For companies, employee stock ownership plans (Esop) are a way of attracting and retaining the best talent by pegging a part of their compensation to the company’s stock price.

But how do Esops work, and what benefits and risks do they carry for employees?

How do Esops work?

A stock option is simply a contract that gives a person investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date.

Esops thus allow employees to buy a set number of company shares at a set price after the vesting period has expired (typically a few years). This means employees must work for the company for a certain number of years before they can exercise their stock options.

Once the vesting period is over, the company facilitates a buyback exercise in which employees can liquidate their shares and create wealth.

Discover the stories of your interest

Why do companies offer Esops?

Companies typically use Esops as a way of attracting and retaining high-quality employees. Turning them into shareholders is seen as a way of instilling ownership – and thus better performance – among employees.

Esops can also be used to retain employees at critical times. For example, a company might give its employees Esops at the end of the fiscal year as an incentive to stay on.

What are the benefits (and risks) for employees?

Esops can be very lucrative for employees, allowing them to build wealth in a way that wouldn’t be possible with regular salaries.

Employees in India typically pay a nominal amount for shares allotted to them, allowing them to invest in the company at a heavily discounted rate.

, for instance, recently announced

Esops with an exercise price of just Rs 9.

All of this assumes, however, that the company will do well in the future. If its valuation erodes significantly, Esops can quickly become worthless.

There’s a tax component to keep in mind, too. If you were allotted the options at, say, Rs 9 and at the time of selling these shares they are priced at Rs 500, you have to pay tax on Rs 491 – the difference between allotment price and exercise price. The better the company is doing, the more tax you’ll pay.

State of Esops in India

According to a report by venture capital firm Saison Capital, over half of Indian startup founders think they understand Esops significantly better than their Southeast Asian counterparts.

Only a minority of founders view Esops as a cost-saving device to reduce overheads spent on salary and other benefits. While Esops can reduce the initial cash spent on compensation, it is by no means a “cheap” fix – especially considering it dilutes stock pools for future fundraising, the report noted.

ETtech

ETtechSource: State of Esops in India, Saison Capital

The majority of Indian startups, according to the report, offer Esops to employees other than senior management. They are offered to about one-third of all employees, regardless of rank, it said.

ETtech

ETtechSource: State of Esops in India, Saison Capital

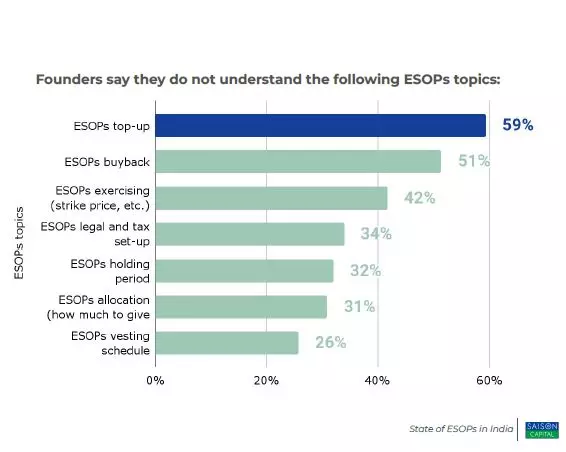

The majority of founders understand Esop vesting schedules, but not how to top-up Esops, according to the report. Top-ups to Esops expand the pool of unallocated shares available for future employee recruitment and retention. “This explains why Esops do not grow across subsequent rounds of funding,” the report noted.

Startup Esop-mania

In December 2021, Walmart-owned ecommerce platform Flipkart created an

Esop pool of Rs 17,000 crore, propelling it to the top of the list of Indian technology firms that have allocated stock options to staff.

It was followed by Oyo,

, Paytm and , according to data exclusively sourced by ET from executive search firm Longhouse Consulting.

ETtech

ETtechGraphic: Rahul Awasthi

In November 2021, PhonePe

conducted an Esop buyback worth Rs 135 crore, but the company’s founders—Sameer Nigam and Rahul Chari—gave it a miss.

ETtech

reported on February 16 that Udaan would issue Esops to every employee and make a key change in its policy under which they could now vest stocks every quarter, instead of waiting a minimum of one year.

The same month, edtech unicorn Lead School

announced a $3 million Esop liquidation programme for its employees.

In March, crypto unicorn CoinSwitch Kuber

completed an Esop buyback worth $2.5 million (about Rs 19 crore).

On May 10, payments and banking platform Razorpay

announced its fourth Esop buyback sale for 650 employees. The company claims that it has created value for 1,940 employees across levels.