Also in this letter:

- India’s super-rich win big on domestic startup bets

- Single body may regulate personal, non-personal data

- ShareChat’s parent firm raises $266 million

Flipkart CEO outlines 2022 IPO plans, says grocery is key

Flipkart has begun discussions for an initial public offering (IPO), which it is likely to conduct next year.

Driving the news: Flipkart Group CEO Kalyan Krishnamurthy told a select group of executives at an offsite earlier this week that the company was looking at a public offering outside India around November-December 2022, sources told us.

A US listing may get stretched to March 2023, depending on market conditions and other external factors, the sources said.

The Walmart-owned firm is considering raising a pre-IPO round in the next quarter or so, to benchmark its valuation before the offering. Flipkart was last valued at $37.6 billion in July, after raising $3.6 billion from the Canada Pension Plan Investment Board and others.

Quote: “The intent is to get there by around the final quarter of next year,” a person aware of the matter said. “There was a formal discussion on the path to IPO by Kalyan (Krishnamurthy). He said it would potentially happen in the next 12 months ideally…unless things change dramatically, triggered by external events.”

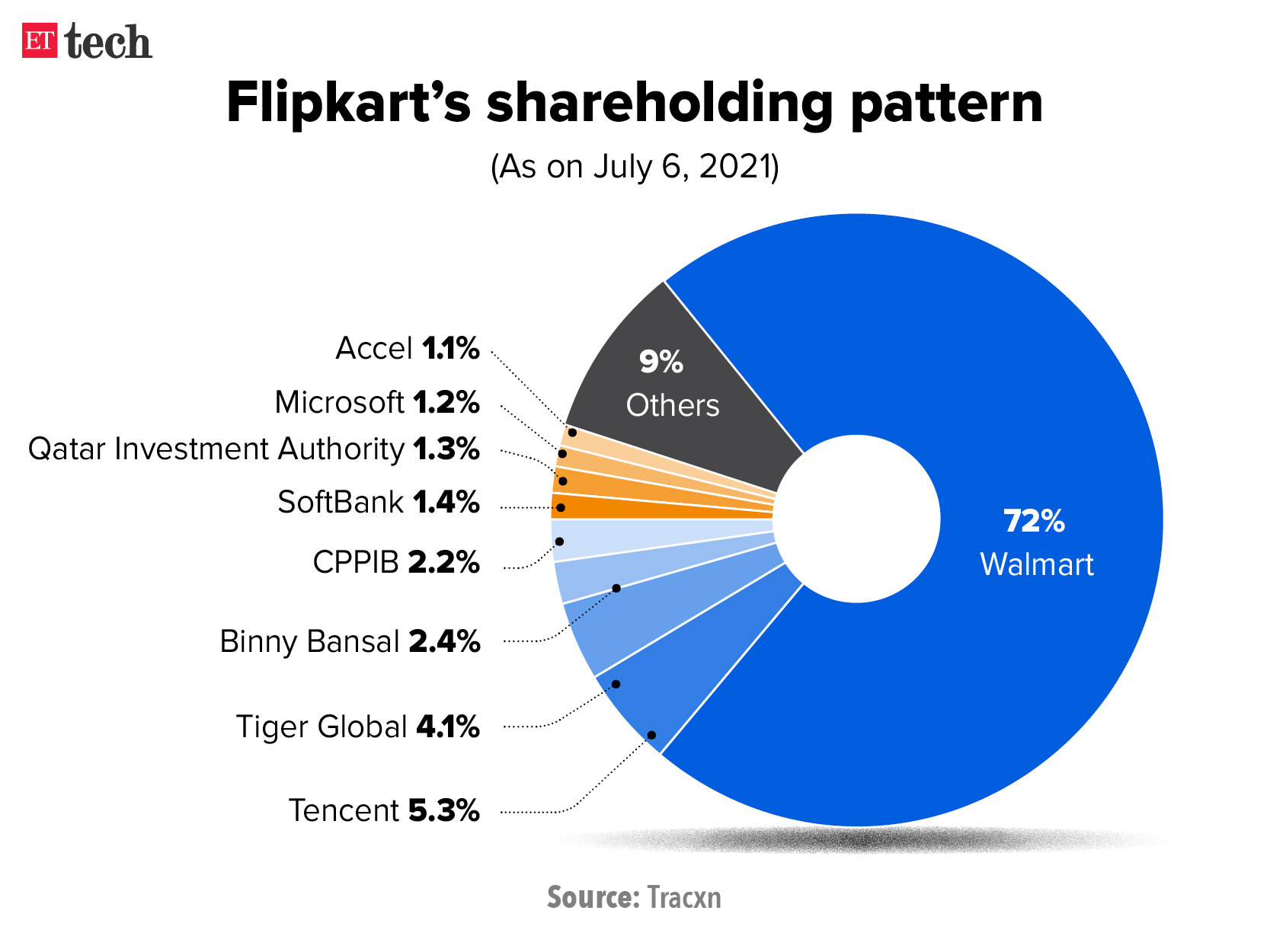

Walmart, which owns 72% in Flipkart, has said previously that it wants to take the Indian ecommerce major public. Its chief financial officer Brett Biggs reiterated this at a recent conference, without giving details on timelines.

Grocery is the key: Krishnamurthy told executives at the offsite that scaling the grocery business would be critical to the company’s IPO .

Flipkart recently upped its grocery play with a $145 million investment in Ninjacart. Its social commerce platform Shopsy has also entered the space to challenge existing players such as DealShare and Meesho.

We reported in July, citing sources, that a disproportionate portion of Flipkart’s $3.6 billion funding would go to the grocery business. “They want to take Flipkart Grocery across the country while it is expanding Flipkart Quick – the 90 minute hyperlocal delivery – service to top cities,” one of the sources said.

India’s super-rich win big on domestic startup bets

Family offices and high net-worth individuals (HNIs) in India have clocked huge gains this year. Their aggressive bets on new-age Indian startups like Nykaa and Zomato – both of which listed on domestic stock exchanges earlier this year – have paid off handsomely.

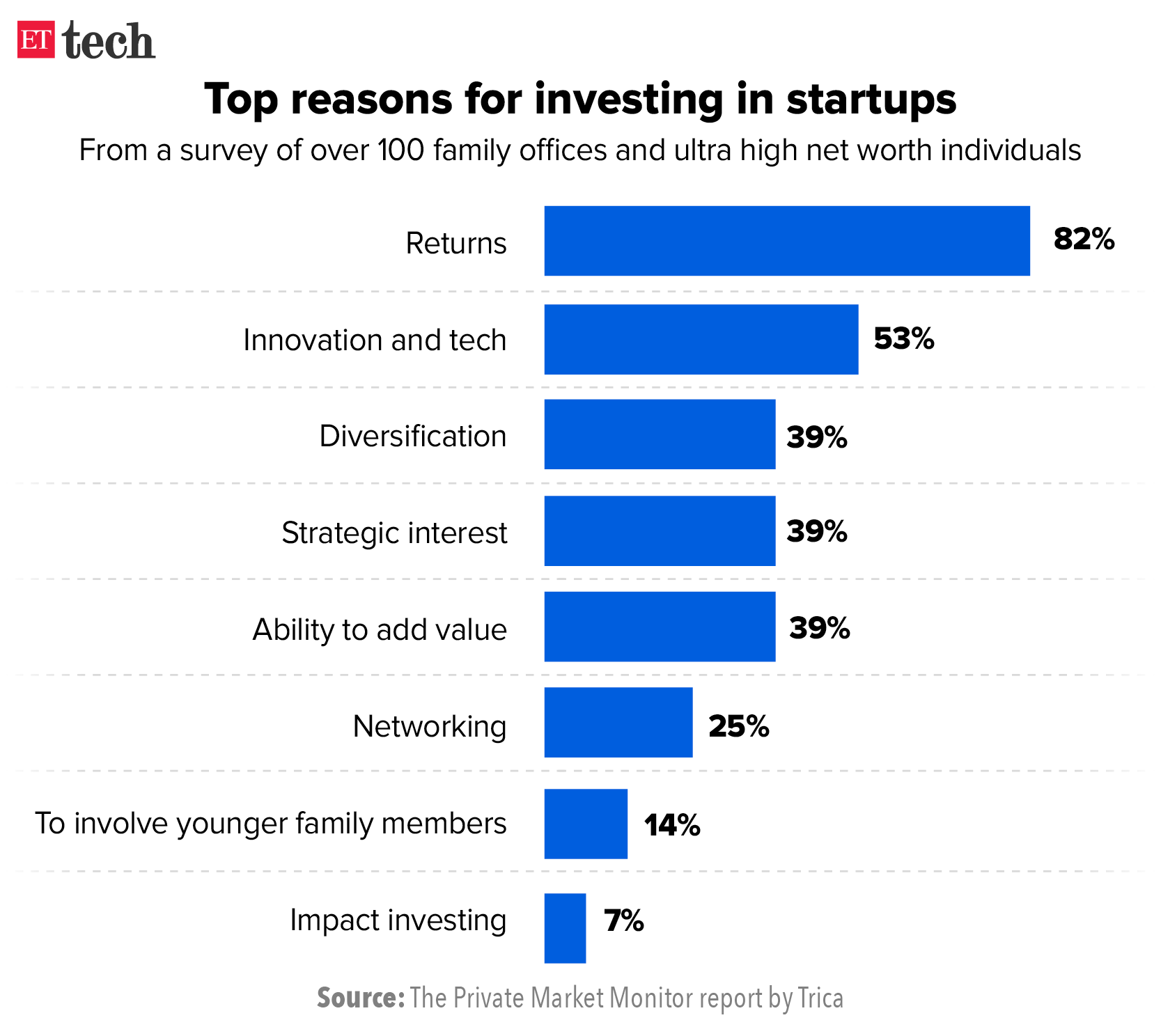

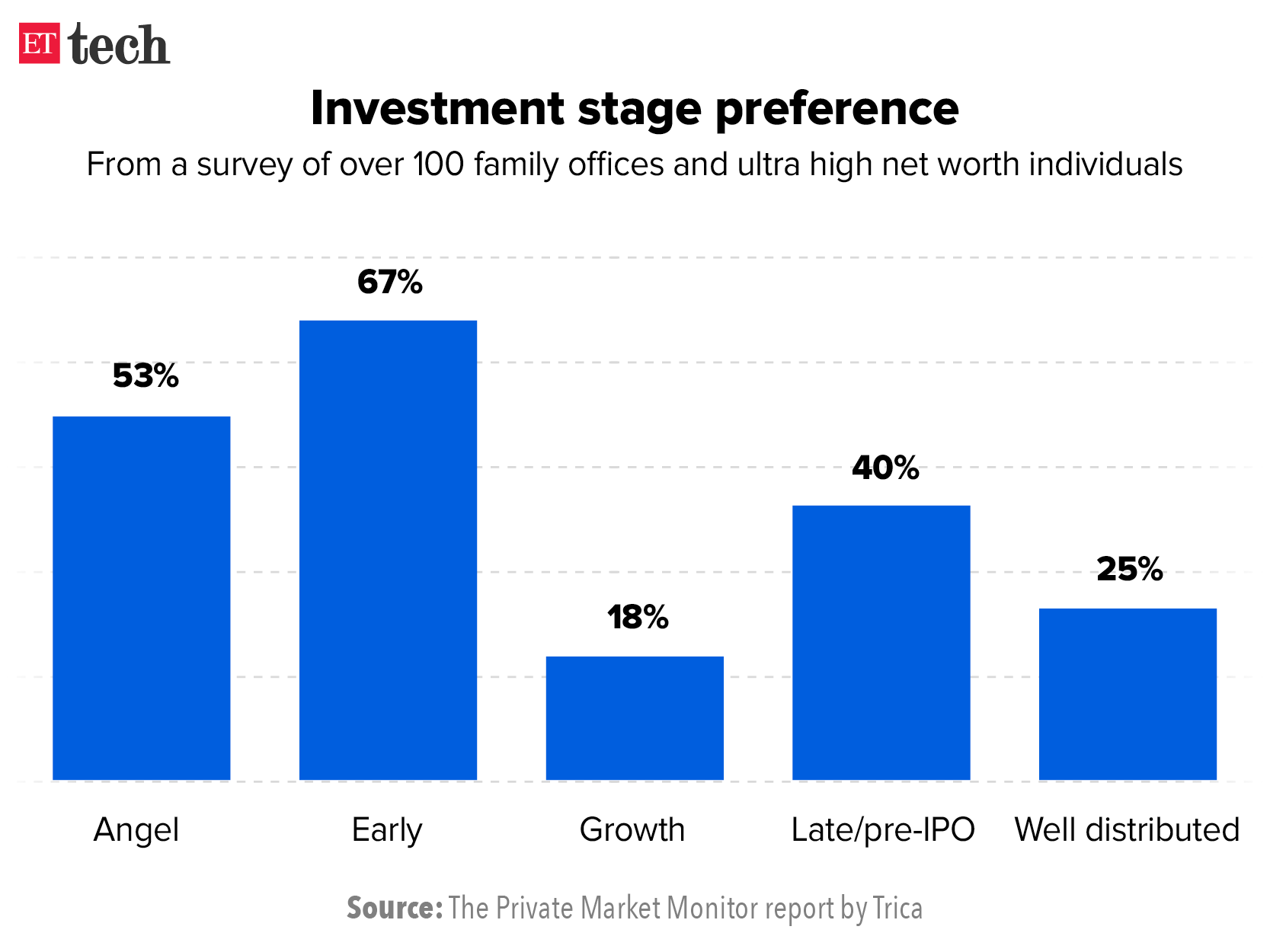

Private markets gain ground: A survey of 100 family offices and ultra HNIs – those whose net worth exceeds Rs 500 crore – found that more than 40% had doubled their allocation to private markets in the past five years.

Other findings: The survey, conducted by Trica, also showed that cash-rich individuals prefer to cut large cheques and be part of a startup’s capitalisation table instead of being limited partners (LPs) or sponsors in venture and private equity funds.

Indian startups have raised a record $31.9 billion as of December 10, according to Venture Intelligence data. About 10% of this has been domestic capital, comprising Indian funds, family offices and UHNIs, and angel investors, said Nimesh Kampani, cofounder and chief executive of Trica.

First-gen UHNIs: India’s evolving startup ecosystem has created a new category of first-generation UHNIs that are looking at setting up family offices to manage their wealth. The report estimated that more than 140 family offices have been set up in the past year.

In their words: Adar Poonawalla, chief executive of vaccine maker Serum Institute of India, said his family office has increased its allocation to the private market and is actively pursuing more deals.

“In the private market, the valuations of these startups have not been priced in, whereas some of the listed companies in the stock market are already overvalued…therefore, private, direct investment acts as a good alternative to back companies that are not fully valued at the moment,” Poonawalla said.

Falguni Nayar, founder and chief executive of omnichannel beauty retailer Nykaa, which made a stellar stock market debut last month, told us on the day of its listing that the capital she had raised from HNIs and family offices came with fewer conditions.

“High net-worth capital is good capital, they understand the risk profile, they support you on your decisions as they have done it themselves,” she said.

Tweet of the day

Joint committee calls for one body to regulate personal, non-personal data

India’s data protection regime must include both personal and non-personal data, provide for local storage of sensitive and critical data and treat social media platforms as content publishers according to the much-awaited report tabled in both houses of Parliament on Thursday.

Details: The Joint Committee of Parliament (JCP) in its report on the Personal Data Protection Bill (2019) has sought the establishment of a single regulatory authority to oversee both personal and non-personal data and recommended that the centre, in consultation with sectoral regulators, prepare an extensive policy on data localisation.

The committee also said there is a need to establish a “statutory body for media regulation”, while terming existing media regulators as “not appropriately equipped” to regulate platforms that use modern methods of communication such as social media platforms or the internet at large.

Quote: “While the JCP has retained much of what was positive with the 2019 Bill, and accepted many more recommendations from the industry, certain areas will require further deliberation – particularly the expansion of the scope to cover non-personal data,” said Debjani Ghosh, president of industry lobby Nasscom.

The bill’s application to non-personal data and having a single regulator for both personal and non-personal data needs careful analysis and deeper debate, the industry grouping said.

Experts studying the impact of the provisions expressed concern over the composition of the data protection authority (DPA) that is slated to have a majority of either government appointed members or government recommended-experts.

ShareChat’s parent firm raises $266 million at $3.7 billion valuation

Mohalla Tech, the parent firm of Moj and ShareChat, said it has raised $266 million as part of its Series G round at a valuation of $3.7 billion.

Fundraising champ: With this, the company has now raised over $1.177 billion across eight fundraising rounds, including $913 million in three rounds this year. It counts Tiger Global, Snap, Twitter and Lightspeed Ventures among its investors.

Details: The round, which was led by Alkeon Capital, also included new and existing investors such as Temasek, Moore Strategic Ventures, Harbourvest and India Quotient.

Mohalla Tech said the funding will help build capabilities such as social and live commerce, grow its artificial intelligence and machine learning team, which now has over 100 people spread across the US, Europe and India.

How’s business? Since January, the company has grown to over 2,000 employees and added several new features as it focuses on building its products. It is targeting $100 million in annualised creator earnings by the end of 2023. The company claimed that Moj has more monthly active users than any short video platform in India. It said the average user spends 34 minutes a day on the app, which clocks more than 4.5 billion views daily.

Other done deals

■ Ride-hailing company Ola said on Thursday it had raised a $500 million loan from international institutional investors, as the SoftBank Group-backed startup preps to make its stock market debut next year. The proposed loan issuance got a staggering response from investors with interest and a commitment of about $1.5 billion, the Bengaluru-based company said.

■ Beauty and personal care ecommerce platform Purplle has acquired cosmetics and skincare brand, Faces Canada. Both the companies are backed by Sequoia Capital. The acquisition comes after Purplle raised $60 million last month from Premji Invest, the family office of Wipro founder-chairman Azim Premji, valuing the direct-to-consumer (D2C) brand at $630 million.

■ Consumer products-focused Atomberg Technologies has announced a $20 million fundraise for a new manufacturing facility, in a round led by Jungle Ventures. The round, which takes the overall funds raised by the city-headquartered company to $45 million since inception in 2012, also saw participation from Inflexor Ventures, and existing investors A91 Partners and angel investor Ramakant Sharma.

Risk investors put a record $6.8 billion into Indian startups in November: report

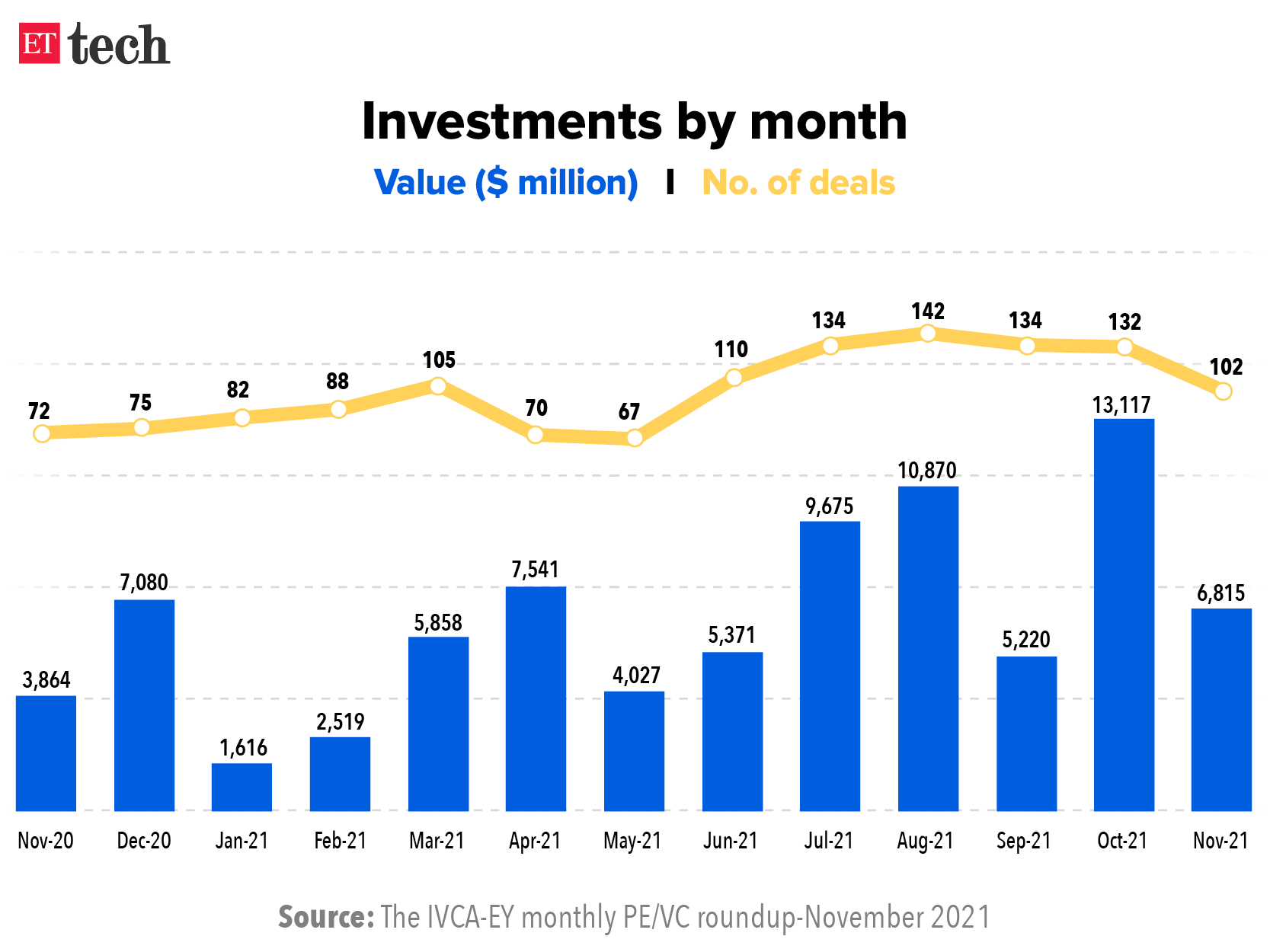

Investments by private equity (PE) and venture capital (VC) funds in November stood at $6.8 billion across 102 deals, a record for the month, according to a report by industry lobby IVCA and consultancy EY.

Comparison: In the year-ago period, such high-risk investors had infused $3.9 billion, while in October 2021, the total investments stood at $13.1 billion, the monthly data showed.

Overall investments in the first 11 months of the year touched $72.6 billion, which is 53% higher than the all-time high for a year, achieved in 2020, it said.

In November, the activity was led by $2.4 billion of investments into startups and exits by PE companies in nine initial public offerings, EY’s partner Vivek Soni said.

Quote: “Although India has found itself in a macroeconomic and geopolitical sweet spot, downside risks remain. The rise in domestic inflation on account of surging global energy prices, any potential slowdown in the government’s reform agenda in view of upcoming important state elections and the threat of a new variant driven third Covid wave remain key speed bumps to watch out for in the coming months,” he added.

November recorded 17 deals of over $100 million each, which alone totalled to $5.4 billion, while the pure-play PE/VC investments (excluding the ones in infrastructure and real estate) stood at $5.7 billion, it said.

The largest deals in November included the $1.5 billion buyout of Encora Digital by Advent and the $840 million investment in Dream11 by a group of investors including Falcon Edge, D1 Capital, Tiger Global, TPG and others.

The month saw 21 exits worth $3.6 billion, as against $974 million in November 2020 and $5.3 billion in October.

Venture Catalysts bets big on Indian startups: Meanwhile, early-stage startup investor Venture Catalysts plans to invest $108 million (around Rs 824 crore) in about 300 startups in 2022.

The Venture Catalysts group closed as many as 207 deals in 2021 and invested in 178 unique startups.

- “In 2022, we aim to invest $108 million and are targeting 300 unique start-ups,” Apoorva Ranjan Sharma, cofounder and president, Venture Catalysts Group said.

Sharma said, “We will continue investing in sectors such as fintech, edtech, agritech, FMCG, ecommerce, logistics and supply chain management. We expect D2C and deeptech to dominate in 2022 and many of these startups to emerge from small towns.”

Portfolio: Venture Catalysts’ investments this year include BluSmart, Dukaan, Klub, Melorra, Kala Gato, Mitron TV, Rage Coffee, Power Gummies, Coutloot, Prescinto, Resolve AI, Toch, Zingbus, RoundLabs, and Stage.

Byju’s in talks to go public through SPAC route

Byju Raveendran, cofounder, Byju’s

Byju’s is in advanced talks to go public through a merger with one of Churchill Capital’s special-purpose acquisition companies (SPAC), sources told us. It is also evaluating a domestic listing in the second half of calendar year 2022, they said.

What’s a SPAC? Sometimes called blank-check companies, SPACs are shell companies created with the sole intention of merging with a private business. Read our full explainer on SPACs here.

Under India’s current regulations, companies headquartered in the country can’t go public through conventional initial public offerings in the US.

Details: “Michael Klein’s Churchill Capital has made an offer of investing $4 billion at a valuation of more than $48 billion,” the source said. “Since a large part of the business is in the US, a listing in that market is being considered,” the person added.

The startup was last valued at $21 billion in November, when it mopped up the first tranche of its intended $1.5 billion from investors.

Churchill Capital VII, the seventh blank check company founded by dealmaker and former Citi executive Michael Klein, raised more than $1.3 billion in an offering in February and trades on the New York Stock Exchange.

Yes, but: While an announcement could come as soon as January, the negotiations are not final. Byju’s or Churchill could still opt-out of such a deal, and Byju’s could consider an IPO in India next year, sources told Bloomberg.

The sources said Byju’s held talks with several potential SPAC partners is closest to working out an agreement with Churchill Capital. The startup had earlier discussed a SPAC merger with Michael Dell’s MSD Acquisition Corp. and Altimeter Capital Management, one of the sources said.

Change of plans? Byju’s had been aiming to file preliminary papers for a traditional IPO as early as the second quarter of 2022 and was also considering a SPAC merger, Bloomberg reported in September. That had been an acceleration of earlier plans to go public in 12 to 24 months. The startup and its bankers had discussed a valuation of $40 billion to $50 billion.

Byju’s has been on an acquisition binge in the past year, acquiring startups offering coding lessons, professional learning courses and test prep classes for competitive exams.

It has spent more than $2 billion on acquisitions in jut the past few months.

- In July, it announced two acquisitions: professional and higher education platform Great Learning for $600 million in cash and stocks, and Toppr for $150 million.

- On September 7, it acquired Gradeup, an online exam preparation startup, and plans to rename it Byju’s Exam Prep.

Other Top Stories By Our Reporters

Infogain acquires cloud-native app development firm NNT: Silicon Valley-based digital platform engineering company Infogain has announced it has entered into a definitive agreement to acquire Nggawe Nirman Technologies (NNT), a cloud-native app development company servicing customers in the manufacturing, fintech, edtech, healthcare, and software industries.

India Inc. intends to increase spending on AI: Indian enterprises intend to increase their investments in artificial intelligence, given the returns they’ve seen on existing AI investments, according to the Deloitte State of AI report. The report, based on a survey of 300 senior executives in India, focuses on how organisations can succeed in the age of AI.

TCS wins Plaza Premium deal to digitise global airport hospitality: TCS has won a deal from Plaza Premium Group, a global airport hospitality services provider based in Hong Kong, to develop an end-to-end digital platform that will improve customer experience and operational excellence at its 70 airport locations that serve 20 million passengers annually.

Global Picks We Are Reading