Also in this letter:

■ Cognizant aims to fully shift to hybrid work by early 2023

■ Edtech unicorn Vedantu lays off 200 employees

■ Ola Cars CEO Arun Sirdeshmukh steps down

Not worried about short-term valuations, says Delhivery CEO

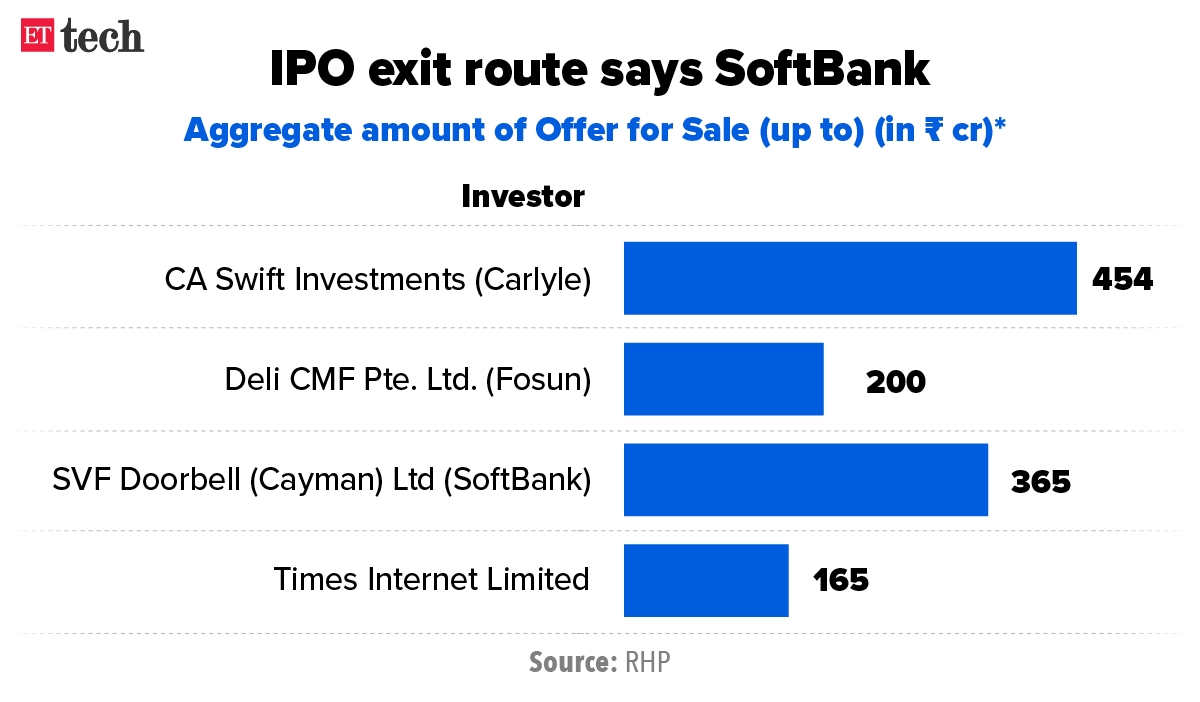

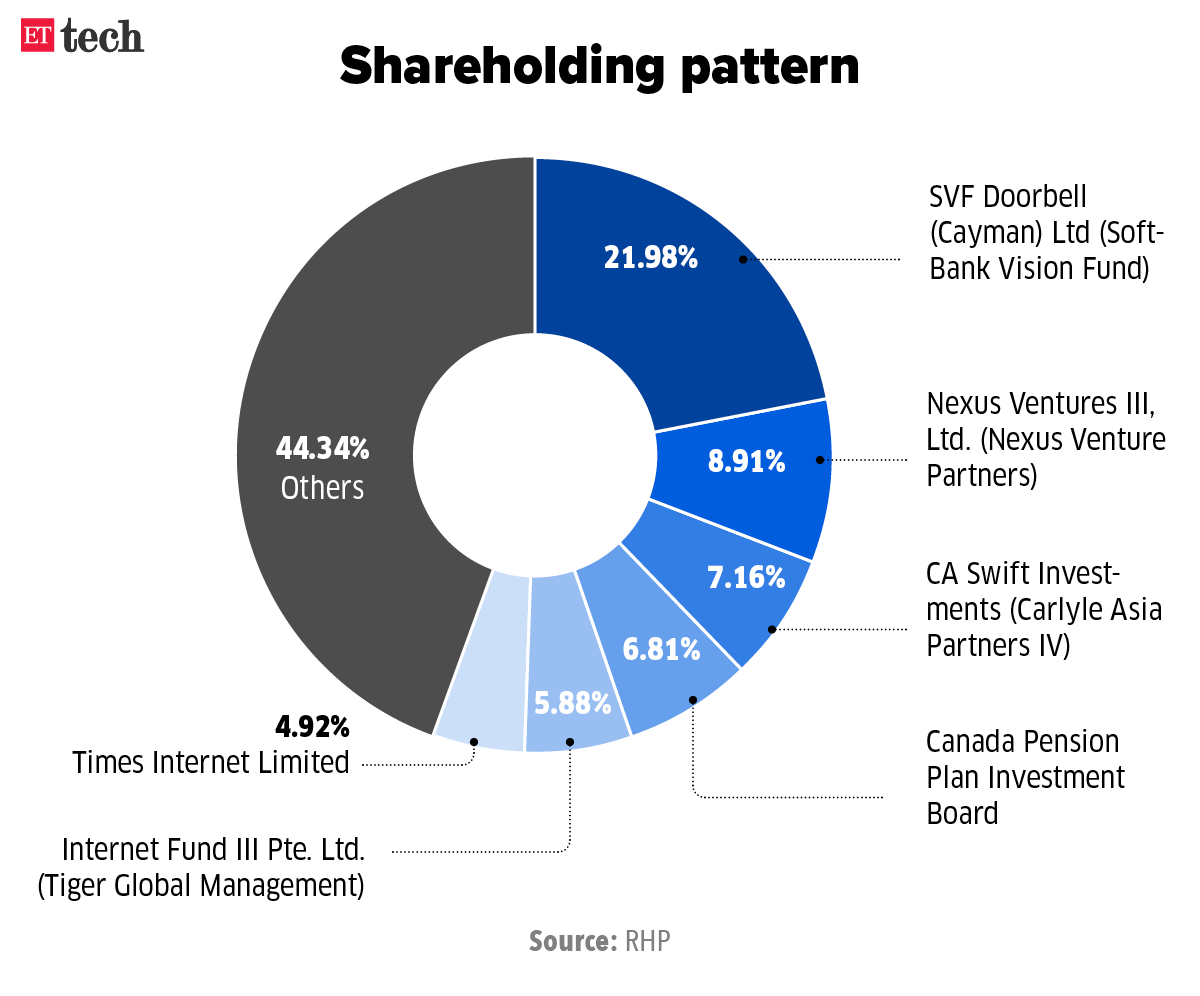

Sahil Barua, cofounder and CEO of Delhivery, which will launch its IPO on May 11, told us the company is not worried about valuations in the short term because markets eventually value businesses correctly in the long term.

With a price band of Rs 462-Rs 487 a share, Delhivery is aiming for a $5 billion valuation for its IPO.

Ploughing ahead: Delhivery postponed its IPO – and adjusted the size and pricing as markets turned volatile. It is going ahead with the offering while many of its peers have chosen to wait.

Barua told us he took advice from his board on the IPO. He said the company was going ahead with it because “a large, mature and well-understood business” like Delhivery should be able to float its issue in less-than-ideal conditions.

“(Delhivery) has reached a stage that gives us confidence. We have a mature business model. And we are on track to achieve $1 billion in revenue,” he said.

Barua also said while the company relies on technology, logistics is a business that public market investors understand well.

Quote: “If you look at great IPOs like DMart — it is a stock that has never traded below its IPO price. I think that is the ambition we have. We want to price it in a manner that our investors make a substantial amount of money and where ultimately there is very clear visibility of how the stock compounds,” added Barua, who owns 2.08% in the company and won’t part with any shares in the IPO.

In the doldrums: New-age firms such as Zomato, Paytm, Nykaa and Policybazaar made a beeline for the bourses last year but are now trading well below their IPO prices. Paytm’s share price has fallen more than 70% from the issue price.

Edtech unicorn Vedantu lays off 200 employees amid dry spell

Online tutoring platform Vedantu is the latest startup to cut staff in an attempt to reduce costs as late-stage funding dries up.

The company has laid off about 120 contractual workers and 80 full-time employees. Almost all were from the company’s academic teams, working as assistant teachers.

Cutting costs by all means: The company recently slashed the cost of its courses to manage falling demand for online education as offline learning centres reopen.

It is also leveraging technology to reduce overall costs, which is also one of the reasons for the restructuring exercise, the company said.

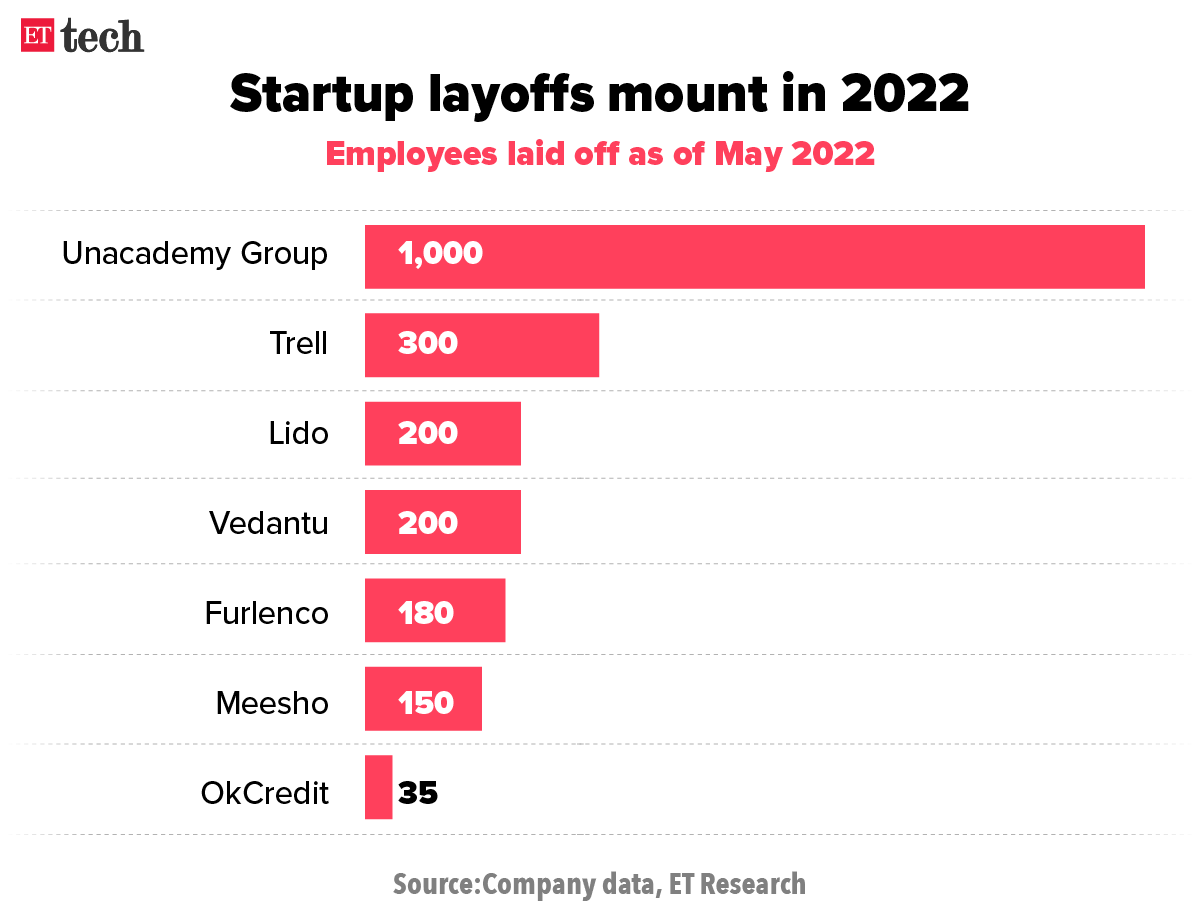

Layoff season: On April 28, we reported that more than 1,800 contractual and full-time employees have been fired from various startups as investors begin to ask high-growth companies to go back to basics — chasing profits and reducing cash burn. Companies that have laid off employees over the past month include:

- Edtech firm Unacademy

- Social commerce startups Meesho and Trell

- Online learning platform Lido Learning

- Furniture rental startup Furlenco

More to come: As investors step up their diligence amid a softening of public market valuations, many late-stage rounds have been delayed, increasing pressure on late-stage companies to reduce their burn rate.

Industry experts said if these startups fail to raise new rounds, there could be more layoffs on the horizon.

Cognizant will complete shift to hybrid work by early 2023, says India chief

Cognizant Technology Solutions expects to fully transition to a hybrid work model by early 2023 as it gives employees more flexibility, its India chairman and managing director Rajesh Nambiar told us in an interview. Here are some edited excerpts:

What led to the robust first-quarter revenue growth?

This is our largest quarter ever in what obviously continues to be a very intensely competitive global labour market. For the very first time, 50% of Cognizant’s revenue has come from digital (vertical). This is not only a result of the digital demand that you see in the marketplace but also a strategic shift to digital, which is what we’ve been forecasting.

Your operating margins seem to be under some stress. Why is this?

I don’t think so. We continue to stay with our margin guidance. It might be slightly lower sequentially but that’s only because of the seasonality. This is the first-quarter margin… (and is) because of wage inflation and this pressure on the market, but I think one of the few ways we will address that is to ensure that we have the right level of pricing and operational efficiency.

Click here to read the full interview.

Also Read:Cognizant revenue rises nearly 10% to $4.83 billion in March quarter

ETtech Done Deals

■ Farming and supply chain startup Absolute Foods has raised $100 million across recent funding rounds from Sequoia Capital India, Alpha Wave Global, and Tiger Global, the company said. Absolute Foods said it is now valued at $500 million.

■ Redcliffe Lifetech, a diagnostics platform, has raised $61 million in a round led by LeapFrog Investments, with participation from Healthquad, Schroders, LC Nueva, Growth Spark Ventures and existing investors Chiratae Ventures and Alkemi Venture Partners. The company will use the capital to expand its geographic reach across tier II and III cities.

■ Even flow Brands, an ecommerce rollup firm, said it has closed a $5 million fundraise from a clutch of investors. The round also saw participation from Village Global, 9Unicorns, Venture Catalysts, LetsVenture, Shiprocket, and several marquee angel investors.

TWEET OF THE DAY

Ola Cars CEO Arun Sirdeshmukh steps down

Arun Sirdeshmukh, the CEO of Ola Cars, has resigned, according to multiple sources familiar with the matter. Sirdeshmukh’s departure comes after the company’s chief financial officer GR Arun Kumar was promoted to a new position at the ride-hailing company.

We reported Kumar’s elevation on April 12.

Quote: “Our group CFO Arun Kumar GR now has an expanded role managing day to day operations,” said an Ola spokesperson over email. This includes overseeing the go-to-market (GTM) function, which Sirdeshmukh was heading, Ols said.

Timing: His departure comes at a time when Ola has been trying to broaden its business beyond ride-hailing, which still accounts for more than 90% of its income. Ola Cars, Ola Foods, Ola Dash and Ola Money are all ways for Ola to market itself as a ‘super app’ ahead of its IPO.

India R&D team crucial to our fossil-free, services-related goals: Volvo CTO

Volvo Group’s research and development team in India will play a key role in the Swedish auto giant’s goal of becoming fossil-free by 2040, its chief technology officer told us.

The Bengaluru-based team will also help double the share of services and solutions revenue by the end of the decade, said Lars Stenqvist, group CTO of Volvo.

Stenqvist, who is also executive vice president of truck technology at the group, said the aim is to double its revenue share from software and solutions to 50% by 2030.

“Bengaluru is becoming an important part of the system that is working intertwined with other R&D centres globally. It is not a service centre. We are giving more responsibility to the centre for complete delivery for different parts of solutions that we’re using such as testing, quality control and cost,” Stenqvist said.

Other Top Stories By Our Reporters

India has the most fact checkers: India is the country with the highest number of certified fact checkers in the world, Irene Jay Liu, News Lab lead for APAC at Google said on Thursday. She said that this is in stark contrast to when she first started working with the Google News Lab in 2017, when there were only two or three certified, professional fact checkers in the country.

Neobank Fi marks financial services foray with mutual funds: Neobanking platform Fi is foraying into financial services, launching products such as mutual fund investments, peer-to-peer (P2P) investments and digital lending on its platform along with other savings products. To begin with, it will offer a few index funds and eventually increase their number to 600, the company said at a virtual press conference on Thursday.

Global Picks We Are Reading

■ If lightbulbs are smarter, why haven’t sockets changed in over 140 years? (WSJ)

■ ‘I don’t really have a business plan’: How Elon Musk wings it (NYT)

■ A teen girl sexually exploited on Snapchat takes on American tech (Washington Post)