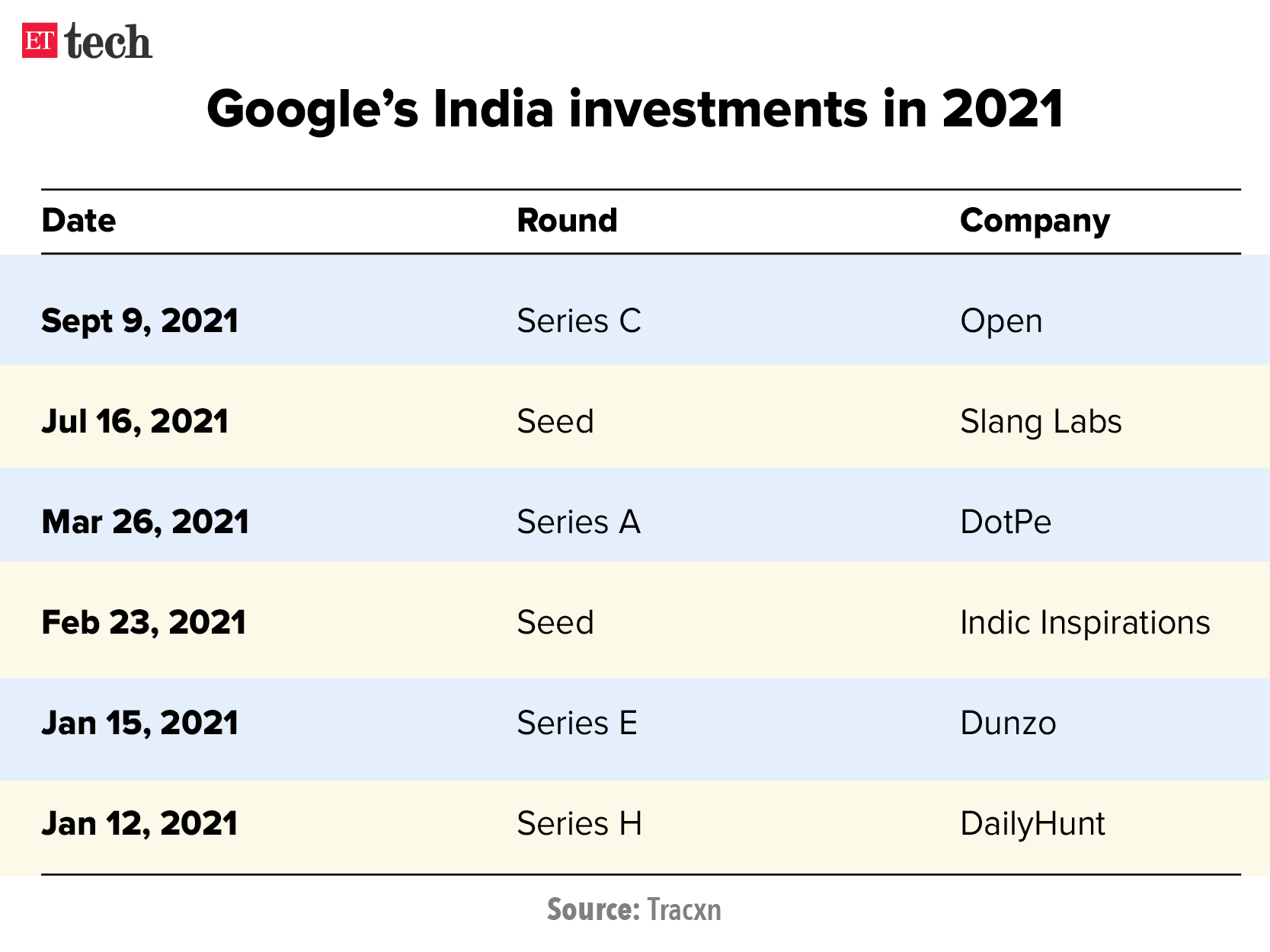

Google’s recent bets in India: The tech behemoth has in the last couple of years doubled down on its investments in Indian companies, focusing on content and commerce.

It has invested $4.5 billion in Reliance Industries’ Jio Platforms and led an investment of $145 million in InMobi’s Glance, which also owns a short-video platform, Roposo.

Got a minute?

ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

Zomato picks up stakes in two more startups

Zomato has told Indian stock exchanges that it is investing in digital advertising company Adonmo and food ordering platform UrbanPiper. The deals have been approved by the company’s board of directors, it said. These transactions are expected to close in a week.

That’s not all: The company’s board has also approved the incorporation of a non-banking finance company (NBFC), which will be a wholly-owned subsidiary of Zomato. While the name of the subsidiary is still to be decided, Zomato is in process of acquiring an NBFC license. The company plans to provide loans to its restaurant partners, a person aware of Zomato’s plans told us.

Details: According to the filing, Zomato is picking up a 19.48% stake in Adonmo Rs 112.20 crore in cash. Adonmo provides targeted digital advertising through outdoor digital screens. Zomato said in its BSE filing that the company would help its food ordering and delivery business leverage new digital avenues for customer acquisition.

Zomato is also picking up a 5% stake in UrbanPiper Technologies for Rs 37.38 crore. UrbanPiper is a business-to-business (B2B) software platform that acts as an intermediary between restaurants and food delivery players. It helps restaurants integrate with multiple services through a single interface.

Investment spree: These investments are a part of Zomato’s larger strategy to back startups. Last year, it said it plans to invest $1 billion in Indian startups over the next two years. It had previously announced investments in fitness platform Curefit, hyperlocal discovery business Magicpin and logistics firm Shiprocket.

Read our interview with Zomato CEO Deepinder Goyal for more on the company’s investment strategy.

Tweet of the day

Dealshare turns unicorn after raking in $130 million

Social commerce grocery startup Dealshare has raised $130 million led by Tiger Global and Alpha Wave Ventures, making it the fifth Indian unicorn of the year. The company is valued at $1.5 billion.

Deal details: According to regulatory filings sourced from business intelligence platform Tofler, Tiger Global invested almost $40 million while Alpha Wave Ventures invested more than $31 million. After the funding, Tiger Global owns 11.71% in the company, while Alpha Wave Ventures owns close to 2%. The promoters’ holdings dropped 2% to 23% after the deal.

Previous rounds: The Bengaluru-headquartered startup raised $144 million last July. ET reported in September that Dealshare was in talks to raise another round at over $1 billion valuation. With this round, the company has raised a total of $313 million so far.

Founded in 2018 by Rajat Shikhar, Sankar Bora, Sourjyendu Medda, Vineet Rao, Dealshare sells daily essentials and targets the middle-income demographic through a community group buying model. In December, Rao said it was on track to clock $750 million in revenue in 2021.

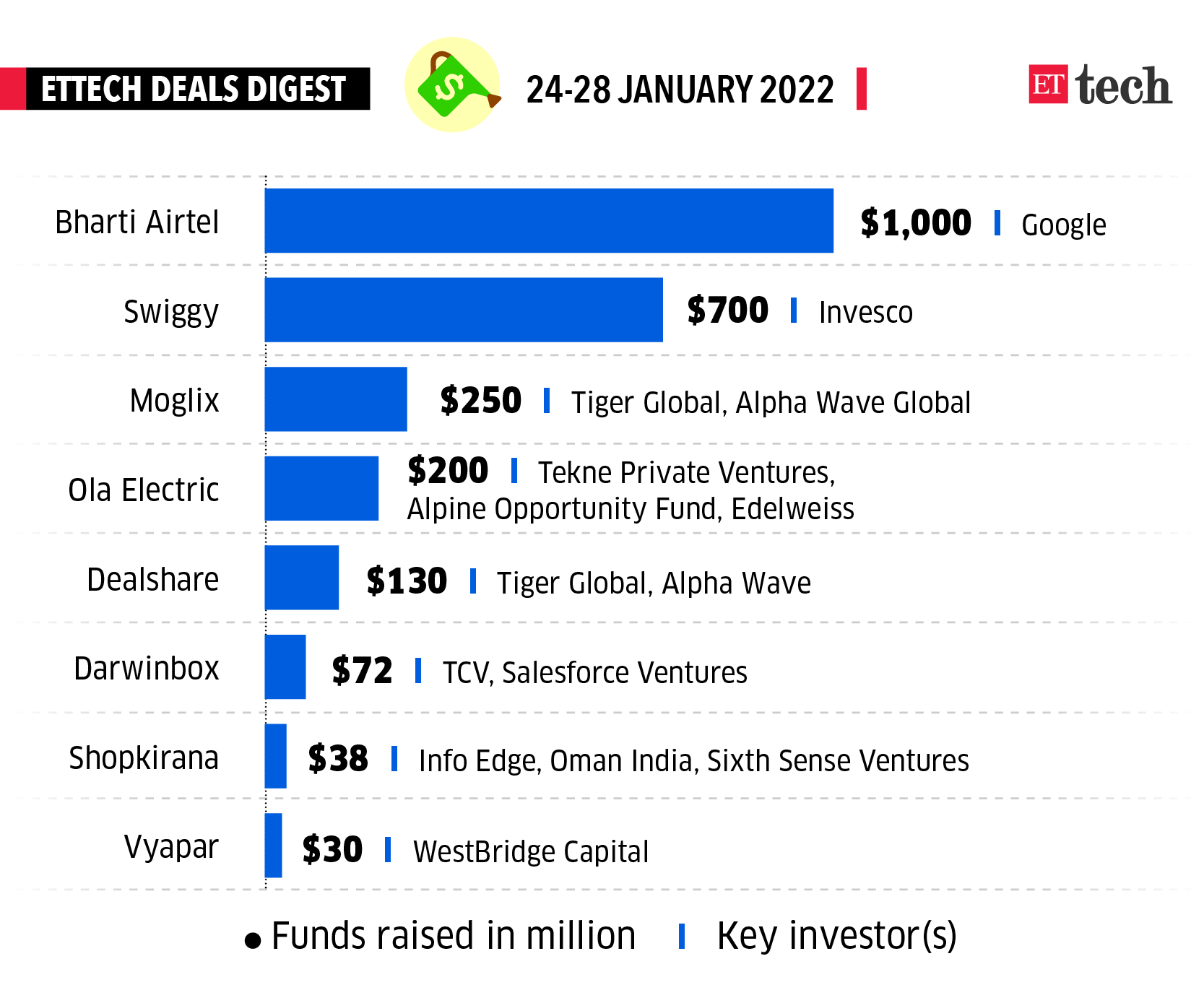

ETtech Deals Digest

Here’s a look at the top funding deals of the week.

SoftBank COO Marcelo Claure quits over pay dispute with Son

SoftBank COO Marcelo Claure

SoftBank Group Corp said its chief operating officer Marcelo Claure is leaving the firm, in what is a fresh blow to SoftBank after a string of high-profile departures.

Why? Claure’s exit comes after a fallout with founder and chief executive Masayoshi Son over his pay. Son had discussed a potential structure that could have allowed Claure to be paid much more than his existing pay package, but he never committed to it in writing, resulting in a clash with Claure that led to his decision to resign imminently, according to a person familiar with the matter.

Why it matters: The departure of Claure, one of SoftBank’s top decision-makers along with Vision Fund head Rajeev Misra, underscores the uncertainty over who might succeed the 64-year-old Son.

Tell me more: Claure became one of Son’s top lieutenants after selling his cellphone distributor to SoftBank, rising to become COO in 2018.

Already one of the highest-paid executives at SoftBank, taking home a cool $17 million in 2020, he has been in talks to leave SoftBank for several months and may soon launch his own investment firm, earlier media reports indicated.

Replacement: Claure’s deputy Michel Combes, a French former telecoms executive, has been appointed chief executive of SoftBank Group International, SoftBank said.

A string of exits: Claure’s exit is the latest in a string of top-level departures from SoftBank over the past few years. Others who left include Deep Nishar and Jeff Housenbold from the Vision Fund. Housenbold also resigned over his compensation.

Chief strategy officer Katsunori Sago, who was also seen as a possible successor to Son, left last year.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanaban in New Delhi and Zaheer Merchant in Mumbai.