Also in this letter:

■ Karnataka’s IT minister on tech and state’s future

■ Legal experts flag concerns on fact-checking unit

■ ETtech Done Deals

Elite jury meets today to pick winners of ET Startup Awards

An elite jury led by Kotak Mahindra Bank founder Uday Kotak will meet virtually on Tuesday to pick the winners of the ninth edition of India’s most coveted prize for entrepreneurial excellence – The Economic Times Startup Awards (ETSA).

Jury members from across the globe will come together to recognise the brightest and best entrepreneurial talent in what has turned out to be one of the most testing years for the startup ecosystem.

Also read | ETSA 2023: Balancing growth and monetisation will be key while picking winners

The awards will also recognise students who have founded companies while on campus, women entrepreneurs in the Woman Ahead category, and the year’s best investor in the Midas Touch category.

Also read | ET Startup Awards 2023: A growth mindset will set the winner apart

“I look forward to creativity, enterprise and sustainability. This must combine with integrity and transparency. Great ideas are important, execution is even more critical. And, we must do good and do well at the same time,” said Kotak.

Read what the jury has to say about our nominees

Here’s a look at the nominees across the eight award categories we have unveiled.

■ Bootstrap Champ: Boldfit, Fyers, Boult Audio, Klenty, Gameberry Labs

■ Top Innovator: StringBio, Zero Cow Factory, GalaxEye, Brainsight AI, Newtrace

■ Comeback Kid: Amit Gupta, Naveen Dachuri and RK Misra (Yulu), Aneesh Reddy, Anant Choubey and Sridhar Bollam (Capillary Technologies), Mukesh Singh, Raj Pandey and Vikash Kumar (ZopSmart), Uttam Digga, Pranav Goel and Vikas Choudhary (Porter), Ankit Mehta, Rahul Singh and Ashish Bhat (Ideaforge Technology)

■ Best on Campus: XYMA Analytics, Digantara Technologies, Minus Zero Robotics, Bunpai India (Rescript), Farmicon India Ltd

■ Social Enterprise: Bioprime Agrisolutions, GramCover, Vidyakul, FIA Global

■ Woman Ahead: Ayushi Gudwani (FS Life), Minu Margaret (Blissclub) Rashi Narang (Heads Up for Tails) Aarti Gill (Oziva) Ruchi Kalra (Oxyzo)

■ Midas Touch: Kunal Bahl, Rohit Bansal (Titan Capital), Kanwaljit Singh (Fireside Ventures), Jishnu Bhattacharjee (Nexus Venture Partners), Varsha Tagare (Qualcomm Ventures), TCM Sundaram (Chiratae Ventures)

■ Startup of the Year: Groww, MamaEarth, Lenskart, OfBusiness, Icertis

Byju’s puts Epic, Great Learning on the block, seeks $800 million to $1 billion

Troubled edtech company Byju’s plans to sell two of its prized assets – Epic and Great Learning – to generate $800 million-$1 billion in cash.

Driving the news: Byju’s has proposed to clear its $1.2 billion Term Loan B, and the sale is part of its plans to meet this commitment, among others, people in the know said. Bloomberg first reported that Byju’s proposed to pay back its entire $1.2 billion term loan in less than six months.

Also read | More trouble for Byju’s as three board members, auditor Deloitte resign

What else is happening? Byju’s key assets have garnered some interest in the market, sources told us, adding that the company is also in talks to raise fresh equity capital.

The company is expecting to raise $400-$500 million from the sale of Epic, a US-based kids’ learning company it acquired in a $500 million cash-and-stock deal in July 2021. A further $500-$600 million is also expected from the sale of higher education and upskilling firm Great Learning.

Also read | Byju’s, lenders agree to alter terms of $1.2 billion loan

Tell me more: There is about $500 million remaining from the TLB itself, a source told us. Byju’s had secured the loan in November 2021.

Also read | Byju’s, Davidson Kempner in talks to settle dispute

$1.2 billion TLB repayment: The company is offering to repay $300 million of the distressed debt within three months, if its amended proposal is accepted, and the remainder over the next three months, Bloomberg reported citing sources.

Karnataka looking to attract global tech firms: state IT minister Priyank Kharge

Priyank Kharge, Karnataka’s minister for information technology

Karnataka’s information technology minister, Priyank Kharge, told ET that the state is expanding its focus beyond the Indian IT ecosystem to attract investments from global companies, especially electronics and semiconductor firms.

What’s being done: The state’s focus is on creating a larger number of investment hubs beyond Bengaluru, Kharge told ET. “We have higher subsidies and incentives anchored by the Karnataka digital economy mission,” he said, adding that this will ensure that the focus of the IT and manufacturing sector extends beyond the top cities to areas such as Tumkur, Chikballapur and Hubbali-Dharwad.

ESDM ecosystem: The state launched the Electronics System Design and Manufacturing (ESDM) policy in 2017 to stimulate the growth of 2,000 ESDM startups during the policy period, and also enhance value-addition done in Karnataka by 50%.

Further, the ESDM semiconductor ecosystem aims to attract investments from global semiconductor manufacturing companies.

Infra woes: “Every growing city across the world has some mobility challenges. That said, we are not shirking any responsibilities,” said Kharge. “The idea is to restore the brand by building better infrastructure at a greater speed to ensure that companies find it a better environment for investments.”

ETtech Done Deals

Sabyasachi Goswami, CEO, Perfios

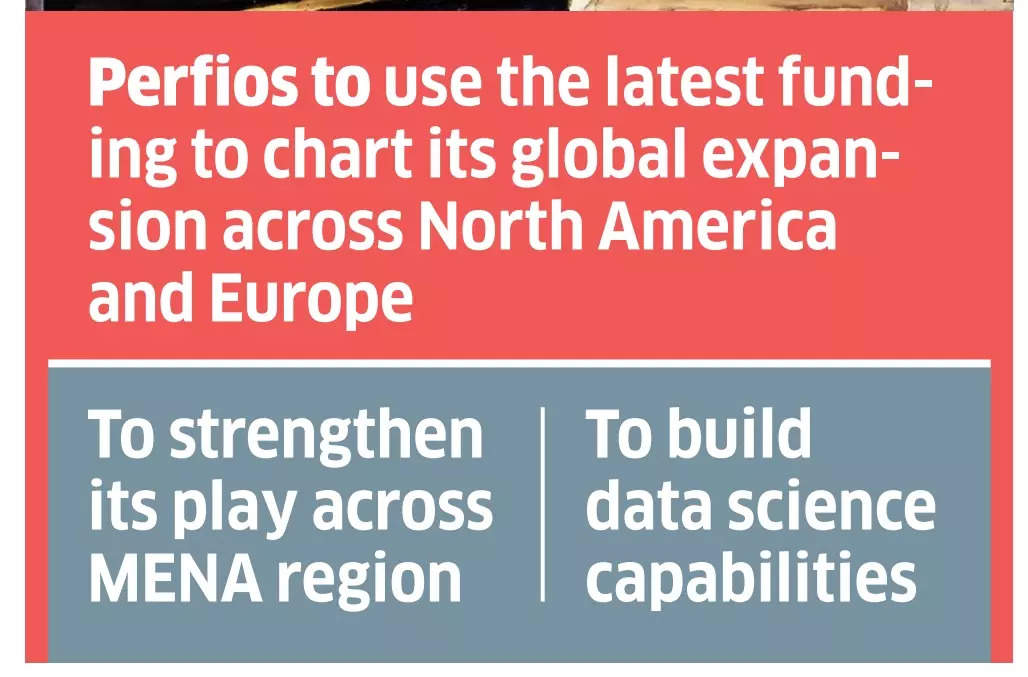

Perfios raises $229 million from Kedaara Capital in primary, secondary mix | Business-to-business fintech software provider Perfios said it has raised $229 million from private equity investor Kedaara Capital. The capital was raised through a combination of primary and secondary share sales. It is expected to fuel the company’s global expansion across North America and Europe.

About Perfios: The Bengaluru-headquartered company offers a software technology platform to over 1,000 financial institutions across 18 countries, helping them extract, aggregate and analyse financial data to improve credit assessment. It also helps these institutions create reports and monitor fraud by analysing financial data, including bank statements, taxes and business financials.

WestBridge Capital invests in TSS Trackwizz at Rs 900 crore valuation | Regulatory tech platform Trackwizz has raised an undisclosed sum from WestBridge Capital in its maiden investment round, at a valuation of Rs 900 crore. The company plans to use the funds for research and development, with a focus on AI.

The company is the software suite of financial technology and compliance firm TSS Consultancy. It works with more than 350 financial institutions, including banks, brokerage firms and payment solution providers, across India, South Africa and the US to tackle financial crime.

States don’t have powers to constitute fact-check bodies: legal experts

The Karnataka government’s decision to set up a fact-checking unit for curbing fake news online may not be legally enforceable as the Information Technology Act, 2000 – the primary legislation governing online content in the country – does not provide powers to state governments for forming such bodies, policy lawyers and experts told ET.

What’s the issue? Falaq Patel, a technology and data privacy lawyer, told ET the decision appears to be ultra vires and void because while the parent legislation (IT Act) empowers the states to make rules to carry out the provisions, it only allows them to execute measures upon receipt of directions from the Centre.

On hold: The Editors Guild of India has filed a petition in the Bombay High Court challenging the amendments to the IT Rules 2023 that allow the central government to set up such a unit giving the executive sole authority to determine what is fake or not, and with powers to order content take-down.

The Centre has given an undertaking to the Bombay High Court to not notify the proposed fact check unit until October 3.

Other Top Stories by Our Reporters

Scrutiny on app-based services in Bengaluru may be tightened: App-based cab and auto-hailing services may come under increased scrutiny in Bengaluru as this was one of the main demands of the striking transporters on Monday, although they have nothing to do with the government’s Shakti free ride for women scheme.

Razorpay acquires BillMe to build on its omnichannel capabilities: Merchant services provider Razorpay has acquired digital invoicing startup BillMe, as it looks to deepen its merchant loyalty business and expand the suite of value-added services. Razorpay declined to comment on the financial terms, but people in the know said the Tiger Global-backed startup is paying about $10 million in cash and shares for BillMe.

Global Picks We Are Reading

■ Tech giants face fines for animal cruelty videos (BBC)

■ A preacher who moonlights as a cab driver is suing Uber and Bolt in Kenya (Rest of World)

■ AI voices are taking over the internet (The Verge)