NPCI, which manages the digital payments network of Unified Payments Interface (UPI), is expected to invest around Rs 10 crore in ONDC, the people said. Approvals are already in place and the process is likely to be completed in the next 10 days, said one of them.

The government’s National Securities Depository Ltd (NSDL) and

are also expected to acquire stakes in ONDC. While the person said these proposals would also be finalised in 10 days, details weren’t available.

NPCI, NSDL and Bank of India didn’t respond to emails seeking comment till press time Tuesday. ONDC chief executive Thampy Koshy refused to comment, but sources close to the digital network confirmed the matter to ET.

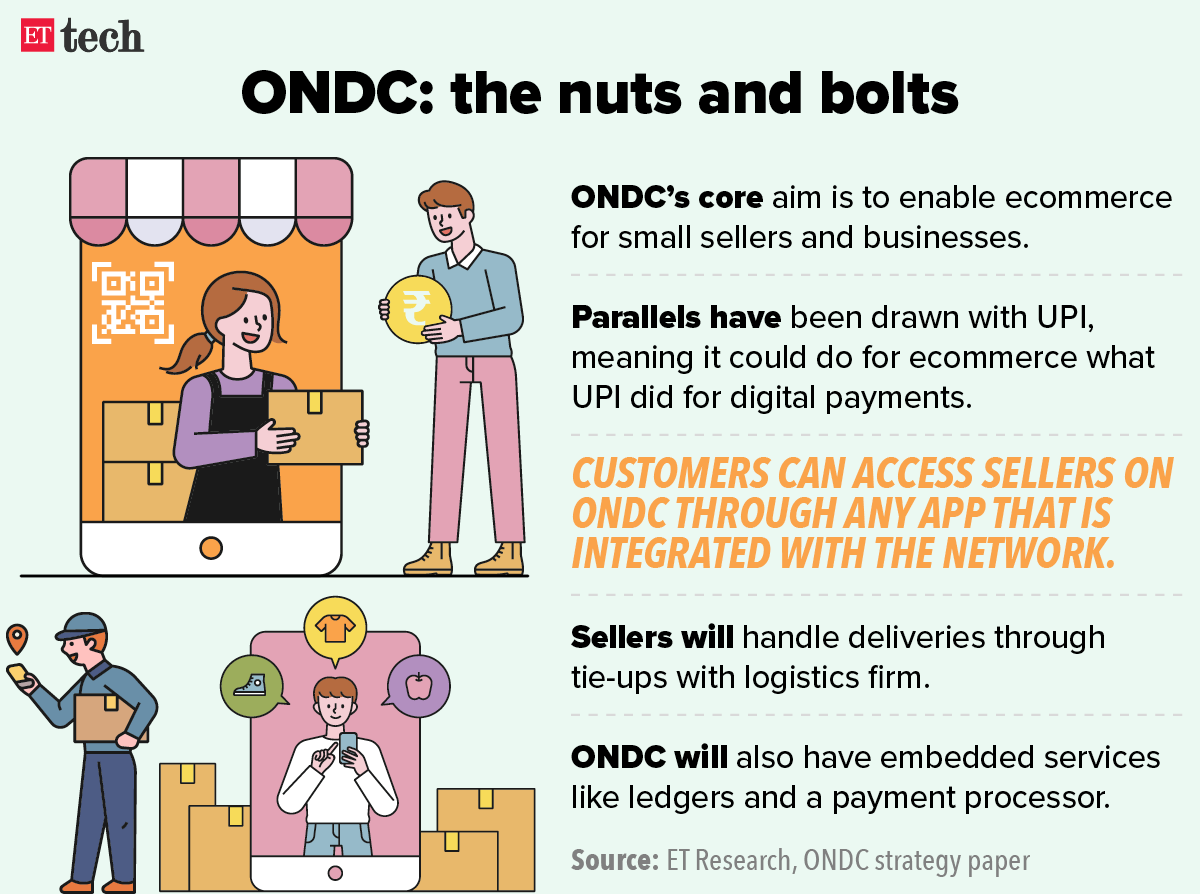

ONDC aims to dilute the dominance of large ecommerce firms like Walmart-owned Flipkart and Amazon India in the local market. In online commerce, experts believe, ONDC is primed to do what UPI has done to digital commerce: expanding the space and making the service accessible even at the grassroots level.

Both organisations are already working very closely and NPCI becoming a stakeholder will further strengthen that, said a person aware of the plans, adding: “It (the deal) is not done to make investment gains though.”

Discover the stories of your interest

NPCI chief executive Dilip Asbe is part of the ONDC advisory council.

ETtech

ETtechAccording to the person, ONDC will have a total of 20 stakeholders, who include private and public sector banks like , and . It had completed the paperwork for 17 entities by March this year, this person said. “The remaining three, which include NPCI, will be completed in the next 10 days.” Even as ONDC is preparing for a public launch in September, it has started the groundwork for enabling business-to-business (B2B) commerce transactions on the network. Two startups — B2B trade platform Rapidor and a retail tech firm Signcatch — are going to be the entities that will kickstart the B2B business on the network.

Also Read:

ETtech Explainer | ONDC: India’s bid to break ecommerce monopolies

A person closely associated with the platform said its B2B business could transform the way the retail market was operated in India. “The stockist is giving the kirana store two services: one is of giving me the product, second is actually giving me the credit, which is my working capital,” he said. “So, you have to evaluate the creditworthiness and recovery. So now, the buyer can give the history of digital transactions and help me get the credit which means this buyer can go to any stockists and buy any number of items. That stockist can also sell it to anyone,” he said.

The seller apps could customise the results sourced from the network once it is integrated into the network, he said.

“Players can put the language filter for the nearby language, text, audio, etc, and convert that search into ONDC protocol-compliant search in the network and pick up the relevant goods from anywhere in India. It can be customised for specific needs like garment manufacturers, textile and other sectors,” he said.

Signcatch debuted its seller-side platform Bech.app on ONDC in August. Other than onboarding sellers, it has also inducted financial service providers like insurers, lenders and banks on to the platform. It enables both business to consumers (B2C) and B2B transactions.

The startup has also partnered with logistics aggregators like Shiprocket, global payment aggregator Worldline, payments firm Razorpay, supply chain credit providers ePayLater and IT firm SAP to provide digital commerce solutions to all the sellers listed on its Bech platform.

“The Bech app is compatible across all MSME retail verticals and as an ONDC-compliant platform; it caters to various categories of sellers including — hardware, grocery, mobile, electronics, garments, agricultural goods and tools, and many more,” Signcatch founder and chief executive Sumit Duggal said.