Also in this letter:

■ Startups pull out all the stops to stem attrition, retain techies

■ Demand for tech talent drives attrition to 50% in some jobs

■ Trading volumes jump in India as bitcoin crashes to $30,000

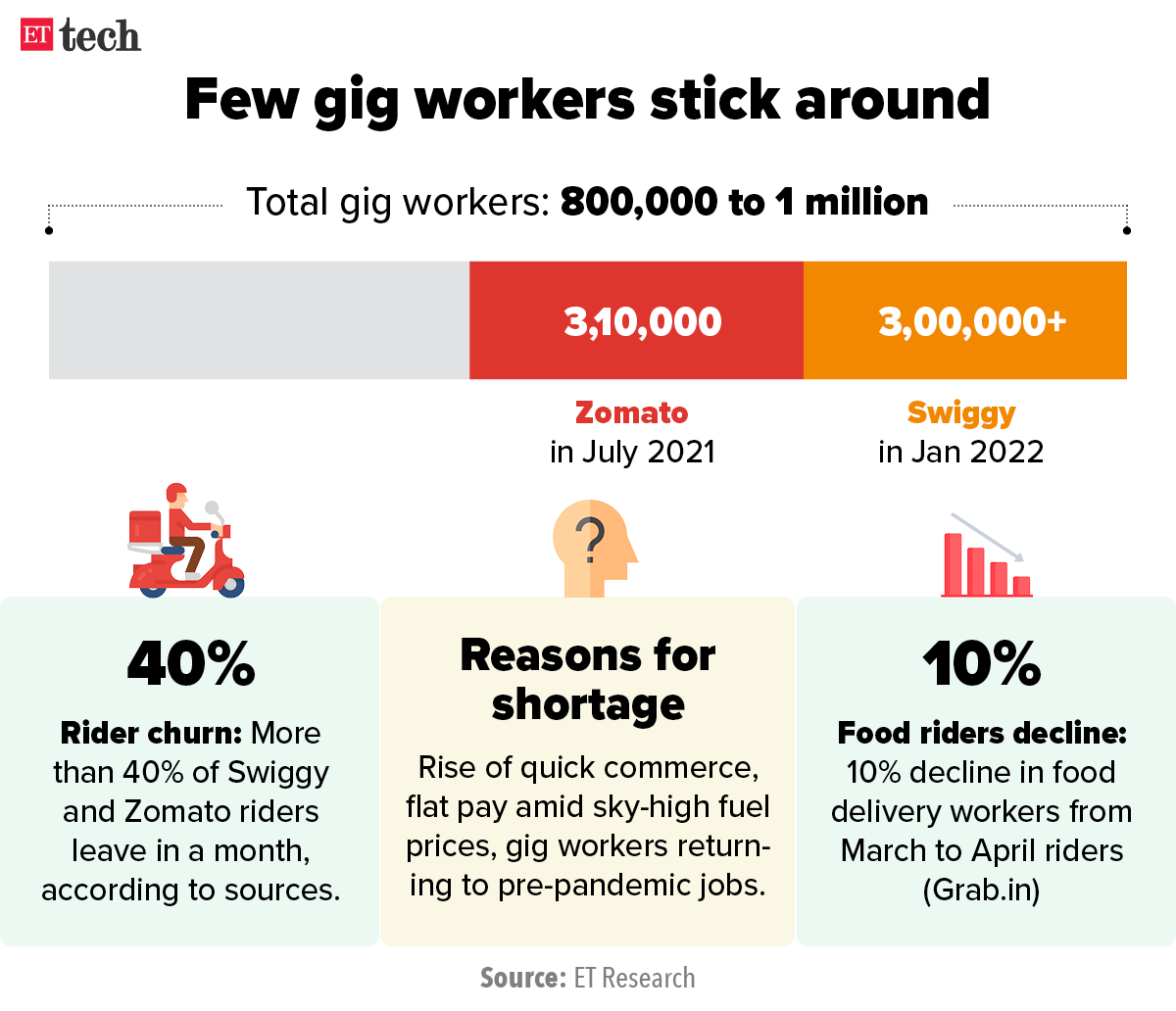

Shortage of gig workers hits food delivery, quick commerce startups

An acute shortage of delivery personnel is proving a huge concern for online platforms, which are unable to meet rising demand amid supply-side challenges in the gig economy, sources told us.

What’s happening? Zomato, Swiggy and Zepto, among others, are seeing delivery timelines lengthen as workers battle rising fuel prices and high inflation, with some even choosing to return to pre-pandemic jobs.

Gig workers are freelancers and do not receive benefits offered to permanent employees.

Fallout: Swiggy has temporarily shut its pick-up-and-drop service Genie across Mumbai, Hyderabad, and Bengaluru, according to a person privy to the development.

The development reflects a broader trend among ultra-fast grocery and food delivery firms, which have been facing severe rider shortages for the past 6-8 weeks. This is largely driven by fuel price hikes failing to reflect in their compensation structures, according to sources. The price of petrol breached the Rs 100 mark in several cities. Mumbai has the highest fuel cost with petrol retailing above Rs 120 and diesel at Rs 104.

High churn: Churn among delivery personnel for food delivery apps has been hovering around 40% on a monthly basis, according to two people familiar with the matter. That means 40 delivery workers out of every 100 switch platforms or leave this line of work in any given month. In addition, many online delivery companies have been unable to increase payouts to their riders despite spiralling fuel prices.

Also Read: Swiggy shutters Supr Daily operations across five cities

Delhivery raises Rs 2,347 crore from 64 anchor investors ahead of IPO

Logistics and supply chain startup Delhivery has raised Rs 2,347 crore from 64 anchor investors ahead of its initial public offering (IPO), which will open for subscription on May 11.

Details: About 48 million shares were allotted to anchor investors at Rs 487 a piece, as the upper end of the price band for the IPO, according to investment bankers.

Some of the foreign investors who participated in the anchor share allotment were Tiger Global, Bay Capital, Steadview, Fidelity, Baillie Gifford, Schroders, Amansa, Aberdeen Standard Life, GIC, Government Pension Fund Global and Invesco HK, said the banking sources.

About 14.59 million shares were allotted to seven domestic mutual funds such as HDFC, SBI, ICICI Prudential, Franklin Templeton, Invesco, Nippon and Mirae.

The Rs-5,235 crore public issue of Delhivery will close for subscription on May 13. The price band of the offer has been fixed at Rs 462 to Rs 487 per share. Bids can be made for a minimum of 30 shares and multiples of 30 shares thereafter.

The offer comprises a fresh issue of shares aggregating up to Rs 4,000 crore and an offer for sale by some existing company shareholders aggregating up to Rs 1,235 crore.

Startups pull out all the stops for those with specific skills

India’s startups are stepping up their efforts to retain workers with specific skills and stem high attrition rates by offering attractive growth prospects.

What’s in demand? Skills in data science, engineering, product, digital marketing, design, artificial intelligence and machine learning are commanding a premium, and companies such as Livspace, Urban Company, Chargebee, BankBazaar, Clear and API Holdings are pulling out all the stops to hire and retain people with these skills.

Such as? Experts say that while salary corrections and employee stock options are key, a big focus at new-age companies is ensuring a clear alignment to career paths, driving regular conversations with the leadership, having monthly check-ins, giving young talent a chance to flourish, and running upskilling boot camps.

The concept of ‘feed forward’ conversations is also coming into the picture as employees want sessions with managerial leadership to focus more on their larger career goals and not just their deliverables.

Who’s doing what: Urban Company has identified people across teams with potential to help scale up for the next phase of growth. These employees are given larger mandates, problem-solving opportunities and mentorship, said Neha Mathur, senior vice-president for people success at Urban Company.

Companies like Chargebee, Clear and BankBazaar are focusing on providing ample internal job opportunities and access to leadership. At BankBazaar, more than 30% of the roles are filled by internal talent, said Sriram Vaidhyanathan, the company’s CHRO.

Huge demand for tech talent drives attrition to 50% in some jobs

Even as the $200-billion Indian IT industry battles unprecedented attrition levels, attrition areas such as cloud computing, artificial intelligence, big data, is almost at 50%, according data collated and analysed by ET.

Other skills in high demand include analytics and internet of things (IoT), apart from crypto, cybersecurity and blockchain. The attrition rate in these jobs is close to twice the average attrition rate of 15 to 25% reported by companies in the Jan-Mar quarter.

Take a hike: Experts said that even hikes in the range of 40-120% are not enough to retain employees with these skills. “Tech functions with niche digital talent in demand have experienced higher attrition rates, upwards of 45% in certain sectors,” said Anil Ethanur, cofounder, Xpheno, a specialist staffing company.

Attrition rates have been high across companies through the last few quarters as demand for tech talent continues to outstrip supply. The four top IT companies — TCS, Infosys, HCL and Wipro — reported record attrition levels at 17.4%, 27.7%, 21.9% and 23.8% respectively in the March quarter, compared to high single-digit and midteen level attrition a year ago.

Five lakh jobs created: Meanwhile, India’s IT services sector created more than 500,000 new jobs in FY22, twice as many as projected, according to data put together by Xpheno and shared exclusively with ET. This is over and above the hiring due to record high attrition refills.

TWEET OF THE DAY

Trading volumes jump in India as bitcoin crashes to $30,000

Trading volumes on Indian crypto exchanges rose after a dry spell as Bitcoin, the world’s most valuable crypto asset, slid by more than 56% from its all-time high of around $69,000 in November 2021 to below $30,000 on May 9.

Bitcoin prices have since stablised at around $31,000 but down about 20% since May 3.

Investors stir: In India, crypto trading platforms WazirX, CoinDCX, and Unocoin saw a 20-75% jump in trading volumes, the companies told us.

Trading volumes on Indian crypto exchanges have dwindled ever since the new tax regime was introduced on April 1. In addition, payment aggregators and banks have been cutting ties with crypto exchanges.

We reported on April 12 that WazirX saw 65-90% of its business vanish after e-wallet Mobikwik disabled its services on the platform. Trading volumes on other exchanges like ZebPay and CoinDCX hit a six-month low in April.

But the past two days have been different. CoinDCX said its volumes doubled on May 10 from the previous day.

Grin and bear it: Meanwhile, Indian investors who jumped onto the crypto bandwagon in their droves in 2021 are seeing their losses mount as the bears take over.

Experts said most new Indian investors had only seen crypto prices go up, but are now suffering a rude shock as they see their portfolios erode sharply.

Other Top Stories By Our Reporters

BharatPe vows to claw back Grover’s shares: Fintech firm BharatPe said on Tuesday it would claw back restricted shares of a ‘former founder’, vowing to “take steps to enforce its right under the law”. While the statement didn’t include names, it was clear the company was referring to its cofounder and former managing director Ashneer Grover, who left BharatPe after a months-long controversy earlier this year.

Great Learning’s $100 million buy: Byju’s group company Great Learning has acquired Singapore’s executive education provider Northwest Executive Education for roughly $100 million in a stock and cash deal, sources told us.

CoinDCX to invest Rs 100 crore in 12 months: Crypto exchange CoinDCX will invest Rs 100 crore over the next 12 months through its corporate venture arm CoinDCX Ventures. The venture arm will write cheques ranging from $100,000 to $1 million to web3 firms in seed to Series A rounds around the world. It intends to make between 40 and 80 investments.

CoinSwitch Kuber to double workforce: CoinSwitch Kuber said it plans to double its headcount to over 1,000 by the end of the calendar year. It said by the end of the fiscal year, it expects to triple its engineering team to about 300 people.

Global Picks We Are Reading

■ Musk says his Twitter plans align with EU rules (WSJ)

■ Google and Meta’s underwater cables up the stakes on internet control (Rest of World)

■ Netflix’s ad-supported tier and password-sharing crackdown could launch by the end of 2022 (The Verge)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.