Also in this letter:

■ Noise eyes overseas markets for wearables, open to fundraising

■ Demand for niche tech skills drops back to pre-Covid levels

■ Top-level exits continue at BharatPe

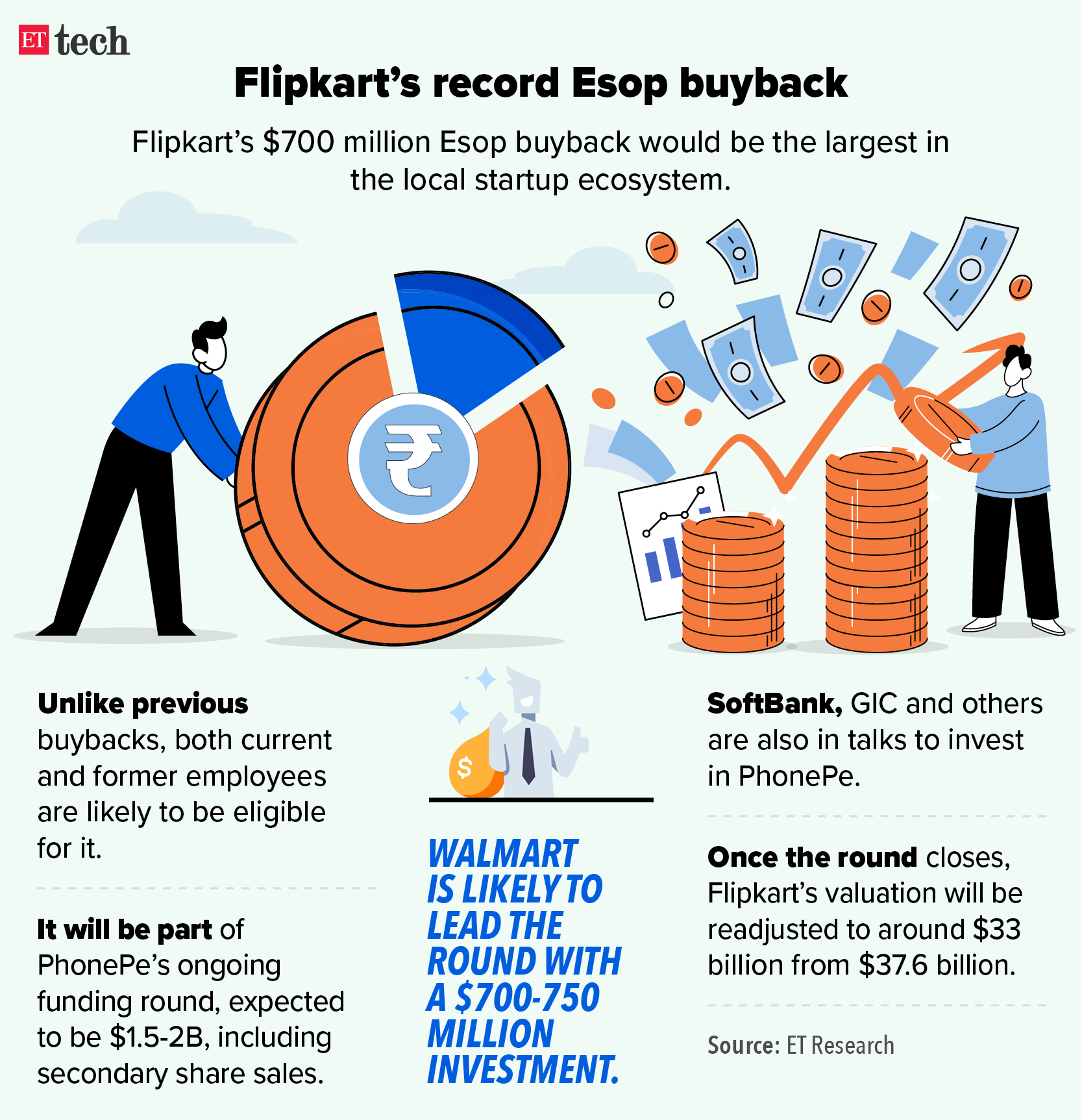

Flipkart readies $700M Esop buyback as part of PhonePe funding round

Flipkart is likely to facilitate a $700 million employee stock buyback as part of PhonePe’s new financing round, multiple sources briefed on the matter told us.

Multiple current and former employees have been briefed on the liquidity event and a formal communication is expected in a month, the sources added.

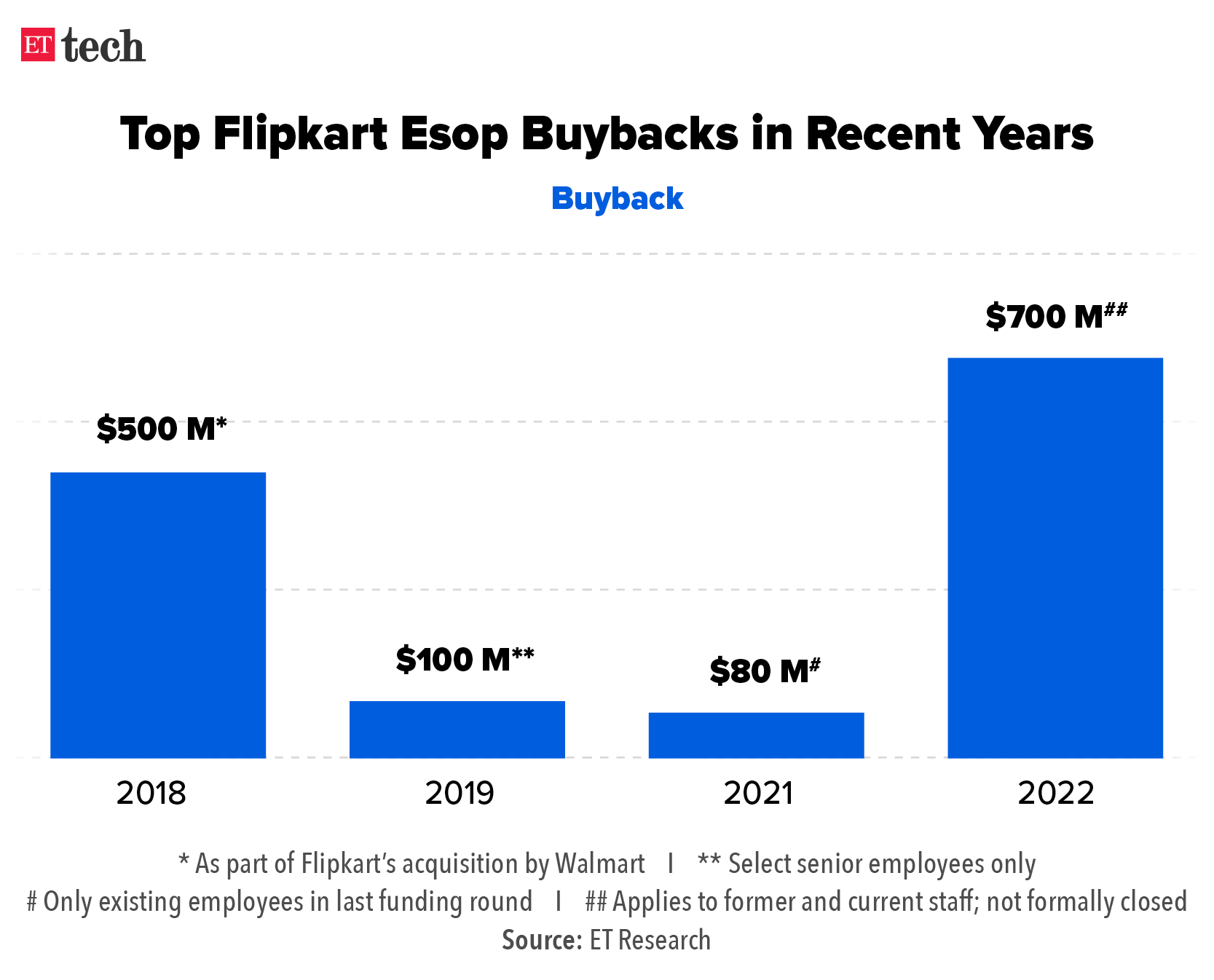

Record buyback: The buyback, likely the largest in India’s new-age economy, is part of PhonePe’s latest $1.5 billion to $2 billion funding round led by Walmart. The US retailing behemoth and private equity fund General Atlantic will infuse primary capital of about $1 billion and the rest will be raised through a secondary share sale.

The transaction will cause Flipkart’s valuation to be adjusted from from $37.6 billion to about $33 billion, as PhonePe will have a separate shareholding structure, our sources said. PhonePe, valued at $5.5 billion, is currently marked as an asset within Flipkart.

Significance: The buyback is significant not only because of its size but also because it comes amid a funding crunch for the technology and startup ecosystem in India and around the world.

PhonePe’s fresh funding: While the Bentonville–based retail giant is expected to plough $700-$750 million into PhonePe, General Atlantic may invest up to $250-$300 million, according to people briefed on the matter.

Flipkart’s existing investors such as SoftBank and GIC are among those that are still deciding if they will take a position on PhonePe’s cap table.

Flipkart’s Esop buybacks: Flipkart, the poster child of local startups, is known for its regular Esop buyback programmes. In 2021, the Bengaluru-based e-tailer purchased shares worth $80-85 million from employees as part of its $3.6 billion financing round.

Noise eyes overseas markets for wearables, open to fundraising

Smart wearables maker Noise, which won the Bootstrap Champ award at The Economic Times Startup Awards 2022 earlier this month, plans to take the brand to countries that have a similar demography as India, chief executive Gaurav Khatri told us.

Founded in 2014 by Gaurav Khatri and his cousin Amit Khatri, the startup started off selling mobile phone cases. It pivoted to designing and selling smart wearables in 2018 and has since grown in leaps and bounds.

State of play: The company has had “cold conversations” with investors, Khatri said, adding that he would not shy away from raising funds to fuel its ambitions amid fast-paced growth.

While Khatri did not disclose a timeline or which countries that the company would target, he said securing leadership in the Indian market would take precedence before venturing abroad.

Seeking funds: “I would not deny that capital is needed,” he said. “More important than capital, you need a partner who takes your thought processes to the next level and brings maturity to the business. You need much more governance, much more stability and a more corporate style of doing things.”

Competitive market: Noise faces stiff competition from companies within India and abroad.

According to data from Counterpoint Research, Noida-based Fire-boltt claimed the top spot in the Indian smartwatch market with a 27.7% market share in the second quarter (April-June) this year, marginally beating Noise, which had a 26% share.

In July, August and September, Noise clawed its way back up with a 29.5% market share while Fire-boltt slipped to the second spot with a 26.2% share, according to market research firm IDC.

Companies such as audio products maker Boat are also bullish on the wearables space with multiple product launches, whereas South Korea’s Samsung is the fourth largest player, with a 2.8% market share.

A MESSAGE FROM ZS

ZS PRIZE healthcare challenge invites startups to solve for India

ZS, a global management consulting and technology firm, is inviting startups, students, innovators, and working professionals to apply for ZS PRIZE, an initiative to recognize, celebrate, and advance the most impactful tech-enabled healthcare innovations solving for India.

Here are some reasons why you should participate in ZS PRIZE:

- #SolveForIndia: Once-in-a-lifetime opportunity to solve for India’s most pressing healthcare challenges and create real impact

- Prize money: ZS PRIZE has total prize amount to Rs 1.5 crore to be shared among the winners

- Eminent jury: Showcase solutions to a jury that boasts of some of the biggest names from the healthcare and tech industries

- Mentorship: In-depth expertise from within the healthcare industry through an in-built 6-weeks mentorship program

- Recognition: Honor of winning the coveted ZS PRIZE and getting nation-wide recognition

Registrations will close late December 2022. Apply now.

Demand for niche tech skills drops back to pre-Covid levels

High-end tech skills – which commanded a salary premium as organisations jostled for talent over the past two years – have seen an up to one-third drop in the negotiation bandwidth between employers and employees for new hires this fiscal year, said executive search firms and IT sector consultants.

What’s going on? Companies that were doling out unprecedented hikes to rope in talent, have slashed their negotiation range with job seekers for niche skills to 15-40% this fiscal year from an average of 50-120% in FY22, according to estimates by staffing firm Xpheno, based on inbound recruitment mandates from employers and job listings on popular job boards.

For example, the offer negotiation range for a full-stack engineer with four to seven years of experience has narrowed to 20-40% from 50-100% in FY22. Likewise, for a frontend engineer with similar experience, companies may be willing to negotiate a maximum of 15-35% versus 50-90% in FY22.

Top-level exits continue at BharatPe

Fintech firm BharatPe has seen another round of top-level exits.

Nehul Malhotra, head of buy-now-pay-later product, PostPe; Vijay Aggarwal, chief technology officer; Rajat Jain, chief product officer for lending and consumer products, and Geetanshu Singla, vice president, technology, have resigned. BharatPe confirmed the development.

The company had roped in Malhotra in September last year to lead its consumer lending division, while Aggarwal has been CTO since March 2020. Jain and Singla came on board in 2019.

Previous exits: In August, one of BharatPe’s cofounders, Bhavik Koladiya, moved on, while senior executive Satyam Nathani quit the firm in June. We reported on June 8 that chief revenue officer Nishit Sharma and head of institutional debt Chandrima Dhar had also left the company, citing personal reasons.

Controversy: BharatPe has been under intense scrutiny since cofounder Ashneer Grover sought damages from Kotak Mahindra Bank managing director Uday Kotak in January, claiming the bank refused him financing for a personal investment in Nykaa’s IPO last November.

Soon after, BharatPe’s board hired independent auditors upon receiving complaints from a whistleblower about alleged financial malpractices and corporate misgovernance at the firm. This led to the ouster of Madhuri Jain, the company’s head of controls and Grover’s wife. Grover resigned from BharatPe and its board in March.

Aditya Birla Group’s TMRW to invest in eight D2C brands

TMRW, the Aditya Birla Group’s online ‘house of brands’ business, said it is investing in eight digital-first lifestyle brands.

With these brands on board, TMRW has achieved a revenue run-rate of Rs 700 crore and is on track to cross an annual revenue rate of Rs 1,500 crore in the next 12 months, the company said.

Catch up quick: On Friday we reported that the Aditya Birla Group was in the final stages of acquiring a controlling stake in one of these brands, apparel and accessories firm Bewakoof, for about Rs 100 crore, marking its entry in the direct-to-consumer (D2C) segment.

Mumbai-based Bewakoof has been out to raise fresh capital from financial investors but those discussions did not fructify into a deal amidst a funding winter, said people in the know of the matter.

The seven other brands TMRW has acquired are Berrylush (women’s western wear), Juneberry (casual wear), Natilene (teen’s occasion wear), Nauti Nati (kid’s wear), Nobero (athleisure), and Urbano and Veirdo (casual and denim wear).

Indian tech adoption cycle still has leg room: Salesforce’s Bhattacharya

There is significant leg room in India for tech demand – which remains “robust” – across technologies such as artificial intelligence and machine learning despite some “cautious” undertones in client conversations, Arundhati Bhattacharya, chief executive of Salesforce India, told us.

Key driver: Bhattacharya said there was massive scope for the Indian public sector and enterprise segment to adopt cloud solutions and that the banking and financial services sector remains a key growth driver.

“(Globally) When they don’t know what the future holds for them economically, at that point of time, everybody turns cautious. So, they are trying to take longer to deliberate on the value that they’re getting out of investments. They (clients) will try to make investments over a longer period,” she said.

“In India, the reason why we are seeing robust demand is because the Indian economy itself is growing quite robustly. And have a lot of catching up to do as well (industry perspective),” she said.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Other Top Stories By Our Reporters

Startups to account for a third of office leasing activity in 2022: The booming Indian startup ecosystem is helping push the demand for workspaces across key commercial property markets of the country. Over the last few years, startups have turned extremely active in terms of real estate absorption.

Amazon to shut its wholesale distribution business in India: Ecommerce giant Amazon India said it is shutting down its wholesale distribution business in India. Called Amazon Distribution, the business operates in Bengaluru, Hubli and Mysore. This is the third business Amazon has shut in India in the past week. Reports emerged earlier this month that it plans to lay off thousands of employees around the world.

Covvalent raises $4.3M: Gurugram-based startup Covvalent has raised $4.3 million in a seed funding round led by Nexus Venture Partners. The startup, founded this year by IIT Kharagpur alumni Sandeep Singh and Arush Dhawan, operates as a tech-enabled managed marketplace for specialty chemicals.

Global Picks We Are Reading

■ BlockFi files for bankruptcy as latest crypto casualty (WSJ)

■ The dirty road to clean energy: how China’s electric vehicle boom is ravaging the environment (Rest of World)

■ Tesla is reportedly working on a redesigned Model 3 (The Verge)