Hello, this is Tarush in Bengaluru. For fintech executives, Diwali festivities came a week early. Several firms announced a top-deck shuffle with founders moving on to focus on the big picture, as business heads became chief executives of separate verticals.

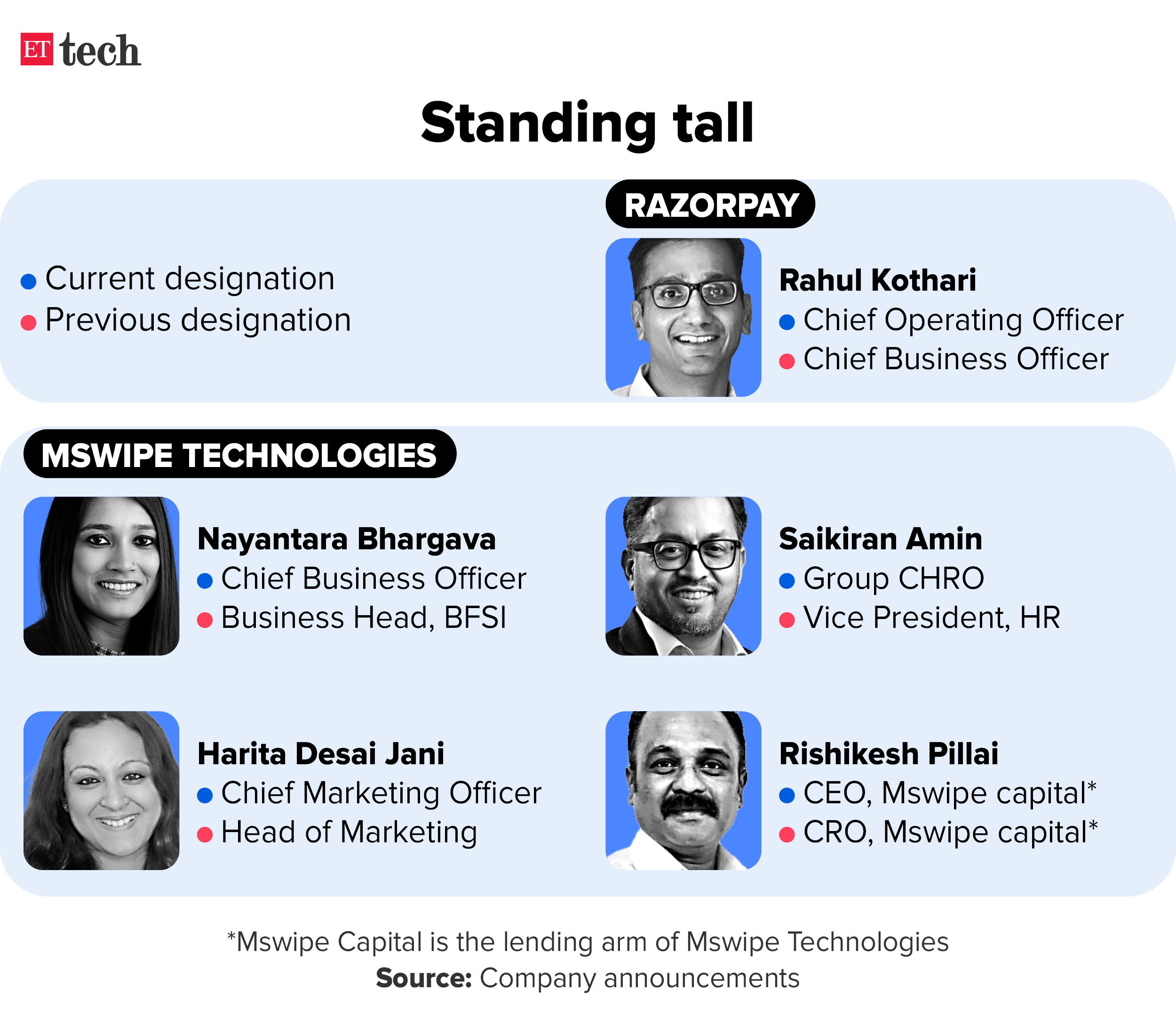

While fintech infrastructure provider Perfios appointed a new chief technology and chief people officer, digital payments service providers Razorpay and Mswipe promoted a bunch of senior executives to leadership roles.

Online payments major PhonePe announced four CEOs to head major its business verticals.

What’s the matter? With fintech startups expanding their scope of business from what they started out with, the appointment of individual leaders for each vertical shows companies are now becoming full stack.

For instance, PhonePe began life with UPI payments in 2015 but now offers credit, insurance, wealth management as well as offline payments. All of these businesses will now have separate CEOs.

Razorpay started off by facilitating ecommerce transactions in 2014, but now offers digital banking, credit and is also bolstering operations outside India.

Zooming in: As startups expand to newer geographies, founders are increasingly looking at these markets and are appointing seasoned professionals to handle their India businesses.

Both Mswipe and Razorpay, are aggressively eyeing international markets across the Middle East, North America and South East Asia.

Mswipe, which recently entered the UAE, is looking to launch in Singapore and Indonesia by January next year. It is also eyeing the US and the UK markets.

Mswipe founder and managing director Manish Patel along with chief executive officer Ketan Patel will now focus on future synergies and international expansion, as the India leadership continues to report into them.

“We wanted to streamline the business and focus on expansion, while ensuring India business is well covered. These leaders will ensure operational excellence for the firm (in the domestic market), as founders may be in different time zones focusing on expansion,” said Ketan Patel, who was also elevated as cofounder.

At Razorpay, which recently ventured into Malaysia, newly-appointed chief operating officer Rahul Kothari will look at product crossover for international geographies and ensure revenue outcomes from Southeast Asia as well. He was earlier responsible for revenue outcomes in India.

Kothari will also be responsible for fine-tuning processes domestically, across technology, quality and customer service functions.

“Inducting a strong leadership in place allows founders to start thinking about the strategic direction of business and not just day-to-day operations,” said a fintech founder closely watching these movements.

Run up to an IPO: For a few of the fintechs that have started preparations for a public listing, these appointments have come at a crucial time.

For PhonePe, the appointment of CEOs for these individual businesses indicates:

1. A strong second-tier leadership structure, essential to give confidence to prospective public investors.

2. Identifying executives responsible for individual business’ revenue lines, needed to spruce up PhonePe’s overall revenues.

3. Signals its transformation into a full stack financial services company, with credit, payments, insurance as standalone businesses within the PhonePe group, much like its close rival Paytm.

Banking on professionals: With key responsibilities in place, cofounder and PhonePe chief Sameer Nigam is likely to focus more of his time on the strategic direction for the group while making the company IPO-ready.

Even fintech infrastructure provider Perfios has roped in Sumit Nigam as chief technology officer, who was previously the engineering head at BigBasket, and Anu Mathew as its new chief people officer from Pine Labs with an eye on an eventual listing.

Fintechs have also been hiring seasoned bankers at key roles indicating their seriousness about the new businesses. Cred recently hired Sujay Das, a senior banker, to head its risk functions as it ventures into lending through its own NBFC.

Fintech Corner

Companies rush for cyber insurance on data laws, digitisation: Insurance is generally difficult to sell, but for a product like cyber insurance, the coin has flipped.

Banks turn to gold loans on RBI stance, woo fintech companies: With the Reserve Bank of India turning cautious on the growing unsecured portfolio of banks, some of them are making a quick move towards pushing secured lending and gold loans.

Also read | InCred set to secure Rs 500 crore in equity funding, join unicorn club

Other Top Stories

Manipal Education and Medical Group chairman Ranjan Pai

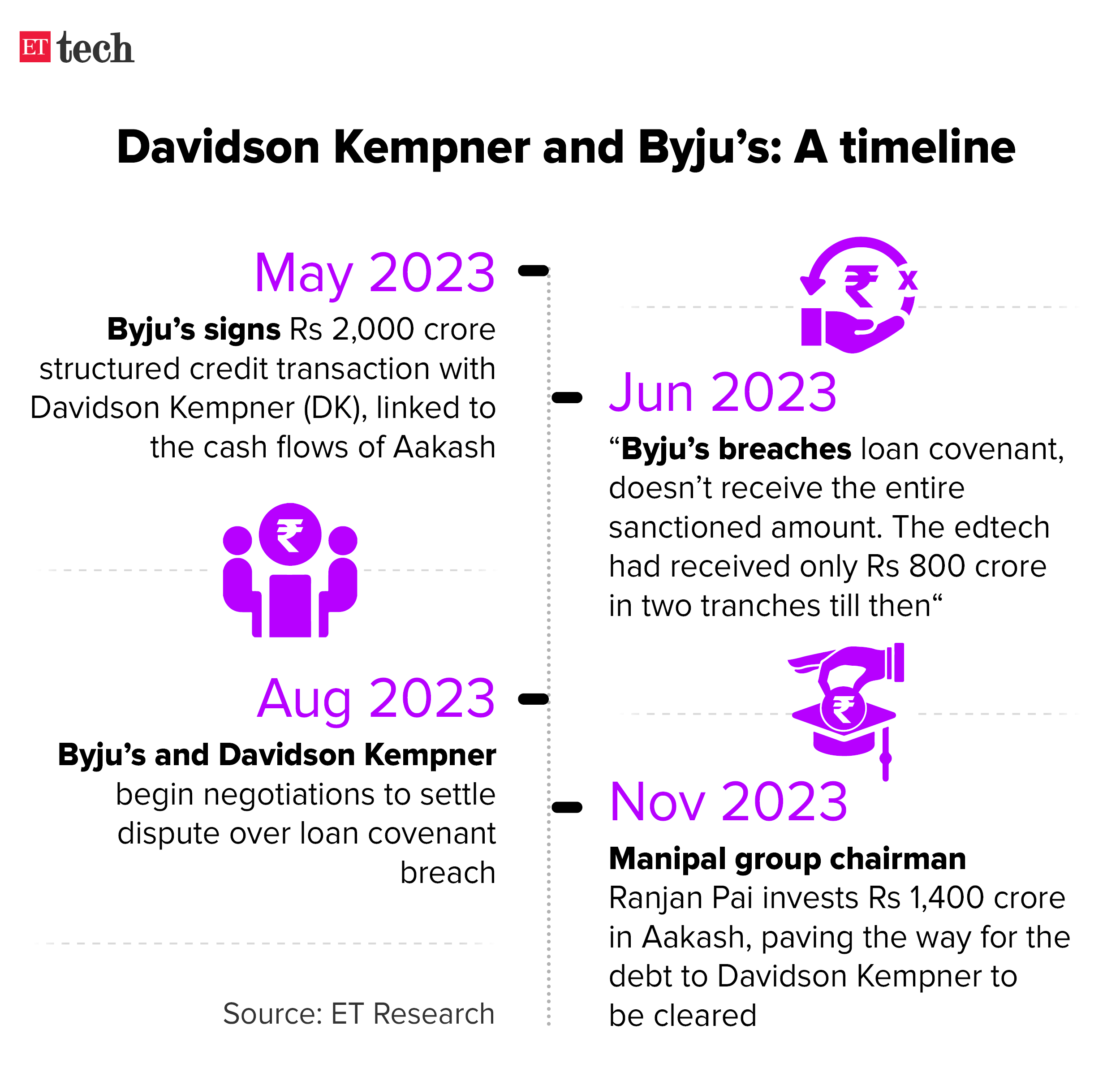

Ranjan Pai books an Aakash seat with Rs 1,400 crore to clear Davidson Kempner debt: Manipal Education and Medical Group chairman Ranjan Pai has invested Rs 1,400 crore (around $168 million) in troubled edtech major Byju’s’ test-prep subsidiary Aakash Institute, paving the way for the company’s debt to the US-based lender Davidson Kempner Capital Management to be cleared, sources said.

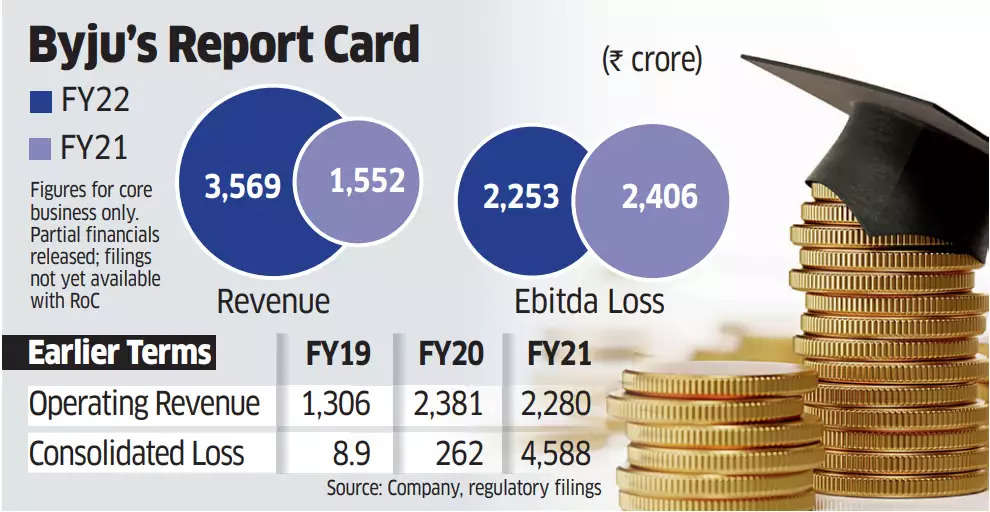

The edtech reported its delayed audited financial accounting for the year ended March 2022 — in parts — showing a 2.3 times growth in revenue to Rs 3,569 crore in its standalone business. Ebitda loss of the core business — financials for which were reported — was down to Rs 2,253 crore in FY22, from Rs 2,406 crore in the previous year.

Evan Spiegel, chief executive officer, Snap Inc

In India, 200 million users is a relatively small number; we have room to grow: Snap cofounder Evan Spiegel | Snap Inc was in the news earlier this year as its messaging platform Snapchat doubled monthly users to 200 million in just a year, locally. But for cofounder & CEO Evan Spiegel, that number is still small. He sees a wide room to expand, as the company looks to grow users and tap advertisers in the country. In an interaction with ETtech, Spiegel spoke about leveraging artificial intelligence (AI) to enhance its augmented reality (AR) playbook.

Also read: AI to cut barriers to creativity for developers, creators, says Snap CEO Evan Spiegel on India visit

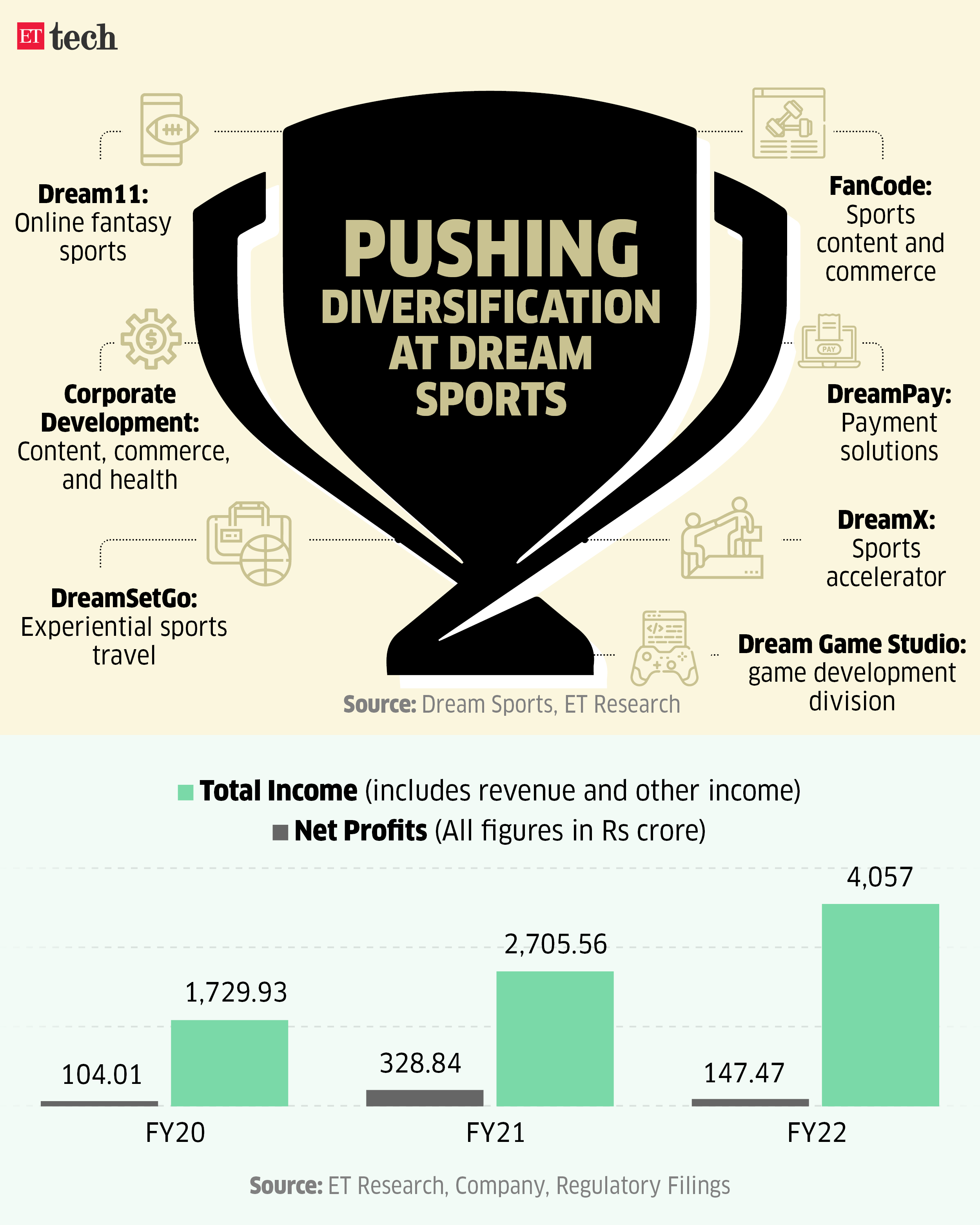

Dream Sports eyes diversification via investments, M&As to cope with tax blow: Dream Sports is aggressively pushing its diversification strategy in a bid to become a sporting conglomerate, as its core business grapples with the country’s new taxation regime introduced for the online gaming sector in October.

The company, which draws more than 90% of its revenue from the fantasy gaming platform Dream11, wants to expand into other adjacent streams through acquisitions to help protect its revenue and profit.

Also read | ETtech in-depth: Rario collapse, tax woes bring curtains down on Dream Sports’ venture arm

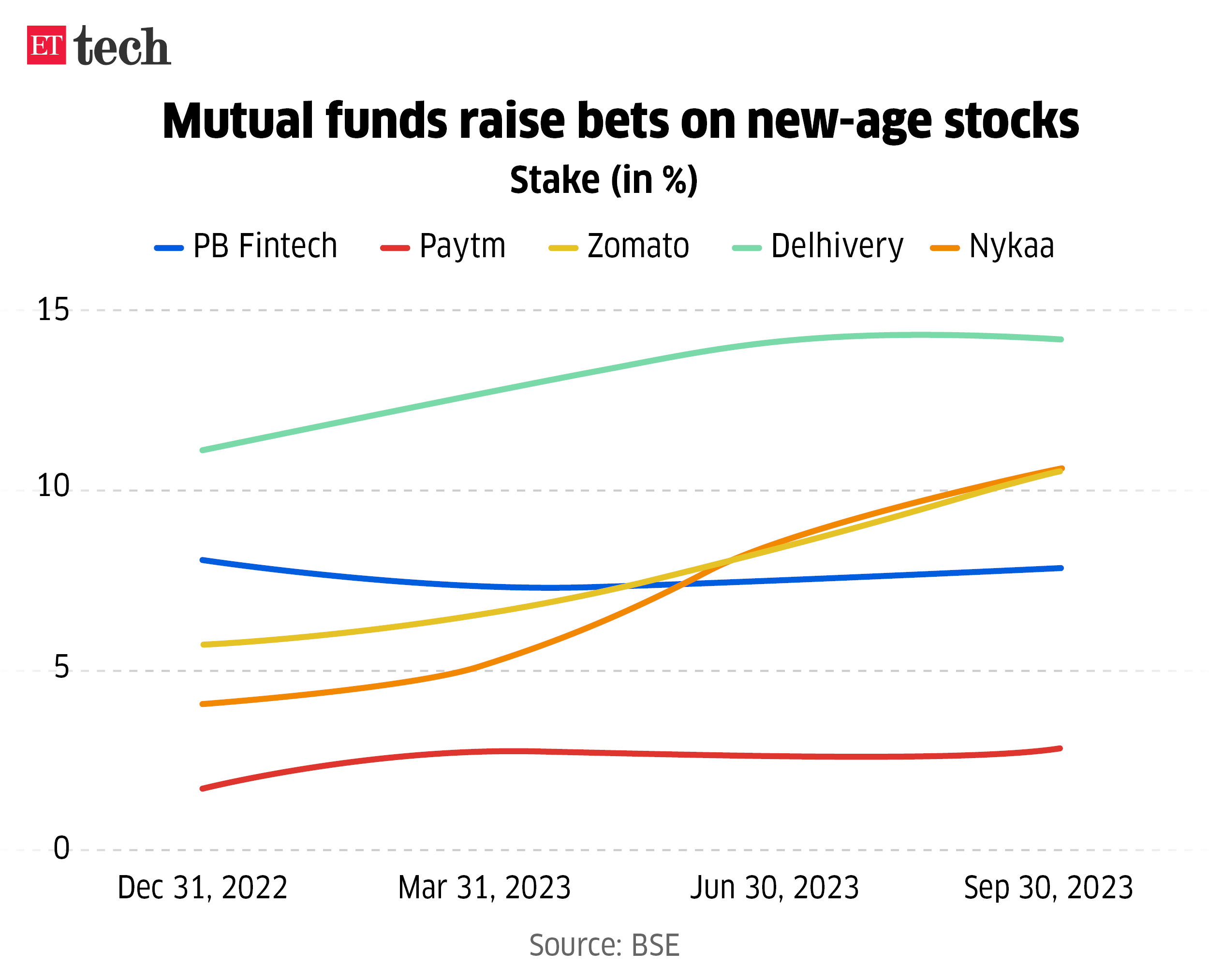

Mutual funds take a shine to Zomato, Nykaa, Paytm, other new-age stocks: When Honasa Consumer, the parent of beauty and personal care brand Mamaearth, opened the anchor portion of its initial public offering (IPO) on October 30, domestic mutual funds bought shares worth Rs 253.61 crore. With this, Honasa Consumer has emerged as the latest addition to the growing list of new-age stocks finding traction among domestic mutual funds.

Despite numbers, Zomato must tweak Gold to cut profitability drag, say experts: Even as Zomato’s loyalty programme Gold, which was relaunched in January this year, continues to drive volumes for the company, the programme may need some fine-tuning to reduce its drag on the company’s profitability, analysts and experts said.

Government issues orders to ban Mahadev, 21 other illegal betting apps: In a late-night order on November 5, the ministry of electronics and information technology blocked several betting and gambling apps, including Mahadev Book Online, over allegations of money laundering.

Read ETtech’s detailed explainer on the Mahadev app case, which also caught Bollywood celebrities in its net.

Honasa Consumer IPO

Varun Alagh and Ghazal Alagh, cofounders, Honasa Consumer

Mamaearth shares list at 2% premium over IPO price: Honasa Consumer listed on the bourses on Tuesday at a slim 2% premium to the issue price. The stock opened at Rs 330 on the NSE as against the IPO price of Rs 324. On the BSE, it debuted at Rs 324.

In his pre-listing speech in Mumbai at the National Stock Exchange (NSE), cofounder and chief executive Varun Alagh said he wants to take Indian skincare products global.

Spotlight on those counting riches, blessings: The muted listing notwithstanding, the spotlight has turned on the returns made by Honasa Consumer’s investors, and also on the unrealised gains that non-selling shareholders are sitting on.

.jpg)

Fireside Ventures, the earliest institutional investor in the omnichannel retailer, cumulatively invested Rs 29.1 crore, and has sold shares worth Rs 258 crore during the IPO alone. The consumer-focussed venture capital firm sold Honasa Consumer shares worth Rs 547.4 crore, and is still sitting on unsold investments worth Rs 821.49 crore.

.jpg)

Mamaearth backers Kunal Bahl, Rohit Bansal to redeploy investment gains: Early-stage venture capital firm Titan Capital’s founders Kunal Bahl and Rohit Bansal, who were among the earliest backers of skincare brand Mamaearth, will reinvest their entire gains from the investment into Indian startups.

Honasa Consumer shares plunge 15% days after listing: Shares of Honasa fell as much as 15% in early trade Friday but recovered to end the day up 7% on the NSE. However, at its closing price of Rs 323.50, Honasa’s stock is still a shade below its issue price of Rs 324, and the listing price of Rs 330 per share.

Also read | Meet Ghazal and Varun Alagh, cofounders of Honasa Consumer

Results Corner

Falguni Nayar, CEO, Nykaa

Nykaa Q2 profit surges 50%: FSN E-Commerce, the parent company of omnichannel beauty and fashion retailer Nykaa, recorded a 50% surge in consolidated net profit to Rs 7.8 crore for the quarter ended September. Revenue from operations rose by 22% to Rs 1,507 crore in Q2 FY24.

Dunzo FY23 loss widens to Rs 1,800 crore: Cash-strapped quick-commerce company Dunzo posted a Rs 1,801.8 crore loss in FY23, nearly four times wider than the previous year, even as revenue from operations grew more than fourfold to Rs 226.6 crore.

PB Fintech reaffirms profitability plan: PB Fintech, the parent of insurance marketplace Policybazaar and credit platform Paisabazaar, on Monday reiterated its forecast for turning a net profit this fiscal year. PB Fintech’s September quarter losses narrowed almost nine-fold to Rs 21.1 crore from Rs 186.6 crore in the year-ago period.

Nazara Technologies posts over 50% jump in quarterly profit: Gaming and media firm Nazara Technologies on Wednesday said its profit after tax rose 53% on a year-on-year basis to Rs 24.2 crore in the September quarter, on an operating revenue of Rs 297.2 crore.

Hiring & Jobs

Wipro mandates work from office thrice a week: Employees at IT major Wipro will have to report to work from the office at least three days a week starting November 15, according to an internal communication. Any non-adherence or non-compliance to the policy could lead to disciplinary action starting January 7, 2024, the company said.

IT pays? Now not much higher for the new hire: Employees of technology companies switching jobs aren’t finding the going easy as salary hikes have witnessed a sharp slump. According to data from staffing firms, the hikes have dropped by nearly half compared to the previous financial year as top IT exporters reduce their intake amid slowing demand for technology services globally.

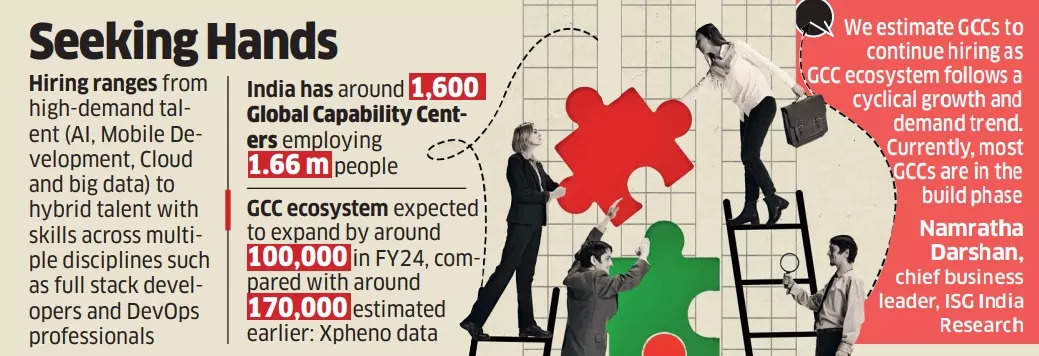

Global captives buck the trend, likely to hire 30% more this year: Technology captives or Global Capability Centres (GCC) are bucking the broader industry’s hiring downtrend. This year, GCC hiring could climb up to 30% from last year, with on an average four out of five facilities adding jobs.

Tech Policy

Social media companies receive advisory to take action on deepfake content: The government has sent an advisory to social media and internet intermediaries, asking them to take strict action on any deep-fake content under the IT Act of 2000 and the IT Rules of 2021. The advisory came after a deepfake video of actor Rashmika Mandanna went viral and drew criticism from celebrities and government officials.

Watch here | How to spot a deepfake

Delhi taxi ban likely to hit ride-hailing apps; Uber writes to LG: The Delhi government’s proposed ban on app-based taxis registered in other states from entering the national capital is likely to disrupt operations of cab aggregators such as Uber and Ola. Uber opposed the move in a letter to the LG of Delhi-National Capital Territory.

ETtech Deals Digest

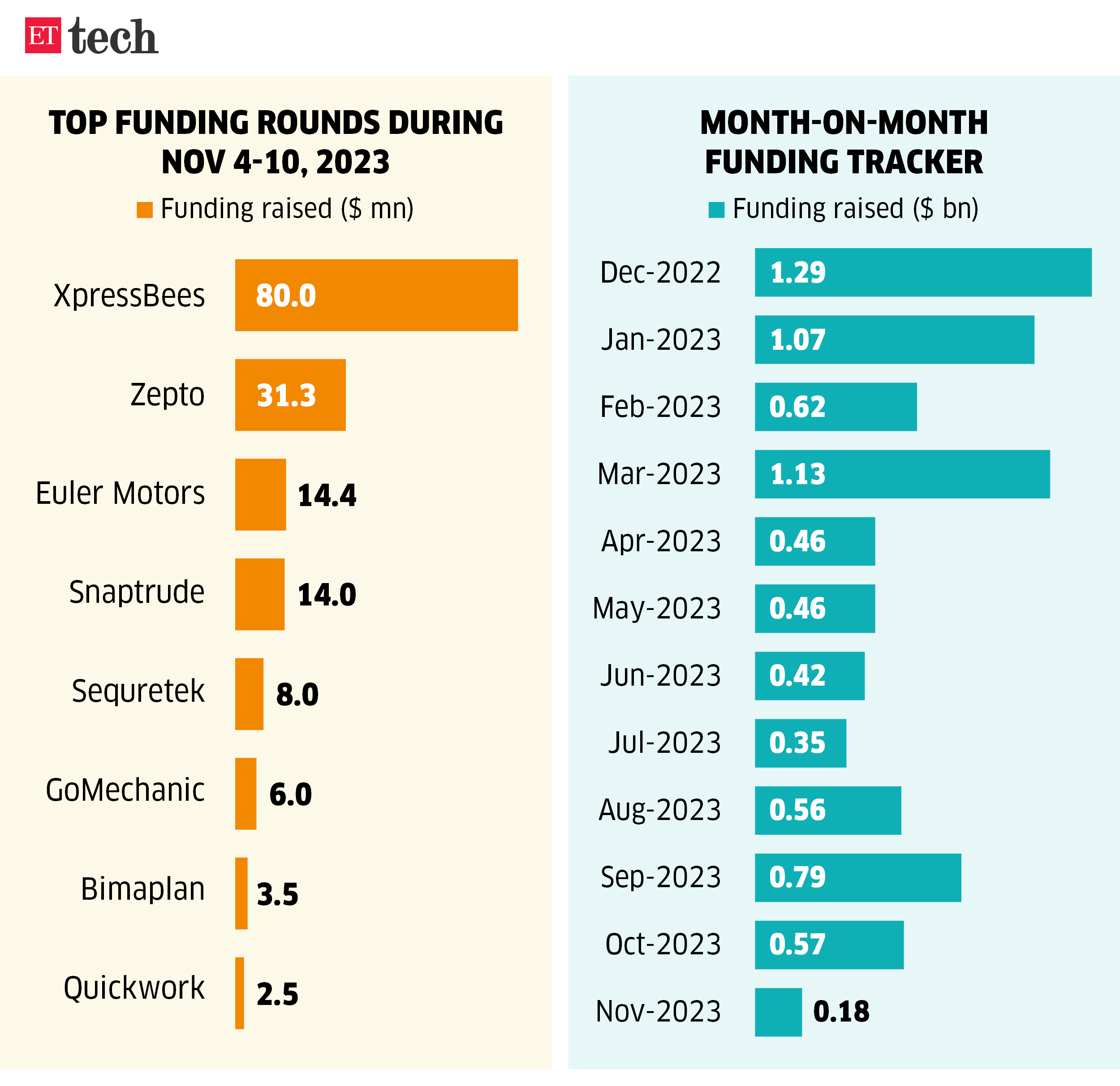

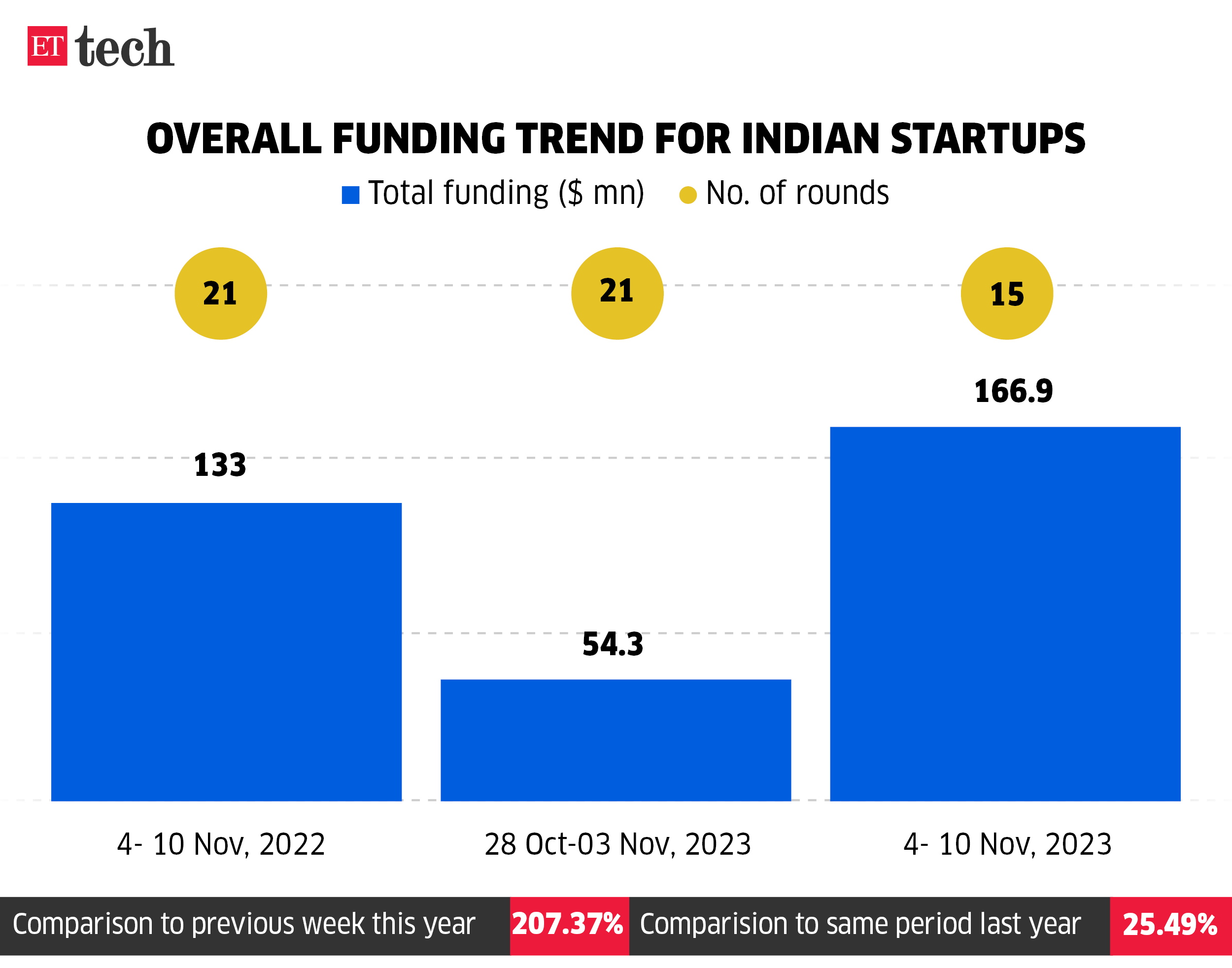

The funding climate for Indian technology startups improved year over year, with $166.9 million deployed across 15 funding rounds in the week of November 4-10, according to data from Tracxn.

In the comparable week in 2022, startups had raised $133 million across 21 funding rounds. The deals this week averaged about $11.13 million each, versus $6.33 million per deal in 2022.