New-age ecommerce companies are going through a challenging period with a rise in the cost of capital and a crash in valuations. The tech-heavy Nasdaq index has declined 28% so far this year, while the NYSE FANG+ index has plunged 33% since January 1.

The situation is no different in India.

The ET Ecommerce index has fallen 44% this year compared to a 7.5% drop in the Nifty 50 index. The ET Ecommerce Profitable index has outperformed the other two over six months, with 31% negative returns, compared to the 51% plunge by the ET Ecommerce Non-Profitable index and an about 44% fall in the main index.

ETtech

ETtechThe Economic Times launched the three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed new-age technology companies. ET has compiled these three indices with non-promoter’s market capitalization, taking December 2021 as the base period.

Discover the stories of your interest

ETtech

ETtechOver three months, the ET Ecommerce Non-Profitable index has outperformed the profitable and main index.

ETtech

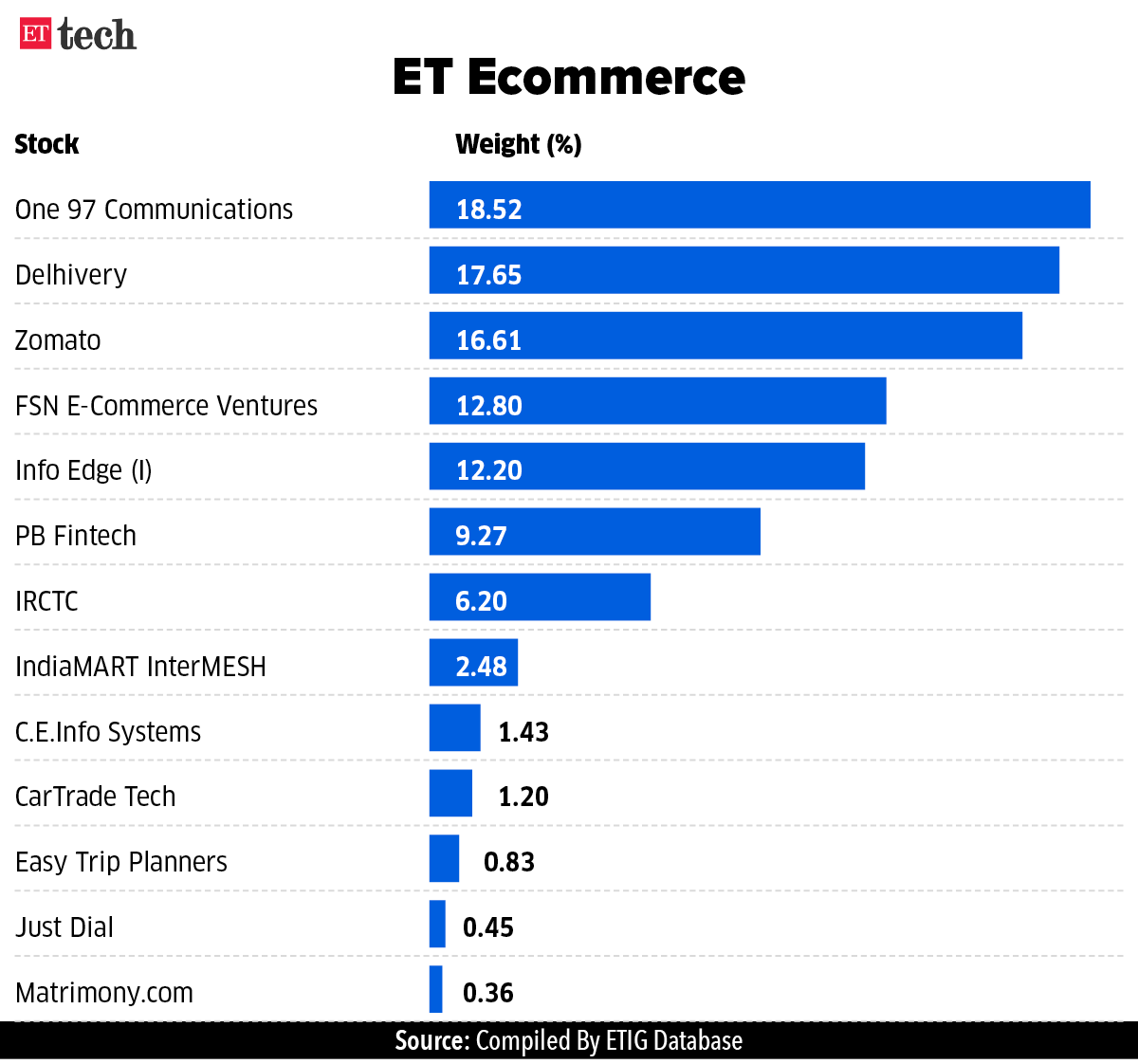

ETtechCartrade Tech, , Delhivery, , and have been included in the non-profitable index, and eight stocks – including , , , , CE Info Systems, , Matrimony.Com and FSN E-Commerce – are part of the profitable index.

The ET Ecommerce index includes all 13 stocks.

ETtech

ETtechStocks such as Zomato, One97 Communications, , and PB Fintech have declined between 60% and 70% from their yearly highs.

The excess liquidity has created a bubble, with many businesses lacking a path to profitability, but the current conditions will bring in a much-needed correction, analysts said.

“As the financial liquidity conditions are tightening, companies are prioritising margin improvement overgrowth,” said Vivek Maheshwari, analyst, Jefferies India.

“Fast-growing companies enjoyed higher valuations in the funding rounds, encouraging a faster cash burn. This virtuous cycle of growth and valuation has come to a pause now. The cost of funding is rising and will impact valuations,” Maheshwari added.