A “free speech absolutist”, Musk has long had a love-hate relationship with the platform. He has accused it of caving to censorship, while also tweeting more than nine times a day on average in 2021.

Here’s a look at Musk’s special relationship with Twitter through numbers.

73.5 million

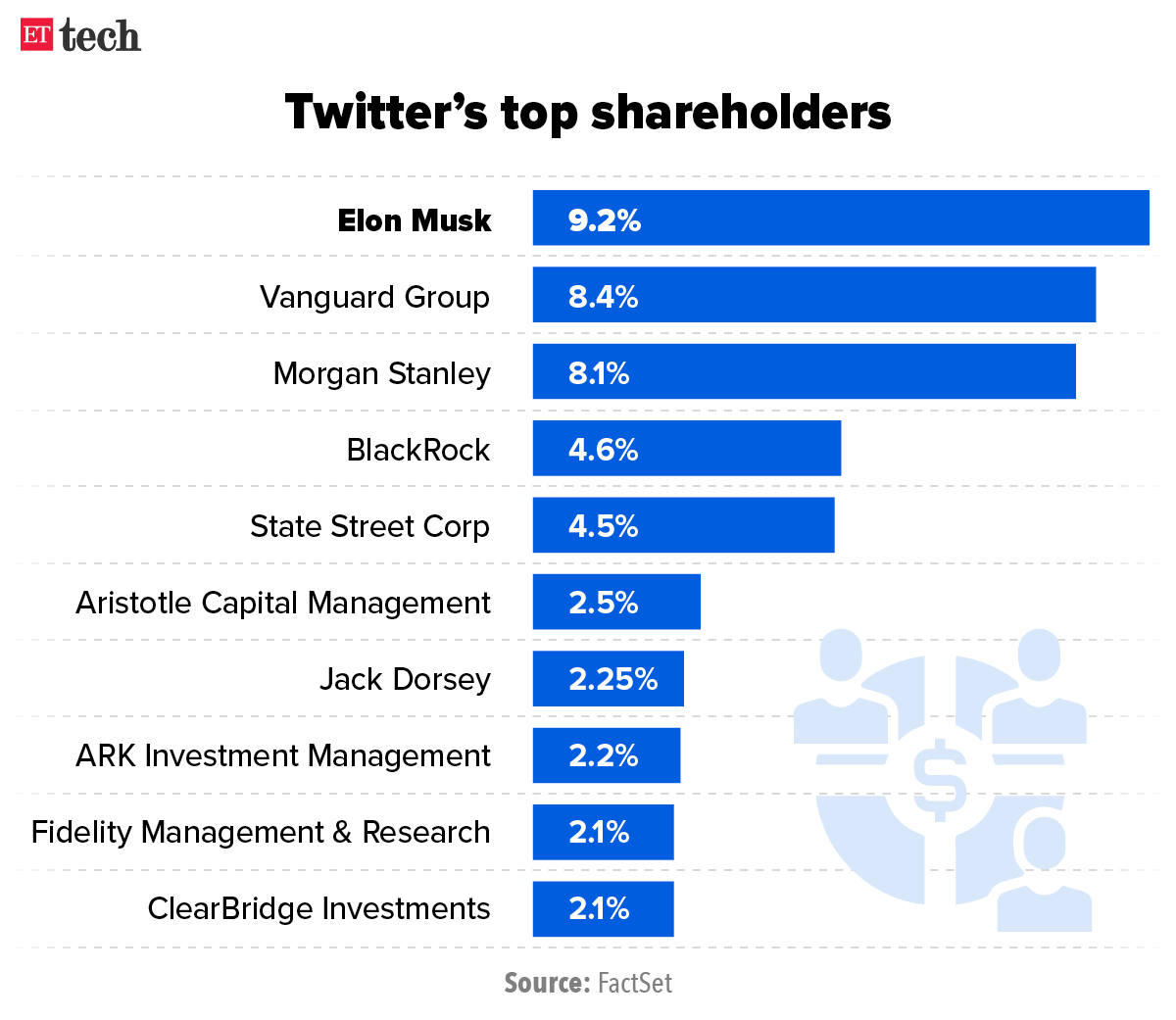

The number of Twitter shares Musk owns, or nearly four times as many as Twitter founder Jack Dorsey, who has a 2.25% stake.

$2.89 billion

The value of Musk’s stake at Twitter’s closing share price on Friday, April 1.

27%

The jump in Twitter’s stock price – its biggest-ever one-day gain – after he disclosed his stake the following Monday.

$784 million

How much the rally earned Musk on paper that day, increasing the value of his Twitter stake to $3.7 billion.

$108.6 million

Twitter’s net profit from 2019 to 2021.

The proportion of Musk’s net worth – $268 billion – that $3.7 billion represents.

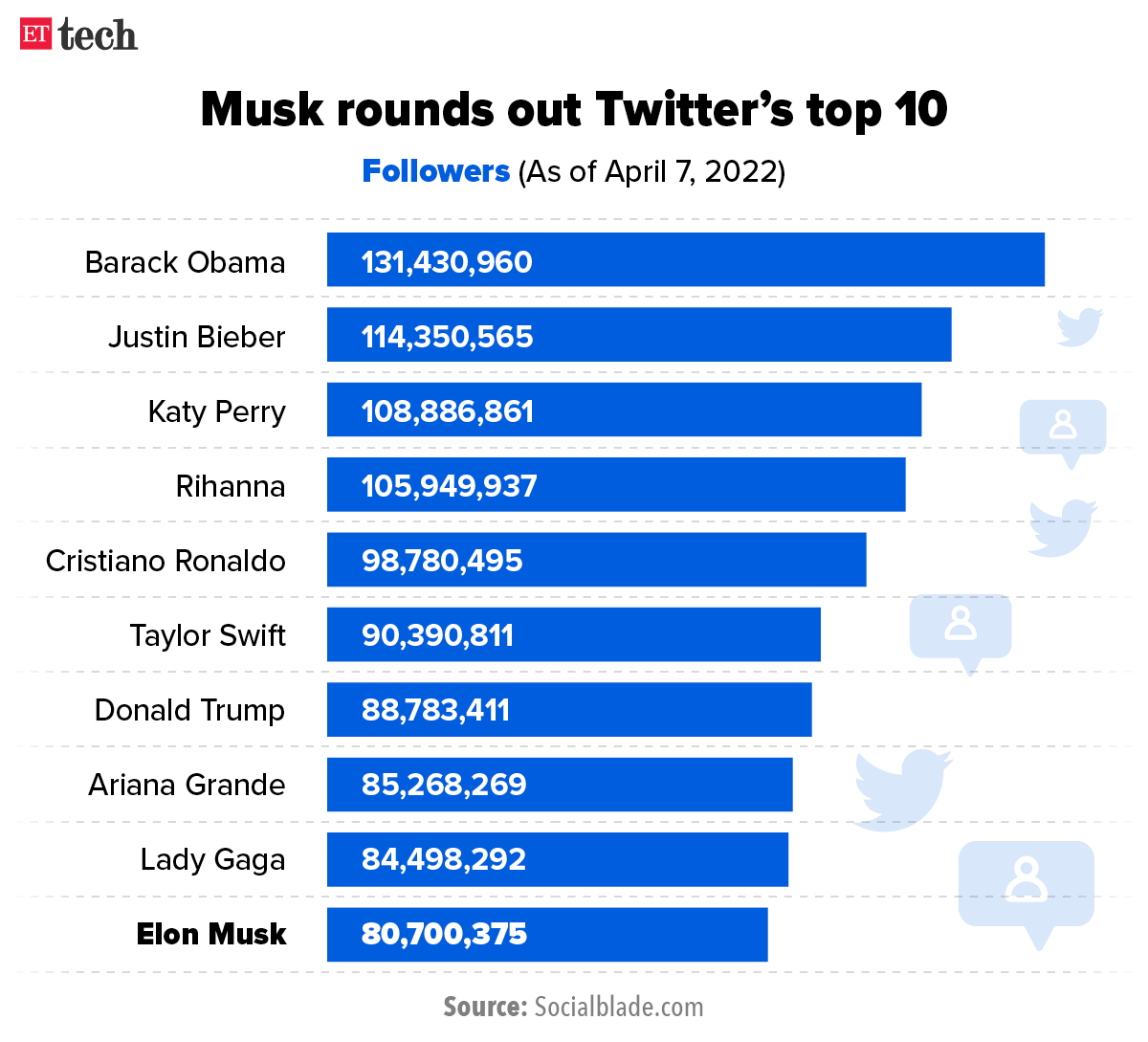

80,700,375

The number of Twitter followers Musk has (as of April 7, 2022), making him the platform’s 10th most popular user.

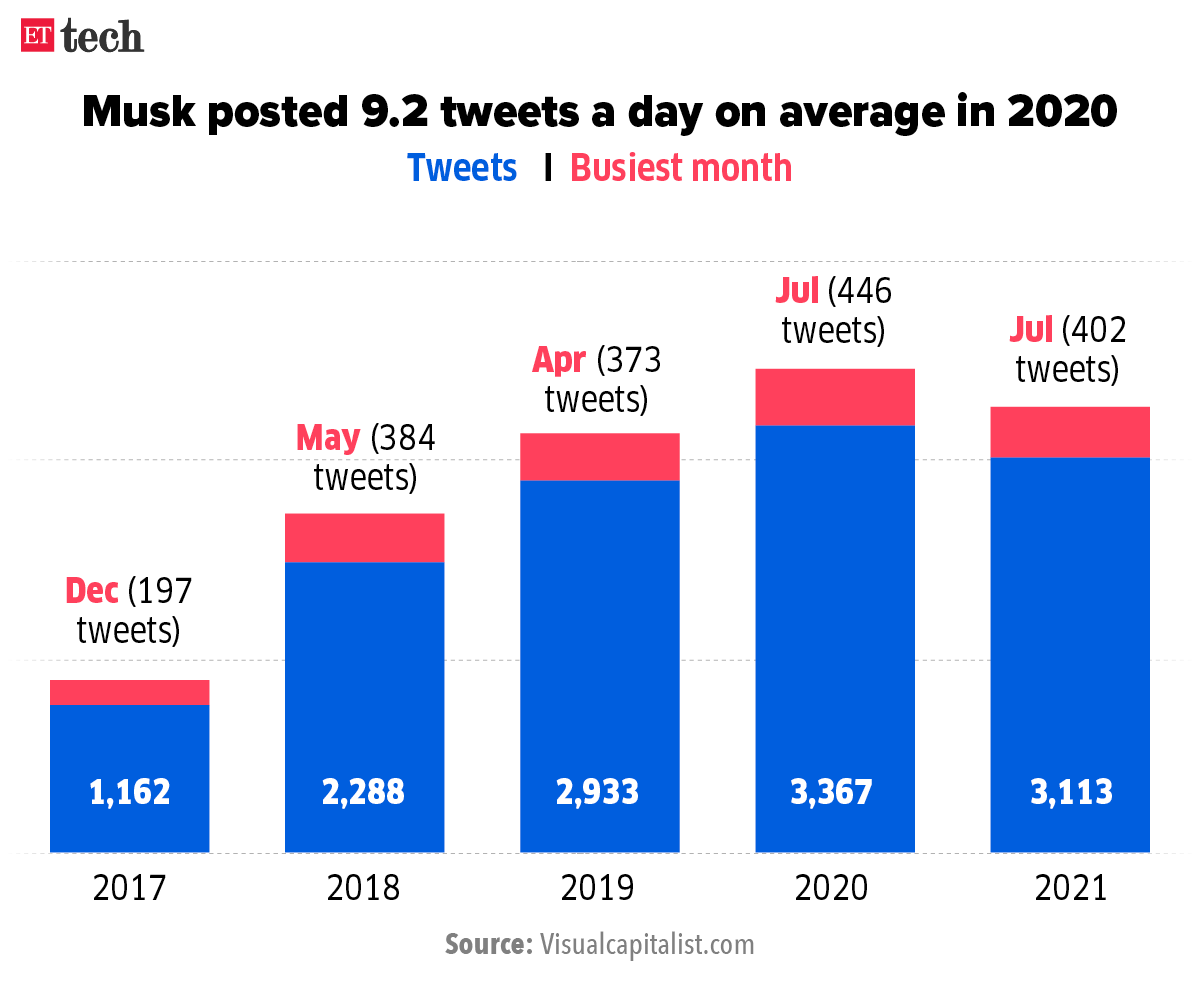

3,367

The number of times Musk tweeted in 2020, his busiest year on Twitter so far. Since it was a leap year, that works out to 9.2 tweets a day.

446

The number of tweets he posted in July 2020, his busiest month on Twitter so far. That’s more than 14 tweets a day.

2010

The year Musk posted his first tweet. Before that, someone pretending to be him had been using the @elonmusk handle. The imposter didn’t gain much traction and Musk cleared the air with his debut tweet on June 4, 2010. He didn’t tweet again until the end of 2011.

Sources: Visual Capitalist, Statista, WSJ, FT, The Guardian

Written by Zaheer Merchant in Mumbai.

Other Top Stories By Our Reporters

Unacademy lays off around 1,000 employees in huge cost-cutting exercise

Why? Around 600 were asked to leave last week as the Bengaluru firm looks to cut costs amid an impending slowdown in venture funding and tightening of the economy. Unacademy was valued at $3.4 billion last August, when it raised $440 million led by Singapore’s Temasek.

BNPL firm Sezzle to exit India: US-based buy-now-pay-later (BNPL) firm Sezzle is shutting down its India operations from April 9 as part of a restructuring exercise at its parent company. The fintech firm informed merchants of its decision on Wednesday and asked them to remove the service from their websites at the earliest.

CCI will probe Zomato, Swiggy for unfair pricing, other NRAI allegations under lens

In a detailed note on Monday, CCI ordered a probe into Zomato and Swiggy over alleged unfair pricing practices and other issues flagged last year by a restaurants’ association. NRAI, which represents over 500,000 restaurants, had filed a complaint with the anti-monopoly watchdog last July.

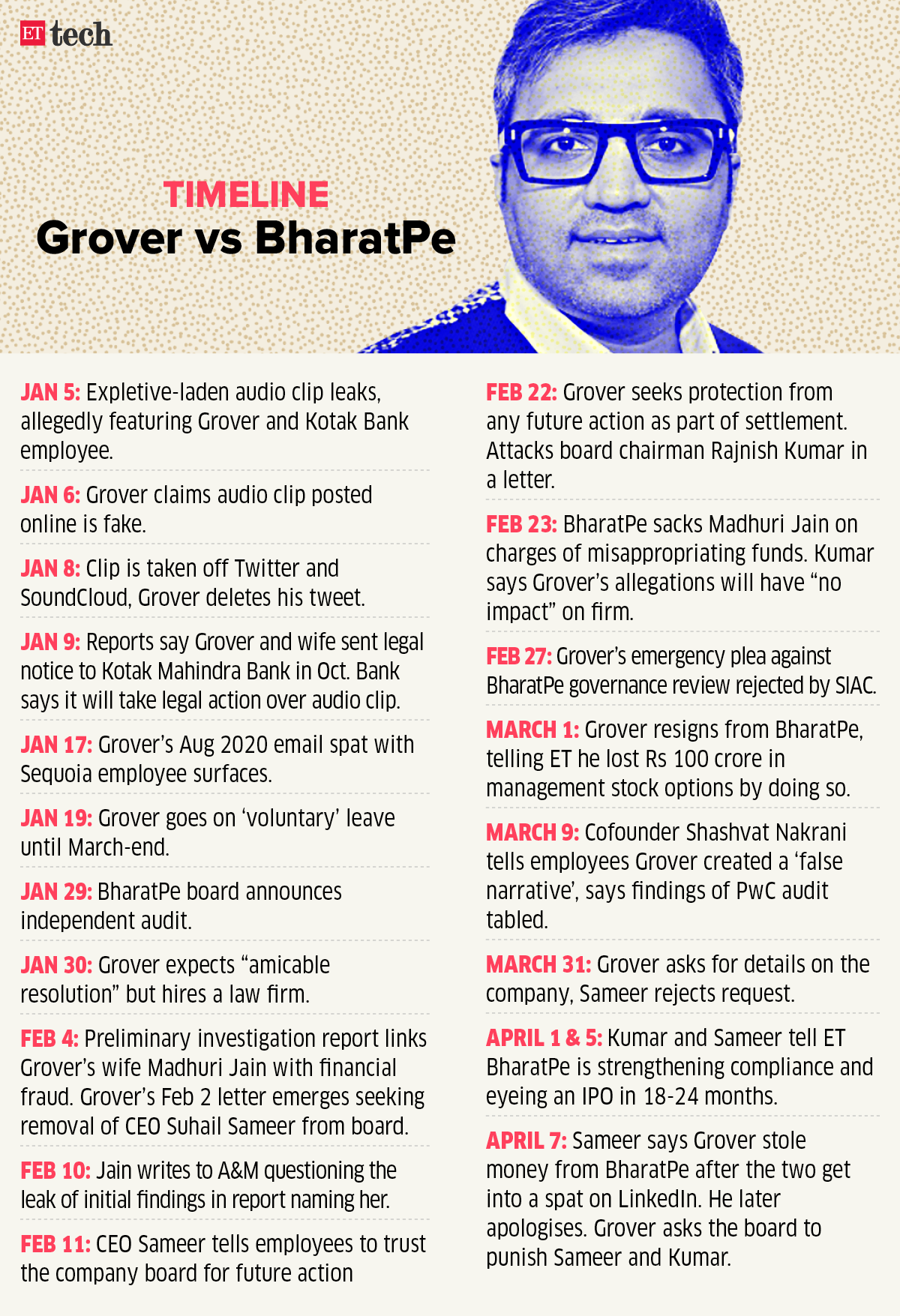

Ashneer Grover asked for BharatPe financials, CEO denied access

On Friday, we reported that BharatPe cofounder Ashneer Grover had asked for the company’s management information system (MIS) which details its business performance. But his request was rejected by Sameer, who said Grover was not defined as an investor in the company. Grover owns about 8.5% of BharatPe.

The same day, Grover wrote to the board of BharatPe, asking it to serve Sameer a show-cause notice after he accused Grover of stealing money from the company during a spat on LinkedIn the previous day.

Grover says he and others bought Bhavik Koladiya’s BharatPe stake: Grover told us on Wednesday that the shares of Bhavik Koladiya – one of the company’s original cofounders – were bought in a pre-Series A funding round by him, Sequoia Capital, cofounder Shashvat Nakrani, and angel investor Beenext.

Systems in place to prevent slips, says BharatPe CEO Suhail Sameer: BharatPe will focus on changing certain governance practices, including how procurement takes place within the firm and improving compliance and transparency, the fintech company’s CEO Suhail Sameer said.

Tata Digital unveils super app Neu at last

After several delays, Tata Group finally launched its much-awaited super app Tata Neu for the public on Thursday. “Tata Neu is an exciting platform that gathers all our brands into one powerful app,” Tata Sons chairman N Chandrasekaran said in a LinkedIn post, “Combining our traditional consumer-first approach with the modern ethos of technology, it is an all-new way to discover the wonderful world of Tata.”

Earlier, Tata Digital had started testing online payments through the Unified Payments Interface (UPI) on Tata Neu. The test was conducted with a closed user group in partnership with ICICI Bank, sources said.

Tata Digital snags top ecomm execs: Tata Digital, led by its president Mukesh Bansal, who previously cofounded Myntra and also runs Curefit (now rebranded as Cultfit) has quietly been making key hires in the ecommerce arm of Tata Group.

From the crypto world

Coinbase launch brings UPI use for crypto under lens

Will make long-term investments in India, says Coinbase CEO: Coinbase co-founder and chief executive Brian Armstrong said the company would invest for the long term in India. He said Coinbase was attracted by the country’s developer talent, entrepreneurial spirit, and “willingness to embrace new technologies”.

Crypto exchanges under stress as 1% TDS deters liquidity providers: Order books of cryptocurrency players are under renewed stress, and investors are finding it difficult to buy or sell such assets as liquidity providers have decided to stay away, deterred by tax complications.

Crypto trading volumes decline: Trading volumes on cryptocurrency exchanges have declined by 30-70% after hitting a monthly peak on March 31. Traders are now required to pay a flat 30% tax on gains made on VDAs.

Crypto exchanges look to institutional investors, college students as volumes fall: Crypto exchanges are hoping to rope in everyone from large institutional investors to college students to stem the drastic drop in daily trading volumes.

From the IT space

As many as 50,000 IT jobs may temporarily shift to India as Ukraine burns

Up to 50,000 tech jobs may temporarily shift to India from the conflict zone over the next quarter if the tensions continue.

India’s top IT firms expected to post double-digit sales growth: India’s top IT firms are expected to post strong revenue growth for the fourth quarter, analysts and brokerage firms have said, while the ongoing talent shortage and inflation-led pressures are likely to drag down margins.

To battle talent crunch, IT firms shift to smaller cities: IT service providers such as Accenture Inc, Tech Mahindra, HCL Technologies and Mindtree, among others, are expanding to tier II and tier III locations as they battle an unprecedented talent crunch.

IT companies laud resolution of double taxation issue with Australia: The resolution of India’s double taxation issue with Australia as part of a larger trade deal has come as a shot in the arm for top IT services providers. India and Australia on March 31 signed an Economic Cooperation and Trade Agreement (ECTA) that seeks to ease norms for collaboration and talent sharing between the two nations.

Startup M&A deals climb up as funding starts to slow: Amid an adverse geopolitical environment and a crash in US technology stocks, another boom cycle is now giving way to consolidation for Indian startups – akin to what happened in 2016-17.

Elevation Capital raises its largest India fund at $670 million

(From left) Elevation Capital’s Mayank Khanduja, Mridul Arora, Ravi Adusumalli, Mukul Arora and Deepak Gaur

Elevation Capital, the early-stage investor that has backed startups such as Swiggy, Paytm, Urban Company and Meesho, has closed its eighth India-dedicated fund at $670 million, its largest ever corpus.

This comes amid signs of a funding slowdown and overall macro headwinds hurting technology investments and valuations globally.

What’s the plan? Elevation, known for having kept its fund at the $300-400 million mark even as peers raised much bigger funds over the last few years, said it was now at an inflection point. It will continue to only invest in India, even as most of the bigger VC funds have diversified into Southeast Asia.

It closed around 30 deals last year and will continue to write cheques of $2 million to $5 million during the early stages with capital commitments going all the way up to $25 million during the lifecycle of a startup.

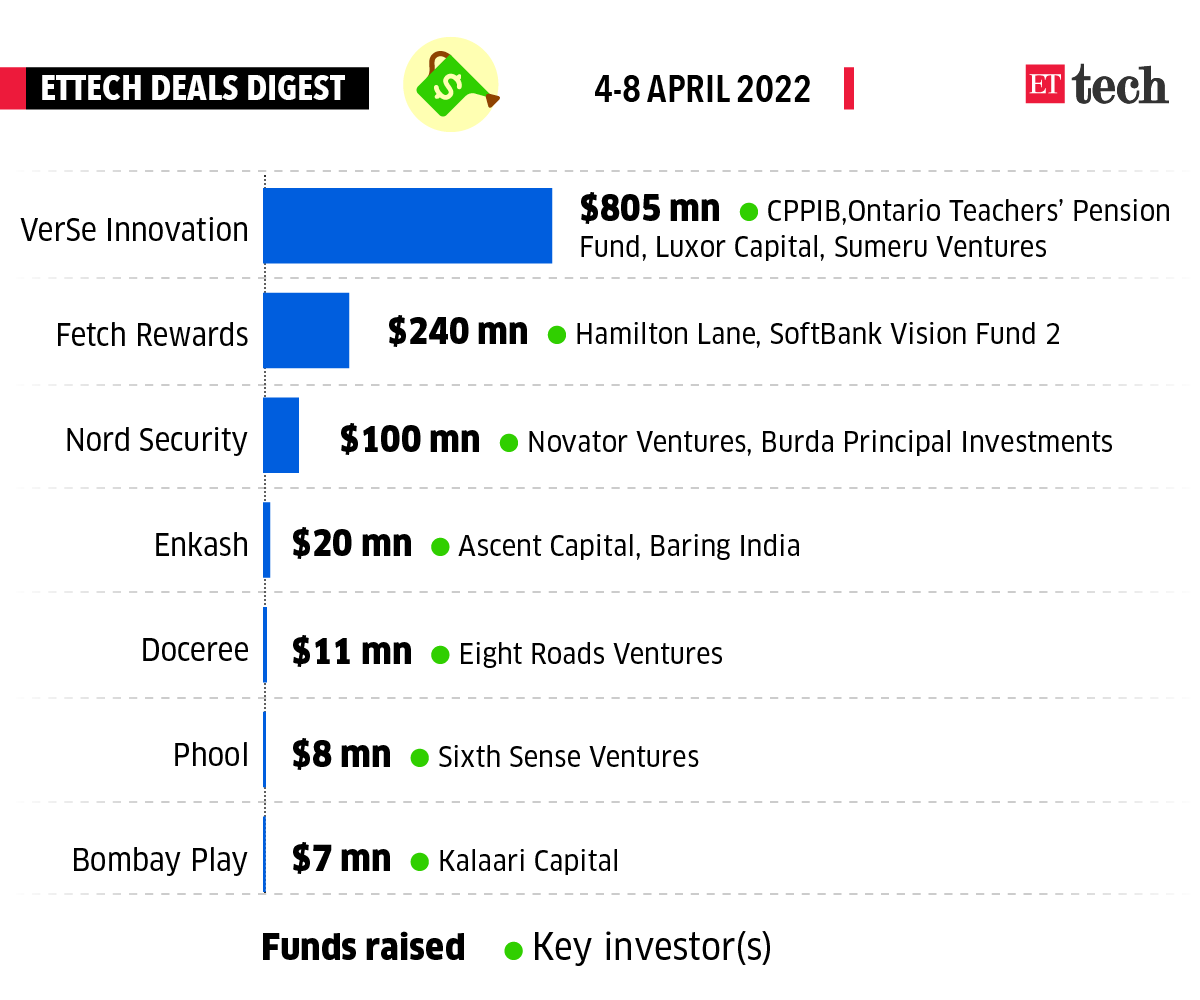

ETtech Deals Digest

DailyHunt parent VerSe Innovation, shopping rewards app Fetch Rewards, and Nord Security were among the startups that raised funds this week. Here’s a look at the top funding deals of the week.

■ Omnivore, an agritech venture capital firm, said it is setting up a new $130 million (Rs 1000 crore) fund to be invested in early-stage technology-driven startups focussing on agriculture, food, climate change and rural development.

■ Deep-tech and enterprise technologies focused investment firm Speciale Invest has raised Rs 286 crore towards the final close of its second fund.

■ Software-as-a-service (SaaS) startup Rattle has raised $26 million in a funding round, led by New York-based venture capital firm Insight Partners, and participation from Global Ventures and existing investors Sequoia Capital India and Lightspeed India Partners

Quick commerce scores big during IPL

As the Indian Premier League grips the nation this year, quick commerce startups are looking to capitalise on the cricketing fever with the likes of Zepto and Swiggy Instamart recording an almost 40% spike in orders during match hours.

Curated by Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

That’s all from us this week. Stay safe.