Also in this letter:

■ Javier Olivan to replace Sheryl Sandberg as Meta’s COO

■ Curefoods raises $43 million led by Winter Capital

■ India considers appeals panel to regulate social media firms

ExpressVPN rejects new VPN rules, to pull all servers from India

ExpressVPN has announced that it will remove all of its VPN servers in India in response to the government’s new rules for VPN companies, which are scheduled to take effect on June 27.

Strong words: “With a recent data law introduced in India requiring all VPN providers to store user information for at least five years, ExpressVPN has made the very straightforward decision to remove our Indian-based VPN servers,” the company said in a blog post.

“ExpressVPN refuses to participate in the Indian government’s attempts to limit internet freedom,” it said.

It added that the new law, intended to help fight cybercrime, is “incompatible with the purpose of VPNs, which are designed to keep users’ online activity private”.

“We believe the damage done by potential misuse of this kind of law far outweighs any benefit that lawmakers claim would come from it,” it said.

Service will continue: The company said its users will still be able to use ExpressVPN to connect to servers that will give them Indian IP addresses and allow them to access the internet as if they were located in India. It said these ‘virtual’ India servers would be physically located in Singapore and the UK.

Catch up quick: In late April, the Indian Computer Emergency Response Team (CERT-In) issued rules that require VPN service providers to maintain logs of users, including their real names, IP addresses, usage patterns, and other identifying data for five years – even after they stopped using the service.

The rules quickly drew criticism from privacy experts and VPN companies such as NordVPN, SurfShark and, of course, ExpressVPN. CERT-In later clarified that the new rules would not apply to enterprise and corporate virtual private networks.

On May 11, a senior official told us the government had the right to seek VPN records to combat cybercrimes.

And on May 19, Minister of State Rajeev Chandrasekhar said VPN service providers that did not adhere to the rules were “free to leave India”.

Blow to privacy: India ranks among the top 20 countries on VPN adoption, according to AtlasVPN’s global index. The number of VPN users in India surged in 2020 and 2021, as they did worldwide, as companies secured their networks with more people working from home.

Many are corporate users but activists, journalists, lawyers and whistleblowers also use VPNs to access blocked websites, secure their data and protect their identity.

Also read: What India’s new VPN rules mean for your privacy

Javier Olivan to replace Sheryl Sandberg as Meta’s COO

Meta Platforms veteran Javier Olivan will replace Sheryl Sandberg as the firm’s No. 2 executive. Sandberg has announced she is stepping down from Meta. She has served as chief operating officer at the social media giant for 14 years, having joined from Google in 2008, four years before Facebook went public.

Olivan is taking over as COO after playing a crucial but largely behind-the-scenes role stoking the company’s explosive growth for 15 years.

Yes, but: Meta CEO Mark Zuckerberg said in a Facebook post that he doesn’t plan to replace Sandberg in the company’s existing structure.

He said, “This role will be different from what Sheryl has done. It will be a more traditional COO role where Javi will be focused internally and operationally, building on his strong track record of making our execution more efficient and rigorous.”

Big shoes: Sandberg has led Facebook — now Meta’s — advertising business and was responsible for nurturing it from its infancy into an over $100 billion-a-year powerhouse.

While she has long been Zuckerberg’s No. 2, even sitting next to him — pre-pandemic, at least — in the company’s headquarters, she also had a very public-facing job, meeting with lawmakers, holding focus groups and speaking out on issues such as women in the workplace and most recently, abortion.

Controversy: As the company’s second most-recognised face after Zuckerberg, Sandberg has also become a polarising figure amid revelations of how some of her business decisions for Facebook helped propagate misinformation and hate speech.

Edged out? Neither Sandberg nor Zuckerberg gave any indication that Sandberg’s resignation wasn’t her decision. But she’s also appeared somewhat sidelined in recent years, with other executives close to Zuckerberg becoming more prominent.

Clubhouse exit: Aarthi Ramamurthy, the international head of the audio-based social network, Clubhouse, has stepped down over a year after joining the company. Ramamurthy previously had stints at Meta, Netflix and Microsoft. She had also founded a Y Combinator-backed photography gear rental startup, Lumoid.

Also read: How Sheryl Sandberg rose to become Meta’s second-in-command

Tweet of the day

Curefoods raises $43 million led by Winter Capital

Cloud kitchen startup Curefoods has raised $43 million in a funding round led by Winter Capital, with participation from new investor Three State Capital and existing investors. The company also raised $500,000 in debt from venture debt firm Alteria Capital.

Started in 2020, Curefoods operates cloud kitchen brands like EatFit, Yumlane, Aligarh House Biryani and MasalaBox among others. The company is building a Thrasio style model — acquiring and scaling brands albeit in the food category in India. Earlier this year, it merged with rival Maverix, and the combined entity runs about 125 cloud kitchens across 12 cities, including Delhi, Mumbai, and Bengaluru.

Other done deals

- Tata owned Innovative Retail Concepts, which operates BigBasket, raised Rs 350 crore more from its holding company, Supermarket Grocery Supplies, according to regulatory filings sourced from Tofler. The latest investment was approved on May 24, the filings showed. ETtech reported in April that BigBasket had received a Rs 1,000-crore infusion from the holding company.

- Homegrown video streaming platform, Eloelo raised $13 million from KB Investments, Kalaari Capital and existing investors. The company has raised $16 million since inception. The new capital will be used to expand its tech and product, and foster new partnerships with creators.

India considers an appeals panel to regulate social media firms

In a first-of-its-kind move worldwide, India is planning to set up an appeals panel to reverse the content moderation decisions of social media firms, a source in the information technology ministry told Reuters.

The revelation came in a document seeking comments on plans for changes to IT rules, which took effect last year. The rules aim to regulate social media content, and make firms such as Facebook , YouTube and Twitter more accountable.

The document proposed one or more such appeal panels. It set a deadline of 30 days for appeals against decisions by company grievance officers. Panels themselves get a further 30 days to take up the matter.

Govt’s clampdown: The new plan is in line with the Indian government’s growing scrutiny of social media firms. Last year, the government introduced the IT rules to make tech giants like Google, Twitter and Facebook more accountable for the content posted on their platforms.

After they were announced, several social media companies lobbied against certain contentious clauses. These companies are already required to have an in-house grievance redressal officer and designate executives to coordinate with law enforcement officials. An appeals panel would make their operations more complex and further strain their relations with the government.

Also Read: India lines up banks for ONDC

India’s digital payments market set to touch $10 trillion by 2026

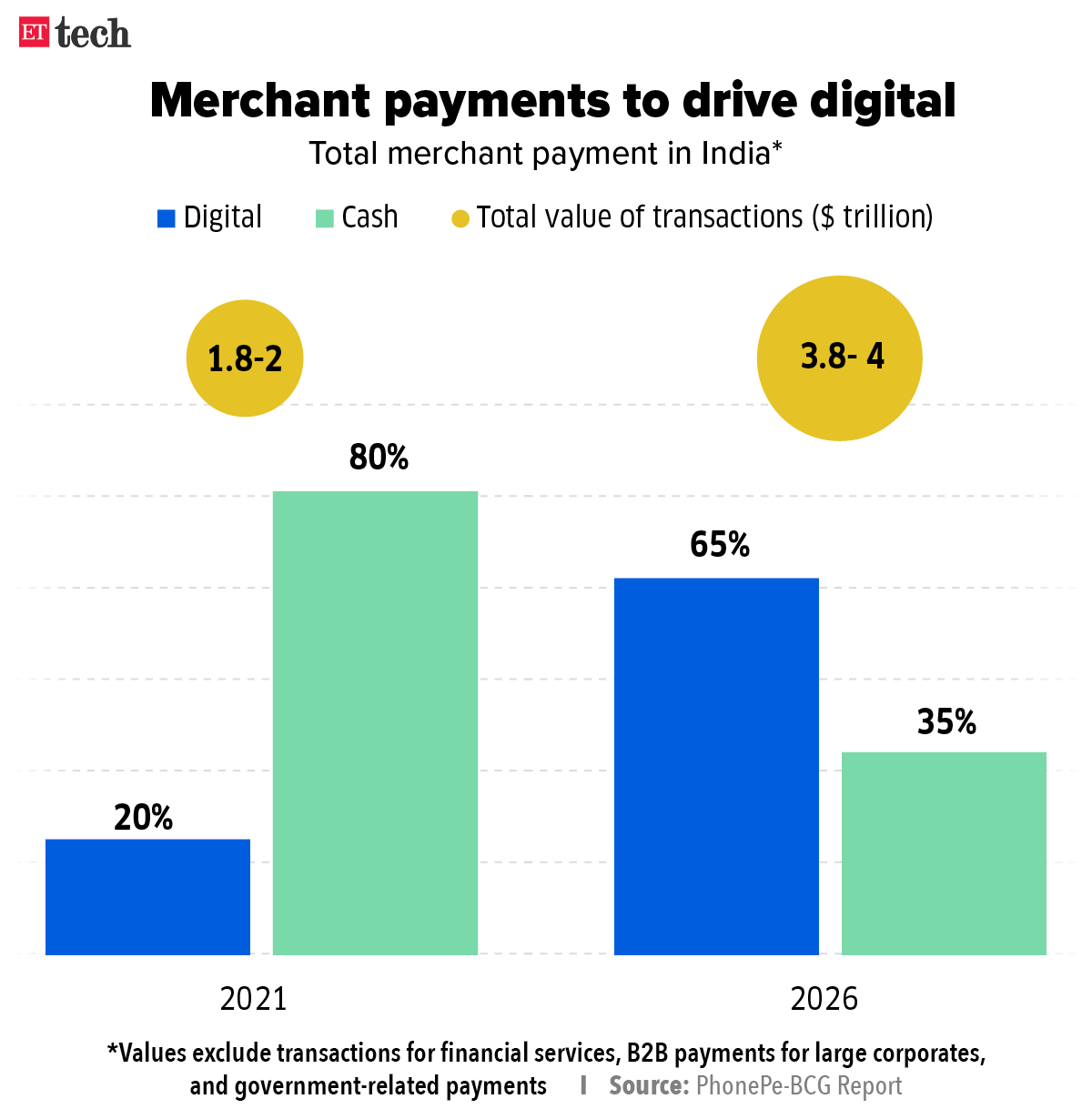

The ongoing digital revolution will triple India’s digital payments market to $10 trillion by 2026, according to a new report by digital payments firm PhonePe and Boston Consulting Group (BCG).

Digital instruments processed payments worth $3 trillion in India last year, and currently 40% of all transactions are digital, the report said.

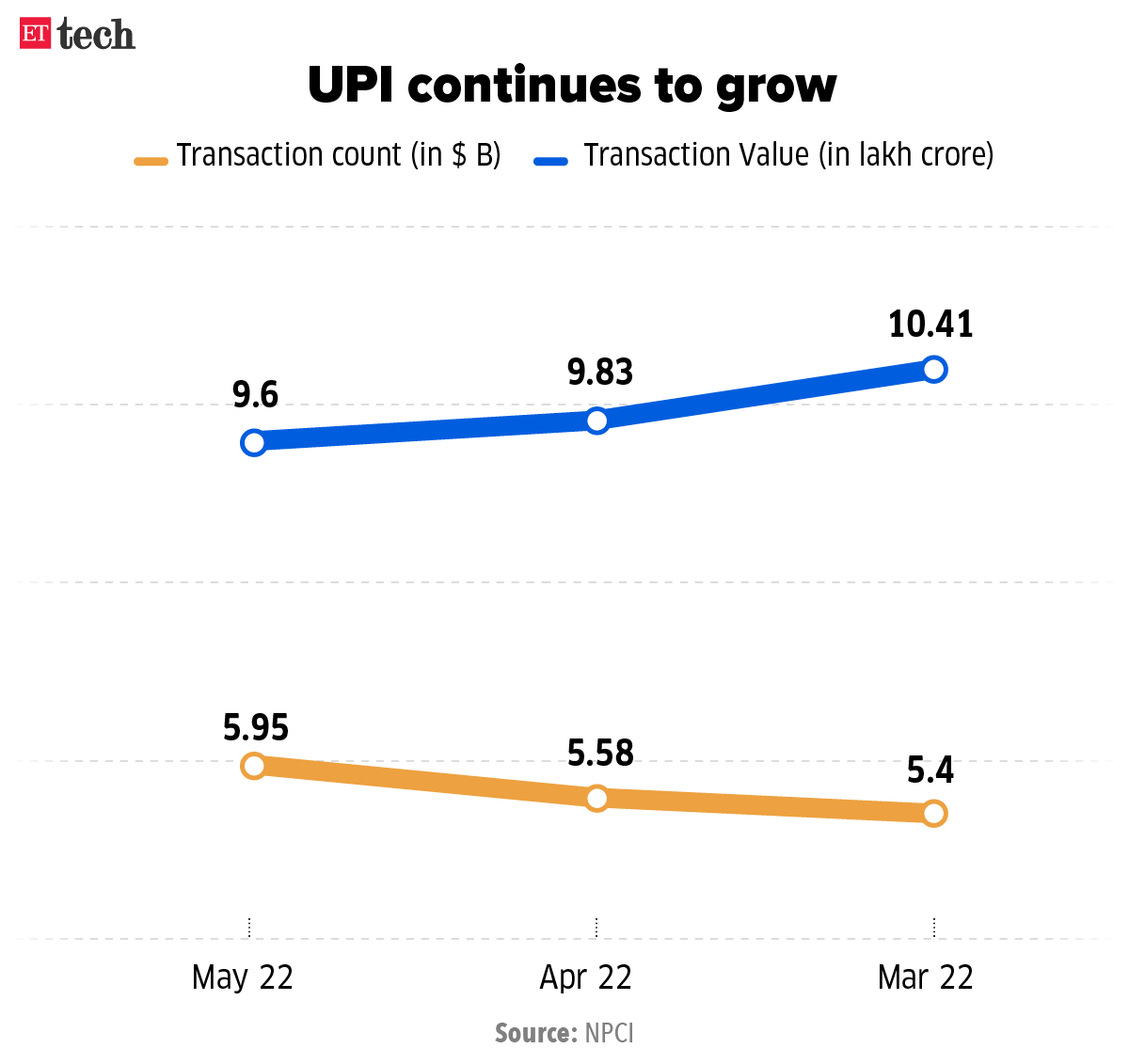

UPI magic: Since the advent of UPI, digital payments have skyrocketed in India. Last month, UPI clocked 5.95 billion transactions worth Rs 10.41 lakh crore. The report forecasts UPI will account for 73% of all digital payment volumes by 2026.

“UPI saw about a nine-fold transaction volume increase in the past three years, from five billion transactions in FY19 to about 46 billion in FY22, accounting for more than 60% of non-cash transaction volumes in FY22,” it said.

Challenges persist: Despite the strong growth in digital payments, issues like KYC norms, fraud and UPI outages continue to restrict wider acceptance.

“Currently, KYC is one of the key bottlenecks discouraging merchants and customers from signing up for digital platforms and e-wallets. While digital KYC means [such as] OKYC (offline KYC), VKYC (video KYC) are enabled for many players, they still come with friction when it comes to end-to-end digital KYC. Full KYC requires either a video or a physical touch point with a biometric device, said the report.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.