Market leaders PhonePe and Google Pay are seeking an extension while Paytm wants the rules to take effect “as per the timeline”. Officials told us the government is monitoring the situation but won’t intervene.

Also in this letter:

■ Be aware of tax implications, tax officials, CAs tell tech moonlighters

■ Startups approach NCLAT in Google app commissions case

■ Shareholder rights firms file class action suits against Freshworks

Firms divided on UPI market-share cap as deadline looms; govt won’t intervene

The Centre will not actively intervene in the matter of conflicting demands by India’s top payment providers over the issue of enforcing a 30% cap on the market share of apps operating on the unified payment interface (UPI), top officials told us on Wednesday.

This follows contrasting demands on the issue by digital payment providers in recent weeks.

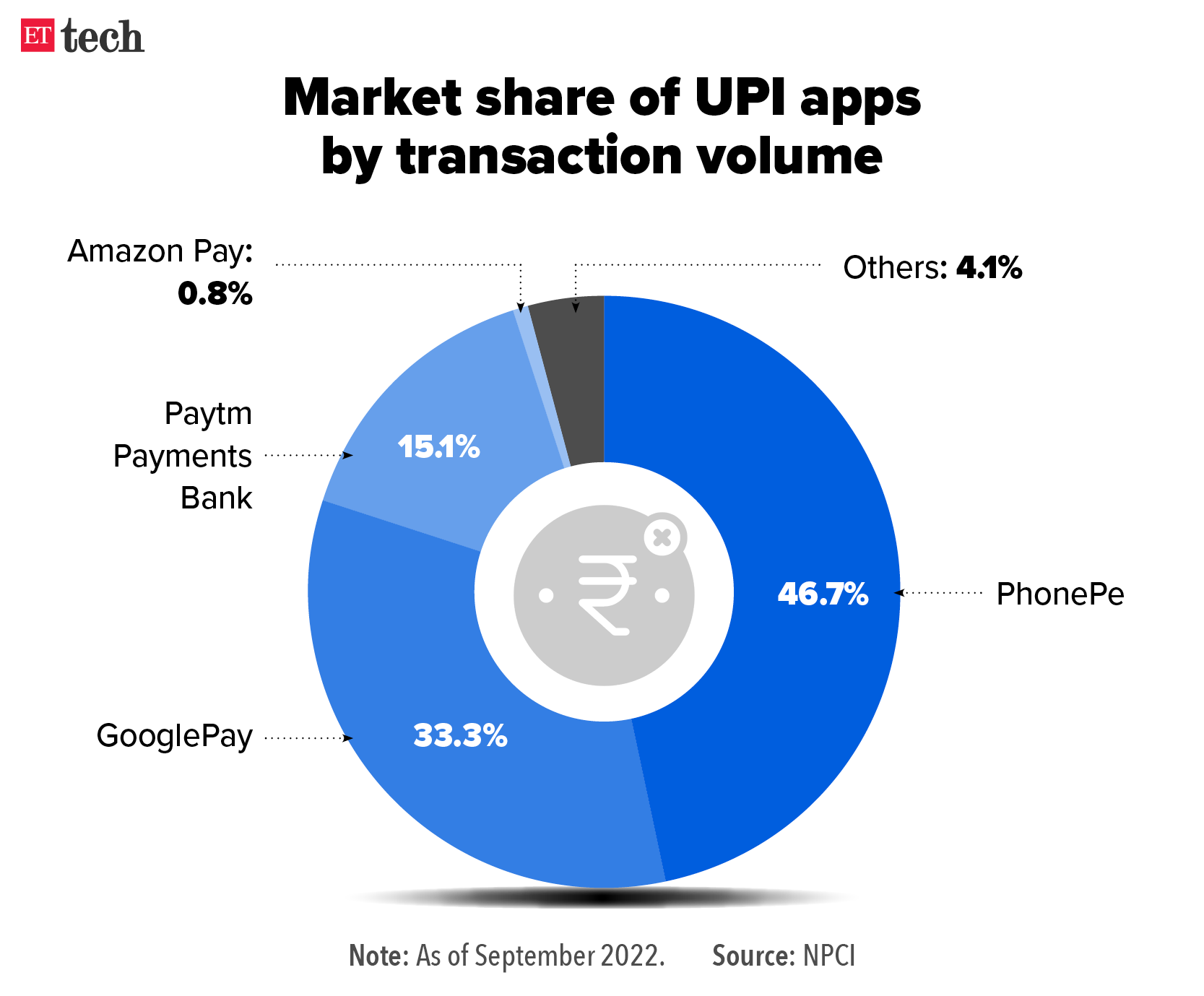

Divided: While Paytm, the third-ranking payment app, “believes market capping should be implemented as per the timeline (December 2022),” market leaders Walmart-owned PhonePe and Google Pay independently approached the National Payments Corporation of India (NPCI), which runs UPI, asking it to extend the deadline by at least three more years.

Govt’s stand: Senior officials told us that the mandate to decide on this issue lies with the NPCI and the Reserve Bank of India. However, the centre will monitor any decision that could potentially affect consumers, they added.

“The Government of India cannot be taking sides. Ultimately, there has to be a balance between consumer good and that of the UPI ecosystem,” a senior IT ministry official told us.

NPCI continues to be in consultation with the government departments as well as the RBI before finalising its decision.

PhonePe, Google Pay dominate: As per latest NPCI data for September, PhonePe and Google Pay had market shares of 46.7% and 33.3% in terms of volumes of UPI transactions handled.

With the deadline less than two months away, the opposing stances have created two distinct camps among third-party UPI apps.

Catch up quick: In November 2020, NPCI first announced that it would enforce a cap of 30% on transaction volume clocked by any single player starting 2021. Platforms such as Google Pay, PhonePe would have a period of two years starting January 2021 to comply with the mandate in a phased manner, it had said.

In March 2021, it set out operational guidelines for digital payment firms to limit their share. It said the market cap of 30% would be calculated on the basis of total volume of transactions processed during the preceding three months, on a rolling basis.

Be aware of tax implications, tax officials and CAs tell tech moonlighters

Income tax authorities and chartered accountants have cautioned technology professionals who resort to ‘moonlighting’ – taking up more than one job at a time – and asked them to be aware of the tax implications of doing so.

The extra income they earn from moonlighting should be declared in their tax returns, they said.

Controversy: Top technology companies have been airing concerns of late about moonlighting, with some like Wipro and Infosys sacking employees who were found to be working two jobs at once.

Tax implications: An individual or a company making a payment of more than Rs 30,000 to someone in return for a contract job (under Section 194C of IT Act, 1961) or paying a professional fee (Section 194J) must deduct tax at source (TDS) at the applicable rate, said R Ravichandran, principal chief IT commissioner, Tamil Nadu, Puducherry & Kerala.

TDS also applies if such payments to the same person exceed Rs 1 lakh in a financial year, under Section 194C. The recipient must declare such income in his or her tax returns and pay the applicable tax rate.

A payee not deducting TDS or a recipient not declaring such income would amount to violation of the I-T law and invite action.

Seeking advice: Many professionals, largely tech workers, have started seeking the advice of chartered accountants and tax planners on how to treat the external income to avoid or reduce their tax burden.

Typically, human resource departments send tax declaration forms by December or January.

Tech workers are looking to find out whether the extra money can be legally declared as professional income.

Startups approach NCLAT in Google app commissions case

The startup community has filed a caveat in the National Company Law Appellate Tribunal, anticipating that Google would challenge the recent verdicts by India’s competition watchdog.

The caveat seeks to ensure that they are a party to the case and will be called to present their views on the matter, multiple sources aware of the development told us.

It was filed last week through the Alliance of Digital India Foundation (ADIF), one of the parties in the Google’s Play Store commission issue.

Google has 60 days to challenge the order by the Competition Commission of India (CCI), either in NCLAT or a high court.

Catch up quick: The antitrust regulator had on October 25 imposed a penalty of Rs 936.44 crore on Google for abusing its dominant position with respect to its Play Store policies, apart from issuing a cease-and-desist order. On Tuesday, Google said it would pause the enforcement of its deadline for Indian developers to adopt its Play Store billing system.

Google India’s gross ad sales up 55.7%: Meanwhile, Google India Pvt Ltd mopped up advertising worth Rs 24,926.5 crore from Indian advertisers in fiscal 2022, registering a 55.7% increase from the previous fiscal year, as per its latest regulatory filings.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Shareholder rights firms file class action suits against Freshworks

US-based shareholder rights litigation firms Scott+Scott Attorneys and The Schall Law firm have said they have filed securities class action suits against Nasdaq-listed product software company Freshworks.

What’s that? A securities class action suit allows shareholders to collectively litigate against a company for causing ‘economic injury’ by violating certain securities laws, and allows for monetary compensation.

Why? The Scott+Scott statement said Freshworks’ offering documents at the time of its IPO were “false and misleading” and did not mention that the company’s business had encountered obstacles.

The statement, referring to a complaint filed in the Northern District of California, said the securities class action suit has been filed against Freshworks and certain directors, officers at the company and underwriters of the September 2021 IPO. The Schall Law firm encouraged investors to get in touch with the firm before January 2023.

TWEET OF THE DAY

Indian microblogging app Koo crosses 50 million downloads

Indian microblogging platform Koo has crossed 50 million downloads, its CEO and cofounder Aprameya Radhakrishna told us. The company expects to hit 100 million downloads over the next year, he added.

“As an app which just started at the onset of the pandemic we have seen tremendous growth over the last two and a half years. Our monthly active users range between 10-12 million. While our downloads keep increasing, our focus is on increasing engagement. We have grown significantly in the last one year. 60% of our audience only speaks Hindi on the platform,” he added.

Verification badge: On Elon Musk announcing that Twitter will charge $8 a month for blue-tick verification, Radhakrishna said he does not expect many users to pay for verification in India and that Koo will not charge users for this.

“There might be a small percentage who will still pay, but they might be more internationally relevant folks. Anybody who wants to be a part of an international community on microblogging and would want to be actively there might still pay. But anybody who is India-focused will not pay,” he added.

Other Top Stories By Our Reporters

The Sleep Company raises Rs 177 crore: The Sleep Company, a direct-to-consumer sleep-tech startup, has raised Rs 177 crore (about $21.3 million) as part of a fresh funding round led by Premji Invest. Existing investor Fireside Ventures also participated in the round.

The capital raising round also includes a debt component of up to Rs 8.2 crore ($1 million) from Alteria Capital. Premji Invest now owns roughly 15%-20% stake in the startup, sources aware of the deal told ET.

Freshworks Q3 revenue beats estimates, jumps 37%: US-based customer and employee engagement software provider Freshworks reported a 37% jump in its third quarter (July-September) revenue in constant currency terms, even as operating losses widened to $3.1 million year-on-year (YoY) amid a tight macro environment marked by high inflation, greater scrutiny on tech spending, and recessionary trends across Western markets.

Global Picks We Are Reading

■ India’s new telecomms bill is messed up (Rest of World)

■ Elon Musk says Twitter won’t restore banned accounts ‘for weeks’ (The Washington Post)

■ Jony Ive on life after Apple (WSJ)