Credit: Giphy

Also in this letter:

■ Finance minister pitches for global crypto rules

■ Indian SaaS to hit $116 billion revenue by 2026: report

■ Lightspeed promotes three execs to partner level

Former Myntra CFO frontrunner to be new Zilingo CEO amid probe

Ramesh Bafna, chief financial officer at Zilingo, has emerged as one of the contenders to take over as interim CEO of the company as its board considers removing suspended CEO Ankiti Bose for good, multiple sources aware of the matter said.

Bafna, who was most recently with Myntra as its CFO and SVP, joined the Sequoia Capital-backed startup in March. He has been involved in the review of the alleged financial irregularities at the firm as well, another person privy to the talks said.

His appointment has not been finalised yet, these people said.

Tell me more: Sources told us that an existing senior employee or an investors-approved executive is likely to be the successor of Bose even as its current funding talks have stalled owing to the latest controversies.

A spokesperson for Zilingo’s board said in an emailed statement, “Any question of a change in management is speculative and premature at this stage.”

Earlier, Bloomberg reported that the board was considering permanently replacing Bose. Directors of the company have been meeting regularly in recent days to debate Bose’s and Zilingo’s futures. Bose, who is suspended until May 5, has pressured the board to clarify her situation.

End of the road? Bose has denied any wrongdoing and has hired an attorney to fight back against what she calls a “witch hunt.” She has grown frustrated with the conflicts and has begun to realise she is unlikely to return as chief executive officer.

Also Read: Sequoia’s Shailendra Singh leaves Zilingo board amid accounting probe

FM pitches for global crypto rules to prevent money laundering, terror financing

Finance Minister Nirmala Sitharam has pitched for a global framework to regulate crypto, identifying their use in money laundering and terror financing as the biggest risks for all countries.

Driving the news: Speaking at a discussion on “Money at a crossroad” hosted by the IMF in Washington DC, the minister added that no country could handle these issues alone.

“I think regulation using technology is the only answer. And that’s not possible if any one country thinks that it can handle it. It has to be across the board,” Sitharaman said.

FM on crypto tax: She added that India introduced a 30% tax on crypto assets to keep track of who was transacting in them.

“How can we keep a trail following these transactions which were happening. After all these were electronic codes eventually. So we wanted to be sure. So through that (30% tax) we will be able to know who’s buying and who is selling it,” Sitharaman said.

Also Read: Govt plans bill to ban private cryptocurrency, allow RBI digital coin

Double whammy for Indian crypto: Apart from high taxes, crypto companies and investors have to contend with banks and other payment providers refusing them services.

On April 18 we reported that many crypto exchanges are facilitating peer-to-peer (P2P) deals, while some are directly accepting deposits from coin buyers to bypass curbs imposed by banks and payment companies.

- P2P deals: In a P2P transaction, the exchange, after receiving an order, shares the seller’s bank account details with the buyer. The buyer then directly transfers funds to the seller using any regular online payment option, while the seller moves the cryptocurrency from their wallet to the buyer’s. The exchange simply connects the buyer and seller; the money does not flow through it.

- Direct deposits: Alternatively, some exchanges receive funds directly in their current accounts from crypto buyers. Once the money is remitted, the amount is credited to the trader’s account with the exchange, which can then be used to purchase crypto. The current account is typically in the name of the company which provides the software solution to the crypto exchange.

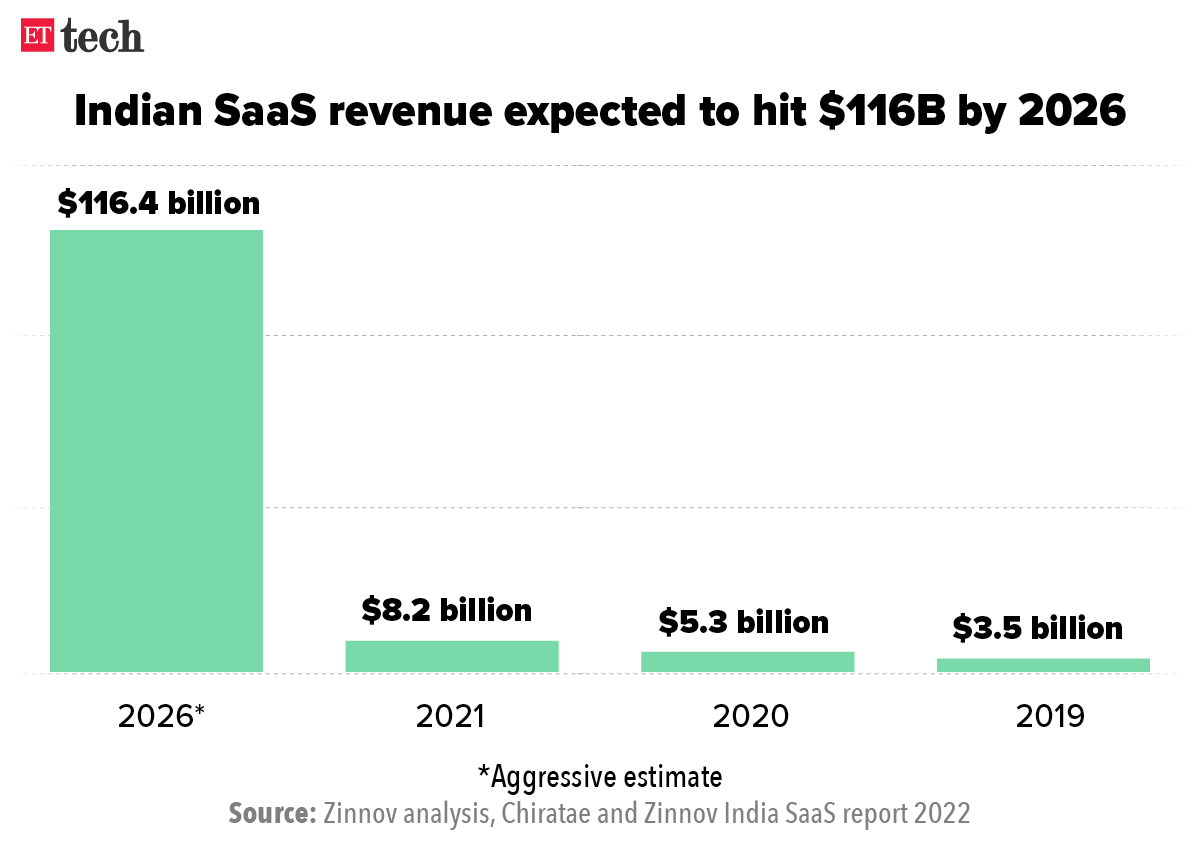

Indian SaaS to hit $116 billion revenue by 2026: report

Indian software-as-a-service (SaaS) startups are expected to clock overall revenues of $116 billion by 2026, growing at a compound annual growth rate (CAGR) of 55-70%, according to the latest report from venture capital firm Chiratae and management consultancy Zinnov.

Funding to jump this year: Titled ‘India SaaS: Punching through the global pecking order’, the report said that overall funding for Indian SaaS startups is expected to touch $6.5 billion this year from $4 billion in 2021 – a 62.5% increase.

The average size of investments in Indian SaaS grew from roughly $25 million in 2020 to $56 million in 2021, the report added.

It said there are presently more than 1,150 active Indian SaaS companies.

Also Read: SaaS space heats up with big deals at Chargebee, Innovaccer as valuations soar

According to data from research platform Venture Intelligence, SaaS companies raised $2 billion across 93 deals in the first quarter of 2022.

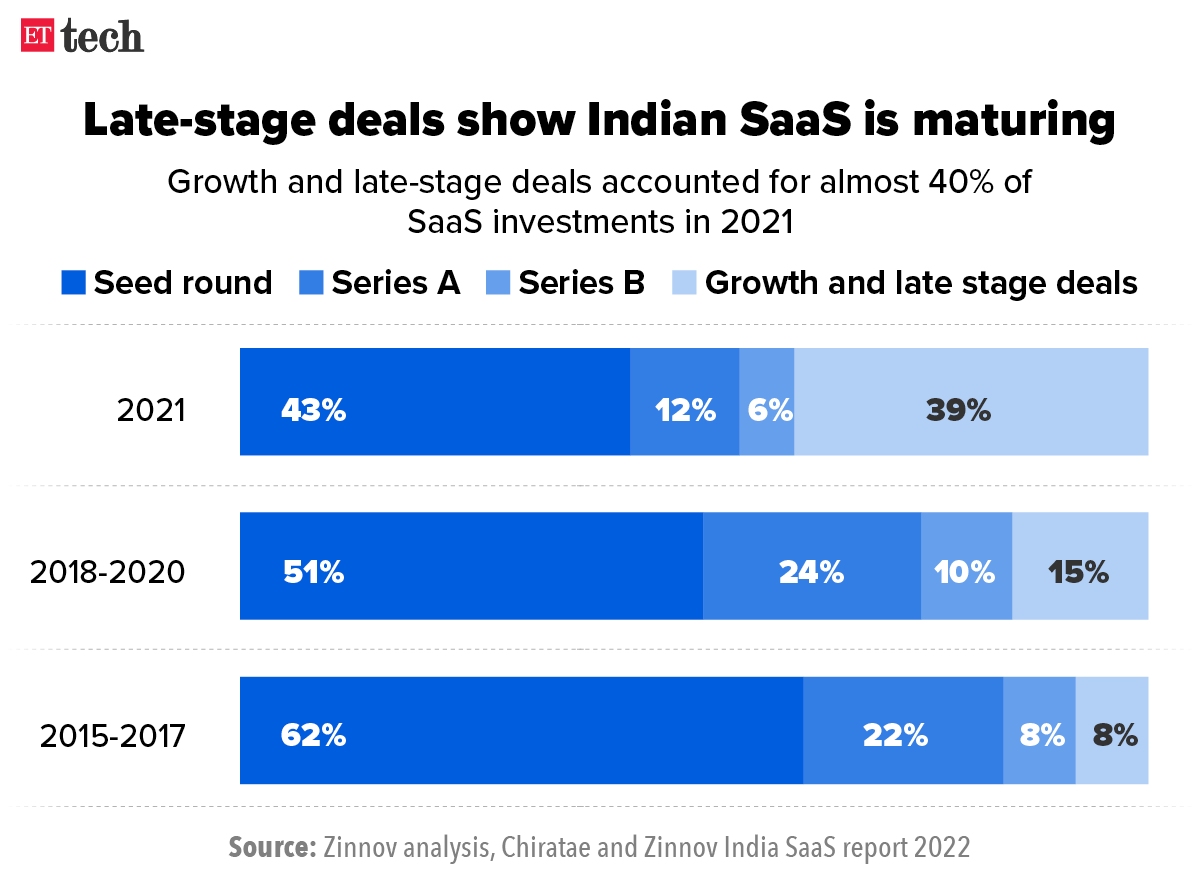

Sector maturing: In 2021, almost 40% of overall funding invested in Indian SaaS was in growth to late-stage rounds, compared to just 15% between 2018 and 2020.

Also Read: Indian SaaS market to grow 20 times to $50-70 billion by 2030: report

Unicorn factory: With investors continuing to back Indian SaaS startups for their predictable revenues and growth outcomes amidst the global downturn, the report said as many as eight SaaS startups could become unicorns in 2022.

Also Read: India will have over 250 unicorns by 2025: report

Of the 14 startups that turned unicorns in the first quarter of 2022, five were SaaS companies – HR software provider DarwinBox, analytics company Fractal, conversational automation startup Uniphore, cloud broadcasting software company Amagi Media Labs, and developer tools platform Hasura.

Also Read: 50 more startups in wings to be unicorns: report

Web3, the next frontier: As Web3 continues to catch investor interest, with venture capital firms such as Elevation and Accel betting big on the space, the sector has seen increasing SaaS innovation. The report added that Web3, data analytics, developer tools and security represent the next frontier for SaaS startups.

Tweet of the day

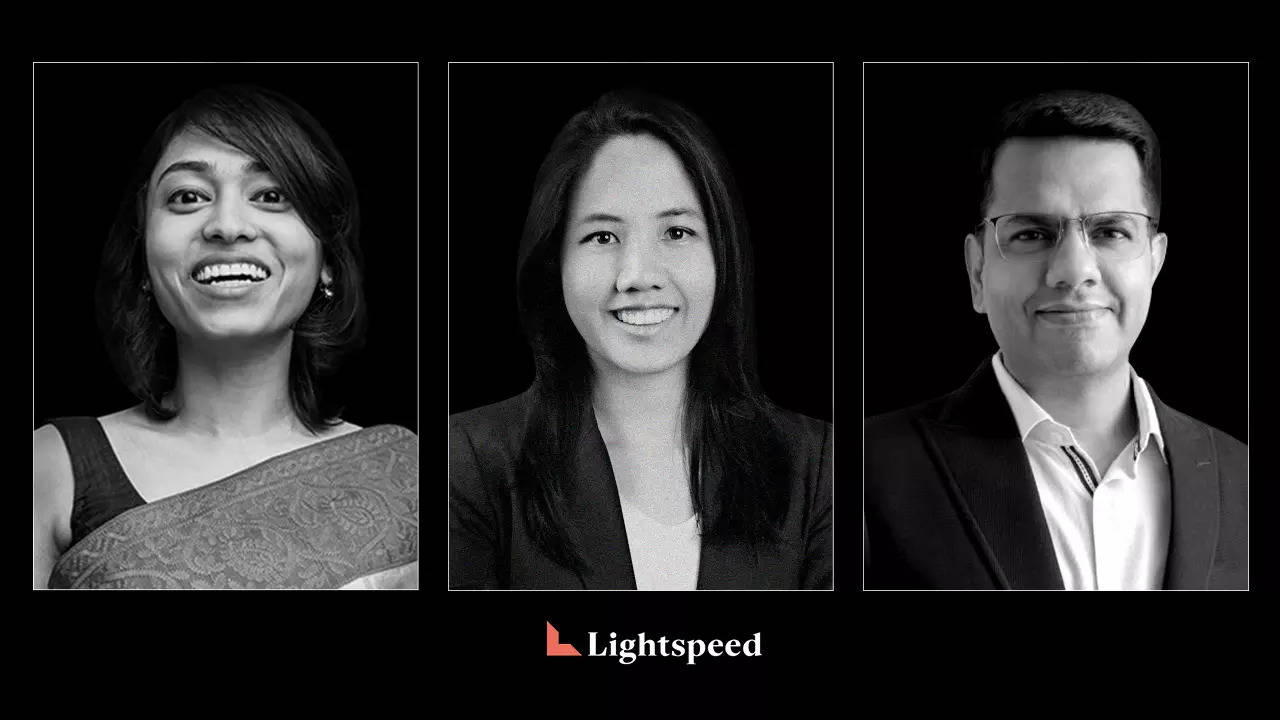

Lightspeed promotes three executives to partner level, including two women

(From left) Shuvi Shrivastava, Pinn Lawjindakul, and Rahul Taneja

Shuvi Shrivastava, Pinn Lawjindakul, and Rahul Taneja have been promoted to partner roles in Lightspeed Venture Partners’ early-stage investment advisory team. Lightspeed Venture Partners has funded businesses such as Byju’s, Sharechat, and Udaan.

The new appointees: Shrivastava started at the fund in 2015 as an associate after moving back from the US, where she had founded a company. She has played an “instrumental role in identifying and accessing multiple exciting opportunities including Darwinbox, Uni, Pixxel, Rattle, Bhanzu, and xFlow,” the company said in its blog post.

Lightspeed said Lawjindakul, who joined in 2020, helped establish its office in Singapore for its Southeast Asia practice. Both Lawjindakul and Shrivastava joined Harsha Kumar, the third female partner at the fund.

Also Read: Lightspeed Venture Partners to increase its focus on growth deals

Lightspeed also said Taneja, who joined as a chief business officer, had been elevated to partner.

Bias: Women leadership at venture capital (VC) funds is extremely scant across investment firms, especially at the bigger funds.

Other early-stage funds like Elevation Capital have an all-male partnership while Sequoia Capital India has one female managing director – Sakshi Chopra – in its India team.

ETtech Done Deals

■ Insurance startup Loop has raised $25 million as a part of a new funding round co-led by existing investors General Catalyst and Elevation Capital (formerly Saif Partners). The company said it would use the fresh funds to drive sales growth, product development and strategic hiring to scale its new health assurance delivery model.

■ Collateral-free micro, small & medium enterprise (MSME) loans provider Kinara Capital said it closed a fresh equity round of Rs 380 crore led by global investment manager Nuveen with participation from Dutch microfinance fund ASN Microkredietfonds.

■ Recur Technologies PTE, a Singapore-based financing platform, announced fundraising of $30 million in a combination of equity and debt from a clutch of Indian investors. The fintech startup operates in India through its Delhi-based subsidiary called Recur Club Technologies.

ETtech Opinion: Demystifying the customer acquisition cost riddle

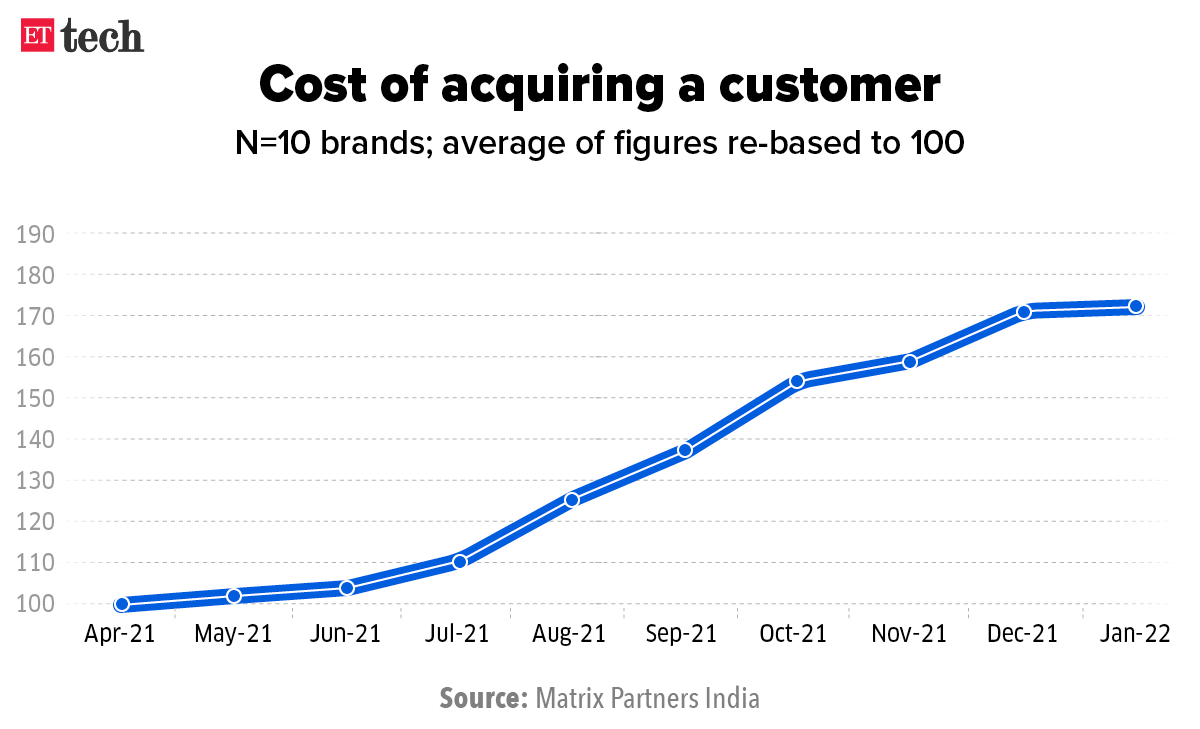

At Matrix Partners India, we have been an early investor in several consumer internet businesses across marketplaces, consumer brands, edtech, media, social, gaming, and so on. One common issue we see most early-stage consumer internet companies facing today is the ballooning customer acquisition cost (CAC) as shown by the chart below.

In such a scenario, especially when the ‘grow at all costs’ days are firmly behind us, founders and growth teams often grapple with three core questions:

- Why is CAC ballooning?

- What’s the right CAC for my business?

- What can I do about ballooning CAC, especially as an early-stage company?

While I’m no expert on this topic, I’m going to attempt to give our point of view based on some of our learnings across companies.

Why is CAC ballooning? We would all like to believe that CAC is going up because of too much competition and too much money being invested by investors in similar companies. While that is likely true, there are three underlying issues that are at the heart of the problem:

- Products and services are not differentiated enough in the eyes of the customer (e.g., the mattress industry fiasco in US).

- Total addressable market is much smaller than what the company or investors might have thought initially (1-1 live classes, arguably).

- Digital-only channels for customer acquisition are getting exhausted much sooner than we would like to believe.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.