Also in this letter:

- PM meeting underlines govt’s differences with RBI on crypto

- Nykaa revenue grows 47% year on year but profit declines

- 3one4 Capital to double its fund size to Rs 1,500 crore

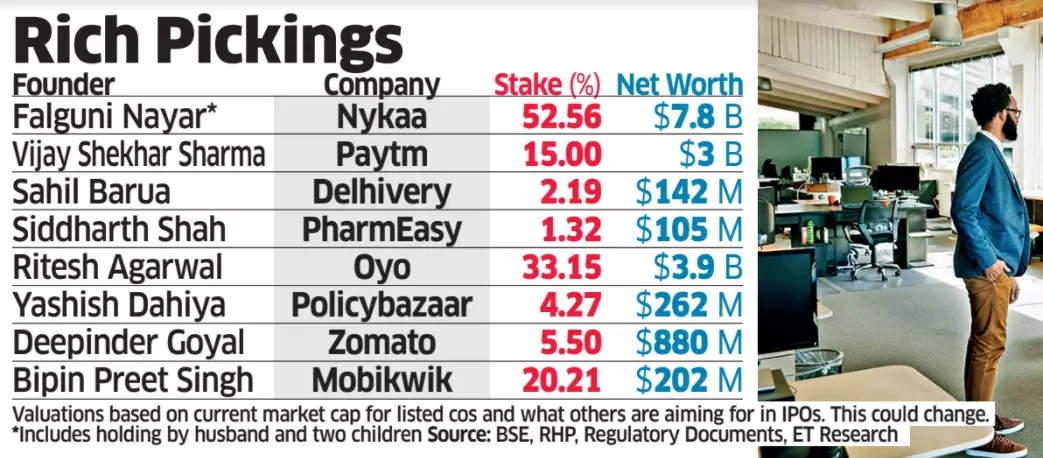

Startups going public reward founders with stock options and bonuses

Indian startups that have listed or plan to list on India’s stock exchanges in 2021 are rewarding their founders with stock options and bonuses, sources told us. They said the growing trend is aimed at rewarding founders at such firms, in which investors typically have much bigger stakes than the founders.

“This has emerged as an important trend in tech startups to instil confidence in the management of a company after the listing,” people involved in the approvals told us.

They said in most startups with multiple founders, each ends up having low single-digit holdings in their firms by the time of the IPO. This leaves entrepreneurs with little incentive to continue scaling their ventures even as early investors clock record gains through the IPO, the sources said.

So who’s doing what? Policybazaar parent PB Fintech, which will list on the stock exchanges today (Nov 15), granted up to 10,657,500 fresh stock options to founder Yashish Dahiya, and 4,567,500 to cofounder Alok Bansal, according to its red herring prospectus. Dahiya and Bansal own 4.27% and 1.45%, respectively, in the firm, while SoftBank owns more than 15%.

“Founders have been given long-term Esops for continuing to lead the company over the next six to seven years. In some cases, founders have also invested their own money, to show their confidence in the firm at pre-IPO round valuation,” said one of the founders going public this year, explaining why the board had granted the new stock options and awarded them a bonus for achieving certain milestones.

Positive trend: Experts told us this was a positive trend for the startup sector.

Siddarth Pai, founding partner at venture fund 3one4 Capital, saidm “Compared to major US startups, where founders can have 30-40% in their company, (in India), it is in the single digits to early teens, depending on whether it’s a solo founder or multiple cofounders.”

“Besides the new options and bonus being an incentive, it also increases their (founders’) stake in the company after the IPO and inspires confidence in management,” he said. “Skin in the game and shareholder alignment are crucial for investors. It’s a combination of factors that are at play, as founders now also have to be answerable to analysts and public shareholders.”

PM’s meeting underlines govt’s differences with RBI on crypto

The meeting chaired by Prime Minister Narendra Modi on cryptocurrencies on Saturday underscored the divergent views of the government and the Reserve Bank of India (RBI) on cryptocurrencies such as bitcoin and the exchanges on which they are traded.

What happened? Most stakeholder departments at the meeting favoured some form of regulation but the central bank is believed to have reiterated its advocacy of a ban, citing macroeconomic and financial stability concerns.

Following the deliberations, the government is likely to approach the Advertising Standards Council of India soon to push for greater disclosures and stricter statutory warnings with ads about virtual currencies or trading platforms, sources told us.

About two crore crypto investors in India are estimated to hold assets worth $4-5 billion.

RBI’s concerns: Secretaries from various stakeholder ministries, including finance and home affairs, attended the meeting along with regulators including the RBI. The meeting was called specifically to discuss the way forward on virtual currencies, which have rapidly gained the attention of investors in India.

One of the key issues the RBI flagged at the meeting was that these virtual currencies were intangible, making regulation and taxation challenging, said another source. Another issue it raised was that many Indians buy cryptocurrencies from exchanges located overseas, which makes it harder to regulate them.

Middle path: Last week we reported that India may take the “middle path” on cryptocurrencies as it finalises legislation on these virtual assets for the upcoming winter session of Parliament.

A source told us that a growing view among policymakers is that the law should take into consideration technological developments in the space.

“A balance has to be found,” the person said, adding that a final call on the contours of the law will be taken shortly. “A middle path that balances the concerns of all stakeholders is more likely.”

RBI’s meeting with crypto players: Meanwhile, questions that could shape India’s cryptocurrency rules were discussed at the RBI’s first ever meeting with members of crypto industry players on November 2.

Such as? Who is supplying cryptocurrency, and how, when there is hardly any mining in the country? How many coins should be listed in India? What kind of coins should be allowed? What protections for investors should be in place?

Amid the crypto craze, fuelled by an ad blitz by crypto exchanges, it is unclear how cryptocurrency exchanges are meeting the rising demand. With no rules on disclosure of holdings, no one knows how much crypto is in investors’ e-wallets and how much of this was bought through local exchanges.

“If crypto supply keeps on growing, at some stage it could even become a monetary policy challenge. Many in the industry want crypto to be purchased only from exchanges domiciled in India and like banks, these exchanges should be allowed foreign direct investment (FDI) up to 74%,” said a source.

Attacks on crypto exchanges double: The most serious security threat India’s top cryptocurrency exchanges face daily is sophisticated criminal frauds that combine social engineering with computer intrusion. Criminals are impersonating or spoofing social media identities to deceive consumers into giving them access to their cryptocurrency wallets.

As a result, cryptocurrency exchanges have experienced a twofold increase in the number of attacks in recent months as bitcoin and many other cryptocurrencies have touched all-time highs.

Tweet of the day

Nykaa revenue grows 47% year on year but profit declines

Beauty ecommerce platform Nykaa saw a 63% year-on-year growth in gross merchandise value (GMV) in the July-September quarter, regulatory filings showed. The company’s consolidated revenue from operations jumped 47% year-on-year to Rs 885.30 crore in the quarter, as against Rs 603.8 crore for the same period last year.

For half year ended September 30, the company’s revenues grew 91% to Rs 1,702.3 crore as against Rs 8,924 crore for the same period last year.

Profit declines: Its profit after tax for the second quarter of FY22 fell to Rs 1.2 crore from Rs 27 crore in Q2FY21.

FSN E-Commerce Ventures, Nykaa’s parent firm, hit the Indian stock exchanges last week in what was a bumper debut for the Mumbai-based firm. Its market cap went past Rs 1 lakh crore on day one after the stock started trading at nearly 80% premium to its issue price of Rs 1,125.

The listing propelled Falguni Nayar, its founder and CEO, into the club of top billionaires with a net worth of around $7.4 billion. In an interview with ET last week, Nayar said the company will continue to focus on growth across beauty and fashion businesses.

Also Read: Who is Falguni Nayar, India’s richest self-made woman?

3one4 Capital to double its fund size

Early-stage venture capital firm 3one4 Capital is looking to increase the fund size of its third fund to almost Rs 1,500 crore from Rs 750 crore, a senior executive said. This comes at a time when venture capital funds are mopping up larger corpuses amid frenetic deal making.

Details: The fund has already surpassed Rs 1,000 crore owing to oversubscription from investors. The Rs 750-crore fund came with a green shoe option of Rs 500 crore. The company is likely to extend that by a further Rs 250 crore to close at Rs 1,500 crore.

Quote: “It has been a great year for venture capital firms. Not only have companies seen heightened investor interest, GPs (general partners) such as ours are also seeing top quartile limited partners backing new funds. We had to increase our fund size to accommodate the incoming investors,” Pranav Pai, founding partner, 3one4 Capital told us.

3one4, which has invested in companies such as Licious, Darwinbox, and Koo, expects to allocate more funds to back its winner portfolio companies with larger cheque sizes.

Fund III is majority subscribed by Indian family offices, endowment funds and institutional investors. Some of the marquee new investors that have backed the fund include CDC Group Plc, the UK sovereign development finance institution; the Japan-India Fund-of-Funds – Nippon India Digital Innovation AIF (NIDIA); South Korean video gaming giant Krafton, Inc; prominent Indian endowments and foundations such as Catamaran and Premji Invest, and several others.

Advent to buy Encora from Warburg for $1.5 billion

Advent International is all set to acquire Encora, an Indian origin IT services firm, from Warburg Pincus for $1.5 billion, sources told us.

This comes at a time when the global private equity investor continues to actively buy companies and capitalise on the growing digitisation and cloud migration of businesses the world over.

Advent trumped Apax Partners, Blackstone and a European strategic investor to scalp its first tech services buyout in India. A formal announcement is expected in the coming weeks. Warburg might retain a small stake in the company.

While Warburg holds 80% in the company, the rest is held by founder Venu Raghavan and management. In 2008, Encora merged with Bengaluru-based Indecomm Corporation.

US-based Advent International has $81 billion in assets under management as of June 30, 2021. In one of its largest buyouts, Advent and a clutch of investors acquired McAfee Corp., a global leader in online protection, for an enterprise value of $14 billion last week.

Future Retail’s independent directors ramp up attack on Amazon

The independent directors of Future Retail Ltd (FRL), in a letter to the Competition Commission of India (CCI) on Sunday, accused Amazon of submitting to the commission “completely opposite” information that was “contradictory” to Amazon’s own internal communications regarding its 2019 investments into FRL’s promoter company.

In their latest letter to the CCI chairman Ashok Kumar Gupta, the directors quoted Amazon’s internal communications and said the US giant was initially planning to pump money directly into FRL through a proposed foreign portfolio investment.

In late 2018, the government, through a policy document called Press Note 2, amended foreign direct investment regulations for e-commerce marketplaces, restricting them from selling their own products on their platforms. That prompted Amazon to invest in the promoter firm Future Coupons Pvt Ltd (FCPL) rather than directly infuse capital into FRL, the letter said.

Myntra’s top brass exits: Meanwhile, Myntra’s chief financial officer Ramesh Bafna and chief marketing officer Harish Narayanan have put in their papers. The executives are moving out of Flipkart Group. This comes days after the Flipkart-owned fashion portal appointed Nandita Sinha as its new chief executive officer (CEO), replacing Amar Nagaram.

Other Top Stories By Our Reporters

Chalo in talks to acquire two-wheeler rental startup Vogo: Chalo, a mobile app that helps users track buses across cities and book bus tickets online, is in advanced talks to acquire two-wheeler rental startup Vogo in a share-swap deal, according to several people aware of the matter.

How Startup IPOs are changing the valuation game in India: The blockbuster IPOs of new-age tech companies, such as Zomato and Nykaa, show the valuation game has changed, as focus shifts from earnings to growth potential.

Coders, studios in demand as India’s gaming industry booms: Growing demand for entertainment, availability of design talent and rising investor interest are spurring video game development for mobiles and consoles in India.

Collaboration, connectivity key focus of office technology post WFH: Chief information officers (94%), traditionally in-office workers (93%) and IT decision makers (93%) believe that work-from-home (WFH) habits have changed the technology expectations for an in-office experience, a Future of Technology Narrative India report by Cisco says.

Global Picks We Are Reading