Also in this letter:

■ Mamaearth founders to sell 2% stake in IPO

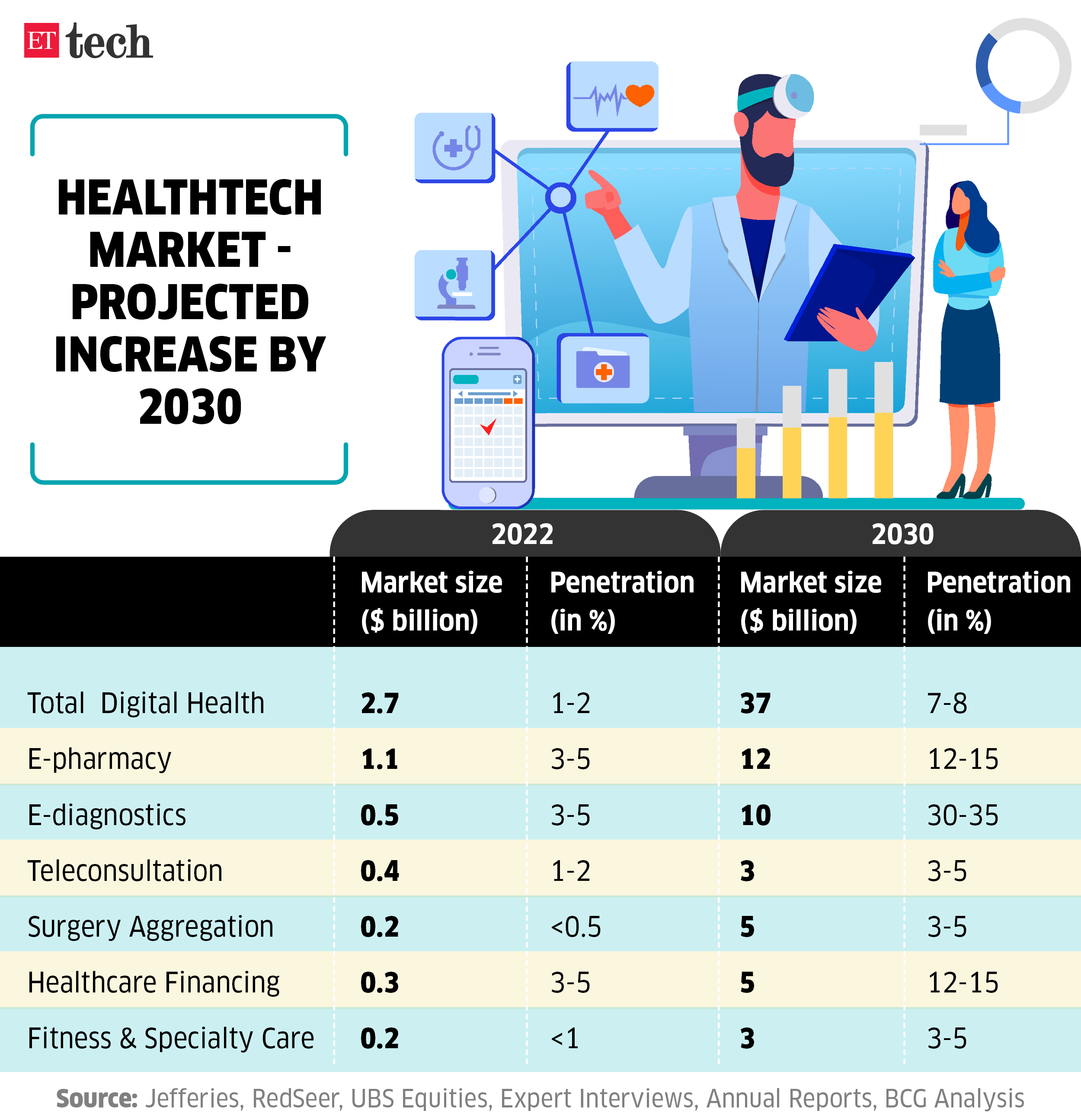

■ Indian healthtech firms to generate $37 billion by 2030

■ Premji Invest shook by three long-term partners’ exit

Local investors spot an opening in fintech infrastructure players

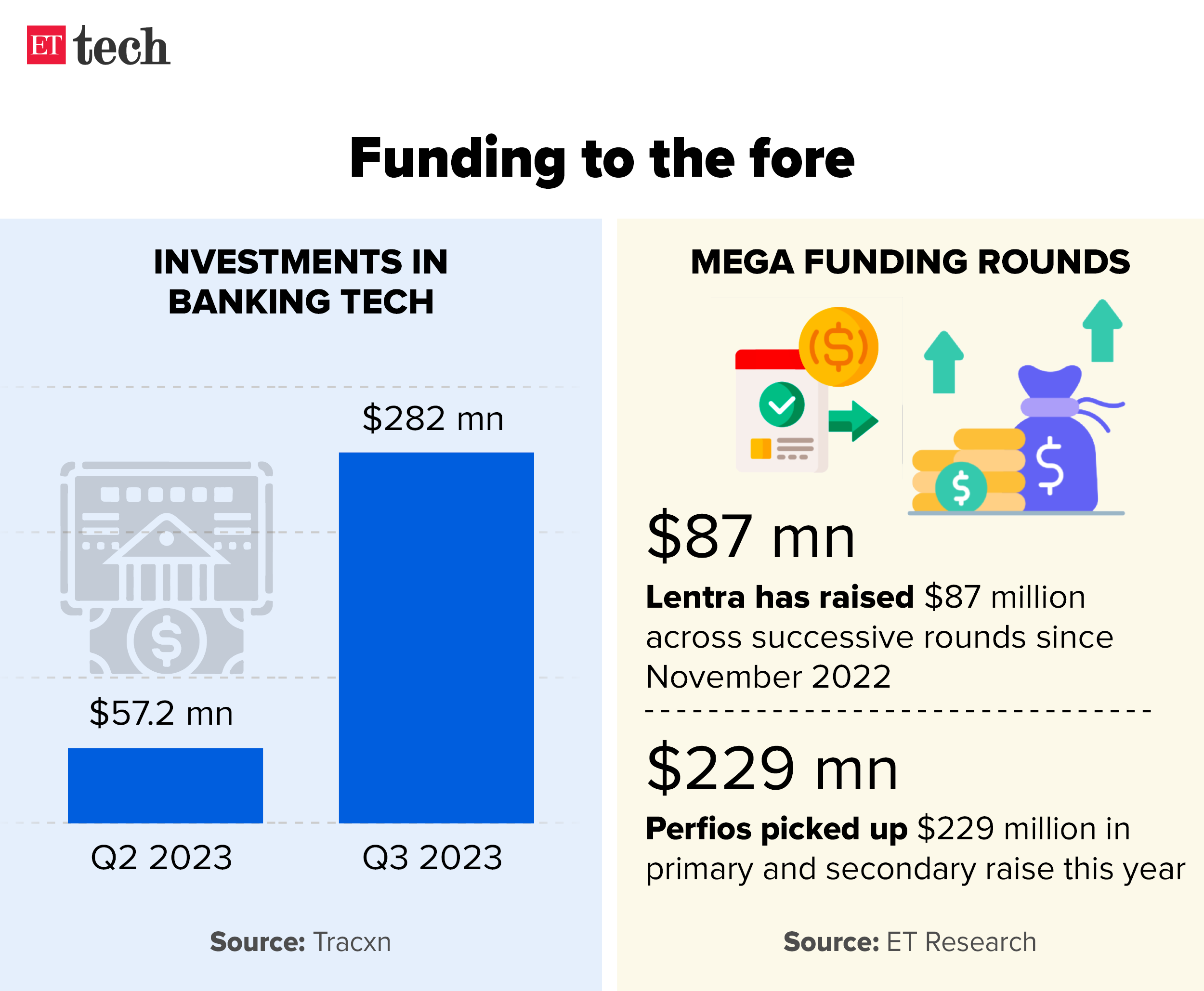

Even as overall investments in domestic fintech startups see a slump, a new category of companies providing financial infrastructure is attracting local investors. These companies provide the necessary technology stack, which is helping banks further digitise their processes, expedite the launch of newer financial products, while also helping fintechs partner with these institutions.

But, why? What is really drawing investors to this niche category is a large addressable market as banks look for credit card programmes and API management solutions, along with better predictability of outcomes that B2B businesses promise over their consumer counterparts.

Deals continue: This year fintech software providers Lentra and Perfios raised $27 million and over $70 million in equity funding respectively, at a time when growth and late-stage deals have dissipated amidst a souring macroeconomic environment. Early-stage startups such as 42 Card Solutions, Falcon and Knight Fintech are also in talks with investors to raise fresh equity.

Challenges remain: Industry experts say that while there might be investor interest, these B2B fintech infrastructure providers operate in a tough segment as they have to prepare themselves for long, tedious product build-outs and sales cycles with banks. Also, it is imperative for these players to work with large banks as investors assess them for the moat created.

Midcap IT firms likely faring better than their larger peers: analysts

Analysts are of the view that midcap software services companies such as Persistent Systems, L&T Technology Services (LTTS), Cyient and KPIT Technologies are faring better than their larger peers in battling the broader slowdown in the sector. This is due to the rise in demand for engineering and R&D (ER&D) services.

What’s working? A combination of factors has worked out for the midcaps, despite macroeconomic concerns, said outsourcing expert Pareekh Jain. “We see the midcaps winning several larger deals which could be due to clients taking some of these cost takeout deals to these players out of ‘large player fatigue’ leading to good large deal wins in the segment.”

Beating projections: LTIMindtree reported a 2% on-year dip in net profit for Q2 FY23 and an 8.2% growth in revenue. On a sequential constant currency basis, the company reported 1.7% revenue growth, all of which beat estimates. Similarly, LTTS saw its growth led by transportation and plant engineering verticals with a 3.2% constant currency sequential revenue growth.

Yes, but: Much like the large caps, the midcap firms will also be driving their margin growth through internal utilisation improvement and operational efficiencies as they have also called out macro uncertainties and delayed decision-making. For instance, Happiest Minds, which missed Street estimates to report sequential CC revenue growth of 3.6%, saw wage hikes impact operating margins.

Also read | Stars of Indian IT companies dim amid challenging demand situation

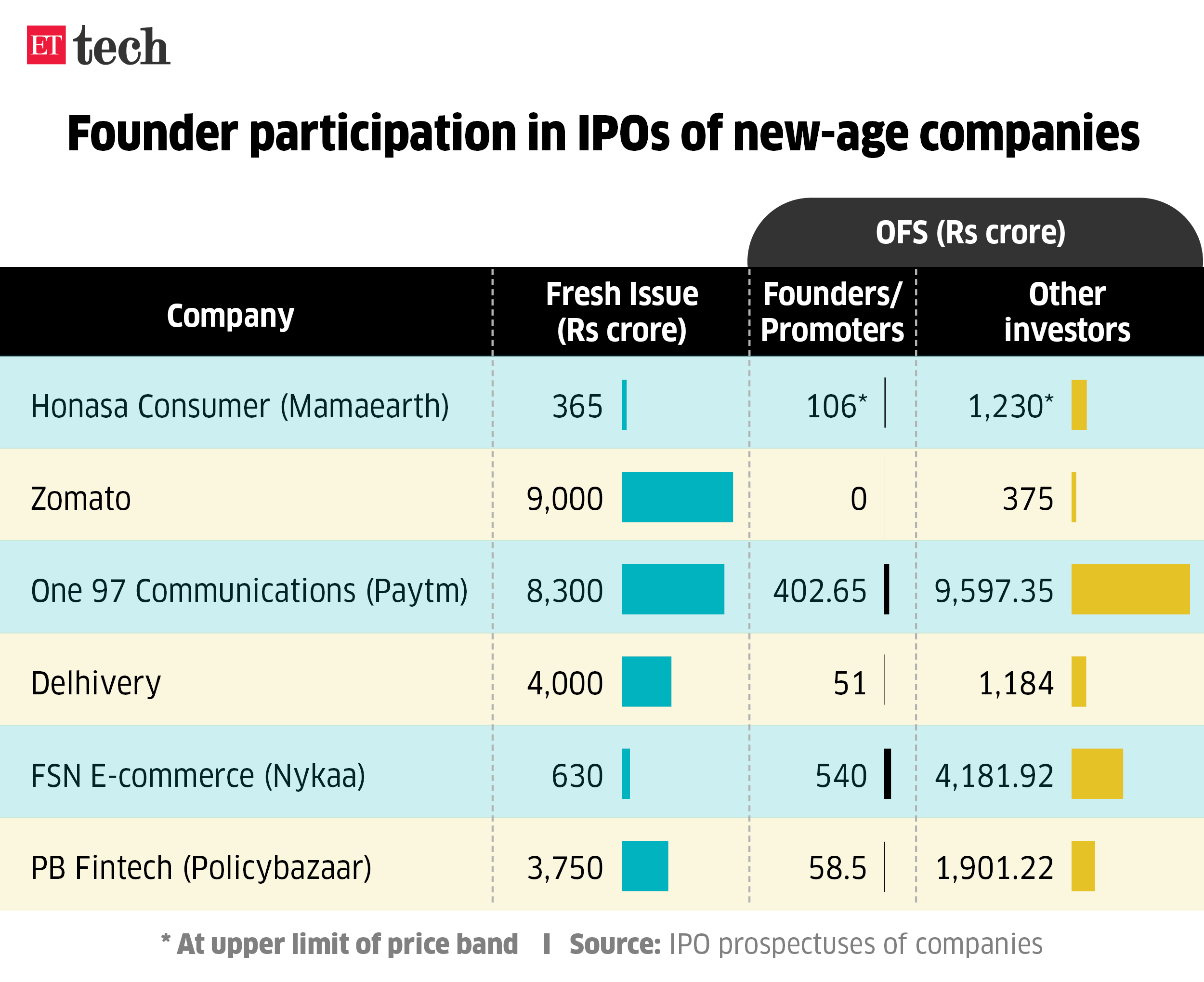

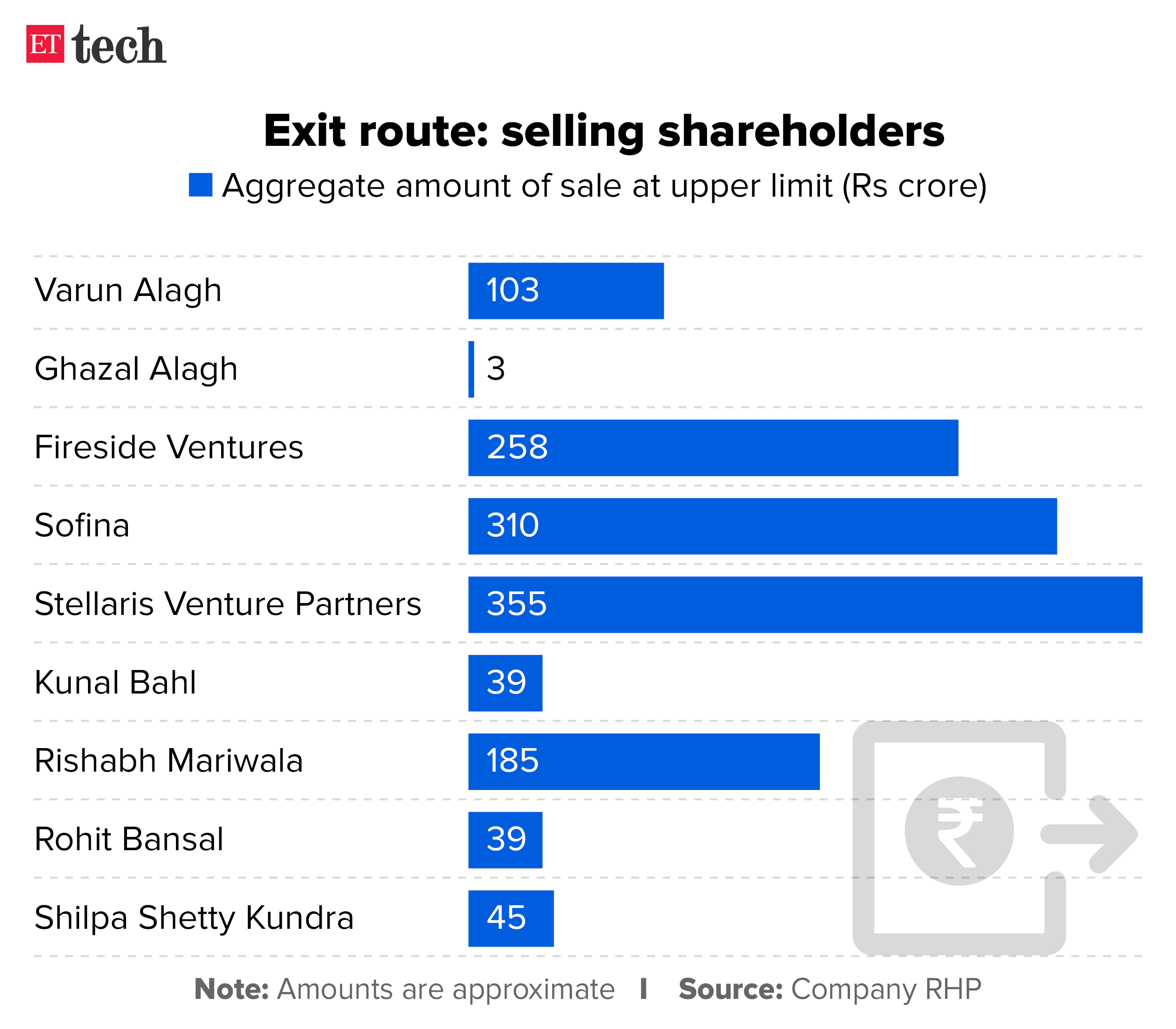

Mamaearth founders to sell 2% stake; follow previous new-age IPOs

%20Varun%20Alagh%20and%20Ghazal%20Alagh,%20cofounders,%20Mamaearth.jpg)

Mamaearth cofounders Varun Alagh (left) and Ghazal Alagh

Mamaearth founders Varun Alagh and Ghazal Alagh intend to sell 32.86 lakh shares from their overall holding of 10.67 crore shares in the ongoing initial public offering (IPO) of the beauty and personal care brand’s parent, Honasa Consumer Ltd.

Interestingly, founders or promoters participating in the IPOs of their companies to sell stakes is emerging as a trend among new-age companies.

Liquidity event: With a price range of Rs 308-324 per share for the offering, the Alaghs are projected to raise a combined Rs 101.22 crore to Rs 106.47 crore through this transaction.

The sale of stakes by promoters in their companies is generally perceived as a negative signal by both the markets and public investors.

The reason: According to CEO Varun Alagh, the founders wanted to build confidence in selling shareholders by participating in the stake sale. Explaining the decision, he said, “Around 97% of our ownership continues to be in the company … so it’s not like we’re parting away with something considerable. This was an event where we also chose to generate some liquidity for ourselves.”

Also read | Mamaearth IPO: Meet Ghazal and Varun Alagh, cofounders of Honasa Consumer

Indian healthtech firms to generate $37 billion by 2030: report

%20(1).jpg)

The Indian digital health market is estimated to expand to $37 billion by 2030, from the last estimated $2.7 billion, as per a joint report from consulting major Boston Consulting Group and Singapore-based venture capital firm B Capital.

Data decoded: In 2022, epharmacy led with a $1.1 billion market size, but represented only 3.5% of the retail pharmacy sector. This is expected to expand to $12 billion by 2030 with a 12-15% market penetration.

According to the report, e-pharmacy is estimated to be a $10 billion market by 2030, with surgery aggregation and healthcare financing at $5 billion each, while teleconsultation and fitness & specialty care will be worth $3 billion each.

Premji Invest saw three long-term partners leaving firm this year

Former Wipro chairman Azim Premji

Premji Invest, the private investment arm of former Wipro chairman Azim Premji, has been rocked by the exit of three of its four long-term partners this year. The most recent to leave was Rajesh Ramaiah, who resigned in August after a 13-year stint with the Bengaluru-based investment firm.

What is driving this? Confirming the exits of three partners in the course of the past six to eight months, a representative for Premji Invest said, “this is because each of the partners completed approximately 12-15 years, closed three funds, and have different aspirations in their personal journey.”

“This is also in line with the firm’s philosophy of having partners rotate approximately after 15 years and on completion of three funds,” the spokesperson added.

Other exits: Rahul Garg, who led investments across banking and financial services including insurance, payments as well as in the consumer and retail sectors, left early in 2023. So too did Atul Gupta, who oversaw growth investments in the enterprise and consumer technology, education, healthcare and business services sectors. While Garg had put in 12 years at the firm, Gupta was a veteran who’d been with Premji Invest since 2008.

Also read | Infosys loses another veteran to rival company

Fintech firm Perfios rejigs its top deck

Sabyasachi Goswami, CEO, Perfios

Perfios, a Bengaluru-based fintech company, has made a slew of changes to its top deck as it prepares for an IPO.

The reshuffle: Cofounder Debasish Chakraborty has transitioned from being the CTO to a mentor for the technology team. He will continue to be on its board. Sumit Nigam, previously the head of engineering at Tata Digital-owned BigBasket, is the new CTO. Anu Mathew has been named as the first chief human resources officer.

Quote, unquote: The changes are part of the company’s preparation for a public listing over the next 18-24 months as well as global expansion, chief executive officer Sabyasachi Goswami told ET.

“A public listing and global expansion require strengthening the team not only just at a C-suite level, but also across the organisation and that’s why we have hired at multiple levels over the last 12-18 months. It has been a gradual process,” he said.

Also read | Fintech startup Perfios announces employee stock buyback worth $18.5 million

Other Top Stories By Our Reporters

Kulmeet Bawa, president and managing director, SAP Indian Subcontinent

SAP India leans on AI tools to up play in mid-market cloud space: As much as 65-70% of German business software giant SAP’s cloud-based solutions adoption in the Asia Pacific and Japan region comes out of India, said Kulmeet Bawa, president and managing director, SAP Indian Subcontinent. “Today, if you look at our ERP (enterprise resource planning) cloud version, India’s is one of the fastest market growths that I’m seeing, highest adoption in the world,” he told ET in an interview.

Angel One makes first acquisition through Dstreet Finance: Mumbai-based stock broking firm Angel One has acquired fintech startup Dstreet Finance for an undisclosed amount, as the company seeks to focus on inorganic growth to enhance its product offerings and bolster distribution.

ETtech Explainer | Joe Biden’s sweeping executive order on regulation of AI: The order builds on voluntary commitments already made by 15 technology companies and its signing comes at a time when the European Union is nearing final passage of a sweeping law to rein in AI harms. Read the full explainer here.

Freshworks revenue rises 19% to $153.6 million in September quarter: Homegrown software-as-a-service major Freshworks has raised its full-year 2023 financial forecast midpoint for adjusted operating profit to $40 million against its previous forecast of $28 million. Revenue for the quarter rose 19% year-on-year to $153.6 million.

Global Picks We Are Reading

■ After a boom and bust, the chip industry is regaining its health (WSJ)

■ DeepMind’s cofounder: Generative AI is just a phase (MIT Technology Review)

■ Microsoft pioneers use of generative AI in software — at a price (Financial Times)