Inflation and the global venture market slowdown motivate venture capitalists in India to invest more in B2B tech startups. According to NASSCOM’s quarterly factbook on tech startups, between the April and June 2022, investment into B2B startups went up significantly.

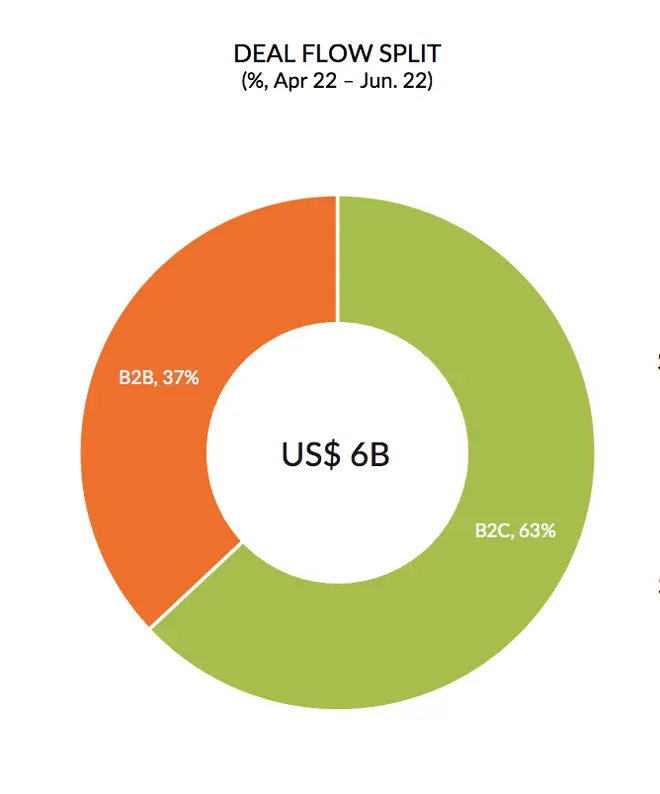

For Q2 of the 2022 Calender year, as per the NASSCOM report, funding in B2B tech startups accounted for 37 per cent of the overall $6 billion raised by tech startups. In comparison, in Q4CY21, B2B startups accounted for 22 per cent of the investment deals raised that quarter ($7.2 billion). This is a new trend especially as consumer tech startups have such a strong foothold in the Indian startup ecosystem.

B2B startups

Experts note that the funding winter is motivating investors to be cautious and invest more in B2B startups which generate more revenue while burning lesser cash. Vivek Soni, Partner and National Leader, Private Equity Services, EY India explained, “B2B businesses by their very nature have unit economics that is usually in the ‘positive zone’ starting out and these only get better as economies of scale kick in. Companies deploy resources and investments in a more calibrated manner, keeping an eye on the build-up of the business book.”

“The funding winter is here and when that starts happening, people automatically become conservative about what and where they want to invest in. They look for more sustainable and profitable ventures, where the downside is protected. Consumer businesses burn much more cash and in a much faster way, leading to faster growth but B2B businesses, in general, are more cash and revenue-generating with a lesser burn. This is one of the primary reasons why VCs are now chasing conservative B2B deals,” Sheetal Bahl, Cofounder and Partner, growX Ventures. gorwX is a B2B focused VC fund.

“When markets turn as is the case now (and typical of market cycles), large funds don’t want to get into risky investments. B2C businesses require a lot of capital and hence are risky investments during a market downturn scenario. So basically in 2021, it was all about growth over unit economics or growth at any cost. With the market downturn, it is more about unit economics overgrowth. Hence, B2B companies are good bets as they continue to grow despite the market downturn. These large funds have a lot of funds to deploy and they make money only when they deploy – hence they are investing in B2B companies more currently. As seen with GoKwik, despite market conditions we are continuing to grow,” said Chirag Taneja, Cofounder of GoKwik, a B2B startup which is backed by Sequoia and Matrix Partners.

Dhianu Das, Cofounder, Agility Ventures noted, “After hitting a low in 2019, the B2B startups, in fact, have seen a burgeoning rise during the pandemic that literally changed the way companies interacted with their employees and clients. B2B marketplaces were rightly positioned to take advantage of this opportunity, offering quality products at reasonable prices and reliable delivery schedules, coupled with necessary standard credit terms.”

Published on

July 22, 2022