Also in this letter:

■ Sale of Ola Electric scooters drops to 130-200 a day

■ CoinDCX halts crypto withdrawals, sparks anger

■ MeitY open to changing IT rules as ecosystem evolves: minister of state

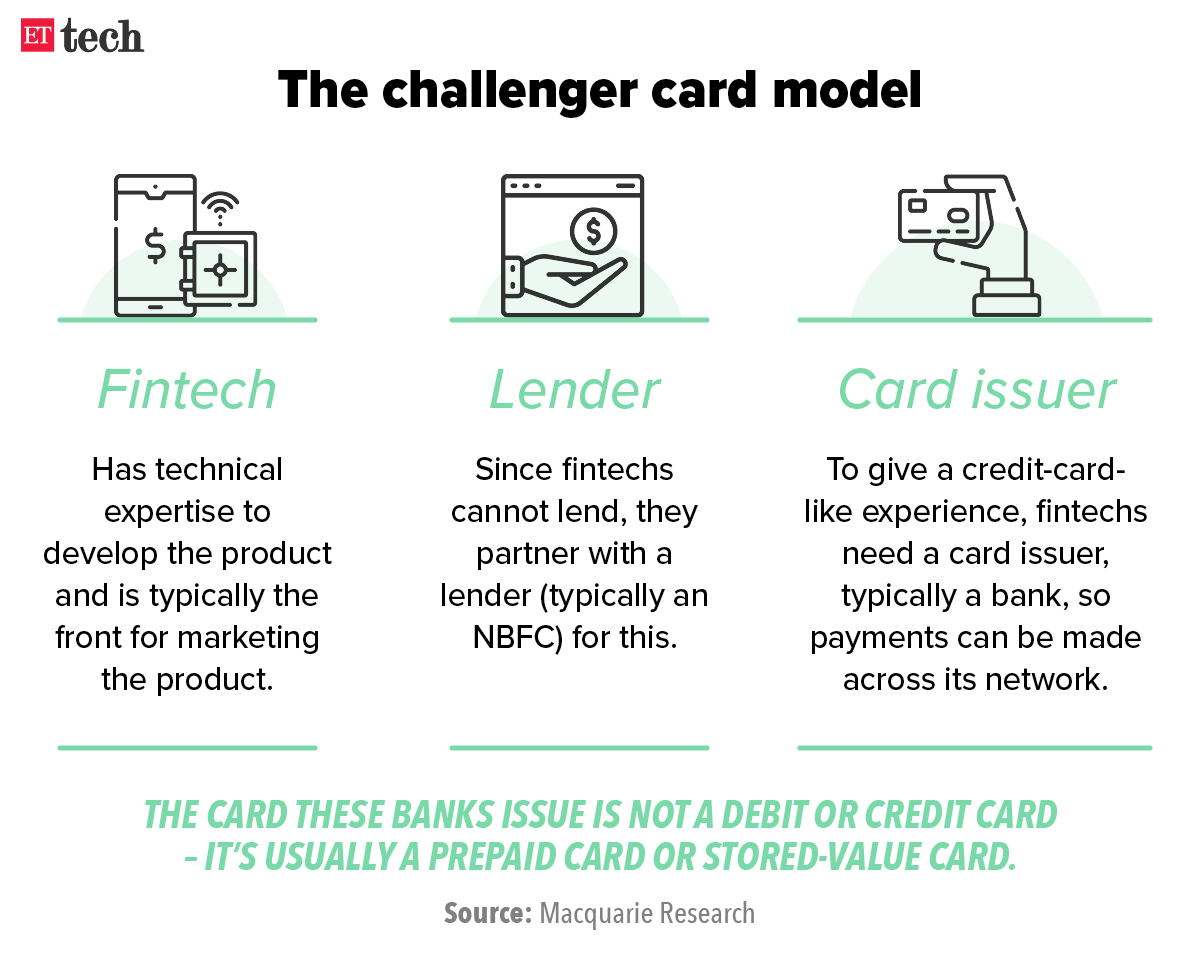

Fintechs seek six months to comply with RBI credit rule

At a meeting on Thursday evening, fintech companies decided to seek an extension of at least six months for Reserve Bank of India latest mandate, which has sent credit card challengers and other card-based fintechs into a tizzy.

Two people who attended the meeting, arranged by Digital Lenders Association of India (DLAI), told us they see the extension request as the “most critical” part of the ongoing issue.

Catch up quick: The central bank had on Monday barred non-bank wallets and pre-paid cards from offering credit lines on fintech platforms.

We reported on Wednesday first that fintech industry associations plan to petition the government and the RBI, and ask for rationale behind the RBI’s circular.

Multi-pronged: Our sources said there were common themes across representations being finalised by industry associations such as the Payments Council of India, under the Internet and Mobile Association of India, and the Fintech Association for Consumer Empowerment (FACE).

Quote: “I can tell you fintech investors are really spooked. It is not about just the latest circular but about what’s next from the regulator,” a fintech founder said.

Focus on fintech: In January, the RBI set up a fintech department headed by executive director Ajay Kumar Choudhary, which recently outlined its three-year plan as part of the RBI’s Payments Vision 2025.

This included a discussion paper on financial regulations for Big Tech, and rules for buy-now-pay-later (BNPL) products and storage of payments data in India.

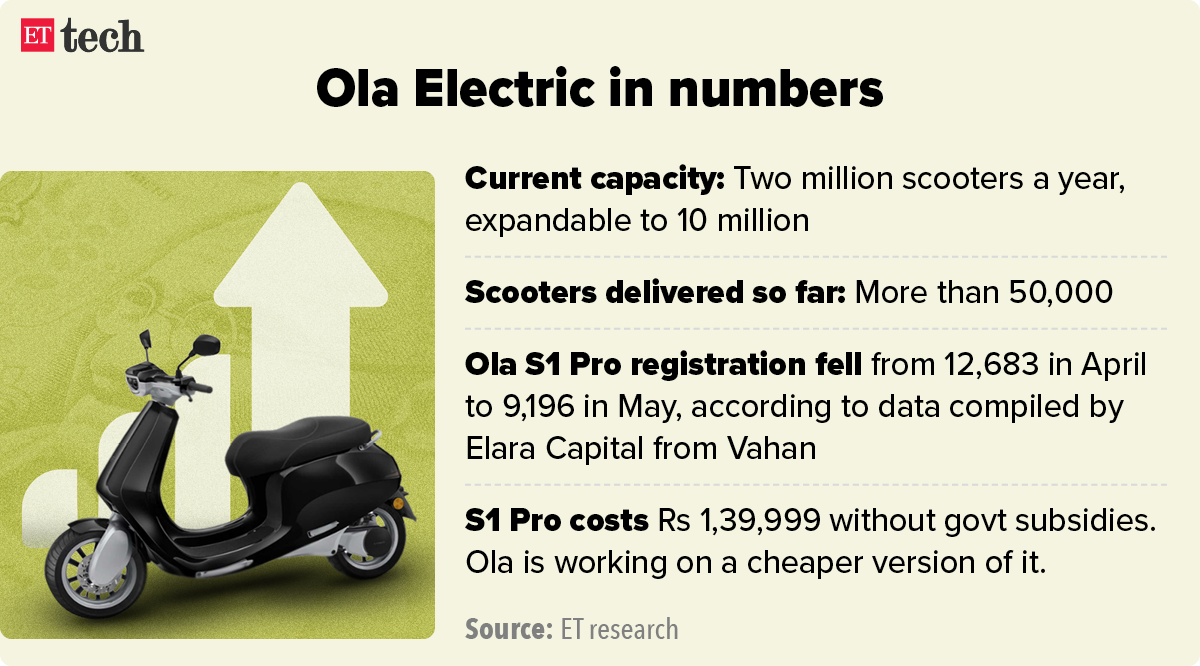

Sale of Ola Electric scooters slumps to 130-200 a day

Electric vehicle maker Ola Electric has been selling only 130-200 of its S1 and S1 Pro scooters a day for the past two weeks, after it moved away from the multiple-payment-window model and started accepting full payments for its scooters at one go, two sources told us.

Several sources told us the company sold around 500 scooters a day for three to four days after ditching the multiple payment window model, but sales have slumped since.

The company switched to the new model on May 28. Earlier, customers could only buy the EVs by making four partial payments on specific dates.

Troubling signs: The company has also offered employees a discount of around Rs 10,000 on the scooters, a source told us.

Some customers have been receiving their scooters in 48 hours, a sign of a shrinking order book for Ola Electric. Just a few months ago, Ola Electric was being criticised for long delivery delays, as we reported on January 18.

Long road ahead: Even if Ola manages to sell 1,000 scooters a day, that translates to only 365,000 scooters a year, well below its ambition of making 10 million scooters a year. To date, the company has delivered about 50,000 vehicles.

Fires hit sales: The lukewarm response to Ola Electric’s scooters comes after a spate of fires involving EVs made by half a dozen firms, including Ola Electric, Pure EV and Okinawa.

Overall sales of EV two-wheelers dropped in May for the first time in months, according to data from Vahan. Ola Electric saw its sales drop by 31% month-on-month, the biggest such slump after Hero Electric.

Also Read:Nexon electric car catches fire, Tata Motors announces probe

CoinDCX halts crypto withdrawals, sparks anger on social media

Crypto exchange CoinDCX had paused all crypto withdrawals without informing its users in advance, causing a furore on social media.

The recent liquidity crises at several institutions, including Celsius Network, which paused crypto withdrawals and transfers, has stirred fear among Indian retail, we reported on June 21.

Yes, but: CoinDCX claimed it halted withdrawals to strengthen its safety protocols.

“The restriction is an enhanced measure to strengthen our safety protocols and was gradually initiated over the past one month for multiple users,” a spokesperson for CoinDCX said. “This measure involves a series of steps such as improving know your customer (KYC) coverage, enhancing the risk framework for crypto deposit and withdrawal, and integrating with compliance and monitoring tools.”

After the news went viral on Twitter, CoinDCX’s head of marketing, Ramalingam S, wrote on June 20 that “while some wallets are under maintenance there is a larger compliance requirement due to evolving regulatory needs resulting in increased scrutiny. The new process is being rolled out in phases, and it will reach all users in due course.”

The company published a blog post the same day, telling users it would release a policy in the next 14 days.

Investors lose: Retail investors say CoinDCX’s decision prevented them from cutting their losses and moving their crypto assets to other platforms that may offer better prices.

The overall crypto market has lost over 70% of its market cap since November due to high inflation, rising interest rates, the Ukraine-Russia conflict and fears of a looming recession.

TWEET OF THE DAY

MeitY open to changing IT rules as ecosystem evolves: minister of state

The Ministry of Electronics and Information Technology (MeitY) is open to changing the Information Technology Rules, 2021 in future as the ecosystem develops further, Minister of State for IT Rajeev Chandrasekhar said on Thursday.

Addressing an open house discussion and consultation with various stakeholders on the proposed changes to the IT Rules, Chandrasekhar said the rules would always keep evolving.

Companies should not, however, cite higher costs of compliance to not follow the rules, Chandrasekhar said, adding that compliance would always add to costs rather than no compliance norms at all.

The IT ministry’s open house consultation was attended by over 100 participants.

Several stakeholders raised concerns about the requirement for social media intermediaries to acknowledge and resolve user concerns within 72 hours. Others suggested that the ministry should clarify how the grievance appellate committees will work.

Fundamental VC targets $130 million corpus for first fund

Early-stage venture capital firm Fundamental VC has launched its maiden fund with a target corpus of $130 million.

The sector-agnostic fund will invest in pre-seed and seed rounds across consumer internet, healthcare, insurance, financial services, Software-as-a-Service (SaaS), gaming, and artificial intelligence, a senior executive told ET.

The Bengaluru-based firm is operating the fund on a zero-carry model unlike other funds that operate on the 2-20 model, where the general partners (GPs), or the managers of these funds, get 2% (of the fund managed) as management fee and take a 20% carry on the returns generated. Therefore, higher the returns, higher the carry.

The firm will raise the money in phases as parts of cohorts from investors. The fund will also deploy the capital in stages. Rather than waiting for the whole fund tenure to be over to return capital, the fund will periodically make payouts to investors.

The fund will invest up to $1.5 million in each startup, and aims to support 30 startups over two years.

Other Top Stories By Our Reporters

Pine Labs acquires Setu for $70-75 million: Digital payments service provider Pine Labs has acquired application programming interface (API)-based infrastructure company Setu in a cash-and-equity deal for about $70-75 million. Pine Labs chief executive Amrish Rau said the deal was significant but refused to disclose its exact size.

Offline centres don’t mean edtech is failing, says Unacademy CEO: Unacademy cofounder Gaurav Munjal said in a series of tweets on Thursday that offline centres set up by online education firms aren’t a sign that edtech is falling. “Opening a few centres in two of our categories should not be linked to edtech failing. Correlation is not causation,” Munjal wrote.

Global Picks We Are Reading

■ Meta Made Millions From Ads That Spread Disinformation (Wired)

■ Businesses risk ‘catastrophic financial loss’ from cyberattacks, US watchdog warns (The Verge)

■ Instagram tests child age verification, but falls short of full ID checks (WSJ)