Also in the letter:

■ Ecommerce growth slows in FY23

■ Gaming major Krafton to invest another $150 million in India

■ Senior execs desert startups for stable roles at big companies

New law on digital competition likely to regulate Big Tech

The corporate affairs ministry is mulling a separate legislation to regulate Big Tech instead of tweaking the existing Competition Act, which was amended recently, people aware of the matter said.

Committee report in works: An official committee, led by corporate affairs secretary Manoj Govil, will this month complete the first draft of its report on the need for ex-ante regulatory mechanisms for digital markets through a separate law.

It has concluded stakeholder consultations, including with local startups and big global players such as Apple, Amazon, Google, Meta and Twitter.

Quote, unquote: “Given the complexity of the issue and differing views of stakeholders, introducing a bill to this effect will take time. It will be a new law, so it will take some time,” said one of the persons, who did not wish to be identified.

ETtech Interview | Data Bill to make social media firms accountable: Ashwini Vaishnaw

Union minister for electronics and information technology Ashwini Vaishnaw

The Digital Personal Data Protection (DPDP) Bill will make social media companies operating in India more accountable, boost the business of the IT industry and change the way organisations process data of Indians, minister for electronics and IT Ashwini Vaishnaw said in an interview to ET.

On exemptions for the government: The exemptions for the government are exactly within the framework of the Constitution of India. There is a robust structure of the grievance redressal mechanism, the Data Protection Board, the TDSAT (Telecom Disputes and Settlement Appellate Tribunal) appeal and, finally, the Supreme Court, which will be applicable to everybody, including the government.

On increased compliance burden: The onus on every person or entity who collects citizens’ personal data will increase after the notification of the law.

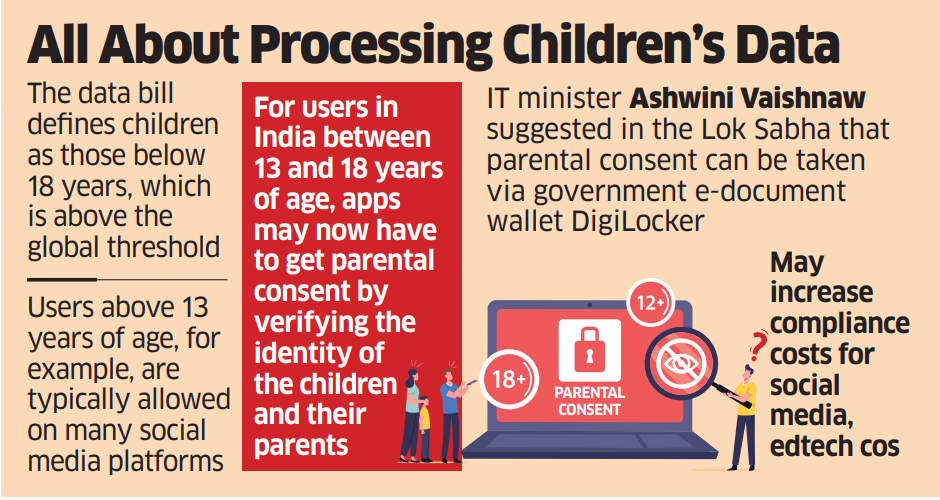

RS passes DPDP bill: The upper house of parliament on Wednesday passed the Digital Personal Data Protection (DPDP) bill, moving it a step closer to becoming the country’s first such legislation. Social media companies, whose data processing habits the bill aims to regulate, are raising concerns about the mandate to verify millions of children and their parents, and have also flagged it as a security risk.

Industry concerns: The bill defines children as anyone below the age of 18, whereas the European Union and other countries consider those below 13 as minors. For children, the bill requires parental consent for providing their data to digital intermediaries, who would then have to verify their identity. Having the ID on different apps installed on a child’s phone could pose a security risk for children as well as parents, industry experts said.

Experts added that edtech, health-tech and social media firms such as Meta’s Facebook and Google’s YouTube may be the most impacted by the provision.

Ecommerce growth slows down in FY23 as Covid effect vanishes

Growth for ecommerce firms slowed down in FY23, as tailwinds provided by the Covid-19 induced lockdowns, started to die down, according to a report by ecommerce enabler Unicommerce.

Dwindling numbers: The order volume growth of India’s ecommerce industry fell from 69.4% in fiscal year 2022 to 26.2% in FY23, according to the report. Growth in gross merchandise value (GMV) also slowed to 23.5% from 73.6%.

Metros performing better: In FY23, Tier-I cities like New Delhi, Bengaluru, and Chennai saw remarkable YoY growth at 31.1%, up from 10.3% the previous fiscal year. These cities increased their market share slightly from 42.17% (FY22) to 44.31%. In contrast, Tier-II cities (23.3% from 50.9%) and Tier-III cities (22.4% from 64.5%) experienced a significant growth slowdown. Their market share also dipped – Tier-II to 18.6% from 19.2% and Tier-III to 18.6% from 19.2% between FY22 and FY23.

A key reason for this change in growth patterns was consumers returning to metropolitan cities for work after concerns over Covid subsided, Kapil Makhija, CEO of Unicommerce, told ET.

Gaming major Krafton to invest another $150 mn in India

South Korean game developer Krafton Inc, whose popular Battlegrounds Mobile India (BGMI) is currently under a three-month government review, has said it will invest $150 million in Indian startups over the next two to three years.

Current portfolio: The company has pumped in nearly $140 million in 11 gaming and content ventures in India including Nazara Technologies’ Nodwin Gaming, Pratilipi, KukuFM, and Loco, in the past three years. It has also invested as a limited partner in 3one4 Capital and Lumikai.

Sean Hyunil Sohn, CEO, Krafton India, told ET that the company will target startups focussed on building intellectual property.

Investment plans: Krafton plans to plough the proposed $150 million into slightly mature firms, with about 50 to 60% of investments going into series B or later rounds. This is in contrast with its investments so far, about 60 to 70% of which took place in early-stage rounds like series A or seed.

Diversification: Krafton is looking to invest a third of the corpus in artificial intelligence (AI) and deeptech firms, while the rest will go to a mix of entertainment and consumer-tech firms that are similar to firms it has put money in so far.

Though the intention earlier was to invest in gaming and gaming-adjacent firms, Sohn said the nascent nature of the game development industry in India and the promising growth in wider consumer tech convinced Krafton to diversify.

BGMI review: BGMI is currently operating under a three-month review mandated by the government after it was blocked for about 10 months till May this year. “Of course, as someone running the operations it was a painful process, but we are happy that we are on the right track now,” he added.

Tata Digital revenue up 13 times; Tata 1mg losses more than double

Tata Digital CEO Pratik Pal

Tata Digital, which runs the ecommerce superapp Neu, posted a standalone revenue of Rs 204.35 crore in FY22-23, a nearly 13-fold rise from the year-ago period. At the same time, it recorded a loss of Rs 1,370 crore — a jump of around 23%.

Key numbers:

- Croma, one of Neu’s largest businesses, reported a turnover of Rs 15,851 crore in FY22-23, and a loss of Rs 325 crore

- Cliq, on the other hand, posted a revenue of Rs 78.5 crore, along with a loss of Rs 175 crore

Tata 1mg’s losses double: Online pharmacy Tata 1mg’s net loss more than doubled to Rs 1,254.9 crore in FY22-23, even as the firm reported a 160% year-on-year jump in revenue to Rs 1,627 crore.

Key numbers:

- Tata 1mg’s miscellaneous expenses swelled to Rs 906.2 crore in FY22-23 from Rs 241.4 crore in FY21-22

- Revenue from the sale of products stood at Rs 1,290 crore in FY22-23, more than double the previous year

- Income from services and other operations totalled Rs 337 crore

- The e-pharmacy’s wage bill rose 58% on-year to Rs 313.87 crore

BigBasket’s B2B losses spike: Tata-owned e-grocery major BigBasket’s B2B arm, Supermarket Grocery Supplies, saw its losses widen about 21% to Rs 215.2 crore for the fiscal year ended March 31, 2023.

Senior execs desert startups for stable roles at established companies

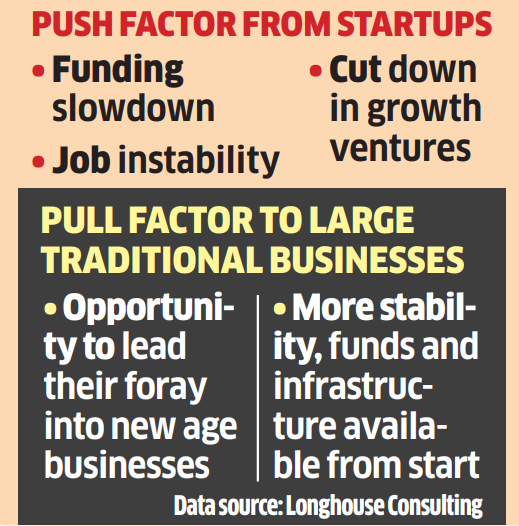

As unicorns, soonicorns, and other new-age firms seek to cope with a grim and protracted funding drought, senior executives are migrating from startups to established companies.

The data: According to data put together for ET by Longhouse Consulting, an executive search firm, about 750 senior executives (CXOs and a level below) out of about 5,000 professionals with a Rs 1 crore-plus salary have exited startups since September 2022.

Who’s hiring? A large majority of these executives were absorbed by conglomerates such as the Reliance group, the Aditya Birla group, the Vedanta group, the JSW group, the Tata group, and Kotak Mahindra Bank, among others.

Why? Big companies are now planning to enter emerging business areas or incubating digital-first businesses, and are looking for professionals with a proven track record in the startup and ecommerce ecosystem.

This also helps large corporations to diversify their talent pool and bring in new thinking.

Word-for-word: “The funding winter and the subsequent cut-back in growth projects have compelled many senior executives from unicorns and soonicorns to look for opportunities with stable, established businesses,” said Anshuman Das, CEO of Longhouse Consulting.

Other Top Stories By Our Reporters

(From left) Cofounders of Credgenics Anand Agrawal, Mayank Khera and Rishabh Goel

Credgenics secures $50 million in funding: Debt collections platform Credgenics has raised $50 million in a series B round of funding. Venture investors Westbridge Capital, Accel, Tanglin Ventures, and Beams Fintech Fund led the round, the company said in a release on Wednesday.

Edtech startup Saarthi, investors drag acquirer Classplus to court: Edtech startup Saarthi said it has taken legal action along with other investors against its acquirer Classplus on several charges including cheating, extortion, criminal breach of trust and misappropriation of funds. Software-as-a-service for coaching institutes Classplus had acquired Saarthi in late 2021.

Infosys refreshing brand identity to stand out in crowded digital world: Infosys’ blue logo is among the most recognised but understated motifs in India’s emergence as the undisputed global leader in technology outsourcing. It is now getting a ‘sonic’ makeover to help the software bellwether better engage with its younger staff and business stakeholders.

Global Picks We Are Reading

■ The AI crackdown is coming (The Atlantic)

■ AI is building highly effective antibodies that humans can’t even imagine (Wired)

■ America’s messy cyber regulations are no match for its adversaries (Financial Times)