Also in this letter:

■Tax authorities alert foreign tech firms of GST

■ Ransomware biggest cybersecurity pain point in India: IBM Security

■ Cricket NFT platform Rario raises $120 million

Will revisit FY23 outlook as things become clearer through the year: Infosys CEO

Infosys CEO & MD Salil Parekh

Global demand for technology services “looks very good” with no impact as yet from geopolitical issues, Infosys chief executive and managing director Salil Parekh told us in an interview.

Buoyed by the “robust deal pipeline” India’s second-largest software exporter expects to grow at a fast clip, having forecast revenue expansion of 13-15 % for the year, its “strongest guidance in a long time,” Parekh said.

On Monday, the industry bellwether saw its stock price crash by 9% – the steepest intra-day fall in the past two years — after it missed street estimates in its fourth-quarter earnings. Infosys reported 1.2% revenue growth and a 2.1% rise in net profit from the previous quarter.

Noting that stock markets “will do what they decide”, Parekh said the company is not accounting for any possible impact of geopolitical uncertainties as it hasn’t come up in any client conversations to date.

“We don’t see anything which gives me any concern,” said the 57-year-old CEO, adding that “of course, we are all reading and hearing about what’s going on in the world.”

He added, “As we get more colour, we will look at (revisiting the revenue guidance) in the future.”

Attrition woes: In the previous financial year, Infosys recorded unprecedented levels of attrition at 27.7%, much higher than 17.4% for TCS. Even smaller rivals such as Mindtree and LTI reported lower numbers.

Parekh said the company has started rolling out its annual wage hikes with effect from April, and is also working on “something actively” to curb attrition.

Tax authorities alert foreign tech firms of GST to avert nasty surprises

Indian tax authorities are alerting overseas gaming, fintech and content service providers in places like the US, Malta, and Curacao about the goods and services tax (GST) law to spare them nasty surprises later.

Driving the news: The Bangalore nodal office of Central Board of Indirect Taxes and Customs, which administers GST, is sending emails to these offshore business-to-customer (B2C) entities, informing them of the tax.

Many companies whose products are used by Indian residents for entertainment, trading and education have so far received the email from the tax office.

Yes, but: Two years ago, some overseas companies that were unaware of India’s new tax were put off by notices from the tax department. While many foreign companies complied and paid the tax to close the matter, some of them questioned the practice of serving notices or summons via email.

“The overseas entities were of the impression that such communications, in accordance with international law, must be routed through their respective governments, as the local tax department does not have jurisdiction,” said a lawyer specialising in taxation of digital services.

Domestic companies have to pay GST only if their turnover exceeds Rs 20 lakh, but there is no such threshold for foreign companies. The tax office can impose a 15% penalty if it believes GST was “intentionally avoided”.

Some companies forked out the penalty as the amounts were not large enough to initiate litigation, but they were upset at having been categorised as tax evaders.

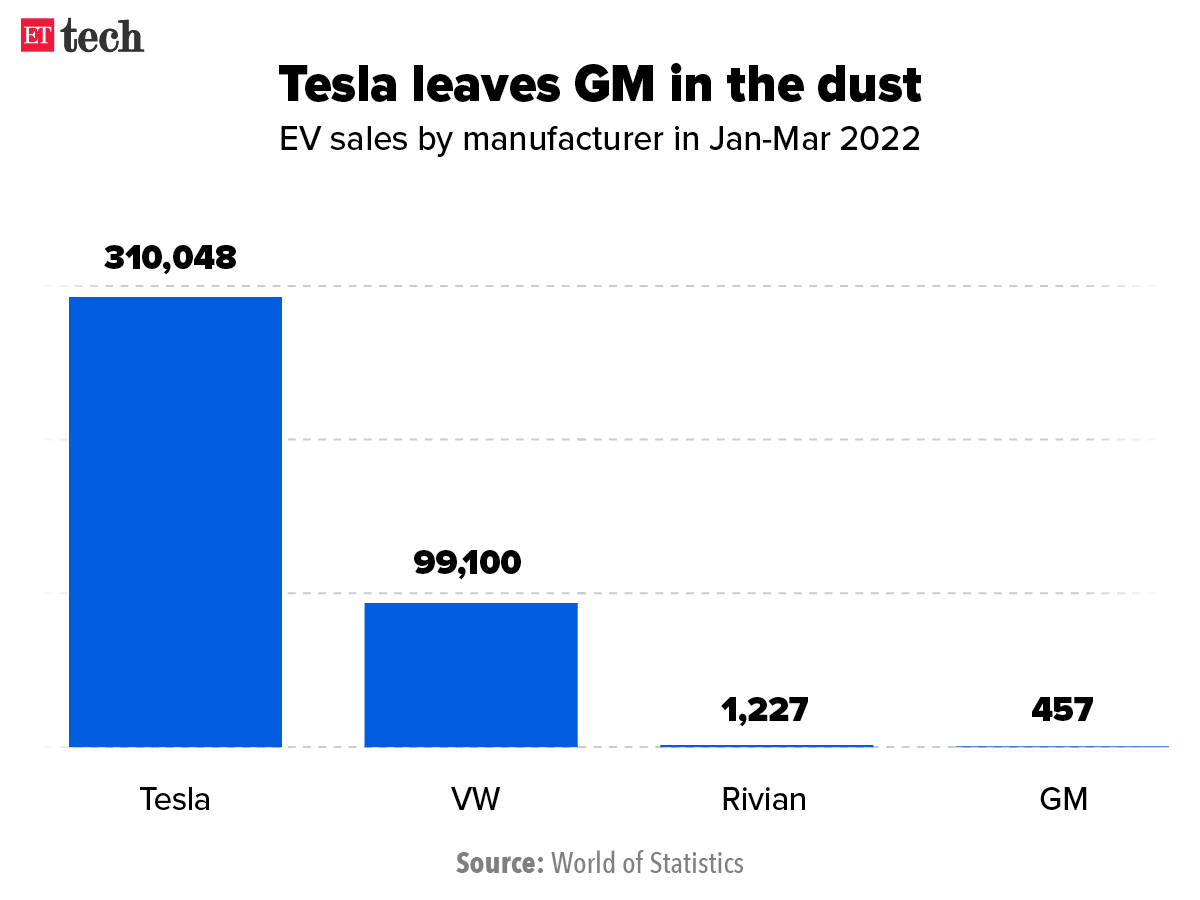

Infographic Insight

Tesla delivered a record 310,048 cars worldwide in Jan-Mar 2022, an increase of 68% year on year. GM meanwhile managed a measly 457.

Cricket NFT platform Rario raises $120 million from Dream Sports and others

Cricket non-fungible token (NFT) platform Rario has raised $120 million in a round led by Dream Capital, the corporate venture capital and M&A arm of Dream Sports.

Alpha Wave Global (previously Falcon Edge Capital) also participated in the round, joining existing investor Animoca Brands. We were the first to report on February 25 that Dream Capital was in advanced talks to lead a funding round in Rario.

This marks Dream Capital’s first investment in the Web3 space and is also its largest cheque so far in a startup.

The strategic investment will give Rario access to the 140 million users of Dream Sports.

ETtech Done Deals

VideoVerse founders

■ Video editing software startup VideoVerse, formerly known as Toch AI, has raised $46.8 million in a funding round led by A91 Partners and Alpha Wave Global. Flipkart cofounder Binny Bansal also participated in the round, as did Stride Ventures, Innoven Capital and Pacific Western Bank, among others. The funding is a mix of equity and debt.

■ Financepeer, an education focussed fintech startup, has raised $31 million in a funding round led by QED Investors and Aavishkaar Capital. The company offers loans to students to pay school and college fees. It will use the funds to enhance its technology platform and offerings, expand and strengthen its education-institution partnerships, and deepen its reach in rural areas.

■ Chennai and Delaware-based software-as-a-service (SaaS) startup Everstage has raised $13 million in a funding round led by Elevation Capital, with participation from existing investor 3one4 Capital. Everstage plans to use the funds to further expand its sales, engineering and solutions teams.

■ Trade finance platform Vayana Network has raised Rs 114 crore (about $15 million) in an extension of its ongoing fundraise, led by International Finance Corporation (IFC) and PayU, the fintech arm of Dutch multinational Prosus. With this, the company has closed its latest fundraising of Rs 397 crore (about $52 million).

■ Rigi, a platform for creators and influencers, has raised $10 million in a funding round co-led by Accel India, Sequoia Capital India, and Stellaris Venture Partners.

Ransomware is biggest cybersecurity pain point in India, says CTO of IBM Security

The biggest cybersecurity pain point in India relates to ransomware, Chris Hockings, IBM Security’s chief technology officer for Asia Pacific told us.

He said IBM has found that ransomware gangs persist for an average of 17 months on a particular ransomware approach before pivoting to an alternative one.

Hockings added that Asia – for the first time – was the region most targeted by cyberattacks in 2021, having faced 26% of attacks analysed, according to an IBM report. Asia in IBM’s definition includes Australia, East and Southeast Asia, India, and the Pacific islands.

According to the report, Japan, Australia and India were the most attacked countries in Asia. Server access attacks (20%), ransomware (11%), and data theft (10%) were the top attack types observed in Asia. Vulnerability exploitation and phishing tied for the top infection vector at Asian organisations in 2021, each representing 43% of attacks observed in the region, Hockings said.

Quote: “Financial services and manufacturing were the most attacked industries in Asia, representing nearly 60% of attacks studied,” he said. “The attackers were looking for leverage in 2021 with more supply chains under pressure and people doing a lot more shopping online during the pandemic.”

TWEET OF THE DAY

Other Top Stories By Our Reporters

Koo brings more transparency to its algorithms: Homegrown microblogging platform Koo has published the philosophy and workings behind its core algorithms in a bid to bring in more transparency. The move is aimed at helping users understand why they see the content they do.

Infosys says ‘non-compete’ clause won’t prevent employees from switching jobs: The ‘non-compete’ clause in employment contracts of Infosys employees is a standard business practice to protect confidential information and won’t prevent employees from joining other organisations, the company said in an emailed statement to ET.

Global Picks We Are Reading

■ Elon Musk races to secure financing for Twitter bid (NYT)

■ For Russian tech firms, Putin’s crackdown ended their global ambitions (The Washington Post)

■ Netflix stock price drops over 35%, on track for biggest fall in over a decade (WSJ)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.