Also in this letter:

■ Elon Musk faces difficult choices on Twitter payments: report

■ Z3Partners marks final close of first fund at Rs 550 crore

■ Microsoft will add ChatGPT to Azure soon: CEO Satya Nadella

Goldman expects Paytm to turn profitable in March quarter, stock to double

Goldman Sachs expects Paytm to turn adjusted-Ebitda profitable by the March 2023 quarter and has revised the target price upwards to Rs 1,120. Paytm had earlier said in its guidance that it aimed to become Ebitda-profitable by the September 2023 quarter.

Jargon buster: Ebitda, or earnings before interest, tax, depreciation and amortisation, is an alternative measure of profitability to net income, and attempts to represent cash profit generated by the company’s operations.

Driving the news: “Paytm’s FY23 lending volumes are tracking 90% higher than our earlier estimates, and this, coupled with stronger payment margins, has resulted in the company’s profitability continuing to surprise to the upside,” Goldman said in a report.

The expectation of profitability is further aided by the presence of UPI reimbursement from the government in the March quarter, the report said.

Target price revised: The global investment bank has reiterated a ‘buy’ rating on Paytm with a revised target price of Rs 1,120 against an earlier estimate of Rs 1,100.

How’s business? Paytm reported 357% growth in its loan distribution business, with Rs 9,958 crore worth of loans disbursed in December. The total merchant gross merchandise value (GMV) processed during the third quarter grew 38% year-on-year (YoY) at Rs 3.46 lakh crore.

Yes, but: On Tuesday, Paytm cracked about 2.77% to Rs 538.20 on NSE. In the past year, the stock is down by about 51%. The shares have been under sustained pressure throughout the year over profitability concerns and by a host of pre-IPO investors partially exiting the company after lock-in periods expired.

Elon Musk faces difficult choices on Twitter payments: report

As the date for an interest payment on a loan secured by tech billionaire Elon Musk to fund his Twitter acquisition nears, he is left with options that would further dent his ambitions of staging a turnaround at Twitter and leave him with a set of difficult choices, according to a report in the Financial Times.

Payment due this month: The first instalment of interest payments related to $13 billion of debt he used to fund the takeover could be due as soon as the end of January, the report said, citing three people close to Musk’s buyout of Twitter. That debt means the company must pay about $1.5 billion in annual interest payments.

Musk financed his $44 billion Twitter deal in October by securing the huge debt from a syndicate of banks led by Morgan Stanley, Bank of America, Barclays and Mitsubishi. The $13 billion debt is held by Twitter at a corporate level, with no personal guarantee by Musk.

Bankruptcy threat: If Twitter fails to make its first interest payment, it will join companies such as US car rental company Hertz and German payments group Wirecard dubbed “NCAA” by debt traders — short for “no coupon at all”.

The default would probably result in Twitter’s management filing for bankruptcy, the FT report noted, “at which point the US courts would begin an expensive and bureaucratic debt restructuring process”.

Musk’s options: Musk has repeatedly said Twitter is staring at bankruptcy if costs are not slashed. The company recorded losses to the tune of $221 million in 2021 (the last financial results before it went private).

So, what options does he have? Click here to find out.

Z3Partners marks final close of first fund at Rs 550 crore

Z3Partners on Tuesday announced the final close of its first fund at Rs 550 crore. This comes almost two years after the fund announced its first close in January 2021. It plans to raise its second fund by the end of 2023.

Details: The round was led by global and domestic institutions as well as family offices including the likes of Europe-based fund-of-fund Orient Growth Fund; Netherlands-based Bikbergen Sàrl family office, Kenya-based Spin Ventures Group (SVG).

Indian family offices including ACME family office; Narotam Sekhsaria Family Office (NSFO); Parle Family office along with insurance major HDFC Life and Small Industries Development Bank of India (SIDBI) have also invested in Z3Partners’ latest fund.

Almost 75% of the total corpus raised by the fund is from international investors, Rishi Maheshwari, cofounder and managing partner of Z3Partners told ET in an interaction. With the new fund, Z3Partners is looking to make eight to 10 investments across early to growth stage startups.

Also read: Groyyo appoints ThreadSol’s Abhishek Srivastava as CTO

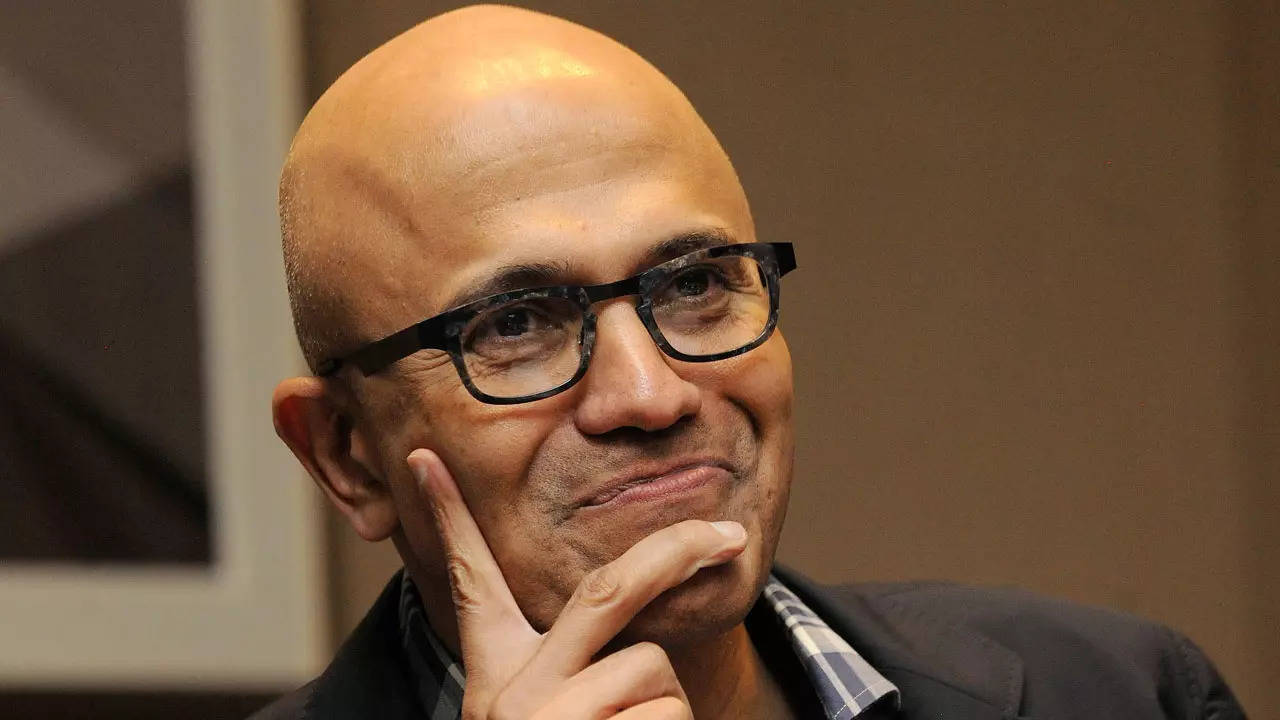

Microsoft will add ChatGPT to Azure soon: CEO Satya Nadella

Microsoft CEO Satya Nadella said on Monday the company will add OpenAI’s artificial intelligence bot ChatGPT to its cloud-based Azure service soon, building on an existing relationship between the two companies as Microsoft mulls taking a far larger stake in OpenAI.

Details: The company announced the broad availability of its Azure OpenAI Service, which has been only available to a few customers since it was unveiled in 2021. The service gives Microsoft’s cloud customers access to various OpenAI tools like the GPT-3.5 language system that ChatGPT is based on, as well as the Dall-E model for generating images from text prompts, the company said in a blog post. That enables Azure customers to use the OpenAI products in their own applications running in the cloud.

Investment talks: According to a news report by Semafor last week, Microsoft is in talks to invest $10 billion in OpenAI. The latest funding round will value OpenAI at $29 billion, and Microsoft will snag 75% of the company’s profits until it recoups its initial investment. After this, it will own a 49% stake in OpenAI, with other investors sharing another 49% between them and OpenAI’s non-profit parent firm getting 2%.

Microsoft invested $1 billion in OpenAI in 2019 and has quietly invested another $2 billion in the years since, according to a New York Times report.

Also Read | CEOs buzz about ChatGPT-style AI at World Economic Forum

Apple supplier Foxconn replaces iPhone business chief

Taiwan’s Foxconn has appointed Michael Chiang as the new boss for its iPhone assembly business after a tumultuous year in China, according to a report by Bloomberg. Chiang replaces Wang Charng-yang as head of the iPhone assembly division.

Behind the move: Chiang’s appointment is part of Foxconn Chairman Young Liu’s efforts to elevate younger executives to maintain the company’s supply chain leadership in the face of growing competition from Chinese contenders, the Bloomberg report said.

Rising competition: According to a Financial Times report, Apple is likely to sign up Chinese contract manufacturer Luxshare Precision Industry Co Ltd to produce premium iPhone models, to make up for lost production at Foxconn’s Zhengzhou factory last year.

Large plant, big challenges: Foxconn’s plant in China’s Zhengzhou city, which is the world’s largest manufacturing facility of Apple iPhones, was heavily affected late last year after a Covid-19 outbreak and the stringent curbs to control the virus prompted thousands of workers to leave the plant. The plant was also hit by a bout of worker unrest over payment issues late last year.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Erick Massey in Delhi. Graphics and illustrations by Rahul Awasthi.