Also in this letter:

■ Zomato’s Goyal transfers his Blinkit shares to Tiger Global

■ Digital rupee rollout to begin this year: economic affairs secretary

■ Govt close to finalising incentives under battery swap scheme

Meta says Facebook’s growth slowing in India, its largest market

Meta, which on Thursday reported the first ever quarter-to-quarter drop in Facebook’s daily active users in its history, is seeing the platform’s growth slow in India too, the company said during an earnings call.

The numbers: It had earlier reported a small but significant drop in its global daily active users to 1.929 billion from 1.930 billion in the previous quarter. Analysts expected it to report 1.95 billion.

- Facebook also reported 2.91 billion monthly active users globally in the fourth quarter, the same as in the previous quarter.

- The company’s tepid performance caused its stock to sink as much as 22%.

Meta said that user growth in India had slowed down during the quarter partly because of an increase in data costs and partly due to increased competition.

“User growth in India was limited by an increase in data package pricing. We believe competitive services are [also] negatively impacting growth, particularly with younger audiences,” said Dave Wehner, chief financial officer, Meta.

Prices of data plans of Bharti Airtel, Reliance Jio and Vodafone Idea rose by up to 25% in the last quarter of 2021.

Globally, Meta blamed Apple’s privacy changes and increased competition for users from rivals such as TikTok, which is banned in India, for the drop in its active users.

But Shah said that in India, Facebook faced stiffer competition from OTT players than from short video platforms, as many Indians binge-watch shows on their smartphones.

Spotify’s podcast bet pays off: Meanwhile, Spotify reported fourth-quarter revenue above analysts’ estimates, fueled by a surge in ad sales from a big investment in newer services such as podcasts, while recording a 16% increase in paid subscribers.

- Total monthly active users rose 18% to a record 406 million.

- But the company forecast 183 million paid subscribers in the current quarter, below expectations of 184 million.

- Revenue is expected to meet estimates of €2.60 billion.

Financials: Quarterly revenue rose to €2.69 billion ($3.04 billion) for the quarter from 2.17 billion a year earlier, and above the €2.65 billion expected by analysts, according to IBES data from Refinitiv.

Zomato’s Deepinder Goyal transfers his Blinkit shares to Tiger Global

Deepinder Goyal

Zomato founder and chief executive Deepinder Goyal has transferred all his shares in Blinkit’s parent firm Grofers International Pte. Ltd. to US investment firm Tiger Global, according to regulatory documents accessed by ET.

According to filings with Singapore’s Accounting and Corporate Regulatory Authority (ACRA), Goyal transferred 42,371 preference shares to Tiger Global’s Internet Fund III. After the transfer, Tiger Global held 2.96 million shares in Blinkit’s parent, with a total paid up capital of $107.55 million, the filings showed.

The development was first reported by Deal Street Asia.

Quick commerce battle: The share transfer comes as Zomato is ramping up its investment in Blinkit (formerly Grofers), after abandoning its plans to enter the e-grocery segment for a second time since the pandemic hit.

We reported in November 2021 that Zomato was in talks to invest up to $500 million in Blinkit, marking one of its largest investments ever in a startup. The proposed deal marked an extension of Zomato’s battle with Swiggy into the so-called ultrafast commerce segment, which has been attracting a slug of investor capital globally.

Swiggy also recently allocated $700 million to grow its quick commerce vertical, Instamart.

Goyal’s personal investments: On December 10, startup investor Mohandas Pai had raised concerns on Twitter around Goyal’s “conflict of interest” in having a personal investment in Shiprocket, which Zomato later invested in.

To this, Goyal replied, “There was no conflict of interest to begin with… This personal investment was one of the key reasons we got closer to Shiprocket (and its founders). That’s how we discovered that there was potential long-term strategic fit between the two companies.”

In December, Goyal exited his $100,000 personal investment in Shiprocket, in which Zomato had co-led a $185 million round.

Tweet of the day

Digital rupee will start to be rolled out this year: economic affairs secretary

The Reserve Bank of India’s digital currency is expected to be rolled out in the coming financial year and the requisite legislative changes have been proposed in the finance bill, economic affairs secretary Ajay Seth told us in an interview.

“Once the finance bill is approved, a legislative framework will be available for RBI to [roll it out],” he said, adding that a start will be made in FY23.

Will open up opportunities: The proposed central bank digital currency will open up opportunities, he said, creating an ecosystem for products and services.

Seth said it was up to the RBI to decide whether to address the wholesale or retail market first.

Crypto could still be banned: Seth also said that providing tax clarity on virtual currencies did not mean the government was legitimising them or that a ban was off the table. He said India was in discussions with institutions such as the International Monetary Fund and the Financial Stability Board on crypto, and that the issue was also likely to come up at the G20 meeting.

Seconded: Revenue secretary Tarun Bajaj echoed his views in a separate interview, saying the tax rules for virtual assets didn’t necessarily confer legitimacy to them. “We were keen to bring clarity in the taxation regime for these assets. It is not an illegal activity. If it had been illegal, we would have nabbed those dealing in it,” he added.

Also Read: Blockchain not best for digital currency, experts say

India close to finalising incentives under new battery swap scheme

The government is expected to finalise incentives under its new battery swap scheme for electric vehicles (EVs) within the next two months, according to a Reuters report.

To increase the adoption of electric vehicles, Finance Minister Nirmala Sitharaman said in her budget speech that the government will release a policy for battery swapping this year to bring in standardisation and interoperability.

Tell me more: In a boost for sectors like last-mile delivery and ride-sharing, the policy will initially focus on battery swap services for electric scooters, motorcycles and three-wheeled auto-rickshaws.

The government is likely to offer EV owners an incentive of up to 20% of the total subscription or lease cost of the battery and this will be in addition to what they already get for buying clean vehicles, the person said.

Charged up: In 2019, India set aside Rs 10,000 crore ($1.3 billion) to promote EVs by giving incentives directly to buyers, but only about 10% of this has been used. Incentives for battery swapping will likely be given from the same fund, the official said.

Apple makes progress in India as iPhone sales rise 34%

Apple had its strongest quarter for iPhone sales in India yet, a sign the company is making progress in the world’s fastest-growing smartphone market.

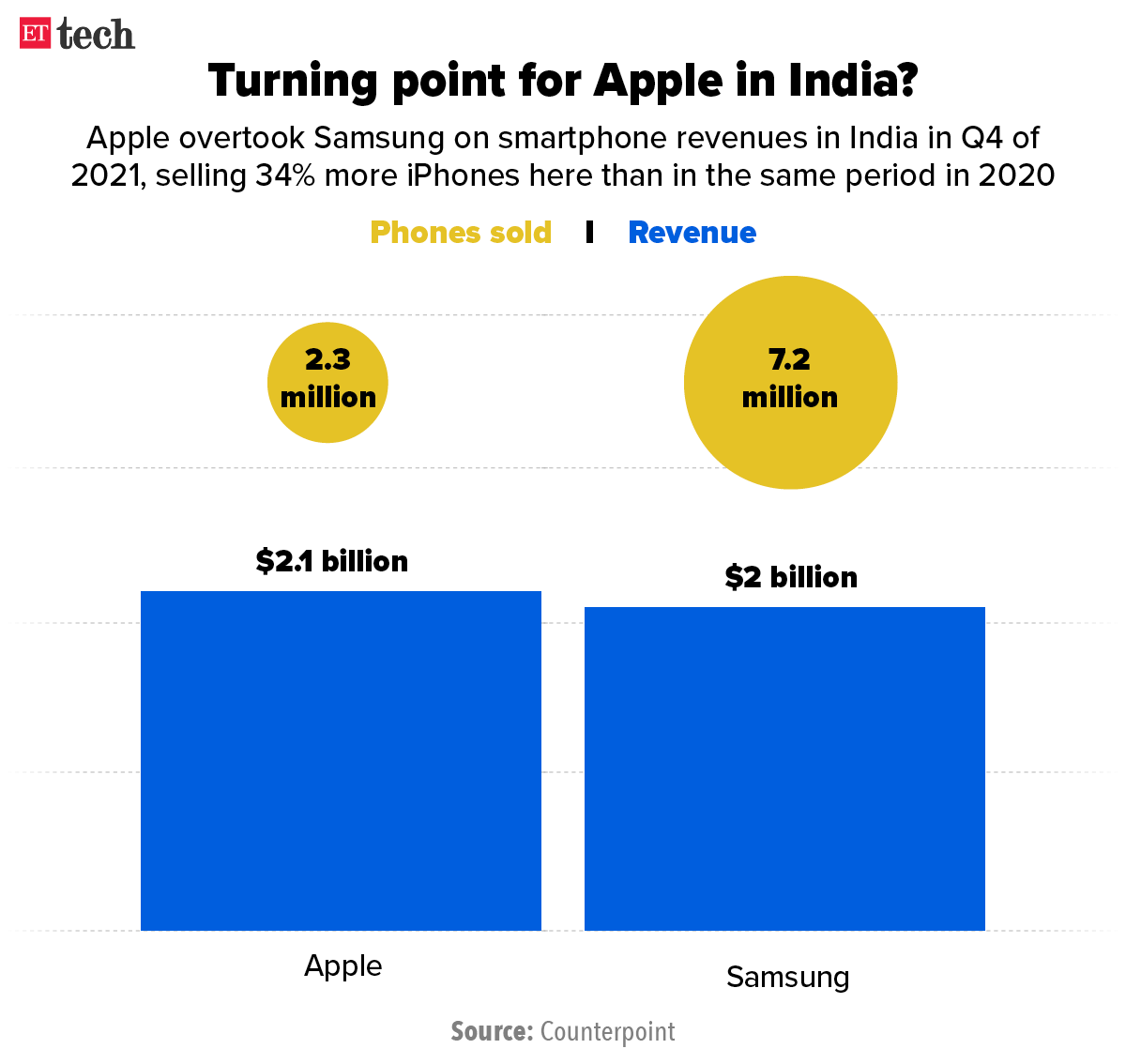

Sales increased to 2.3 million units in the fourth quarter, up 34% from a year earlier, according to numbers from the market research firm Counterpoint. Xiaomi and Samsung Electronics Co. sold 9.3 million and 7.2 million smartphones for the quarter respectively, leading in terms of units.

Bearing fruit: Apple appears to have pulled in more revenue than any of its rivals, however, because of the iPhone’s high price tag, according to Counterpoint’s calculations. The US company took in an estimated $2.09 billion for the quarter, edging aside Samsung with revenue of about $2 billion.

A tough sell: While Apple has become the most valuable company in the world on the popularity of its iPhone, it has struggled in India. For the most recent quarter, the average iPhone selling price in the country was $908, while Samsung’s was $278 and Xiaomi’s was $172, according to Counterpoint.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.