Credit: Giphy

Also in this letter:

- Edtech firms work with ASCI on ad rules

- View: Buffering, the market reassesses startups

- A pivotal techade for Indian IT

FRL’s independent directors to turn down Amazon’s request

Future Group CEO Kishore Biyani

The independent directors of Future Retail Ltd (FRL) have decided not to accept Amazon’s request to allow private equity fund Samara Capital to conduct an urgent due diligence of the cash-strapped retailer.

Catch up quick: In a letter to the independent directors on Saturday evening, Amazon said Samara Capital remained committed to the term sheet signed on June 15, 2020, which proposed a “purchase consideration” of Rs 7,000 crore for FRL. But first, FRL would have to hand over details of its finances to Samara for due diligence, Amazon said.

Not buying it: Ravindra Dhariwal, one of FRL’s three independent directors, described Amazon’s offer as a “smokescreen” and said it was untenable.

“All the diligence has been done to death—by Reliance Retail and by the banks as part of the OTR process. Their diligence request is just smoke and mirrors,” Dhariwal told us. “Their intent is clear: they want to say in media headlines that they can solve the problem and we are not allowing them. They want to stand up in court and claim they have a solution. But any scrutiny of their offer will immediately tell you that it is untenable, unviable and will not come even close to solving the problem.”

Next steps: The three independent directors were scheduled to send a reply to Amazon late Sunday night. Gagan Singh and Jacob Mathew are the other two independent directors.

Meanwhile, Future Retail is planning to approach the Supreme Court on Monday, seeking an extension for the Rs 3,500 crore it has to repay lenders by Jan. 29.

If FRL fails to pay lenders Rs 3,494 crore by Jan. 29, lenders’ debt exposure of around Rs 10,000 crore will have to be classified as non-performing loans by this month end. A $14 million coupon on its $500 million bonds is due today (Jan. 24).

Amazon’s letter: In its letter to the independent directors, Amazon had sought immediate access to FRL’s key financial, operational and other data for Samara to conduct an “expedited due diligence” before bailing out the company.

A person familiar with the independent directors’ thinking said when Reliance Retail was offering Rs 24,000 crore and the company owed the banks Rs 12,500 crore, how could they accept a Rs 7,000 crore offer? “The banks have the first charge on assets. Will they allow this?”

Amazon’s letter was a response to FRL’s independent directors, who on Friday had sought Rs 3,500 crore in unsecured long-term loans from the US company to prevent Future Retail’s debt from being classified as non-performing assets (NPAs) in case it failed to repay its lenders by Jan. 29. They had asked Amazon to confirm by Monday whether it would be willing to grant the loan.

Edtech firms work with ASCI on ad rules

Top Indian edtech startups such as Byju’s, Unacademy and upGrad, which had recently formed a consortium for self-regulation, are now consulting with the Advertising Standards Council of India to address one of the most critical concerns for the edtech firms—their communication.

The Indian Edtech Consortium, the formation of which was first reported by ET, has had multiple conversations with the ASCI to finalise its code for marketing and advertising, people aware of the matter said.

Why it matters: At a recent meeting, officials from the education ministry told the consortium that it should implement the proposed self-regulatory codes in spirit and should not allow advertisements that, for example, guarantee a job or any particular outcome. We had reported earlier this month that edtech firms were primarily focusing on addressing two core issues: no misleading advertisements and opaque payment structures.

The government is said to have told the consortium that the move to form a self-regulatory code was welcome, and as long as it was adhered to honestly, the government would go for light-touch regulations.

Why now? Edtech firms realise they are likely to be scrutinised more going forward as more people sign up for their services and investors continue to pour huge sums of money into them on the back of the pandemic.

“Government officials are closely tracking the payment and advertising issues related to edtech as they have been receiving complaints from various sections of society. In all likelihood this would be like ecommerce, where policy and regulations now play a critical role in India,” sources said.

Edtech startups raised over $4 billion in 2021 and $2.1 billion in 2020. They raised just $393 million in 2019 and $675 million in 2018, according to data from Venture Intelligence.

In the spotlight: We reported earlier this month on the growing concerns about the business practises of edtech firms. In December 2021, Lok Sabha member Karti Chidambaram said in Parliament that there was a need to regulate the sector. Soon after, the government also spoke about the need to regulate the sector. Education Minister Dharmendra Pradhan said interministerial conversations were underway to work out rules for the sector.

Tweet of the day

ETtech Done Deals

■ The Good Glamm Group has acquired a majority stake in Organic Harvest, organic beauty and personal care brand, at an estimated enterprise valuation of $275-280 million. This is the seventh acquisition by the D2C firm in the past 12 months.

■ StanPlus, an online ambulance aggregator, has raised $20 million in debt and equity from Healthquad, Kalaari Capital and others to grow its operations to 500 hospitals and launch its Red Ambulance service in 10 more cities.

View: Buffering, the market reassesses startups

US investors last week brutally unwound bets in pandemic stock darlings like Netflix and Peloton after the former revealed new subscribers on the streaming platform were expected to trickle in and the latter said it was cutting costs as demand for its exercycles slowed.

The pandemic trade came with a sell-by date. Yet the hard landing is a surprise when, by some estimates, 40% of US office workers are still operating from home and the Omicron wave could delay their return.

As dollars swirl out of pandemic play and into beaten down sectors like energy, which is fuelling inflationary concerns in the United States, Dalal Street has caught some of the jitters.

Companies that operate Zomato, Paytm and PolicyBazaar have seen their market cap fall precipitously from richly valued IPOs less than a year ago. The market is reassessing startups that have been chasing customers at the cost of profit as a benign interest rate cycle approaches a point of inflection. (read more)

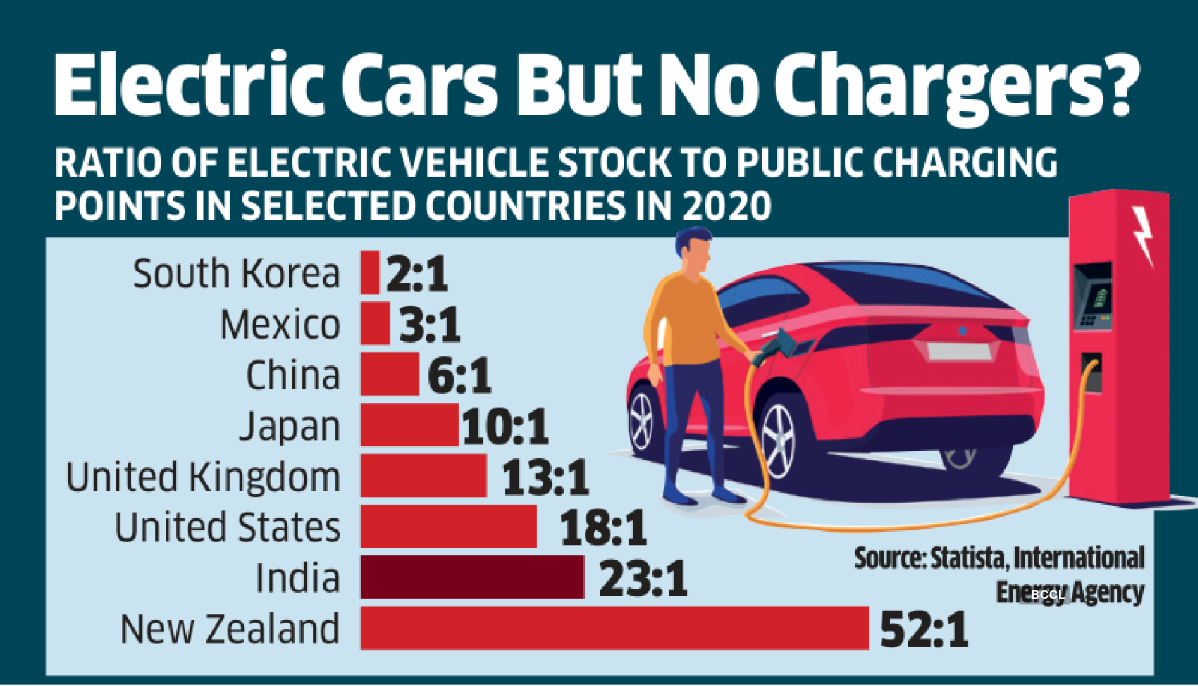

Infographic Insight

A pivotal techade for Indian IT

A little more than half of the top 2,000 companies worldwide is on a digital transformation journey, giving Indian IT services providers with enough opportunities to tap this pool and beyond.

At the pole position: Even before the pandemic struck, Indian IT firms accounted for more than 60% of the new deals struck in the information technology space. Since then, the scale of demand for online solutions to offline processes has meant that these companies have an opportunity to pivot the big league.

Already, TCS, Infosys, Wipro, HCL Technologies and Tech Mahindra are expected to report $70 billion in combined revenue in the ongoing fiscal, with each estimated to grow 15-20%. The story with respect to their smaller peers is similar—in fact, they may even outstrip the growth rates of larger peers.

What sets them apart: Their business model—perfected over the last 40-plus years.

- Having a small pool of experienced associates and hiring and training freshers has helped Indian IT firms create the capacity to capture demand in a cost-effective way, even when the talent is in short supply.

The question, then, is this: Can Indian IT firms rise up to the opportunity despite headwinds, chiefly a talent crunch never before seen in the sector? Read here to find out.

Other Top Stories By Our Reporters

Big and old seek out small and new: Promoters of traditional businesses, as well as large conglomerates, are picking up stakes in startups that are synergistic with or adjacent to their core competencies. Many have even started funds to invest in such companies. The trend has become more pronounced since 2019. (read more)

Demand for women in STEM jobs rises: According to exclusive data from JobsForHer, an online career platform for women, nearly 50% of the total number of jobs currently posted on the platform is for women in STEM roles, an increase from 35% in pre-pandemic 2019. (read more)

Global Picks We Are Reading

■ Why NFTs are more like collectibles than fine art (Bloomberg)

■ Can works like ‘Don’t Look Up’ get us out of our heads? (NYT)

■ Digital cash gets a look from the Fed (The Verge)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai.